Relief checks news summary: 14 March 2023

As the fallout from the SVB continues, the BLS will release the February CPI Index, we will bring you the latest on those stories and more.

Show key events only

US Finance: Latest Updates

Headlines: Tuesday, 14 March 2023

- Inflation rose 0.4 percent in February

- Biden administration moves to shore up confidence in banking system after collapse of Silicon Valley Bank

- Chairman Powell says the Fed will increase rates later this month, but how high could they reach by the end of the year?

- Last week, initial unemployment claims rose by 21,000 to 211,000

- Student-loan borrowers should have a “Plan-B” for debt forgiveness

2023 Tax Season

- Who can claim the additional standard deduction?

- The way to access IRS transcripts to ensure a faster tax refund

- Did you receive a state stimulus check? No need to report the payment as income to the IRS.

Read more from AS USA:

The US government announced a bailout to support the investors, angering many as inflation and interest rates keep putting pressure on everyone else.

Silicon Valley Bank’s collapse on Friday spooked markets, caused by investors hurriedly withdrawing funds after reports of a major loss of funds.

A rebound occurred at the beginning of this week as it was announced the U.S. government would be securing all investments. This overrode the usual rules of the government guaranteeing up to $250,000 of deposits. This bailout will cost $175 billion.

U.S. stock market recovers after initial shock following SVB collapse

Investors are confident of a near-term rebound in the battered shares of U.S. banks after the high-profile failure of Silicon Valley Bank triggered a sector-wide selloff.

Options traders were buying up short-term call options on a variety of companies.

U.S. bank stocks rose and recovered some ground after the failure of SVB and Signature Bank triggered heavy selling by investors who were already worried about the impact of rising interest rates on lenders.

Traders now appeared to be speculating that the worst of the selloff was over.

Outlook on U.S. banking system now ‘negative’

Moody's Investors Service changed its outlook on the U.S. banking system from "stable" to "negative" after the collapse of Silicon Valley Bank. The global financial services company cited heightened risks for the sector after the rapid unraveling of SVB Financial Group fueled fears of contagion.

Bank runs at Silicon Valley Bank, Silvergate Capital Corporation, and Signature Bank have deteriorated the operating environment for the sector that is now battling a crisis of confidence, both from investors and depositors, according to the ratings agency.

Lenders that had "substantial" unrealized securities losses and uninsured deposits may be hurt more as customers look for safer alternatives to park their funds.

Egg prices are dropping

In the midst of news of banks collapsing, there’s one positive development that will be felt in many households. Breakfast will be cheaper after the price of eggs went down for the first time in five months.

The cost of eggs had soared to record heights after the world’s deadliest bird flu outbreak killed tens of millions of chickens. Prices finally fell 6.7% last month.

If you know or suspect that tax fraud is being committed and wish to let the Internal Revenue Service about it, you can choose to do it without compromising your identity.

The IRS has a Whistleblower Office that allows people to report suspected fraud, and they may choose not to reveal their identity if they so desire. There are various ways by which you can make a report.

Investors pleased at more unemployment

Previous cuts eliminated 11,000 jobs, around 13% of the workforce in November. Since the start of 2022 tech companies have cut 290,000 jobs though this figure has not yet been felt in overall unemployment figures which remain strong.

The job cuts were expected and Wall Street accepted them greedily with shares in the company increasing in value by 6% on the news.

Meta, the parent company of social media apps Facebook and Instagram, said it will be cutting 10,000 jobs. It is the second large layoff by the company in recent months as it deals with a changing advertising landscape that is devastating the tech world.

After proudly announcing that this year would be the year of “execution”, CEO Mark Zuckerberg probably didn’t want to be swinging the axe so soon. Big plans such as the Metaverse have not yet yielded sufficient funds to cover for the loss of advertisement revenue. With consumers pulling back from spending, companies are looking to keep investors happy by cutting staff numbers.

Real wages continue to fall according to BLS data

Real average weekly earnings decreased 0.4 percent over the month between January and February due to the change in real average hourly earnings combined with a 0.3-percent decrease in the average workweek.

Year-on-year real wages are down 1.9%, emohasising the pressure inflation is putting on workers.

