Fourth stimulus check and child tax credit summary: 28 July 2021

Latest updates and information on related benefits from President Biden's coronavirus relief bill, and news on a possible fourth stimulus check. Wednesday 28 July 2021.

Show key events only

Headlines

-New reporting shows that disgraced USA gymnastics doctor Larry Nassar received two stimulus checks in prison, but has not paid his victims restitution. (Details)

-$1,000 stimulus checks for educators, how to claim (Details) & who is getting them? (Details)

-Unemployed workers in Ohio and Florida file a lawsuit to have federal benefits reinstated.

- Have stimulus checks and Child Tax Credit payments caused a rise in inflation and price increase? (Details)

-Will a fourth stimulus check be included in the $3.5 trillion reconciliation package? (Details)

Useful information / links

What is IRS TREAS 310 and how is it related to 2020 tax returns? (Details)

IRS Child Tax Credit portal: how can I use it to opt out? (Details)

How much money can you get from stimulus checks and the Child Tax Credit? (Calculate)

Child Tax Credit | When is the deadline to opt-out of the August payment? (Details)

US Congress 101 | What is a reconciliation bill and how is it different from a normal bill? (Details)

Unemployment | Will benefits be reinstated in states that have ended them because of the delta variant? (Details)

Still waiting for your tax refund? Find out when to contact the IRS

Have a read of some of our related news articles:

Still thinking about investing your $1,400 stimulus check?

Investors.com has listed 10 ways to invest your third stimulus check if you still have it...

Did more men or women work from home in 2020?

The pandemic has been very challenging for parents, single parents in particular. Balancing the demands of work for those who remained employed and caring for their children brought many to their breaking points.

The Department of Labor's Bureau of Labor Statistics released new data showing, that nearly half of employed women worked from home in 2020.

For women, this indicator was about 5 points higher than their male counterparts. The data also shows that the rate has increased considerably over 2019 levels.

Could the possibility of a Democrat led reconciliation bill thwart the chances of the Bipartisan Infrastructure package passing?

Kyle Midura, a local DC based reporter, spoke with Energy Secretary Jennifer Granholm just that question. Watch to see how she responds.

Half of states have already ended federal unemployment benefits. The program will end in all states on 6 September and leaders are already worried as unemployment could tick up as the delta variant surges across the country. Where are cases increasing the fastest? Read our full coverage.

Larry Nassar, the disgraced former team doctor for the USA national gymnastics team received two stimulus checks. Nassar's prison account has reached over $2000.

Nassar was found guilty of assaulting over 150 women and girls, including Olympic superstar Simone Biles. Biles has withdrawn from various Olympic events due to mental health issues, and many wonder if she will compete in the individual events next week. More on Biles, read our coverage.

What is a reconciliation bill and how is it different from a regular bill?

What is a reconciliation bill and how is it different from a regular bill?

After negotiations on President Biden’s American Jobs Plan fell apart, a group of Democratic and Republican Senators drafted a bill that makes more traditional investments in physical infrastructure. The American Jobs Plan had included other measures targeting human infrastructure and workers in the care economy, which were excluded from the bipartisan bill.

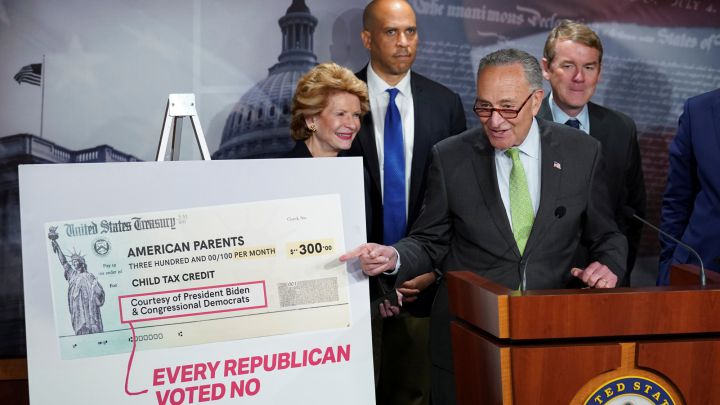

Recently, Senator Bernie Sanders unveiled a reconciliation bill totaling over 3.5 trillion dollars that includes many of the popular provisions of the American Families Plan and the American Jobs Plan, like making the changes to the Child Tax Credit permanent.

