Fourth stimulus check summary: 30 June 2021

Updates and information on the third stimulus check in President Biden's coronavirus relief bill, and news on a possible fourth direct payment.

Show key events only

Headlines:

-Chance of fourth stimulus check by the end of this summer (Full details)

- California lawmakers vote to approve another round of $600 stimulus checks. Interest in who qualifies, when are payments expected, how many people will receive a check, and what has Gov. Newsom said?

-Will a fourth stimulus check be approved before the end of summer? (full details)

-IRS launches two new portals to help families manage the Child Tax Credit payments. (full details)

- New factors including the delta variant and states ending federal unemployment benefits may impact the possibility of a fourth stimulus check. (Full details)

-Everything you need to know about the possible "labor shortage." (Full details)

-Still waiting for your tax refund? Find out when it might be time to contact the IRS.

-Workers in Indiana, Maryland and Texas are suing to keep their federal pandemic-related unemployment benefits. Full details.

- US Dollar off to firm start as focus shifts to jobs data

- IRS prompts families to file taxes or, if eligible, use the Non-Filer tool ahead of Child Tax Payment date

- Biden walks back comments on infrastructure spending add-ons

- Ending Unemployment benefits is costly and not having desired effect (full story)

- Bipartisan infrastructure bill agreed and the inclusion of a fourth stimulus check (full details)

- Some non-profit organizations continue their push for an additional stimulus check (full details)

- Over half of states are ending federal unemployment benefits (full story)

- IRS has launched: Child Tax Credit Update Portal and Child Tax Credit Eligibility Assistant

- IRS has confirmed that the monthly Child Tax Credit payments will begin on 15 July (full story)

- Child Tax Credit monthly payments next "opt out" deadline: 2 August

- $10 billion fund for homeowner stimulus checks (how to apply)

- You can track your third stimulus check by using the IRS' online Get My Payment tool

Related news articles:

How to spend the new Child Tax Credit monthly payments

From 15 July until the end of the year the IRS will be sending out monthly payments worth up to $300 per child as part of the overhauled Child Tax Credit programme. The support on offer is unlike anything provided for parents in the past and some are unsure of how best to make use of the federal relief.

Lily Adams of the US Treasury Department has shared this article which takes a look at how some families are planning to use the monthly payments. However some parents are choosing to opt out of the new system to receive all of the monthly payments as a single 'lump sum' tax credit at the end of the year.

Why is Gavin Newsom being recalled in California?

Why is Gavin Newsom being recalled in California?

Gov.Newsom of California is the 11th governor to face a recall election in the California history. The move comes after many Republican leaders in the state believe that he has mismanaged the economic recovery and the pandemic crisis over the last year.

Support for Newsom has declined in recent months, but some of the measures he has pushed for, including the sending of a $600 stimulus check to two thirds of residents remain popular.

Read our full coverage for all the details you need to know about the recall, including when the election is expected to take place.

Are unemployment claims decreasing?

On 24 June, the Department of Labor reported that for the week ending on 18 June, 411,000 claims were made, representing "a decrease of 7,000 from the previous week's revised level." Since President Biden took office in January claims have dropped steadily as more and more people in the US got their covid-19 vaccines, slowing the spread, and allowing more businesses to open and staff up.

Which states saw the largest increase in claims for the week ending on 12 June? (Bold indicates that they plan or have ended federal pandemic unemployment benefits)

1. Pennsylvania (+21,905),

2. California (+15,131),

3. Kentucky (+9,172),

4. Florida (+3,344),

5. Texas (+3,127),

Which states saw the largest decrease in claims for the week ending on 12 June?

1. Michigan (-5,615),

2. Delaware (-2,516),

3. Washington (-1,998), T

4. Tennessee (-1,746),

5. Alabama (-1,706).

Read the full report here.

ACLU supports making changes to the child tax credit permanent. Read more about the changes here.

Which states represented the greatest part of US GDP from January to March 2021?

A year ago, many economists worried about how long it would take the US economy to recover from the covid-19 pandemic. This month, the Department of Commerce released data on GDP that shows "Real gross domestic product (GDP) increased at an annual rate of 6.4 percent in the first quarter of 2021."

The real GDP from January to March 2020, before the pandemic took hold in the US was $21.56 billion. For the same period in 2021, that number grew to $22.06 billion. After declining in Quarter 2 2020 (April to June), the GDP has increased each quarter.

Major increases in Q1 2021, are in part due to the increase in spending that took place after both the $600 and $1,400 stimulus checks were sent.