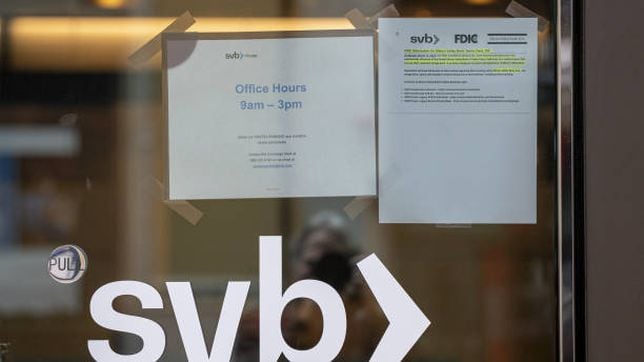

It’s been a rough few days for the banking industry with the largest bank failure since the 2008 crisis, and the first since 2020, occurring on Friday. Silicon Valley Bank, the sixteenth largest bank in the US, was taken over by regulators just 48 hours after depositors began removing their funds en masse.

On Sunday, while announcing emergency measures, the Biden administration said that Signature Bank had been closed as well. However, to prevent further contagion from the evolving banking crisis US banking regulators in a joint statement said that all deposits at the failed financial institutions would be made whole.

The emergency measures though haven’t had the complete calming effect on investors that was hoped for. The collapse of SVB has sent shockwaves through the banking sector and a wave of customers have applied to have their accounts moved to larger financial institutions from smaller lenders.

But just how safe are depositors’ savings at banks right now?

Every year, many Americans leave money on the table failing to claim tax credits that could reduce how much they owe to Uncle Sam, or even be fatten up their tax refund by thousands of dollars. Once such overlooked credit is the Earned Income Tax Credit (EITC), which is aimed at low-income workers and their families possibly worth almost $7,000.

Inflation being driven by services, housing rent is the biggest driver.

Core goods was a predominant driver of inflation in 2021 and into 2022. However, while it has been cooling, inflation in services has been gaining offsetting the reduction in goods. The bulk of inflation, 3% in the fourth quarter of 2022, came from rent, housing services. Prior to this period of accelerated price increases, when inflation was around 2%, rent inflation was around 1.5%.

One of the driving factors behind rent inflation is labor market conditions. A tight labor market, with jobs gains and wage increases, helps fuel rent inflation through greater demand. This will be a challenge for the Federal Reserve in order to get inflation down to its 2% target. Although other factors have pushed up rent inflatio as well, the strong tie between the labor market means that rent inflation will most likely remain high.

Has the US become a “bailout nation” after measures to secure SVB deposits?

Republican Rep. Patrick McHenry, Chair of the House Financial Services Committee was asked whether the United States has become a “bailout nation” after the Biden administration announced plans to ensure customers’ deposits would be wholly protected at defunct financial institutions Silicon Valley Bank and Signature Bank on Squawk Box by Andrew Sorkin. His answer, the federal agencies in charge of handling the mess are doing what they are supposed to do be doing “in conformance with the law.”

"Today is about making sure the American people have confidence in their financial system. We have politicians dancing around in a hackish way, trying to drive their own agenda. We have folks that are opining so that they can actually have a greater platform. And what we see is people trying to dine on the bones of America. And I think that’s highly irresponsible.

"In a moment like this, we should understand what these agencies do. The Fed is doing what the Fed is supposed to do. The FDIC is doing what the FDIC is supposed to do in conformance with the law. And I have no partisan grudge about this, I want to convey confidence to the American people that these agencies are doing the right thing as I see it at this time," said McHenry.

Harvard professor Jason Furman highlights price surges in 'services'

Professor Jason Furman has taken to Twitter to highlight that the Federal Reserve's concerns that services, rather than goods, are now driving inflation were reflected in the February CPI report.

When looking at 'super core inflation,' which looks at services and excludes housing, Furman shows that prices are still rising, and at higher rates than this time last year. Exactly how the Federal Reserve will respond to this data remains to be seen, but it may be the evidence the central bank needs to begin increasing interest rates at a faster pace. The Fed is expected to announce further rate hikes next week.

Regardless, Wall Street markets opened higher, showing that the inflation news is not the most pressing factor on the mind of investors.

BLS says rapid increasing in housing costs drove CPI up by 0.4 percent in February

The index for shelter was the largest contributor to the monthly all items increase, accounting for over 70 percent of the increase, with the indexes for food, recreation, and household furnishings and operations also contributing. The food index increased 0.4 percent over the month with the food at home index rising 0.3 percent. The energy index decreased 0.6 percent over the month as the natural gas and fuel oil indexes both declined.

After the financial devastation caused by the Great Depression, the federal government established the Federal Deposit Insurance Corporation to protect depositors and set new rules for banks.

Currently, there are just under five thousand banks under the supervision of the FDIC. Until last week, one of those institutions was Silicon Valley Bank (SVB), which collapsed under pressure from raising interest rates and a subsequent run by depositors. SVB was the sixteenth largest bank in the United States, and some of its clients included the financial tech company Circle, Etsy, and Roku.