Read our full coverage for more on what a reconciliation bill is and how it differs from standard pieces of legislation.

When does Donald Trump think of the Bipartisan Infrastructure deal?

After Mitch McConnell, the former leader of the Senate through his support behind the infrastructure package, Trump released a statement voicing his opposition.

The former president sees the deal as a "loser" for Republicans, and bashed members of his party for negotiating with the "radical left." Over 11 Republicans had supported the package, but with the party leader against it, some support may begin to dwindle.

$1000 stimulus check for educators: how to claim it if I haven't received it

$1000 stimulus check for educators: how to claim it if I haven't received it

Teaching staff have been at the forefront of the pandemic, either with dangerous in-person teaching or preparing classes to teach online. It has been a tumultuous 18 months for the profession and it isn't going to get much easier soon. The CDC, for example, now recommends that all students in grades K-12 wear masks in the classroom regardless of their vaccination status.

As a way to show appreciation for their efforts, and to help retain teachers and staff, states have been approving one-time “thank you” using federal stimulus funds.

Read our full coverage for more details on how to claim your check.

What should I do if my Child Tax Credit amount is wrong?

What should I do if my Child Tax Credit amount is wrong?

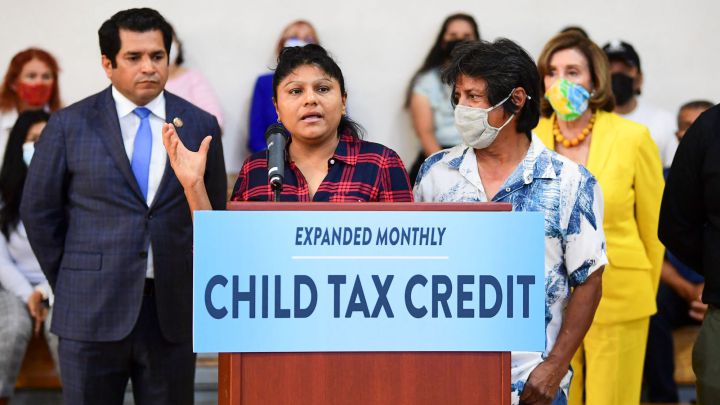

On 15 July the IRS began sending out payments as part of the new-look Child Tax Credit, the first of its kind in American history. The United States Treasury Department has confirmed that more than 35 million families, with roughly 60 million children, received the support.

The total cost of that first round of payments was $15 billion, meaning that the average payment was $423. However some have found that their payment was less than they expected; what can you do if your Child Tax Credit payment amount is wrong?

Read our full coverage for more details.

How can lawmakers learn from the mistakes made during the economic recovery from the Great Recession?

The Tax Policy Institute addresses the lack of stimulus passed during the Great Recession and how that left local and municipal governments strapped for cash. Over time, these entities became a drag on the economy. See their full coverage for how lawmakers can avoid this phenomenon again.

Deal reached on Biden's infrastructure plan

"We now have an agreement on the major issues," chief Republican negotiator Portman said. "We are prepared to move forward."

The bipartisan package includes about $600 billion in new spending on highways, bridges, transit, broadband, water systems and other public works projects.

Senate Majority Leader Chuck Schumer opened the Senate on Wednesday announcing a possible test vote on the bipartisan package in the evening.

Why might you want to opt out of the Child Tax Credit?

NBC's Bay Area correspondent looks at some of the reasons why people may choose to opt out of the new Child Tax Credit, which came into effect this month. The monthly payment structure will provide a more steady stream of support for families struggling through the pandemic but brings the risk of having to pay some of it back if your household income increase before the end of the year.

Fourth Stimulus Check: Is another payment included in the reconciliation bill?

As negotiations over the bipartisan infrastructure plan stall, Senator Bernie Sanders unveiled a $3.5 trillion reconciliation package. The proposal includes many popular measures that were left out of the infrastructure plan put together by over twenty Democratic and Republican Senators.

