Student loan payments restart in October: What happens if you don’t pay?

The student loan moratorium has ended, and the first round of payments should have been remitted early this month. What are the penalties if you don’t pay?

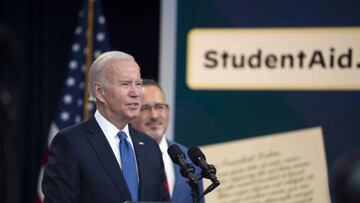

With the first round of student loan payments supposed to have been paid on 1 October, many borrowers have been adjusting their budgets after three years under the loan moratorium. The debt moratorium implemented in March 2020 prevented borrowers from accruing interest and made repayment optional. Debt forgiveness plans died in the Supreme Court earlier this year.

In early August, 70% of borrowers surveyed by U.S. News and World Report were unaware that payments were set to resume, giving many little time to come up with the extra dollars to put towards their educational debts. In September, according to data from the US Bureau of Economic Analysis, household savings, as a portion of disposable income, fell to 3.4 percent.

To protect those who have taken on debt to finance their education, the Department of Education has implemented a one-year leniency program that began on 1 October 2023 and will end on 30 September 2024. During this “on-ramp” period, Secretary of Education Miguel Cardona said borrowers would be protected from “the harshest consequences of missed, partial, or late payments like negative credit reports and having loans referred to collection agencies.” However, interest on loans will accrue, meaning that if borrowers wait until next year, their debts will have grown.

If a borrower is eligible and enrolls in the Saving on a Valuable Education (SAVE) Plan, they will no longer see their loans grow due to unpaid interest.

— Federal Student Aid (@FAFSA) October 20, 2023

Watch this new video, explaining the benefits of the SAVE Plan: https://t.co/ELe5X7HnnL

How to enroll in an income-driven repayment plan?

To prepare borrowers to begin making payments once again, the Department of Education established a few different income-driven repayment plans to limit the minimum payment servicers can require.

An option is the SAVE plan. The SAVE plan aims to lower monthly payments, and currently, any borrower is eligible to apply. Petitions to enroll in the program can be made through the US Department of Education’s website. As the name implies, these plans, including SAVE, ensure that the minimum payment is tied to one’s income and the size of their family. The amount due each month is subject to change in cases where the borrower’s income increases or decreases or if a borrower can claim more or fewer dependents.

#DYK: Your federal student loan payment could be as low as $0 a month thanks to the Saving on A Valuable Education (SAVE) Plan, a new program to help federal student loan borrowers.

— U.S. Department of Education (@usedgov) October 27, 2023

Learn more and apply today: https://t.co/W1NHeZFpgJ #SAVEOnStudentDebt pic.twitter.com/26upb7yPXa

Penalties for not paying debts

After the “on-ramp” period ends in October 2024, student loan servicers could take borrowers to collections if they do not make payments. Additionally, skipping payments could impact borrowers’ credit scores, making it harder for them to take out loans of other sorts at reasonable interest rates.

If you do not make payment on your student loan within 90 days, it will be marked as delinquent, resulting in a negative impact on your credit score.

The U.S. Now Has:

— The Kobeissi Letter (@KobeissiLetter) August 8, 2023

1. Record $17.1 trillion in household debt

2. Record $12.0 trillion in mortgages

3. Record $1.6 trillion in auto loans

4. Record $1.6 trillion in student loans

5. Record $1.0 trillion in credit card debt

Total mortgage debt is now more than double the 2006…

Related stories

If you continue to miss payment deadlines, interest will continue to accrue on the outstanding balance of your loan. After 270 days, your loan will go into default. When a loan is in default, the entire remaining balance becomes due immediately, and the lender (also known as the US government) will take legal action to collect the debt.

Ultimately, this will lead to assets being seized and you being denied access to certain federal support systems such as Social Security.