US financial news summary | 22 May 2023

Debt ceiling negotiations continue as the threat of default looms. Follow along for more on that, Social Security, interest rates, and home prices.

Show key events only

US Finance News: Latest Updates

Headlines | Monday, 22 May 2023

- Republicans and the White House are set to meet today asboth sides say talks are moving backward.

- The day the US could default on its debts, otherwise known as Day X, could come as soon as 1 June

- The impact of a default could present greater challenges for some states over others.

- Treasury Secretary Janet Yellen says that the US could hit the debt limit by 1 June. What role has Sec. Yellen played in the negotiations?

- A look at the countries who own most of the US debt

- Can President Bidenuse the Fourteenth Amendment to increase the debt limit?

- GOP push for work requirements for SNAP and Medicaid

Read more from AS USA:

Motorists keep their ride longer due to rise in car prices

Americans are keeping their cars longer than ever. The average age of a passenger vehicle on the road hit a record 12.5 years this year, according to data gathered by S&P Global Mobility.

Sedans are even older, on average- 13.6 years.

Since the pandemic struck three years ago, the average new vehicle has jumped 24% to nearly $48,000 as of April, according to Edmunds.com. Typical loan rates on new-car purchases have ballooned to 7%, a consequence of the Federal Reserve's aggressive run of interest rate hikes to fight inflation.

In an effort to populate various areas of the United States, some cities are offering land and money to attract prospective residents to relocate to their area.

If you're looking to move to another location in the US, here are some cities that our report enumerates, which are offering attractive incentives to lure people into becoming part of their city.

Despite the high cost of living, California attracts many residents; not just because of the weather but also because it offers various benefits to those who live there. According to an analysis by Bloomberg, the state has the fastest-growing labor force, gross domestic product, manufacturing industry, and median household income in the US.

The Bureau of Labor Statistics has revealed that the state also has the highest average annual wages, According to the BLS, these are the fastest growing jobs in California in 2023. As our report indicates, a number of them are in the health care sector.

Negotiations over raising the debt ceiling remain ongoing in Washington DC as both sides of the table report that the talks soured over the weekend. Treasury Secretary Janet Yellen has warned Congress that her department could run out of money to pay its debts by 1 June, leaving negotiators just over a week to reach an agreement to avert a financial crisis.

One of the groups left most vulnerable during a default would be US veterans who receive healthcare, job training, disability assistance, or a pension through the Veterans Administration. As our coverage reports, its operations to serve the veteran population would be severely impacted if the country defaults.

Wall Street ends mixed as investors await debt ceiling talks

Wall Street finished mixed on Monday, with the Nasdaq helped by gains in Alphabet and Meta Platforms, while the S&P 500 ended near flat as investors refrained from big bets ahead of a fresh round of talks about raising the debt ceiling.

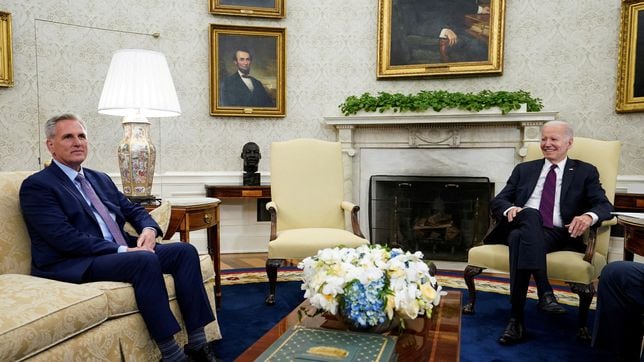

President Joe Biden and top congressional Republican Kevin McCarthy were set to meet to discuss raising the federal debt ceiling, just 10 days before the United States could face an unprecedented default.

"Investors are basically saying, 'We're giving at least a 60:40 likelihood that they will come to an agreement in time,'" said Sam Stovall, chief investment strategist at CFRA Research.

"An agreement could simply be the extension, kicking it down the road to decide on a debt ceiling when they also discuss the budgets in September."

(REUTERS)

Personal consumption helps prop up economic growth

Worries about recession risks linger, and the focus last week shifted to the consumer. Personal consumption accounts for about 71% of GDP, and there's good news on this front- according to Census Bureau data, retail sales in April climbed 0.4% to $686.1 billion.

While the pace of sales is off its record high, it continues to trend well above pre-pandemic levels.

"America runs on consumer spending,” JP Morgan economist Michael Feroli said. “And consumer spending continues to run in the right direction, as this week’s strong April retail sales report confirmed.”

Meta fined $1.3 billion in European data protection breach

Meta, the parent company of Facebook, has been handed down a jaw-dropping fine of $1.3 billion for illegally transferring user data from the European Union to the United States.

According to the forecast of the International Monetary Fund, China will overtake the United States as the world’s largest economy in 2028. The projection also indicates that China will be one of four Asian countries that make up the top six with the highest gross domestic product by purchasing power parity values at that period.

The financial institution shows the economic growth of China and India has been pronounced since the 1990s, while Indonesia has entered more recently among the ten largest economies in the world. It is expected to reach the sixth position within five years.

The economy of the United States could be facing a crisis very soon if the White House and Congress fail to agree on raising the debt ceiling.

