Fourth stimulus check new summary | 7 October 2021

Updates as the Democrats attempt to pass their agenda, including their $3.5 trillion Build Back Better plan which could lead to expanded Child Tax Credits.

Show key events only

Eligibility and how to apply for Social Security as a permanent resident in the US

Every single permanent resident in the United States should have a Social Security Number, which is used to grant access for a huge variety of federal programmes and services. The registration process to receive a Social Security Number is fairly straight forward, and can even be initiated while the recipient is completing the residency process. We take a look at how to apply for a Social Security Number...

“Thanks to the American Rescue Plan, families across the country will begin receiving monthly Child Tax Credit payments today. In our community, nearly 3 in 4 children will receive these payments, putting money in the pockets of parents to help pay for mortgages, child care, summer learning, and more, as we continue to recover economically from the pandemic."

“The Child Tax Credit will deliver critical resources to families when they need it most, but let’s be clear: families need support well beyond this pandemic. I’m fighting in Congress to permanently expand these Child Tax Credit payments, so our families have the resources needed to thrive this month and into the future.”

Child Tax Credit expansion could be a net gain for the United States

Moderate Democrats currently appear unwilling to support an extension of the expanded Child Tax Credit, despite early evidence suggesting that it is having a considerable impact on the number of children in poverty in the US. Many, like NBC and MSNBC Political Analyst Julian Castro, have pointed out that the economic benefits that the country can expect to reap would far exceed the cost of the programme.

What is the debt increase by president?

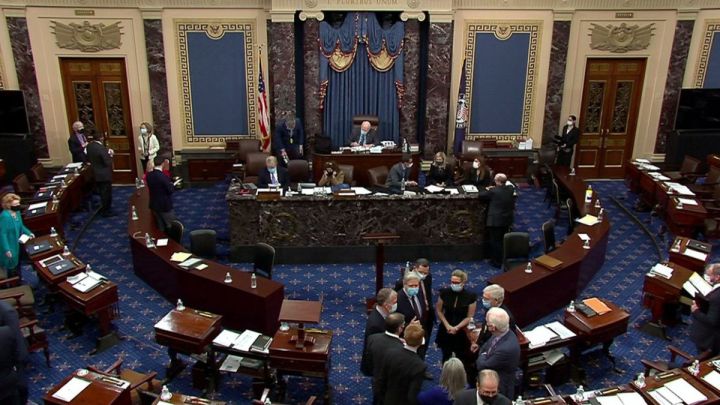

After weeks of congressional wrangling, the Senate has finally approved a temporary suspension to the national debt ceiling which should prevent the US defaulting on its debts later this month.

The US hasn’t always ran deficits, and at one point in time had nearly paid off its entire debt, but in recent years the debt leavel has increased to a whopping $28 trillion. Which presidents are responsible for running up the national tab?

Senate approves debt ceiling increase

After weeks of uncertainty it seems like the United States will be steered clear of an unprecedented first default on its debt obligations, after a deal was struck in the Senate to temporarily raise the debt ceiling. Funding for the likes of Social Security and Child Tax Credit payments was threatened, along with the catastrophic impact that a default would have had on the financial markets.

Do I believe in an "entitlement society"? Yeah, I do.

I believe that all Americans are entitled to a quality education, to affordable housing, to a decent standard of living.

I do not believe that 2 people are entitled to block what the majority of the American people want.

Build Back Better plan needed to counter China

NBC reports that they have received a copy of a memo from the Biden administration laying out why the Senate needs to pass the $3.5 trillion spending package Democrats are negotiating. One of the primary reasons is to keep the nation from falling behind other countries, mainly China.

Initial unemployment benefit claims resume downward trend

After three weeks of increasing first-time jobless benefit claims the number people of out of work seeking financial assistance declined according to data released Thursday by the Department of Labor. The reverse of the downward trend since last winter was blamed on the highly contagious Delta coviid-19 variant keeping people home and forcing businesses to reinstate restrictions.

Last week there were 326,000 initial claims for benefits, 38,000 fewer than in the previous week.

President Biden will sign short-term debt ceiling extension

The US was racing toward calamity with a possible default on the national debt estimated on or around 18 October. An agreement between Democrats and Republicans will give lawmakers a nine-week breathing period.

They will raise the debt ceiling by $480 billion keeping the US from defaulting on its debt until 3 December. According to the White House President Biden will go along with the deal.

Can a person who has never worked collect Social Security?

Around 63 million people in the United States receive Social Security benefits. Primarily the benefits are distributed to seniors who have retired or have a disability and have worked for the required number of years.

To qualify for Social Security benefits one must meet a few requirements.

For those hoping to claim benefits once they have retired, it is mandatory that the worker has paid into the Social Security pot. Depending on the number of years contributing and your annual income you will earn a certain number of work credits, which help to calculate your total benefit amount.

Can a fourth stimulus check still happen in 2021? Are the negotiations still ongoing?

