Fourth stimulus check and child tax credit live updates: Tuesday 27 July

Latest updates and information on related benefits from President Biden's coronavirus relief bill, and news on a possible fourth stimulus check. This live blog is now closed.

Show key events only

Stimulus checks and Child Tax Credit latest | Tue 27 July

Headlines

-$1,000 stimulus checks for educators, who is getting them? (Details)

-Unemployed workers file a lawsuit to have federal benefits reinstated. (Details)

- Have stimulus checks and Child Tax Credit payments caused a rise in inflation and price increase? (Details)

- Will a fourth stimulus check be included in the $3.5 trillion reconciliation package? (Details)

- Why is my Child Tax Credit payment lower than I had expected? (Details)

- Watch out for scammers trying to steal your stimulus check and Child Tax Credit payments (Details)

Useful information / links

IRS Child Tax Credit portal: how can I use it to opt out? (Details)

How much money can you get from stimulus checks and the Child Tax Credit? (Calculate)

Child Tax Credit | When is the deadline to opt-out of the August payment? (Details)

US Congress 101 | What is a reconciliation bill and how is it different from a normal bill? (Details)

Unemployment | Will benefits be reinstated in states that have ended them because of the delta variant? (Details)

Still waiting for your tax refund? Find out when to contact the IRS

Have a read of some of our related news articles:

Child Tax Credit 2021: when is the deadline to opt out from August payment?

Child Tax Credit 2021: when is the deadline to opt out from August payment?

The deadline for opting out of the credit is August 2.

Opting out at this stage prevents you from receiving any more of the credit until the end of the tax year in April 2022. However, the IRS says they will be adding functionality on the portal so families who opt out and change their mind can rejoin the monthly payments.

Read our full coverage for more details.

How have the various generations of Americans been impacted by unemployment and the pandemic?

Florida Union-Times, reports that "Gen Xers" have been hit especially hard by unemployment.

As lawmakers negotiate over infrastructure, CBS took a look at America's crumbling infrastructure -- in desperate need of investment.

What is the vaccine mandate for NYC and California employees? When is the deadline?

What is the vaccine mandate for NYC and California employees? When is the deadline?

Some states opt to make covid-19 vaccination mandatory for state workers. Find out which in our full coverage.

Senators and White House may agree to extend a federal program that would increase access to broadband internet to low-income families through the Bipartisan Infrastructure bill -- should the two sides be able to reach an agreement.

Where do negotiations on the Bipartisan Infrastructure plan?

Democratic negotiators are meeting with the White House over the infrastructure plan in an effort to salvage the bill.

The groups have yet to overcome a few hurdles that have arisen in recent days over how to pay for the package and how much money should be allocated for public transit.

$1,000 stimulus checks for educators: who is getting them and when?

$1,000 stimulus checks for educators: who is getting them and when?

The federal government appearsunlikely to pass a fourth stimulus check anytime soon but some states have offered bonus payments for teachers and school staff.

Read our full coverage for more details on who qualifies.

Fate of infrastructure bill hangs in the balance

Leading Democrats have signalled that negotiators may have to be prepared to work over the weekend to thrash out an agreement on the $1.2 trillion package.

There were hopes the bill would be ready to be voted upon yesterday but it now looks like it won't even be ready this week. The longer talks go on the less likely an agreement will be struck as both sides dig in.

But Ohio Senator Rob Portman, the Republican leading the bipartisan infrastructure talks, said he believes the effort is, "headed in the right direction," noting that "it's a big and complicated bill."

It's not too late to opt out of the Child Tax Credit monthly payments

When the Child Tax Credit 2021 officially went live on 15 July the vast majority of eligible parents were automatically sent the first of six monthly direct payments. However some had decided to opt out of the regular payments and chose to keep a single end-of-year tax credit.

If you think that would suit your family, it's not too late to do the same. Simply log in the IRS' online Child Tax Credit portal and you can receive all remaining payments in the form of a single tax credit to be claimed while filing your 2021 taxes.

Are stimulus checks a good idea?

Across the country there is fairly strong support for another round of stimulus checks and a significant number of Democrats in Congress have publically called for President Biden to include recurring stimulus checks in his next piece of relief legislation. However while the direct payments provided a much-needed boost for recipients the long-term impact of such a sudden influx of federal spending into the economy is still unknown.

In this short video from Vox, a number of leading economists look at some of the arguments against a fourth stimulus check...

$1,000 stimulus checks for educators: who is getting them and when?

Throughout the pandemic many frontline workers have been tasked with trying to continue in difficult circumstances, often putting themselves at greater risk to ensure certain essential services can continue. To show appreciation for their efforts some states have passed legislation proving a one-time stimulus check for educators, often termed a ‘thank you’ or hazard pay bonus.

