Credit Suisse stocks summary news: 15 March

Inflation slowed further in February but more interest rate hikes loom to reach Fed target even as concerns are raised over fallout from bank failures.

Show key events only

Finance updates: latest news

Headlines: Wednesday, 15 March 2023

- Producer Price Index shows wholesale inflation cooled more than expected in February

- The value of Credit Suisse's stock took a nose dive during trading this morning

- Regional bank shares rally after heavy losses in wake of SVB and Signature Bank failures

- Inflation rose 0.4 percent in February

- Biden administration moves to shore up confidence in banking system after collapse of Silicon Valley Bank

- Student-loan borrowers should have a “Plan-B” for debt forgiveness

2023 Tax Season

- Who can claim the additional standard deduction?

- The way to access IRS transcripts to ensure a faster tax refund

- Did you receive a state stimulus check? No need to report the payment as income to the IRS.

Read more from AS USA:

US banks being closely monitored by OCC

The US Office of the Comptroller of the Currency (OCC), which supervises national banks, is engaging in 'heightened monitoring' of national banks and coordinating with other regulators amid broader turmoil in the banking sector, a spokesperson for the bank regulator confirmed on Wednesday.

In a statement, the OCC said it is "committed to ensuring that national banks remain safe and sound. In times like these, the OCC engages in heightened monitoring and coordinates with other regulatory agencies in the United States and globally to ensure that the federal banking system remains a trusted source of strength to consumers, businesses and communities".

Along with big names like Etsy and Roku, hundreds of smaller companies will be impacted by the collapse of Silicon Vally Bank, and some may not survive.

AS USA's Maite Knorr-Evans looks at the fall-out from the SVB failure.

AS USA's Maite Knorr-Evans takes a look at the protections that the Federal Deposit Insurance Corporation offers to customers of the Silicon Valley Bank, which collapsed late last week.

What are the requirements to get the Mortgage Interest Tax Credit?

First-time homebuyers may be eligible to receive financial assistance with their mortgage payments through the Mortgage Interest Tax Credit (MCC). The program is targeted at low- and moderate-income families to help them afford homeownership by offsetting a portion of the amount they owe in mortgage interest.

AS USA's Greg Heilman has the full lowdown.

(Photo: MIKE BLAKE/REUTERS)

Turmoil in the banking sector continued into Wednesday with Credit Suisse leading the day’s headlines. The refusal of its largest shareholder to increase the Swiss bank’s capital has caused its shares to plummet by nearly a quarter on the Zurich Stock Exchange. This has set off alarm bells, and the bank is in the spotlight of the financial sector.

Read more on what caused the value fo the giant to fall.

The failure of Silicon Valley Bank at the end of last week was the largest bank collapse since the 2008 financial crisis and the second largest in US history. The demise of the financial institution which caters to tech start-ups and venture capitalists sent shockwaves through the economy and prompted emergency measures from the White House to prevent contagion.

One of the knock-on effects of the turmoil in the banking sector was a drop in mortgage rates which have been rising steadily in recent weeks. The mini banking crisis that played out between Thursday and Tuesday saw the popular 30-year fixed-rate mortgage drop nearly half a percent by Monday. However, the panic in financial markets has eased and mortgage rates across the board were higher on Tuesday but still below their peak last week.

Read our full coverage to understand how the SVB failure will impact the Federal Reserve's decision to raise rates, which will have impacts on the mortgage market.

At a minimum, workers should be aware that the federal government, through the Federal Deposit Insurance Corporation (FDIC), ensures up to $250,000 for most checking, savings, or retirement account.

There are just under five thousand banks with more than 81,000 branches where depositors are protected in case a bank collapses. When selecting a bank or opting into a private retirement account like a 401(k) or an IRA, you can ask either bank employees or your employer if up to $250,000 will be insured by the FDIC.

To better understand the SVB collapse and how the event reflects on the safety of hte financial sector, check out our full coverage.

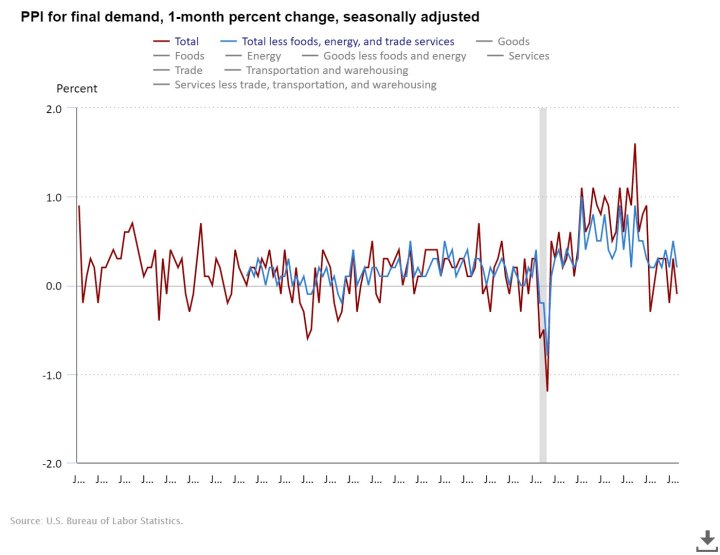

Key inflation measure showed wholesale prices dropped in February

Wholesale price inflation slowed dramatically in February according to Producer Price Index data released by the Labor Department on Wednesday. Year-on-year prices rose just 4.6% last month, experts expected a 5.4% increase, down from January’s revised number of 5.7%.

Month-over-month the price that America’s producers get paid for goods and services was 0.1% lower, compared with rise of 0.6% revised figure for January. It had been predicted to increase by 0.3%.