There is a contentious fight among Democrats over how to proceed with President Biden’s Build Back Better plan as American families still struggle.

So what has happened with the calls for more stimulus checks?

What is in the Build Back Better plan

The White House and Democrats in Congress are negotiating a $3.5 trillion spending package over the next ten years. The sweeping legislation seeks to implement President Biden's vision of reconstructing the nation on a fairer and stronger footing. But what all is in the bill?

Mehdi Hasan at MSNBC tries to explain in 60 seconds...

US at the back of the pack in family infrastructure spending

Congress is pulling together the various proposals of President Biden's Build Back Better plan. The sweeping legislation, if passed, would be the greatest expansion of the US social safety net since the 1960s. Part of the bill would help address the needs of working families to balance the work with the obligations of raising a family, an area where the US lags far behind other developed economies.

Countering Child Tax Credit work disincentive arguments

A new working paper from the University of Chicago’s Becker Friedman Institute, estimates that extending the changes included in the 2021 Child Tax Credit could lead 1.5 million workers exiting the labor force.

Child Tax Credit poverty reduction may be less than anticipated

Congressional Democrats are working to extend the changes made to the Child Tax Credit for the 2021 fiscal year through 2025. Supporters say that the enhanced credit could reduce childhood poverty by up to 50 percent.

In a new working paper from the University of Chicago’s Becker Friedman Institute, they calculate that childhood poverty will reduce by 34% and deep child poverty by 39 percent. However, the paper says that the credit will create work disincentives which would limit the poverty reduction to just 22 percent with no change in the deep poverty rate.

Debt ceiling limit hike kicked down the road

Democrats and Republicans have reached an agreement to raise the debt ceiling by $480 billion. That's just enough to keep the US government from defaulting on its debt until 3 December.

Treasury Secretary Janet Yellen had warned Congress that if the debt ceiling wasn't raised before 18 October, the US could default on its financial obligations causing widespread harm to the economy. Now Congress will have to workout how to raise the debt ceiling in the long-term by 3 December, which is also the deadline pass a budget to fund the government.

Child Tax Credit, entitlement or stimulus for stagnating economies?

Senator Joe Manchin received direct criticism for his resistance to back the full Build Back Better plan taking shape in Congress. The legislation includes President Biden's plans to strengthen the US social safety net through expanded healthcare, child care, as well as paid family leave and free community college. The legislation would extend the changes to the Child Tax Credit which are already showing pay offs in improving the lives and financial stability of households across the nation.

Senator Manchin has said American "should have a compassionate and rewarding society" and not move " towards an entitlement society." However his state would be in the top 10 of beneficiaries from the enhanced Child Tax Credit, which as a tax cut pumps money into the local economy possible increasing consumer spending by $27 billion and creating 500,000 jobs according to the Niskanen Center.

How much were the first, second and third stimulus checks and when were they sent out?

Three stimulus checks have been sent out by the US federal government since the start of the covid-19 pandemic early last year.

What are the 2022 Medicare premiums?

What are the 2022 Medicare premiums?

Those who receive social security are automatically enrolled in Medicare Parts A and B. Part A covers hospital visits and other intensive medical needs. In contrast, Part B covers doctor's appointments and other essential medical services. The Social Security Administration (SSA) deducts the premiums for these parts from your total benefit amount each month.

Read our full coverage to learn how these prices are expected to change next year.

2021 US economic deadlines: debt ceiling, infrastructure bill and government funding

2021 US economic deadlines: debt ceiling, infrastructure bill and government funding

The Democrats currently wield unified power in Washington, holding the White House, the House of Representatives and, by the slimmest of margins, the Senate. This allows Biden to pass most economic legislation without any Republican support, using a congressional mechanism known as reconciliation, but he may lose that option in the 2022 mid-terms.

The is a concerted effort on behalf of the White House to push through the President’s priorities before the end of the year, with three key deadlines likely to dictate whether that effort is successful or not.

Read more about these deadlines and what they mean for the President's legislative agenda in our full coverage.

How does support for the Child Tax Credit vary by political party?

A new poll released by Morning Consult and POLITICO shows that nearly 3 in 4 Democrats support making the credit's structure permanent. However, the favorability of the policy is much weaker among Republicans, only 30% of which declared their support during the survey.

How long does it take for Social Security to change direct deposit?

Social Security benefits can be paid in two ways.

The first is through a Direct Express® Debit Mastercard®, which is refilled each month by the Social Security Administration (SSA). These cards are also used to distribute payments for the Child Tax Credit and other federal benefits.

The second method, which is recommended by the Social Security Administration is direct deposit. For many Social Security beneficiaries, direct deposit is the safest way to receive benefits because there is no risk of a check or debit card getting lost or stolen.

Read our full coverage for more details on the timeline as well as information on how to receive benefits in other countries.

Why should you check your Social Security earnings records?

