Fourth stimulus check and child tax credit news summary: 8 July 2021

Our live blog on the third stimulus check in President Biden's coronavirus relief bill, and updates on a potential fourth direct payment. This blog is now closed.

Show key events only

Headlines:

- How have the unemployment benefits cuts affected the jobs market? full details)

-Department of Labor will hand out $43 million in grants to help train dislocated workers. How to claim the benefit.

-More than 2.5 million people have signed petition for a fourth stimulus check (full story)

- Courts rule that Maryland must continue to pay federal unemployment benefits to residents (Full details)

- Two-thirds of California residents to receive a $600 stimulus check after the California Comeback Plan was passed by state legislature: who is eligible and what do you need to do to get one?

Useful information / links

-Child Tax Credit: We took a look at the question, is the web portal the best way to apply, what other options do I have? (details)

- You have until Monday 2 August to opt out of the August round of Child Tax Credit monthly payments (find out more)

- How to use the IRS's two new online tools; the Child Tax Credit Update Portal and the Child Tax Credit Eligibility Assistant

- Some families will nee to file taxes or use the Child Tax Credit Non-filer Sign-up Tool to trigger monthly payments

- Should you update your tax return information? Find out when to contact the IRS

Take a look at some of our related news articles:

What next for the outstanding IRS tax refunds?

The IRS is suffering huge delays at the moment as the tax authority fights to work through a backlog of 35 million unprocessed tax returns. It has been tasked with sending out stimulus checks and introducing the new Child Tax Credit in recent months, meaning that many have been left waiting for ther tax refunds to arrive.

More than 2.5 million signatures request a new stimulus payment

As the end to the covid-19 pandemic seems to be in sight many American families are still struggling with the economic fallout. This has prompted calls for a fourth stimulus check from inside the government and out, aiding the growing number of signatures to the largest of the Change.org petitions calling for such action.

The US Senate will be back next week to pick up where it left off with negotiations on a $1.2 trillion infrastructure bill. When they return, it has been reported that senators will sit down to fill in the blanks of what will be included and how it will be funded.

Various Members of Congress have highlighted the need for government to make an investments infrastructure to ensure it can withhold added stress from climate change. Rep. Mondaire Jones tweets video of floods in New York City after the area receives heavy rains from Hurricane Elsa.

Which US states don't have an income tax?

Which US states don't have an income tax?

There are a total of nine states that do not tax income at the state level, Alaska, Florida , Nevada , New Hampshire , South Dakota , Tennessee , Texas, Washington, Wyoming.

Read our full coverage for more on how spending in these states differs from states that do require residents to pay taxes on income.

Hummanity Forward shares data on how "every $1 of taxpayer dollars spent on reducing child poverty, Congress saves the American people $7 later down the road."

Miami Condo Collapse: Why has the search and rescue stopped when people are still missing?

BREAKING from Miami: Why has the search and rescue stopped when people are still missing?

In the middle of a pandemic, with economic certainty rampant, the condo collapse in Miami is a stark reminder of the looming climate crisis and the devastation that can occur when governments to not provide enough oversight.

More than a week after the Surfside condo collapse outside of Miami Florida, officials have informed the public that the operation will be transitioning from rescue to a recovery mission.

The Public Policy Institute of California and Tipping Point remind the public that the Child Tax Credit can only cut rates of child poverty if the funds make it families in need. Read their coverage for the actions they believe should be taken by the government to ensure that poor families receive the funds they are entitled to.

Rep. Sylvia Garcia of Texas, tweets how the expansion of the Child Tax Credit provides a glimpse into the care economy that could be fostered if it was made permanent.

Have pandemic payments cuts been effective for people to get back to work?

Have pandemic payments cuts been effective for people to get back to work?

The decision by 25 states to end their federal unemployment programmes was aimed at coaxing people back into the workplace and by numbers of workers it seems to have worked. But the multiple and varying factors make it difficult to accurately tell at this stage.

Read our full coverage for more on what the data shows.

How many unemployment claims were released last week?

For the week ending on 3 July, unemployment claims rose slightly (~2000) to 373,000 over the previous week.

Which states had the highest increase in initial claims?

1. New Jersey (+3,381)

2. Massachusetts (+2,845)

3. New York (+1,857)

4. Connecticut (+1,516)

Which states saw the largest decrease in initial claims?

1.Pennsylvania (-17,664)

2. Kentucky (-7,878)

3. California (-7,643)

4. Texas (-3,998)

5. Michigan (-2,880).

Read the full report here.

How many people were out of work in June due to a pandemic-related business closure?

The BLS released new unemployment data that found nearly 6.2 million people were out of work due to a closure. While still high, this figure is down from 40 million a year ago.

Secretary of Transporation, Pete Buttigieg hopes that Senate Republicans will change their mind on the infrastructure package and "agree with the American people including a large majority of American Republicans,"

More than 2.5 million signatures request a new stimulus payment

As the end to the covid-19 pandemic seems to be in sight many American families are still struggling with the economic fallout. This has prompted calls for additional stimulus checks from inside the government and out, aiding the growing number of signatures to the largest of the Change.org petitions calling for such action.