Mortgage rates reverse course after SVB failure knocks half a percent off 30-yr fixed

The mini banking crisis that unfolded at the end of last week sent shockwaves through the banking sector. It also raised hopes that the Federal Reserve would hold off raising interest rates by 50 basis points when policymakers meet next week.

As mortgage rates are closely tied to the cost of borrowing for banks, that meant good news for homebuyers in the form of cheaper home loans. Between Thursday and Monday the rate on a 30-year fixed-rate mortgage dropped by nearly half a percent reversing a weeks-long upward trend.

However, emergency measures to shore up financial institutions have restored confidence in the banking sector and calmed investors nerves. On Tuesday mortgage rates rose once again but the daily average is still more than a quarter below their high last week.

Bank stocks rebound after turmoil in the wake of Silicon Valley Bank collapse

Regional banks suffered a major selloff after Silicon Valley Bank collapsed at the end of last week. Depositors moved large amounts of money from smaller banks to larger financial institutions fearing that their funds could be lost.

Emergency measures applied by the Biden administration on Sunday though appear to have finally calmed the waters with shares rebounding on Tuesday. Speaking to Reuters an official said the US banking sector is in "a vastly better position right now" thanks to the swift action. However, the White House is closely monitoring the situation.

Every year, many Americans leave money on the table failing to claim tax credits that could reduce how much they owe to Uncle Sam, or even be fatten up their tax refund by thousands of dollars. Once such overlooked credit is the Earned Income Tax Credit (EITC), which is aimed at low-income workers and their families possibly worth almost $7,000.

Investors pleased at more unemployment

Previous cuts eliminated 11,000 jobs, around 13% of the workforce in November. Since the start of 2022 tech companies have cut 290,000 jobs though this figure has not yet been felt in overall unemployment figures which remain strong.

The job cuts were expected and Wall Street accepted them greedily with shares in the company increasing in value by 6% on the news.

Meta, the parent company of social media apps Facebook and Instagram, said it will be cutting 10,000 jobs. It is the second large layoff by the company in recent months as it deals with a changing advertising landscape that is devastating the tech world.

After proudly announcing that this year would be the year of “execution”, CEO Mark Zuckerberg probably didn’t want to be swinging the axe so soon. Big plans such as the Metaverse have not yet yielded sufficient funds to cover for the loss of advertisement revenue. With consumers pulling back from spending, companies are looking to keep investors happy by cutting staff numbers.

Egg prices are dropping

In the midst of news of banks collapsing, there’s one positive development that will be felt in many households. Breakfast will be cheaper after the price of eggs went down for the first time in five months.

The cost of eggs had soared to record heights after the world’s deadliest bird flu outbreak killed tens of millions of chickens. Prices finally fell 6.7% last month. Still eggs cost 55.4% more than they did this time last year.

Outlook on U.S. banking system now ‘negative’

Moody's Investors Service changed its outlook on the U.S. banking system from "stable" to "negative" after the collapse of Silicon Valley Bank. The global financial services company cited heightened risks for the sector after the rapid unraveling of SVB Financial Group fueled fears of contagion.

Bank runs at Silicon Valley Bank, Silvergate Capital Corporation, and Signature Bank have deteriorated the operating environment for the sector that is now battling a crisis of confidence, both from investors and depositors, according to the ratings agency.

Lenders that had "substantial" unrealized securities losses and uninsured deposits may be hurt more as customers look for safer alternatives to park their funds.

U.S. stock market recovers after initial shock following SVB collapse

Investors are confident of a near-term rebound in the battered shares of U.S. banks after the high-profile failure of Silicon Valley Bank triggered a sector-wide selloff.

Options traders were buying up short-term call options on a variety of companies.

U.S. bank stocks rose and recovered some ground after the failure of SVB and Signature Bank triggered heavy selling by investors who were already worried about the impact of rising interest rates on lenders.

Traders now appeared to be speculating that the worst of the selloff was over.

The US government announced a bailout to support the investors, angering many as inflation and interest rates keep putting pressure on everyone else.

Silicon Valley Bank’s collapse on Friday spooked markets, caused by investors hurriedly withdrawing funds after reports of a major loss of funds.

A rebound occurred at the beginning of this week as it was announced the U.S. government would be securing all investments. This overrode the usual rules of the government guaranteeing up to $250,000 of deposits. This bailout will cost $175 billion.

It’s been a rough few days for the banking industry with the largest bank failure since the 2008 crisis, and the first since 2020, occurring on Friday. Silicon Valley Bank, the sixteenth largest bank in the US, was taken over by regulators just 48 hours after depositors began removing their funds en masse.

On Sunday, while announcing emergency measures, the Biden administration said that Signature Bank had been closed as well. However, to prevent further contagion from the evolving banking crisis US banking regulators in a joint statement said that all deposits at the failed financial institutions would be made whole.

The emergency measures though haven’t had the complete calming effect on investors that was hoped for. The collapse of SVB has sent shockwaves through the banking sector and a wave of customers have applied to have their accounts moved to larger financial institutions from smaller lenders.

But just how safe are depositors’ savings at banks right now?

Welcome to AS USA's live blog on inflation relief and financial news

Good morning and welcome to AS USA's live blog on inflation relief and financial news for Wednesday, 15 March 2023.

Throughout the day we will bring you the latest updates on measures being taking to bring down inflation and provide relief to Americans coping with rising prices. As well, the emergency measures to shore up the US banking system to avert a crisis after two major bank failures.

Also, we'll keep you informed on the 2023 tax season and tax credits to keep in mind when filing this year.

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/XTUXDCKQRRKPDLLEJGPT24ZGB4.jpg)