For many people, Social Security contributions happen without their involvement and are typically made by employers on their behalf. Waiting to turn 70 before beginning to claim Social Security payments can help to maximise the payments, but there is another easy thing that can be done to ensure you get your full entitlement

Your employers will submit a copy of your Wage and Tax Statement, also known as a W-2, to outline your earnings for the year, as well as the amount you have contributed to Social Security. However, an error on this submission could be very costly and could undervalue your Social Security entitlement later in life.

Leading investment publication Barron’s advises that people should check their W-2 submission every year, or risk missing out on tens of thousands of dollars over the course of a lifetime. Here’s everything you need to know to check your Social Security history.

Would failing to extend the Child Tax Credit prevent social climbing?

Senator Joe Manchin wants the Child Tax Credit to become more targeted instead of the current form. As it stands, it is available to more than 85% of American families. The CTC has been targeted because of its relatively high threshold, such that two-earner households making $400,000 still receive $2,000 per child.

“I have got people that are making combined 200 and 300 and more, up to 400 [thousand], saying they’re getting checks,” Manchin complained about the child tax credit earlier this month.

Ironically, lowering the threshold for the child tax credit may act as a work disincentive. Because the phaseout for the tax credit is so high, parents still receive a significant amount even if their income increases. But lowering the income threshold, or cutting the amount a person receives, could discourage people from advancing at work because it means they’ll lose their credit or see it significantly decrease.

The White House credited vaccination requirements with cutting the rate of unvaccinated Americans by one-third

Thursday's report also argued vaccine requirements could help return up to 5 million workers to the workplace, outlining the economic case for mandates.

"Higher vaccination rates will keep more workers safe, healthy, and on-the-job, reducing worker morbidity and mortality as well as worker absenteeism both for the newly-vaccinated workers and people who work with them," the report states.

"The bottom line is that increased vaccination rates through requirements enables a faster and stronger economic recovery."

What medical conditions qualify you for Social Security checks?

Social Security payments don't just cover seniors, they cover the disabled as well. Both the Supplementary Security Income (SSI) and the Social Security Disability Insurance (SSDI) payments can be attained by having a disability, but both have different requirements. A recipient can have both payments at once, if they satisfy both criteria.

To qualify for the SSDI individuals must be registered as disabled, using the list in the article, and must also satisfy certain work history requirements. Bear in mind that family members working (spouse or parent) can also be used to satisfy the requirements, which would be difficult for many to achieve who are born disabled.

Sanders speaks to MSNBC about Joe Manchin

As fears mount in progressives that Senator Manchin is prepared to tank Biden's vision for America, Bernie Sanders has spent the last days speaking to the press about his adversary in the Senate, which is quickly becoming a personal feud.

"I'm tired of hearing about the generalities of what Mr. Manchin and, frankly, what Ms. Sinema are saying," he said.

"When you've got the overwhelming majority of the American people, the overwhelming majority of Democrats and the president [supporting the bills], it's not a 50-50 deal."

"It is wrong for them to think they can dictate the outcome of this process."

Can a person who has never worked collect Social Security?

Around 63 million people in the United States receive Social Security benefits. Primarily the benefits are distributed to seniors who have retired or have a disability and have worked for the required number of years.

To qualify for Social Security benefits one must meet a few requirements.

For those hoping to claim benefits once they have retired, it is mandatory that the worker has paid into the Social Security pot. Depending on the number of years contributing and your annual income you will earn a certain number of work credits, which help to calculate your total benefit amount.

A default would fundamentally hinder the Federal government from serving the American people. Payments from the Federal government that families rely on to make ends meet would be endangered.

Among households receiving any Social Security benefits, those benefits make up more than half of household income on average. And yet, if we default, these Americans may not receive their Social Security payments on time, or even at all.

If the Federal government ended up missing or delaying payments, millions would be unable to put food on the table or pay rent. Before the full weight of the Federal pandemic response had come to bear, the hardships experienced early on—exemplified by families going hungry and waiting in food lines—remind us of the raw misery that inadequate Federal support brings in the wake of an economic shock.

How would debt default affect federal payments?

AN article published by the White House details the problems that would arise from a debt default, you can find select comments above.

Manchin ultimatum to Democrat Progressives

Still raging in Congress, the fight between the right and left wings of the Democrat party has shown no signs of stopping. Emerging last night, moderate senator Joe Manchin has apparently called for Dems to drop two aspects of their policy if they want to continue with the expanded Child Tax Credit. The latter has long been touted by Biden as his flagship policy.

Welcome to our stimulus checks and Child Tax Credit live feed

Hello and welcome to our live feed for Thursday 7 October, as we bring you the latest news on a potential fourth federal stimulus check in the United States. We'll also provide you with information on the monthly Child Tax Credit scheme - which has so far seen three payments of up to $300 go out to eligible households - and on other benefits available to Americans, such as changes to next year's Social Security payments.

Last night the Senate finally voted to temporarily lift the debt ceiling. Republican leaders had said they would support a temporary raise to ensure the US does not default on its national debt. The bill just needs to pass the House which it is expected to in the next few days.