The Change.org petition has surpassed 2.5 million signatures from Americans calling for additional stimulus checks.

Visual of how wages are rising for those in the leisure and hospitality sector

As businesses struggle to find enough employees to fill vacancies workers are able to ask to be compensated more for their time. Companies are reacting offering better wages and perks to boot.

IRS provides families with online portals for the Child Tax Credit

The Internal Revenue Service has set up three portals for the Child Tax Credit that parents can use for specific functions.

The first portal the agency launched was a reboot of the Non-Filers tool which originally allowed those who aren’t required to file a tax return to provide personal information to the IRS to claim the first stimulus check for $1,200. The Non-Filers 2.0 allows parents that haven’t yet used the portal to sign up for the 2021 Child Tax Credit, as well as any stimulus check money they missed out on.

The second portal allows filers to check if they are eligible to receive the monthly advance payments for half of the total credit set to begin 15 July. The IRS sent out a letter to inform families of how much the agency estimated each would receive.

The third portal the IRS launch gives parents the possibility to update their information. Families can see if they are registered for the payments and if need be, can change the direct deposit account number to direct the payments to the right bank. Parents can also choose to unenroll from the monthly payments, opting instead to get the full credit they are eligible for as a lump sum payment as part of their tax return in 2022.

$43 million in grant funding to support reemployment: conditions and how to apply

The application process for CAREER National Dislocated Worker Grants is under way. Eligible entities will have until 31 August 2021 to submit their proposal to help dislocated workers who were most impacted by the economic and employment fallout of the covid-19 pandemic.

Comprehensive and Accessible Reemployment through Equitable Employment Recovery (CAREER) National Dislocated Worker Grants will be targeted at workers from historically marginalized communities or groups, as well as recipients of state or pandemic unemployment benefits who have exhausted their assistance along with the long-term unemployed.

The US Department of Labor will hand out $43 million in grants to help train those dislocated workers most affected by the pandemic reenter the workforce.

Why will the Child Tax Credit be so significant? Find out

The Institute on Taxation and Economic Policy will be holding a webinar 13 July to discuss the transformative nature of the 2021 Child Tax Credit and why it is good economic policy. Looking at small scale experiments of monthly income supplemental payments has shown that it boosts outcomes on many levels.

Workers gaining the upper hand on wages

The recent US jobs report showed that wages pushed up again in June with businesses forced to pay more to fill vacancies as the economy reopens. Many jobs are remaining open due to lingering side effects of the pandemic with parents lacking childcare, residual health concerns and to some extent government support through enhanced unemployment benefits.

The pandemic also let some workers upskill during the lockdown or reconsider their career path, with the number of people quitting a job to look for a better one.

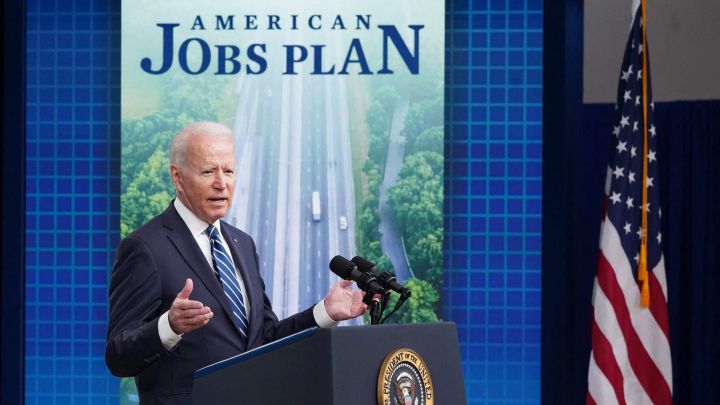

Biden walks a tightrope as agenda moves forward

Reporting by Politico yesterday indicated that the $1.2 trillion bipartisan infrastructure bill could come up for a Senate vote within two weeks. Both sides need to hammer out the details of what that money will be spent on and it will be seen if it satisfies liberals who see the initial proposal as lacking. There is the question of if a second bill incorporating the “non-traditional infrastructure” the Biden and Democrats are pushing for will be brought forth in the House that could be rammed through without Republican support. Such a bill has caused unease among GOP lawmakers.

For now, it appears that House Speaker Nancy Pelosi will wait to see what comes out of the Senate before the House moves on their own proposal. There is hope that if the first bill can get bipartisan support then there would be go faith to negotiate the second part. However Republican lawmakers are eyeing the 2022 midterm race and may not be so quick to give Biden, and their Democratic colleagues such a victory.