But what does this mammoth package include?

What should I do if my Child Tax Credit amount is wrong?

The IRS and the Treasury Department have confirmed that more than 35 million families, with roughly 60 million children, received the support. The total cost of that first round of payments was $15 billion, meaning that the average payment was $423.

But not everyone is happy with the payment they received and some claim that they have been underpaid for the first round of payments. What can you do if your Child Tax Credit payment amount is wrong?

Should you take the advanced payments of the Child Tax Credit?

The new Child Tax Credit programme provides advanced monthly payments of next year's tax credit, but should you ask to opt out? As explained in these tips from USA Today, plenty of people have decided to wait and receive the whole value of the credit when they come to file their taxes next year.

You won't miss out on the money, you'll still the receive the full amount in a lump sum tax credit to reduce your 2021 tax bill or increase the size of your refund.

How many stimulus checks have been sent since March 2020?

Throughout the pandemic the federal government has sought to get financial support out to individuals and businesses to help mitigate the damage that covid-19 has done to the American economy.

One of the most popular, and most expensive, programmes introduced in the last 18 months is the stimulus checks, which have provided a direct cash injection to help pay for essentials and revive the flailing economy. The federal government has spent hundred of billions of dollars of the direct payments, but how many stimulus checks have gone out in total?

How can non-filers apply for the Child Tax Credit?

For most American families the monthly payments from the new Child Tax Credit will have arrived automatically earlier this month, but low-income households may have to complete one extra step to get the money.

If you are not usually required to submit a tax return then the IRS will not have your personal and banking details on file, both of which are required to trigger the payment. Fortunately it is not too late, and the IRS' Non-filers Tool allows you to register for the programme easily to get your payments.

$3000/$3600 Child Tax Credit: what are the IRS warnings about payment scams?

Earlier this month the IRS began distribution of the first round of Child Tax Credits, sending out payments across the US. Unfortunately however, the tax authority is already reporting instances of scammers trying to steal data and money from CTC recipients. With millions of people receiving the credit, a large new market has opened for scammers to exploit.

The IRS are well aware and have set about informing taxpayers about the risk and what signs to look for. We take a look at some of the most common scams and how to protect yourself.

Where's my IRS tax refund?

The IRS has been working against the clock to clear a backlog of around 35 million unprocessed tax returns from 2020. The tax agency has had a very busy 18 months, overseeing all three rounds of stimulus checks as well as the introduction of the new Child Tax Credit monthly payments.

As such, there have been delays to the tax refund process but fortunately you can keep up to date on the latest developments using this online portal to track your payment...

Who do I call about my Child Tax Credit?

With 35 million payments sent on day one, the Child Tax Credit has been a boost to families income across the country. The IRS say that 86% of people received the money through a bank transfer but that still leaves 1 in 6 people waiting for checks in the post.

If you are one of these people then you may have questions about when the money will arrive and how to find out how to access more information from the IRS. Here's everything you need to know...

Teachers will receive stimulus check bonuses for pandemic work

At least six states across the country are planning to send teachers and other school staff a one-time payment of up to $1,000 as a 'thank you' for their work during the pandemic. Educators are one of the few groups of workers who were required to remain working through much of the pandemic, while others were advised to stay at how for their own safety.

The stimulus check payments are often termed a 'recruitment' or 'retention' bonus, designed to encourage more people into, or to stay in, the profession after a very difficult 18 months.

Why are people opting out of the Child Tax Credit monthly payments?

The IRS starting making payments for the new Child Tax Credit on 15 July, sending out monthly payments of up to $300 per child to eligible parents. The new ystem replaces the old single annual tax credit, but not everyone is keen on the new payment structure.

Some parents are choosing to opt out of the monthly payments to get all the support as a single end-of-year credit. This will give them a substantial tax credit to reduce the size of the 2021 tax bill and avoids the risk of being forced to repay the payments if they experience an income increase in the next six months.