States that contributed most to GDP from January to March 2021 were,

1. California -- 14.7%

2. Texas -- 8.5%

3. New York -- 8%

4. Florida -- 5.2%

5. Illinois -- 4.1%

How many people will get the second $600 Golden State stimulus check in California?

How many people will get the second $600 Golden State stimulus check in California?

Golden State stimulus checks worth $600 will soon be delivered to over two-thirds of adults in the state. But, how many people really is that? AS English's Will Gittins took a look.

How has personal and disposable income changed throughout the pandemic?

With new data on personal income in May released by the Department of Commerce on 25 June, a clearer picture of the economic recovery is beginning to show.

The Department of Commerce defines personal income as "the income received by, or on behalf of, all persons from all sources." This includes wages, social security, unemployment benefits, and more.

From January to March 2020, before the pandemic really took hold of the US, personal income in the US stood at 18.95 billion dollars. For the same time period in 2021, this figure stood at 22.1 billion dollars. The largest increase in recent history, much of this could be driven by the fact that 70% of those on unemployment were making more compared to when they were working.

In April and May, these numbers have begun to decrease, which many economists believe is driven by two factors.

The first being that in January and March 2021, incomes increased to record levels after the second and third stimulus checks were sent.

The second reason relates to the continued movement of people back into the workforce. If those on unemployment begin working jobs where they make less than they were when receiving benefits, this number will decrease.

The total income coming from unemployment benefits has fallen in recent months from a high of $556.4 billion, after the $300 a week federal topper was sent for the first time, to $458 billion in May as the unemployment rate dropped and benefit claims hit a record low since the pandemic began.

What has Gavin Newsom said about the second $600 Golden state stimulus in California?

What has Gavin Newsom said about the second $600 Golden state stimulus in California?

On Monday 28 June, both chambers of the California legislature approved a measure that would allocate funding to send a $600 stimulus check to two-thirds of California residents. What has Governor Gavin Newsom, who is facing a recall election said? Nothing. No word from his office or statements on social media.

Read our full coverage for why more on why he has been so silent.

New Child Tax Credit payments set to begin in July

For months Democratic lawmakers have been bigging up the impact that the overhauled Child Tax Credit could have on working families across the country. Here Rep. Bonnie Watson Coleman points out that millions of children will be brought out of poverty during the first 12 months alone.

She also shares a link to the non-filers tool, which will be vital to ensuring that those who do not typically submit a tax returns are still able to receive the support. The payments are worth up to $300 per child on a monthly basis, so make sure you don't miss out.

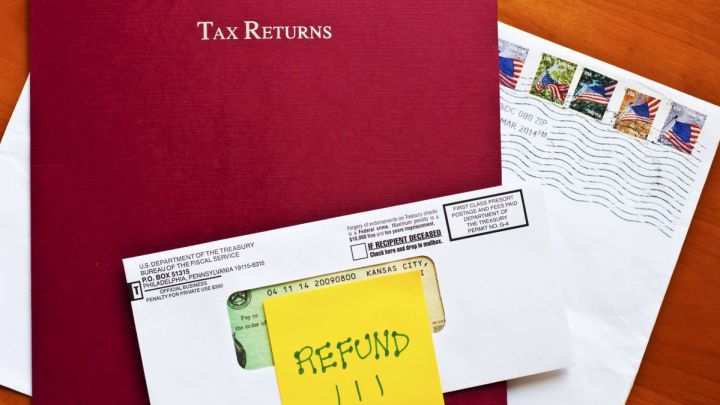

Why is my tax refund taking so long to arrive?

The IRS has been under extreme pressure since the start of the pandemic to implement the various financial programmes introduced to help citizens deal with the economic fallout of covid-19. That has included distributing three rounds of stimulus checks and opening up tax refunds for more people.

Unfortunately this has had an effect on their efficiency and the tax authority has announced a massive tax backlog comprising of roughly 35 million returns. This has left many people waiting for their tax refunds, with the IRS only able to provide person-to-person assistance for 3% of callers.

Who received the stimulus check money?

A new report from the Treasury Department found that the majority of money distributed in the third round of stimulus checks went to individuals earning less than $50,000 per year. There had been some concern that the direct payments were not targeted enough, but the $1,400 stimulus checks do appear have gone to those in need.

The report also confirmed that close to $400 billion of federal spending has already been sent out as part of the third round of sitmulus checks.