A number of states have introduced teachers' stimulus checks to reward those who have worked hard throughout the pandemic, often using federal relief funding to do so. But which states have passed the legislation and when will the payments arrive?

Non-filers can still apply for the Child Tax Credit

Even though the first round of payments has already gone out, it is not too late to register for the Child Tax Credit if you have not yet received a payment. Most families got their payments automatically but those who do not typically file taxes will have had to regiater for the support using the IRS' Non-filers Tool to provide the neccessary details.

IRS Child Tax Credit portal: how can I use it to opt out?

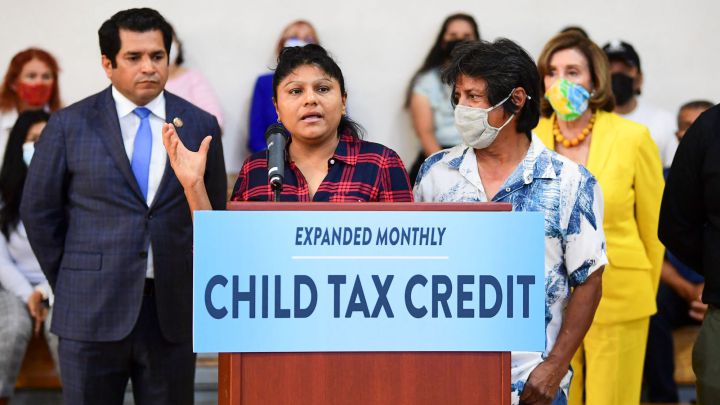

On 15 July the IRS started making payments as part of the reformed Child Tax Credit, which will see parents receive a monthly direct payment for the first time.

However parents can also decide to receive the money as a single annual payment if they prefer. They will instead receive their full entitlement as a lump sum tax credit at the end of the year and they will avoid the risk of having to repay the money if they experience an income increase before the end of 2021.

Child Tax Credit will not affect benefits eligibility

The new-look Child Tax Credit programme is expected to be very lucrative for eligible parents. Over the course of the 12-month programme the IRS will send up to $3,600 for each eligible child younger than six, and $3,000 for those aged six to 17.

Despite potentially earning thousands of dollars from the credit, it will not affect eligibility for other federal benefits because the Child Tax Credit is not considered a form of income.

How many stimulus checks have been sent since March 2020?

Throughout the pandemic the federal government has sought to get financial support out to individuals and businesses to help mitigate the damage that covid-19 has done to the American economy.

One of the most popular, and most expensive, programmes introduced in the last 18 months is the stimulus checks, which have provided a direct cash injection to help pay for essentials and revive the flailing economy. The federal government has spent hundred of billions of dollars on the three rounds of direct payments, but how many stimulus checks have been distirbuted in total?

Economic growth expected to slow as stimulus spending wears off

We know that the huge amounts of federal investment earlier this year had a notable effect on the US economy after consumer confidence soared with the distribution of the third stimulus check. Across the board industries benefitted from the influx of federal cash and the reopening of businesses as covid-19 restrictions eased.

However economists are now warning that this rate of growth is likely to slow in the coming months as the impact of that spending wears off.

“We’ve moved into the more moderate phase of expansion,” said Morgan Stanley's chief US economist Ellen Zentner. “We’re past the peak for growth, but that doesn’t mean something more sinister is going on here and that we’re poised to then drop off sharply.”

Is the Child Tax Credit the new Social Security?

The Biden administration is incredibly optimistic about the impact that the new Child Tax Credit will have on the American society, and has compared its effect to one of the most influencial pieces of federal support in US history.

Speaking from the White House, Biden said: "This has the potential to reduce childhood poverty in the same way that Social Security reduced poverty for the elderly."

The reformed Child Tax Credit is expected to halve the number of children in poverty over the next 12 months and the White House is already attempting to extend it through 2025.

“We have a child allowance for 2021. Without an extension [to the Child Tax Credit expansion], we’ll see the impact for this year, but over time it’ll completely evaporate.”

How much money can you get from stimulus checks and the Child Tax Credit?

One of President Biden’s first priorities upon taking office was to pass a large-scale relief bill that would form the first stage of his administration’s covid-19 recovery efforts. He announced details of the American Rescue Plan shortly before entering the White House but it wasn’t until 13 March that he was able to sign it into law after protracted negotiations in Congress.