Those who could most benefit from new Child Tax Credit might not get it

The IRS has been on an information awareness campaign drive in the run-up to the 15 July start date for advance payments on the 2021 Child Tax Credit. A recent survey found that over 50 percent of families knew little or nothing about the monthly financial assistance that will run through December. The worry is that low-income families that aren’t required to file a tax return and have yet to use the Non-Filer online tool the IRS rebooted to sign up to participate in the program will miss out on the payments that could help pay for basic necessities.

Those that have filed a 2020 tax return or have already used the Non-Filer tool will be automatically registered in the program. The IRS will determine eligibility but families can check their status at the agency’s Advance Child Tax Credit Payments in 2021 webpage.

Parents could get monthly payments of up to $300 for each child under 6 and $250 per child 6 to 17.

Newsweek outlines three reasons why there WON'T be a fourth stimulus check

While there is strong support for a fourth stimulus check among the American public and several Democratic lawmakers, Newsweek has outlined three reasons why it believes there will not be a fourth round of direct payments, namely: economic recovery, the vaccine rollout, and senate resistance.

"I still haven't given up on the idea that at least some Senate Republicans might decide to agree with the American people including a large majority of American Republicans

Paid family and medical leave under Biden agenda

President Joe Biden wants to introduce up to 12 weeks' paid family and medical leave as part of his Build Back Better Agenda. "We are one of the few major economies in the world that does not cover paid family and medical leave," Biden noted. Like the improved Child Tax Credit, this initiative will undoubtedly be welcomed by the majoriry of US workers.

Petition for $2k stimulus checks surpasses 2.5m

A change.org petition calling for recurring monthly stimulus checks of $2,000 has surpassed 2.5m as it continues to draw closer to its 3m target. You can sign the petition here.

Petition mission statement:

"Our country is still deeply struggling. The recovery hasn’t reached many Americans – the true unemployment rate for low-wage workers is estimated at over 20% and many people face large debts from last year for things like utilities, rent and child care. These are all reasons that checks need to be targeted to people who are still struggling and that Congress needs to learn from this past year. It took nine months for Congress to send a second stimulus check, and just moments to spend it. Moving forward Congress needs to make recurring checks automatic if certain triggers are met. No more waiting around for our government to send the help we need. Sign to join our movement to get recurring checks to the people."

Almost $1.8bn went unclaimed in first round of stimulus checks

Americans refused, paid back or failed to cash 1,315,717 checks in the first round $1200 of stimulus checks issued under President Donal Trump's administration last April, according to the IRS. As such, almost $1.8bn of stimulus money went unclaimed.

Dems take swipe at McConnel over stimulus comments

Senator Mitch McConnel, speaking to a group in Murray, Kentucky, discussed how his state would get $4 billion from the American Rescue Plan, twice what Washington sent last year. Intending to talk about the nonnecessity of the funds he gave Democrats an opportunity to take a jab at his expense when he said "Not a single member of my party voted for it. So, you're going to get a lot more money. I didn't vote for it. But you're going to get a lot more money.”

President Biden told reporters in Illinois during a visit to promote his infrastructure proposal "Mitch McConnell loves our programs. You see what Mitch McConnell said? He told me he wasn’t going to get a single vote in order to allow me to get, with the help of everybody here, that $1.9 trillion program for economic growth.” Adding "Look it up, man. He’s bragging about it in Kentucky."

Infrastructure bill could face Senate vote within two weeks

Politico reports that according to congressional sources the White House has been working with senators to have the $1.2 trillion bipartisan infrastructure bill ready for a floor vote the week of 19 July.

The administration is walking a fine line trying to appease the two factions in the Democrat party, those who want a limited infrastructure bill and those that want to go big. This could include passing a second bigger bill through reconciliation which wouldn’t require any votes from the Republicans but could lose Democrat votes.

Do payments for the Child Tax Credit count as income?

No. The IRS has made it clear that the payments do not count as income and will not impact any other welfare benefits, like SNAP or WIC.

Can other states extend pandemic payments like Maryland has done?

Can other states extend pandemic payments like Maryland has done?

Lawsuits have been filed in four of the 26 states that decided to end federal unemployment programs before they expire 6 September. So far, judges in Indiana and Maryland have placed temporary restraining orders on those states ordering them to continue the payments.

Both Maryland and Indiana have appealed the court decisions.

Maryland announced upon its appeal being denied by the state's top court that it will comply continuing enhanced unemployment payments until 13 July when the restraining order expires.

Indiana so far has not complied with the injunction against the state stopping the federal out of work assistance while it awaits a hearing on its appeal. In an email to the IndyStar the Department of Workforce Development said that it “is determining how to proceed because the federal programs in Indiana no longer exist after their termination on June 19.”

Read our full coverage for more details.

Stimulus check live updates: welcome

Hello and welcome to our daily live blog for today, Thursday 8 July 2021, bringing you updates on a possible fourth stimulus check in the US.

We'll also provide you with information on the third round of stimulus checks, which began going out in March as part of President Biden's American Rescue Plan, in addition to news and info on other economic-support programs such as the new, expanded Child Tax Credit.