$3000/$3600 IRS Child Tax Credit: Can the web portal help you to receive extra money?

IRS releases new platforms to help families manage their payments for the Child Tax Credit. Our team took a look at how they help get you the funds faster.

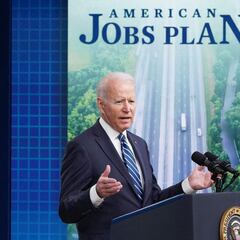

In less than two weeks, 88% of families across the United States will begin to receive payments for the enhanced Child Tax Credit (CTC). Major changes to the quantity and distribution method were made to the CTC under the American Rescue Plan, passed back in March.

Those in the care of dependents who make under a certain amount of money according to their tax filing status will receive payments. For each child under the age of six, $300 will be sent, and for all those between the ages of six and seventeen, $250 will be distributed monthly.

There have been changes to the #ChildTaxCredit that will benefit many families as they receive advance payments starting in summer 2021. Watch an #IRS video to learn more: https://t.co/VEmVPmHjud

— IRS Tax Pros (@IRStaxpros) July 5, 2021

To assist families in managing their payments, the IRS has launched the Child Tax Credit Update Portal. The IRS describes the portal as “a secure, password-protected tool, available to any eligible family with internet access and a smartphone or computer. It is designed to enable them to manage their Child Tax Credit accounts.”

More features will be added to the portal within the next few months, but currently, users can update their bank account information and unenroll from the payments to claim at a later date.

These features should help those in care of dependents get their payments more quickly, as direct deposit ensures that the funds are available almost immediately. Without direct deposit information, the IRS will send a physical check which could take weeks to be mailed and received.

Soon the platform will allow families to check the status of their payments, and a Spanish language version will become available.

Who qualifies for the full value of the Child Tax Credit?

According to the IRS, the income limits are “$75,000 or less for singles, $112,500 or less for heads of household and $150,000 or less for married couples filing a joint return and qualified widows and widowers.”

Related stories

Those making over these amounts will receive partial payments up to a certain level. Regardless of income, whether families will receive the full value of the original credit, $2,000. Then, for every additional $1,000 above the limits, the value of the credit is reduced by $50.

"According to a Data For Progress poll conducted in May, 53% of the poll’s respondents expressed knowing little or nothing about the monthly Child Tax Credit payments, which are expected to cut child poverty in half."https://t.co/515vFbFS1F

— Data for Progress (@DataProgress) July 5, 2021

The changes made to the CTC under the American Rescue Plan altered the income requirements. Rather than there being an income minimum, the government placed caps on the upper band of the incomes to ensure the credit is targeted at families that really need it. For the first time, the credit will be available to people who do not need to pay federal income tax, perhaps because they have been out of work; before, “the refundable portion was limited to $1,400 per child.”

- Ayudas familiares

- Declaración renta

- Crisis económica coronavirus Covid-19

- Ciencia

- Ayuda social

- Agencia Tributaria

- IRPF

- Coronavirus Covid-19

- Crisis económica

- Impuestos

- Hacienda pública

- Agencias Estatales

- Pandemia

- Coronavirus

- Recesión económica

- Tributos

- Coyuntura económica

- Virología

- Epidemia

- Enfermedades infecciosas

- Política social

- Finanzas públicas

- Enfermedades

- Microbiología

- Administración Estado

- Economy

- Society

- Politics

- Public administration

- Finances

- Biology

- Health

- Life sciences