How much tax would you pay if you won the $1.2 billion Powerball jackpot?

The second largest Powerball drawing of all time has another chance to be won on Monday night though the winner will not receive as much as they might think

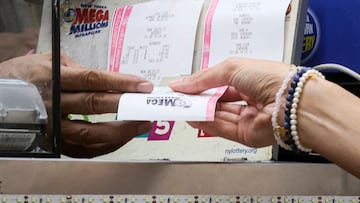

National lotteries have seen a lot of talk since the $1.33 billion mega millions winners in September. Now another lottery is making headlines, this time the Powerball. The current jackpot stands at $1.2 billion or $597 million in immediate cash value.

Why is the cash value much lower? Well, like most other income the winnings are subject to tax laws.

Let’s take a look back at the last winner. One ticket matched all six numbers in the 29 July drawing to win the $1.337 billion prize. The final value was higher than the estimate of 1.28 billion, based on actual sales.

“Congratulations to the Illinois Lottery for selling the winning $1.337 billion Mega Millions jackpot ticket,” said Pat McDonald, Director of the Ohio Lottery, who currently serves as Senior Director of the Mega Millions Consortium.

However, after taxes it was worth $780.5 million cash.

IRS takes most of the winnings

Before the money reached the last winner, the bounty was subjected to a 24 percent federal tax on gambling winnings as US tax residents must pay a top rate of 37 percent on annual earnings over $539,900, so you’ll be liable for the 13 percent difference between that and the 24 percent applied to gambling winnings.

The next winner has two choices, they can opt for an immediate cash lump sum and they also have the option to take the full $1.28 billion prize before taxes paid out over 29 years with 30 annual payments.

The best and worst states to win the lottery

Nine states - Colorado, Illinois, Indiana, Kentucky, Massachusetts, Michigan, North Carolina, Pennsylvania and Utah - have a flat income tax rate that’s mostly around the 5 percent mark. That means you’d have to pay up another $30m or so. The exceptions to that are Pennsylvania and Indiana, which would take 3.07% and 3.23%, respectively, from your winnings.