$1,000 'stimulus check' for teachers

While a fourth stimulus check still seems a long way away, some states and local school boards are tapping federal stimulus money to give teaches a one-off $1,000 bonus payment as means thank them for their efforts during the covid-19 pandemic.

So far, Michigan, Georgia and Florida already have disbursed or agreed to send payments to their teachers.

Infrastructure bill could create nearly 500,000 jobs according to report

The bill, currently held up in the Senate, is predicted to provide boost to the industrial sector.

"The data shows that it would ... generate over $2 billion in new federal, state, and local tax revenue from the equipment manufacturing industry, and result in an additional $27 billion in overall economic output," noted Kip Eidberg of the Association of Equipment Manufacturers trade group.

It is being held up primarily because Republicans and Democrats can't agree how to fund it. The GOP is afraid that the bill may be paid for with a tax increase while Democrats say it will just be a tax on the wealthy.

Calls to expand enhanced child and income tax credits

Many US workers are set to benefit from the enhanced Child Tax Credit and Enhanced Income Tax Credit (EITC). But with both of these measure temporary as things stand, there have been many calls to expand them beyond 2021.

Among those urging US congress to make these enhanced tax credits permanent is Adam Ruben, director of Economic Security Project Action, who has thrown his support behind Rep. Gwen Moore's Worker Relief and Credit Reform Act, which aims to both expand and modernize the EITC.

“When you give people cash, you give people the tools to solve their own problems,” Ruben said.

Much more important infrastructure bill everyone is ignoring - WSJ

With all the attention on the two infrastructure bills currently being debated in Congress, WSJ executive editor writes that there is a much more important bill sitting on the shelf which focuses on boosting US semiconductor domestic production to end a over-dependence on imported semiconductors.

"It’s a relatively modest initiative to supercharge America’s at-home production of the semiconductors that now are vital in everyday life. That measure is sitting on a shelf in Washington, awaiting action, while the U.S.’s computer-chip vulnerability grows."

"America today is dangerously reliant on foreign producers of semiconductors, crucial components of everything from phones to laptops to cars to smart appliances to much of the equipment in your local hospital."

More business support for infrastructure bill

146 business leaders have addressed a letter to senior Democrats and Republicans urging them to get the bipartisan infrastructure bill through the Senate.

Negotiations are still ongoing but there is some doubt whether an agreement will be reached.

“We urge you to finalize and adopt this program to modernize and expand physical and digital assets that are a necessary foundation for our nation’s sustainable growth,” the letter says.

It goes on to say the public-private initiatives established through the new funding, “will accelerate recovery from losses suffered due to covid-19.”

Florida and DeSantis sued for ending unemployment benefits early: can they be brought back?

Florida and DeSantis sued for ending unemployment benefits early: can they be brought back?

Ten unemployed workers in Florida are suing the state government to have their federal unemployment benefits reinstated.

The Florida Phoenix has reported that the filed against the State, “alleges that Gov. Ron DeSantis and the Florida Department of Economic Opportunity are in violation of a statute requiring them to cooperate with federal labor officials “to the fullest extent … necessary to secure for this state all advantages available under the provisions of federal law relating to reemployment assistance.”

Read our full coverage for more details and other similar cases filed in other states.

Chuck Schumer warns Senators that they should be ready to work through the weekend to reach a deal on infrastrcure.

Stimulus check live updates: welcome

Hello and welcome to our daily live blog for Wednesday 27 July 2021, bringing you updates on a potential fourth stimulus check in the United States.

We'll also offer information on the third stimulus check, which began going out in March, as well as economic-support measures such as the new, expanded Child Tax Credit.

Stay with us throughout the day for regular updates, or pop in and out and find out what's fresh.

- Joseph Biden

- USA coronavirus stimulus checks

- Coronavirus stimulus checks

- IRS

- Covid-19 economic crisis

- Science

- Coronavirus Covid-19

- Economic crisis

- United States

- Pandemic

- Coronavirus

- Recession

- Inland Revenue

- North America

- Economic climate

- Virology

- Outbreak

- Infectious diseases

- Diseases

- Microbiology

- Public finances

- America

- Medicine

- Economy

- Biology

- Health

- Finances

- Life sciences