Read more on how the FDIC helps to protect depositors.

The Bureau of Labor Statistics (BLS) has released the February Consumer Price Index (CPI) report and found a 0.4 percent increase month-over-month.

The CPI is one indicator to evaluate inflation in the market. Many had hoped that prices would have fallen, or at a minimum, not increased last month. Following the 0.5 percent rise in prices in January, this additional bump means that since 1 January, average prices have risen nearly a full percent.

Inflation report released amid banking turmoil as Fed ponders rate policy

Bureau of Labor Statistics’ released the consumer price index for February. Overall inflation came in at 6% last month, and core inflation 5.5%, without volatile food and energy prices, both year-on-year numbers were inline with expectations.

This report follows hotter-than-expected recent economic data that had created concern among investors that the Federal Reserve could raise interest rates more than expected when they next meet, especially after Chair Jerome Powell struck a hawkish tone in Congressional testimony.

However, last week saw a new banking crisis erupt with the collapse of Silicon Valley Bank on Friday, and then Signature Bank being closed on Sunday, respectively the second and third largest bank failures in US history.

Investors are now speculating that the Fed may pause rate hikes in light of the latest events.

The sudden collapse of Silicon Valley Bank, the second-largest bank failure in US history, raised concerns about what would happen to customers’ money held at the financial institution. While the bank was federally insured, the Federal Deposit Insurance Corporation (FDIC) only covers insured deposits and financial instruments up to a certain limit.

The Biden administration moved quickly to reassure that the bank’s depositors would be made whole, beyond the federal guarantee, to avoid contagion from the defunct financial institution. The sixteenth largest bank in the United States was put into distress largely because its clients, tech companies and venture capitalists who had deposits far exceeding that guarantee, rushed to withdraw their funds to ensure that they would have money for things such as payroll after Silicon Valley Bank made a financial transaction that spooked its customers.

Read our coverage for more details on how the FDIC works to protect depositors.

The inflation data for February 2023 will be released on Tuesday morning when the Bureau of Labor Statistics (BLS) publishes the Consumer Price Index (CPI) report.

Every month the agency releases the inflation figures for the previous month, outlining how typical prices changed. After rampant inflation throughout much of 2022, the White House is hoping that price rises cool off this year. However, in January, inflationary trends continued, with prices across the market increasing an average of 0.5 percent.

Read more on what has caused inflationary pressure to remain in the market, and the response from the Federal Reserve.

Silicon Valley Bank-branded items for sale on eBay

In the face of Silicon Valley Bank’s failure last week, some enterprising people are trying to get the best out of a bad situation, by making money off items bearing the institution’s logo.

SVB memorabilia that have been sold on eBay include hats, t-shirts, tumblers, and (used) mugs.

The most remarkable bid so far for an item was $201 for a cardboard box with the SVB logo.

44% of Americans have a side hustle

More and more people have a side hustle of some sort, and latest figures show that 44% of Americans are now supplementing the income from their usual jobs with some freelance work.

According to research, there are five side hustles that can earn you $100,000 a year, and all you might need is a fast internet connection and the of course, the right skills. These are digital design, game development, coding, mobile app development, and website development.

Starting in 1940, the Social Security Administration (SSA) has been sending monthly checks to retired workers. Additionally, every month the SSA distributes funds to individuals receiving Supplemental Security Income (SSI), as well as other disability and survivor benefits.

Last year, the SSA announced an 8.7% cost of living adjustment (COLA), resulting in higher Social Security payments for 2023. The SSA has already disbursed payments for January and February and is currently sending out benefits for March. Read more.

Tax filers will be eager to know if and when they will be receiving a tax refund. Filing a tax return as soon as possible is the best way to make sure your return is processed promptly; the IRS will be sifting through tens of millions of tax returns on a first-come-first-served basis.

Typically the IRS is able to distribute a tax refund within 21 days so long as the return is filed electronically. Those who file with paper may have to wait up to six months to receive their refund. Read more.

Good morning and welcome to AS USA's live blog on inflation relief and financial news for Tuesday, 14 March 2023.

Later this morning the BLS will release the Consumer Price Index for February.

We will also be bringing you the latest on the Silicon Valley Bank bailout, and the actions being taken by the Treasury Department to help depositors at the 16th largest bank in the US that went under late last week. So far, President Biden has said that no tax dollars will go toward the bailout.

As tax season is in full swing we will also be bringing you guidance from the IRS, and answering other questions that will help you file your return.

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/XTUXDCKQRRKPDLLEJGPT24ZGB4.jpg)