The ceiling refers to the limit of money that the federal government can borrow. While the Biden administration seeks to increase funding, lawmakers- mostly Republicans- refuse to do so unless spending is cut. The last time the ceiling was raised was in December 2021, increasing the total budget to $31.4 trillion.

According to Treasury Secretary Janet Yellen, the country’s government would no longer be able to pay its financial responsibilities as of June 1, and would therefore face a default. Such an occurrence would affect monthly checks for Social Security, Medicare, and payments to veterans and government workers including military personnel. Several non-essential government agencies would temporarily close, leaving millions of people unemployed.

Read more on how Social Security could be impacted by a national default in our full coverage.

After the start of the pandemic and the risks posed by working in person, the number of people working from home rose rapidly. According to the Census Bureau, between 2019 and 2021, the number of people primarily working from home tripled from 5.7% (approximately 9 million people) to 17.9% (27.6 million people), according to the 2021 American Community Survey (ACS).

Read our full coverage for details on states with the highest number of remote workers and the best places in terms of cost of living for those who are able to telework.

President Biden is returning to Washington to resume negotiations over the debt ceiling, which could be reached as soon as 1 June. The national debt ceiling is a limit on the amount of money the US Treasury Department can borrow to pay the government’s bills for spending that has already been approved. A default would be catastrophic for the domestic and global economy, upending financial markets, ripping hundreds of thousands from the labor force, and leaving many seniors and economically vulnerable households without federal pensions or assistance payments.

Yesterday, President Biden told the press in Tokyo that his team was waiting to hear back on a counter-proposal made by the White House after they were delivered a bill from Republicans that, they felt, was nowhere close to what the two sides “had agreed or discussed.“

Read our full coverage for details on what the Republicans have proposed and the response from the White House.

Bills and coins are ubiquitous in our daily lives, at least for now, but some of them can be worth a fortune. Billions of dollars in US currency are printed and engraved each year and from time to time, something goes wrong and there is a misprint or minting error. Thanks to this, those rarities that circulate can be sold for a wad of cash. For example, having two identical $1 bills could give you up to $150,000.

The value of a coin or note is essentially determined by three main factors: the rarity, the condition/grade of the coin or note, as well as market conditions, i.e. demand. The combination of these three factors give the value of a coin or bill.

Last year, after inflation reached historical levels, several states across the US approved the sending of stimulus checks and tax refunds for their residents to provide economic relief in the face of high prices.

Little by little, the states that are sending money is decreasing. However, residents of some cities and counties in the United States may be eligible for to participate in pilot guaranteed income programs that have been set up and that will issue payments of $500 or more each month.

Read more on where these checks will be sent in our full coverage.

Montana bans TikTok, users concerned. And will it be effective?

There has been growing concern around the world of the potential for the Communist Party in China using data mined from TikTok on everyday citizens and especially those within government to be used for nefarious ends. This has led several governments to implement bans on government employees and politicians from having the app on their personal devices used for administrative purposes or other government devices.

Montana has gone one step further, than the 32 other US states that have taken action to restrict the app on government devices, banning TikTok from all use in the state. Failure to comply would result in a $10,000 fine. That penalty would be paid not by the users but by those that allow the service to be provided on people’s devices such as Google Play and Apple’s App store.

The ability of a single state to restrict access to the app has been called into question, and users in the state have already filed a legal complaint. According to the lawsuit, “Montana can no more ban its residents from viewing or posting to TikTok than it could ban the Wall Street Journal because of who owns it or the ideas it publishes.”

Biden and McCarthy will have another face-to-face on debt ceiling negotiations

Returning from his meeting with G7 partners in Hiroshima, Japan, President Biden spoke with Republican Speaker of the House Kevin McCarthy. The President called the conversation “productive” and the two will sit down together on Monday in the White House.

Staff level discussion were due to resume on Sunday at 6 pm ET. McCarthy when asked about the his hopes for the negotiations after talking to Biden said: "Our teams are talking today and we're setting (sic) to have a meeting tomorrow. That's better than it was earlier. So, yes."

Congress must pass legislation to raise the debt ceiling or suspend it by 1 June, X Date, according to Secretary Janet Yellen. That is the day when the US will no longer be able to pay its bills which would mean a default on the national debt and economic calamity.

Hello and welcome to AS USA's live blog covering economic and financial news.

Happy Monday! Negotiations between President Biden and congressional Republicans will continue at the White House today. Only eight days are left before the US Treasury could hit the debt limit and be left without enough money to pay its bills, so both parties are under pressure to reach an agreement. Both sides have confirmed that the proposal will need bipartisan support, which could pose a challenge for Speaker of the House Kevin McCarthy due to the slim majority he holds.

We will also bring you the latest on states that continue sending relief payments to residents.

As summer approaches, many are beginning to plan their vacations. Airfare prices have dropped, but as gas prices increased slightly, those planning to hit the road could encounter higher prices. However, these, like those for airfare, are likely to be lower than last year.

The Federal Reserve continues evaluating the prospect of another rate hike after saying they planned to pause additional increases for a period. However, with unemployment falling to 3.4 percent in April, the central bank may choose a more aggressive path. As we learn more, we will bring you the latest on that front as well.

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/4RABVAEENYO653NEME2W7P6HJQ.jpg)

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/I6XFIDY5CNP3BDKPIGYDSTUAEY.jpg)