How long will the IRS be sending tax refunds in 2021?

This tax season has been busy for the Internal Revenue Service (IRS). With the passage of the American Rescue Plan in March, the IRS had to adapt quickly to changes in the tax code which altered the amount that would be refunded.

For those who submit a paper tax return, getting a refund normally takes between six to eight weeks. However, with changes to the tax code, the sending of stimulus checks, and more people filing returns this year, the IRS has said that delays are expected.

Second Golden State stimulus check: how much do dependants and undocumented workers get?

In May Gov. Gavin Newsom unveiled details of the California Comeback Plan, the new state-wide relief package aimed at providing fresh impetus to the economic recovery. The proposal came after the announcement of a record-breaking budget surplus.

One of the main features of the bill was a new round of stimulus checks that is expected to reach two-thirds of all Californians. The expansion of the Golden State stimulus checks will see an estimated 9.4 million taxpayers become newly-entitled to the direct payments.

Overworked IRS struggles with stimulus checks and tax refunds

A new report in TIME has found that the IRS has been placed under intense pressure throughout the pandemic, affecting how effectively it can oversee various programmes. The tax authority had been in charge of the stimulus check distribution process but has also attempted to adminstrate a busy tax filing season. This could have a knock-on effect for anyone waiting for a tax refund for their 2020 filing.

IRS confirms huge scale of tax refund backlog

A new report from the IRS has found that the tax authority is currently struggling to process a backlog of more than 35 million individual and business tax returns. This represents a 230% increase on the same point last year and explains why many are being forced to wait for so long to receive their tax refund.

“The 2021 filing season was the quintessential definition of a perfect storm,” wrote Erin Colling of the National Taxpayer Advocate in her mid-year Congressional report. “This filing season has been challenging for tens of millions of taxpayers and anything but normal for the IRS and its employees.”

Will I get the Golden State stimulus check?

California has passed a number of state-wide relief packages aimed at getting the state's economy back on track after 15 months of pandemic. The most recent, the California Comeback Plan, opens up stimulus checks to the state's middle class workers, as well as widening the eligibility for dependents.

The will be stimulus checks worth up to $600 per person for adults earning less than $75,000, meaning that roughly two-thirds of Californians will be getting the cash. Here's a closer look at those eligibility requirements...

When is the last day to opt out from child tax credit 2021?

Across the US, millions of families will be expecting some monthly financial assistance from 15 July, as the new-look 2021 Child Tax Credit is finally introduced. The new programme is slated to halve the number of children in America living in poverty and will affect around 88% of all children.

However, if you expect your income to increase during 2021, reducing your eligibility for the full credit, you may want to consider unenrolling from the monthly payments and collect a lump sum in 2022. Here's everything you need to know about opting out of the new monthly payments...

Who received the latest batch of stimulus check payments

Although the vast majority of eligible Americans have now received their $1,200 payment from the American Rescue Plan, the IRS is continuing to send out the stimulus checks on a weekly basis for the rest of 2021. Many became entitled to larger stimulus checks after filing their 2020 tax returns, which are still being processed.

Of the 2.3 million payments sent out in the most recent batch, 1.2 million were direct deposits and 1.1 million were paper stimulus checks.

Split opinions on whether Dems can pass reconciliation infrastructure bill

Democrats are working on preparing a second infrastructure bill to encompass what the bipartisan “G21” group of senators hashed out and presented to the White House. However, a recent MorningConsult poll found that just as many think it will pass as that the attempt will fail. 40 percent think it will pass while 42 think “it is a long shot.” Not surprisingly, of those surveyed, Democrats were much more confident about the prospects of a second bill getting through Congress at 63 percent.

All or nothing on infrastructure

Nancy Pelosi speaking to the press signals that she will bring the bipartisan infrastructure bill up for a vote once the reconciliation bill, containing what the Senate bill leaves out has passed. The so-called "G21” reached an agreement on a $1.2 trillion framework to invest in America’s infrastructure, a trillion shy of what President Biden was originally asking for. Biden agreed to the deal and has said he will sign it when it comes to his desk. He may need to wait.

Child Tax Credit to stabilize family incomes

Making ends meet from month to month can be hard at any time, but the pandemic has made it even harder for many American families. Starting 15 July millions of families will get a little extra help in the form of advance payments on the 2021 Child Tax Credit. Parents will receive up to $300 per child under 6 and $250 per child between the ages of 6 and 17.

