$3000/$3600 Child Tax Credit: can I receive it if I am single or divorced?

Millions of families have been issued with the first payment of the enhanced Child Tax Credit by the IRS, but doubts surround the situation of a divorced couple.

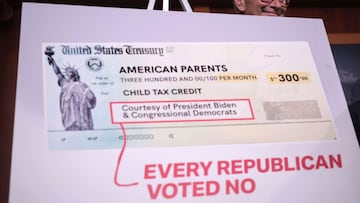

Back in March of this year, President Joe Biden formally launched the American Rescue Plan, and over recent months it has been a waiting game for millions as the 15 July date for the enhanced Child Tax Credit edged ever closer.

Now that we have past that milestone, parents and guardians across the United States have begun to receive their first payments of the fully-refundable credit worth $3,000 for children between the ages of six and seventeen, and $3,600 for those younger than six. But questions have been raised amid concerns over how this is handled for divorced couples.

Child Tax Credit news:

- Child Tax Credit: what is the income limit?

- Is there a limit of children a family can claim for the Child Tax Credit?

- What happens if I don’t want to receive the Child Tax Credit monthly payments?

- Do you have to pay back the Child Tax Credit 2021?

- How to contact the IRS about Child Tax Credit

Child Tax Credit: what if I'm divorced?

For couples who are now divorced, there is an option to opt out (see below). As per the conditions of the credit, it is not possible to split the payment and therefore only one parent can claim it each year, likely to be the one with custody of the child, or children, in question.

It is possible that it would work for some divorced couples to switch who receives the credit each year, although some may prefer to keep the process consistent and work out the finances together thereafter. The credits are based on your 2020 returns, or 2019 if 2020 not yet filed, and the parent that will be claiming for 2021 is the one that should get the payments. Hence why alternating can make it more complicated and there is a risk that it will have to be repaid in the next tax window.

Note that if the parents of minor children are separated, not divorced, and they filed joint returns in 2019 and 2020, and the child tax credit was claimed by both parents, the advance payment will go to the bank account on the tax year 2020 return, or a check will be mailed to the address of record on the tax return.

The Washington Post's Michelle Singletary answered a number of questions, with some expert tax support, related to the new credit and this one rang loud.

Question: I am divorced and share custody of my daughter with my ex. We alternate claiming our child, and I claimed her in 2020. Should I opt out of the monthly tax credit?

Answer: If you will not be claiming the child for 2021, you should unenroll from receiving the monthly payments. Otherwise, you may have to pay that money back next year. You have until 2 August to stop the payments. The next unenroll deadline is 2 August.

Making Child Tax Credit a permanent benefit

The President is putting pressure on Congress to make these changes permanent as it could cut rates of child poverty in half. Before the changes made under the trillion-dollar stimulus legislation, the credit would be sent with a taxpayer’s refund and was only available with those with an income over $2,000. Now, the payments will be made on a monthly basis between July and December.

As stated earlier, the monthly payments began on 15 July and can be expected on or around the 15th of each month through December. The remaining balance of the credit - half - will be claimed when families file their taxes next year.

Child Tax Credit Payment Schedule:

- Thursday 15 July

- Friday 13 August

- Wednesday 15 September

- Friday 15 October

- Monday 15 November

- Wednesday 15 December

For those who would like to opt-out of the monthly payments and receive the credit as a bulk sum during tax season, the IRS’ Child Tax Credit Update Portal can be used.

How to calculate your payment

Each month a certain dollar figure will be distributed to families for each child of a certain age. For children younger than six, $300 per child will be sent, and for those between six and seventeen, $250 per child will be sent.

Consider a family that has four children ages, two, four, seven, and ten. The family can expect $600 for the children under six, and $500 for the seven and ten-year-old; bringing the total value of the monthly payment to $1,100.

#IRS will be issuing advance monthly #ChildTaxCredit payments to millions of families. If you have questions related to these payments, see the answers we’ve posted online: https://t.co/Om9jyBsGP3

— IRSnews (@IRSnews) July 14, 2021

*Thanks for sharing your beautiful painting with us, Madison!* pic.twitter.com/YSsPEPFjeW

Who is eligible?

Eligibility for the credit is based on income. Those with the following annual gross incomes are eligible to receive the full value of the credit,

- Married and filing jointly OR filing as a widow or widower with an annual gross income less or equal to $150,000

- Head of Household filer making less or equal to $112,500 a year

- Single filer making less or equal to $75,000 a year.

Related stories

After these income limits have been reached families may receive some part of the credit but the amount will decrease as the income level increases. If these income requirements are met the IRS will “automatically enroll you for advance payments. You do not need to take any additional action to get advance payments.”

True. As long as you’re eligible and have filed your 2020 tax return or 2019 tax return, you’ll generally receive Advance #ChildTaxCredit payments without taking any action. https://t.co/535gR8FJvp #IRS https://t.co/8JOR1km7tu

— IRSnews (@IRSnews) July 13, 2021

If you are interested in checking if you are eligible and the quantity that will be distributed, taxpayers can use the Child Tax Credit Eligibility Assistant. This portal is now available in English and Spanish.