EDUCATION

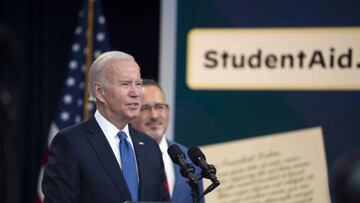

Biden administration’s new student debt repayment plan: differences and improvements over previous plan

A test application has been released today to begin the enrollment in the new student debt plan though it is very different to forgiveness.

With just over a year until the next presidential election, President Joe Biden and the Democrats are on the hunt for votes. After a number of high-key policy failures, major economic plans as well as the Supreme Court overturning the crucial Roe v Wade abortion protections last year.

Not only that, the Supreme Court also struck down his plan for student debt forgiveness. This time last year, the White House announced that borrowers who earned less than $125,000 could have up to $20,000 of student loan debt canceled. It could’ve benefited over 40 million Americans and 26 million people signed up. It did not come to pass.

In reaction, definitely produced with the expectation of a Supreme Court defeat, the White House has produced and published the SAVE plan. For all intents and purposes, this is the replacement for debt forgiveness amidst a hostile Congress and Supreme Court; is it any improvement?

What will the SAVE plan do?

The new SAVE plan will mean many borrowers will not have to make monthly payments under this plan and those who do will save more than $1,000 a year, according to the White House,

The Biden administration says the SAVE Plan will reduce monthly payments to $0 for millions of borrowers who earn $32,800 or less individually per year. The limit will be $67,500 per year for a borrower in a family of four. All other borrowers will save at least $1,000 per year with this plan.

Loan balances can be forgiven after 10 years of payments, instead of 20 years, for borrowers with original loan balances of $12,000 or less.

Those with federal student loans can submit their Income-Driven Repayment (IDR) Plan Request at the beta website.

The application process only takes about 10 minutes. For those borrowers who are currently registered under the REPAYE program, the transition to the SAVE program will happen automatically.

The Save plan will go into effect on July 1, 2024

Is it an improvement?

Short answer; no.

The original plan was transformative in the way that it would have removed debt permanently for tens of millions of students. The SAVE plan does not stop repayments for the vast majority of people, just pauses them until earning over the threshold. There is no guarantee in the future that it won’t be overturned.

However, it is a postive for those whose repayments are reduced to zero, but that cannot last indefinitely. It is better than no action at all too, but will it be enough to keep the youth vote onside?