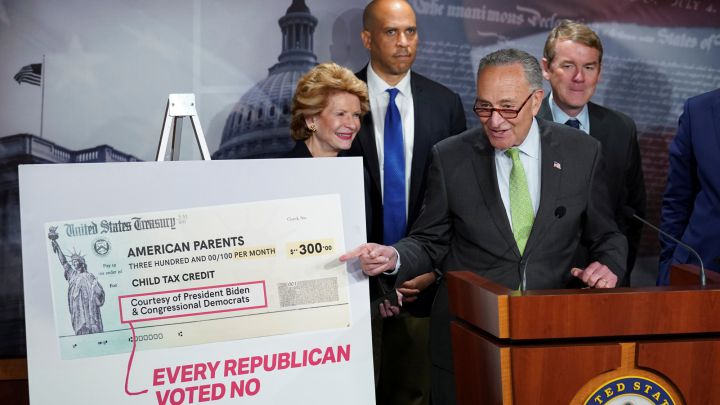

Without any Republican support in the Senate Biden was forced to push the package through using reconciliation. The $1.9 trillion stimulus package was one of the largest of its kind in American history and it provided direct support in the form of stimulus checks and the reformed Child Tax Credit, but how much were these two flagship programmes worth to a typical family?

Yang calls for recurring fourth stimulus checks

Former presidential and New York City mayoral candidate Andrew Yang has shared an article extolling the virtues of recurring stimulus checks to balance out the removal of the additional unemployment benefits. Throughout the pandemic the federal government has offered various support programmes for out-of work Americans.

But those programes are set to end on 6 September and with no replacements looking likely millions of people will be left without the support. Yang suggests that monthly stimulus checks could be a temporary fix.

Where's my IRS tax refund?

tax agency is working through a huge backlog of unprocessed filings from 2020, which is thought to have reached as high as 35 million earlier this month. This has had a knock-on effect on the IRS' other tax-related activities and millions are facing delays in getting their tax refund.

A condition in the American Rescue Plan made the first $10,200 of unemployment benefits received in 2020 completely tax-free, meaning that millions overpaid and are now due a refund. To check the status of you refund and track the payment, use the IRS' Where's My Refund online portal...

$3000/$3600 Child Tax Credit: what are the IRS warnings about payment scams?

It has been nearly two weeks since the first round of Child tax Credits were sent out across the US but already people are under threat from those trying to steal data and money. With millions of people receiving the credit, a large new market has opened for scammers to exploit.

And the IRS are well aware and have set about informing taxpayers about the risk and what signs to look for.

Oliver Povey brings you the latest.

Tax scammers targeting stimulus checks

The Inland Revenue Service once again warns taxpayers of scams which use the IRS name to target potential victims.

Make sure that you're not one of the victims.

US business leaders push for infrastructure bill

Over 140 business leaders have signed onto a a letter of support in favor the Bipartisan Infrastructure proposal.

Stimulus vs inflation: Powell explains position

Jerome Powell speaks on increases in inflation seen across the US as the economic recovery from the covid-19 pandemic crisis continues.

Schumer "fully committed" to infrastructure stimulus

Senate Majority Leader Chuck Schumer has stated that he is "fully committed" to getting the bipartisan infrastructure bill passed this summer. However, this could mean that lawmakers miss some of their recess as they will need to stay in Washington to get it passed.

$3,000/$3,600 Child Tax Credit: why are some payments lower than expected?

From 15 July the IRS began making payments as part of the new Child Tax Credit, after the system was overhauled in the American Rescue Plan. So far more than 35 million families have receive the support, which will continue on a monthly basis for the remainder of 2021 at least.

However with such a massive nationwide distribution effort underway it appears that some families have been underpaid or missed out entirely. If your Child Tax Credit payment was less than you expected.

Maite Knorr-Evans takes a look at some of the reasons why.

Stimulus check live updates: welcome

Hello and welcome to our daily live blog for Tuesday 27 July 2021, bringing you updates on a potential fourth stimulus check in the United States.

We'll also offer information on the third stimulus check, which began going out in March, as well as economic-support measures such as the new, expanded Child Tax Credit.

Stay with us throughout the day for regular updates, or pop in and out and find out what's fresh.

- Coronavirus stimulus checks

- USA coronavirus stimulus checks

- Joseph Biden

- IRS

- Child poverty

- United States Senate

- Science

- United States Congress

- Unemployment

- Coronavirus Covid-19

- United States

- Inland Revenue

- Pandemic

- Coronavirus

- Poverty

- North America

- Parliament

- Employment

- Virology

- Outbreak

- Infectious diseases

- Childhood

- Public finances

- Microbiology

- Diseases

- America

- Medicine

- Work

- Social problems

- Politics

- Finances

- Biology

- Health

- Society

- Life sciences