The 2021 Child Tax Credit payments "will provide direct support to children and families to help pay for the basic expenses of raising children, like food, rent or mortgage and utilities,'' says Julie Kashen, director of women's economic justice and senior fellow at The Century Foundation.

Advance Child Tax Credits 2021 payments recommended to reverse pandemic loses

The pandemic wiped out a decade of gains in fight against childhood poverty according to the Annie E. Casey Foundation’s 2021 KIDS COUNT Data Book, a 50-state report tracking child well-being in the United States. The advance payments are expected to “lift more than 4 million children above the poverty line in 2021,” officials said.

The revamped credit, that more than doubled dollar amount of the refundable portion of the credit, was set up only for the 2021 fiscal year. The Biden administration is pushing to extend the redesign until 2025, Progressives in Congress want to make the changes permanent.

Officials are urging that the credit be extended as well. “Lawmakers across the aisle to find common cause and ensure the largest one-year drop ever in child poverty is not followed by the largest-ever one-year surge.”

Second $600 Golden State Stimulus in California: can I get it if I receive the first one?

On 28 June, the California Legislature approved a $262.6 billion budget including an $8 billion package to send another round of Golden States Stimulus Checks. Governor Gavin Newsom has until 1 July to sign the bill releasing the funds to deliver aid to families and undocumented Californians.

Californians who missed out on the first round of Golden State Stimulus checks may qualify for the second.

Impact of Biden’s tax proposals

President Biden has proposed raising taxes on the wealthiest Americans and big business to raise money for his American Jobs Plan and American Families Plan. The changes will have some winners and losers, across different types of taxpayers and geographic regions.

The Tax Foundation has created an interactive map to see how those changes affect different parts of the country based on 2018 congressional districts.

Still haven't done your taxes? The IRS can help

Tax Day was 17 May this year, if you missed it the IRS urges you to file a tax return as soon as possible in order to take advantage of the 2021 Child Tax Credit. To help the agency is holding Free Tax Prep Days around the country in Atlanta, Brooklyn, Detroit, Houston, Las Vegas, Los Angeles, Miami, Milwaukee, Philadelphia, Phoenix, St. Louis and Washington DC.

"Have to use the reconciliation process to address our economic needs”

Representative Katie Porter discusses with Lawrence O’Donnell the need for Democrats to use reconciliation to pass broader Biden agenda. Reconciliation is the parliamentary procedure that Democrats used to pass the American Rescue Plan allowing them to bypass a Republican veto of the spending bill and pass the legislation with just a simple majority.

Currently there are varying plans for just how big that reconciliation bill could be with Senator Bernie Sanders proposing a $6 billion package. Rep. Porter cautions that before any hard numbers are put out what exactly goes into the plan needs to be laid out.

“We are wholly-committed to the infrastructure bill” Rep. Katie Porter

Representative Porter said that the Democrats are “wholly-committed” to passing an infrastructure bill but that the bill could be held up in the House as leverage until the reconciliation bill is passed by the Senate. Currently the bipartisan deal on infrastructure is just a working framework. Congress' Fourth of July recess starts on Thursday and lawmakers won't return until 12 July.

Why you may want to opt out of Child Tax Credit advance payments

The IRS will be sending millions of families monthly payments on the 2021 Child Tax Credit for up to $300 per child. However, unlike the Economic Impact Payments, or better known as stimulus checks, any overpayments will be required to be repaid. There is a “safe harbor” for lower- and moderate-income taxpayers, above a threshold taxpayers would need to repay any overpayments they receive.

For this reason, the IRS is advising that families that expect to owe taxes next year due to increased income in 2021 should consider unenrolling from the advance payments set to begin 15 July. It’s too late to opt out of the first payment, but those who wish to do so can use theIRS portalbefore 2 August.

2021 Child Tax Credit payments will be a daunting task

The IRS is about to embark on a new mission, sending millions of checks to families on a monthly basis. The tax authority has experience sending out refunds and got experience with advance payments through the stimulus check payments over the past year. However the checks for up to $300 are scheduled go out on the 15th of every month.

There may be other issues with the payments in that those who will benefit the most from it may not know about, nor be signed up to take advantage of the program. The IRS is relying on data collected from tax returns or its Non-Filer tool for those who are not required to file a tax return. A third or more of children in poverty live in households that don’t file tax returns. Add to this that about 53 percent of Americans know little or nothing about the new payments set to come.

