US financial news summary | 2 August 2023

The Biden administration launches a new student loan repayment plan, Social Security checks and SNAP payments for August begin, and other financial news.

Show key events only

US Financial news, Wednesday, 2 August

Headlines: Wednesday 2 August 2023

- Job openings fall to lowest level in more than two years in June

- Fitch downgrades US credit rating, surprising investors

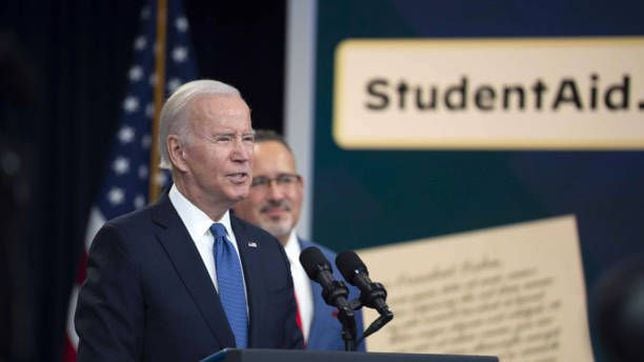

- Biden administration launches new student debt repayment plan

- Federal Reserve has announced a 0.25% hike in interest rates

- Inflation in the US was at 3% in June, as Fed bids to cut rate to 2%

- Initial unemployment claims fell by 9,000 in week ending 15 July, to 228,000

Take a look at related AS USA news articles:

Credit scores are representations of an individual’s creditworthiness and are used by lenders to assess the risk of lending money to a person. The specific factors and their weightings used to calculate credit scores may vary depending on the credit scoring model, such FICO.

The main factors that generally determine a credit score include...

Student debt is hanging around

Studebt debt forgiveness is off the cards and has been since the Supreme Court struck down the plan last month.

Under that plan, 40 million students with outstanding debt could applied for the forgiveness program which would have struck down $10,000 of debt per person.

Don’t worry about the final application date for debt forgiveness, there won’t be any further changes until after the next election. But there is a recently-announced other option for people looking for any support in the ever-increasing student debt sinkhole.

The government has banned the sale of common incandescent light bulbs effective August 1 to implement a new energy efficiency standard.

The Department of Energy finalized a rule in April 2022, stating that bulbs must emit a minimum of 45 lumens per watt. This effectively excludes the common incandescent bulb found in many homes, as these usually produce only 15 lumens per watt.

The new rule aims to lessen carbon emissions and help consumers cut down on their electricity bills.

A month ago, the Supreme Court struck down the student loan forgiveness program proposed by President Joe Biden, which would have forgiven more than $400 billion in student debt, and up to $20,000 per borrower.

In the wake of the high court’s decision, the president announced a series of measures and new plans to help students and their families. Now, the education department has launched a website for the new loan repayment scheme.

How much has the Biden government spent on student loan forgiveness?

Job openings hit more than two-year low; labor market still tight

Job openings fell to the lowest level in more than two years in June, but remained at levels consistent with tight labor market conditions, which could spur the Federal Reserve to keep interest rates elevated for some time.

Labor market resilience was underscored by the third straight monthly decline in layoffs as employers hoard workers after difficulties finding labor during the COVID-19 pandemic. There were 1.61 job openings for every unemployed person in June, up from 1.58 in May.

The report from the Labor Department on Tuesday, however, suggested workers are growing a bit less confident in the labor market, with resignations plunging by the most since April 2020. Fewer workers changing jobs over time bodes well for slowing wage growth and ultimately overall inflation.

"While today's report discusses data from June, this continued strength in the labor market is likely to keep Fed officials hawkish," said Eugenio Aleman, chief economist at Raymond James in St Petersburg, Florida.

(REUTERS)

Each month, the Social Security Administration distributes various benefits. Monthly payments are sent to workers, retirees, and survivors, as well as to people with disability. Some of the beneficiaries fall under the Supplemental Security Income program or Social Security Disability Insurance.

The SSA has already started sending out payments for this month. Find out which benefits have already been sent and who will receive their payments on August 3.

Ratings agency Fitch cuts US credit rating

Ratings agency Fitch has downgraded the US government's top credit rating, a move that drew an angry response from the White House and surprised investors, coming despite the resolution of the debt ceiling crisis two months ago.

Fitch downgraded the United States to AA+ from AAA, citing fiscal deterioration over the next three years and repeated down-the-wire debt ceiling negotiations that threaten the government’s ability to pay its bills.

Fitch had first flagged the possibility of a downgrade in May, then maintained that position in June after the debt ceiling crisis was resolved, saying it intended to finalize the review in the third quarter of this year.

With the downgrade, it becomes the second major rating agency after Standard & Poor’s to strip the United States of its triple-A rating.

The dollar fell across a range of currencies, stock futures ticked down and Treasury futures rose after the announcement. But several investors and analysts said they expected the impact of the downgrade to be limited.

(REUTERS)

The application process only takes about 10 minutes. The government’s new plan for student loan repayment is income-driven, and the newly launched beta site will allow borrowers to start submitting applications for the program.

For those borrowers who are currently registered under the REPAYE program, the transition to the SAVE program will happen automatically.

The Saving on a Valuable Education (SAVE) plan

For undergraduate loans, cut in half the amount that borrowers have to pay each month from 10% to 5% of discretionary income.

Guarantee that no borrower earning under 225% of the federal poverty level, about the annual equivalent of a $15 minimum wage for a single borrower, will have to make a monthly payment.

Forgive loan balances after 10 years of payments, instead of 20 years, for borrowers with original loan balances of $12,000 or less.

Not charge borrowers with unpaid monthly interest, even when that monthly payment is $0 because their income is low.

Public housing units are owned and operated by federal, state, or local housing authorities, and they aim to provide safe and affordable housing options for those who cannot afford market-rate housing. They are a departure from property owned privately or rented from landlords.

The US government website has a link to find and contact your local public housing agency.

Dangers of a reverse mortgage

Reverse mortgages are not inherently dangerous, but they do come with certain risks that borrowers need to be aware of before deciding to take one.

Since borrowers are not making monthly payments, the interest on the loan accumulates over time which could lead to a substantial debt that needs to be repaid when the loan becomes due, usually at the sale of the property.

As the reverse mortgage balance grows, the remaining home equity diminishes. There can also be upfront costs, including origination fees, closing costs, and mortgage insurance premiums.

A reverse mortgage allows homeowners aged 62 and older to access a portion of their home equity while continuing to live in their home. Unlike a traditional mortgage where the borrower makes monthly payments to the lender, a reverse mortgage works in the opposite way—the lender makes payments to the borrower.

Good morning and welcome to AS USA's live financial blog!

With student loan repayment set to start in October, much focus is on SAVE, President Joe Biden’s new student debt repayment plan.

Also, in the wake of the Federal Reserve's recent move to raise interest rates, we will be examining its implications and how it is aimed at tackling inflation in the US.

We will also be providing real-time coverage of crucial topics like SNAP benefits and Social Security payments.

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/WQC65C2UZZPZJPHYARVB2U4REI.jpg)