Over 100,000 California’s never cashed their $1,200 stimulus

Through a Freedom of Information Act request the Boston Herald obtained records on the number of $1,200 stimulus checks from the first round that went uncashed, returned or repaid to the IRS. California had the highest number of checks that didn’t get used at 123,265, albeit the state is also the most populous.

Californians are set to receive an additional stimulus check through the 2022 budget that was approved by the Legislature. Once Governor Newsom signs the bill those earning $75,000 or less and didn’t receive a Golden State Stimulus check in the first round can look forward to another one-time payment of between $500 and $1,100.

California man charged after stealing stimulus checks from mailboxes

A man in Southern California who broke into at least 94 mailboxes to steal stimulus checks, has been sentenced to 18 months in prison.

The office of the U.S. Attorney Southern District of California in San Diego said Theodore Bennett, 33, of Imperial County, California, was sentenced in federal court on three counts of mail theft and one count of possession of stolen mail.

It’s a good deal, it’s a big deal. And the American people want it. You don’t need me to come to a community for people to know that our roads and bridges … need a lot of work.”

CNN: "No, there is no fourth stimulus check on the way"

Is there any hope for a fourth stimulus payment? According to CNN's Katie Lobosco, no there is not:

"The federal government has sent out three rounds of stimulus checks to help people during the pandemic, but despite their political popularity, there's no proposal on the table to deliver a fourth round.

"Congress, which would have to approve the money, is unlikely to consider more spending on direct payments as the economy rebounds. While there's some support from Democratic lawmakers for recurring payments, the party has slim majorities in the House and Senate and limiting the third round of payments was a key priority for moderates during negotiations of the latest pandemic relief package passed in March...."

IRS continues to send out stimulus checks

If you still haven't received a stimulus check in the fourth round, all is not lost.

The IRS said it is continuing to send out stimulus checks, with a further 2.3 million payments distributed earlier this month. These include "plus-up" payments for Americans who received less money than they were entitled to in earlier rounds.

The tax authority said on Tuesday said it continues to issue stimulus checks on a weekly basis, with payments still being sent to those for whom the IRS didn't previously have enough information to issue a check but who recently filed a tax return, as well as to those entitled to "plus-up" payments.

Secretary of Transportation, Pete Buttigieg sits down with late-night host Stephan Colbert to discuss the "historic investments" included in the bipartisan infrastructure bill. For more on what is included in the proposalsee our full coverage.

How many jobs do experts beleive were added in June?

The Department of Labor will release the national June unemployment data on Friday. In anticipation of the release, a few organizations and online outlets have published forecasts.

Experts with the Peterson Institute for International Economics believes that the hot labor market, driven by an increase in the supply of open jobs has made people more comfortable quitting their current job because workers know "that they will be able to find new and better ones—either directly transitioning to those jobs or by taking a brief break between jobs." This does create a barrier bringing down the unemployment rate as some people who were employed may become unemployed in the short term.

Keeping this in mind, their experts still believe that in the next few months the economy could begin to add " 750,000 jobs or more per month."

Second $600 Golden State stimulus in California: when will it be sent?

Second $600 Golden State stimulus in California: when will it be sent?

A $600 dollar stimulus check is on its way to some residents in the state. Adults making $75,000 a year or less are now eligible to receive a check, as long as they did not receive one when the first round was sent.

As for when the checks will be sent, the state has said they will provide more information once the governor signs the bill into law.

Read our full coverage to find out when he is expected to sign the bill, and the state's 2021 budget.

As many in the US look for examples of a Congress that works for them, President Biden presents the infrastructure bill negotiations as an opportunity to show just that.

Stimulus checks live updates: welcome

Hello and welcome to our live stimulus checks blog for today, Wednesday 30 June 2021.

We'll be bringing you updates on a possible fourth direct payment, in addition to the latest information on the third round of checks, which has seen around $395 billion go out to eligible people in the US.

As well as this we'll be providing news on other economic-aid schemes such as the expanded Child Tax Credit, which will see monthly payments of up to $300 distributed to qualifying households and details of economic aid for Californians on low-to-middle incomes in the proposed new state budget. Basically, everything you need to know.

- Joseph Biden

- Coronavirus stimulus checks

- USA coronavirus stimulus checks

- Covid-19 economic crisis

- Science

- Coronavirus Covid-19

- Economic crisis

- United States

- Pandemic

- Coronavirus

- Recession

- North America

- Economic climate

- Virology

- Outbreak

- Infectious diseases

- Diseases

- Microbiology

- America

- Medicine

- Economy

- Biology

- Health

- Life sciences