US Financial News: news summary | 14 July 2023

Keep yourself informed about the latest updates regarding SNAP benefits, social security and IRS refunds, as well as the interest rate strategies of the Federal Reserve.

Show key events only

Headlines | Friday, 14 July 2023

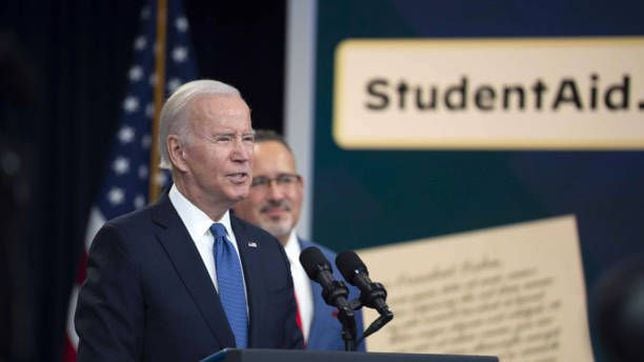

- Biden administration cancels $39bn in student loan debt for 800k borrowers

- Inflation in the US dropped to 3% in June, lower than forecast

- June jobs report: Economy added 209,000 jobs in June as labor market cools

- Federal Reserve expected to raise interest rates later in July

- Layoffs fall to seven-month low in June

- The White House announces the SAVE planto help student loan borrowers

- When do student loan repayments restart?

- When to expect SNAP benefitsthis month

- Dates for Social Security payments in July

Americans who borrowed money for their higher education and are carrying a debt should start preparing for the resumption of payments on their federal student loans. After more than three years of a moratorium, interest will begin accruing once again in September and the first payments will come due in October.

However, there is some relief in sight. Starting in 2024, it will be easier for employers to match contributions to 401(k) accounts when employees make payments on their student loan debt.

The Department of Education is implementing its payment count adjustment for student loan borrowers on IDR payment plans, 800K will have debts canceled.

Severe weather has been affecting various states in the US, and as a result, some areas have chosen to offer financial assistance to those who need it most. Some US residents will be able to apply for an emergency benefit for SNAP coupons. Who qualifies for the extra food assistance?

Medicare and Medicaid are the two largest federal health insurance programs in the United States, but are not the only ones. The US also has a popular program that provides medical coverage to infants, it is the Children’s Health Insurance Program.

Since its inception in 1997, CHIP has played a crucial role in reducing the uninsured rate among children in the United States. It has helped millions of children gain access to affordable healthcare services and improve their overall well-being.

After inflation reached historic levels last year, several entities in the US approved the sending of stimulus checks or tax refunds to help those who were most affected.

Although inflation has fallen considerably in recent months, some states across the country continue to send out checks to help their residents.

Here are the states that are sending financial assistance in July and how much they will be giving out.

Medicaid provides health coverage to tens of millions of Americans but the income thresholds to participate in the program vary from state to state.

Payments of Social Security are issued monthly, but the specific date of receipt depends on the beneficiary’s date of birth. Individuals born between the 1st and 10th of the month will receive their checks on the second Wednesday of the month. Those born between the 11th and 20th will receive their payments on the third Wednesday, while those born between the 21st and 31st will receive their checks on the last Wednesday of the month.

There will be less payments in July than usual.

Why house prices are increasing so much in Florida

A lot of people are still coming to Florida because the economy is really strong, and many like the fact that we don’t have an income tax like in New York, for example. And in places like Miami, we’re seeing a lot of real estate demand from non-Floridians or non-American investors — generally wealthy folks who want to have a nice home here.

Inflation in the US is on the way down. Perhaps as a response to the Federal Reserve’s brutal interest rate hikes that have been killing purchasing power and getting many workers sacked, the Consumer Price Index measuring inflation is tumbling oown.

Core inflation, which doesn’t include the oft volatile food and energy prices, was 0.2 percent last month, the smallest single month increase since August 2021. Year-on-year inflation in 3%, rapidly closing in on the Federal Reserve’s target of 2%.

Good news for everyone right? Well, not if you are living in Florida.

The reason behind rising prices in the sunshine state

Housing costs have been the key metric in Floridian inflation. Florida has seen its population grow a lot over the last year increasing 2%, much higher than the overall US rate of 0.1%. All these people need to pay for homes.

House prices in the state rose by 8% to the year in May with areas like Miami experiencing 17% price increases.

Some Pennsylvania residents may receive up to $975 through the Rental/Property Tax Refund Program, which is a bonus refund of property taxes or rent paid in the prior year.

This program is for Pennsylvanians age 65 and older, widows and widowers age 50 and older, as well as people with disabilities ages 18 and older.

Spouses, personal representatives, or heirs may also apply on behalf of claimants who lived at least one day in the year in which the refund will be claimed and met all other eligibility criteria.

100,000 Floridians could lose their home insurance as Farmers pulls out of state

Farmers Insurance gave 90-day notice that it will stop offering new policies in Florida and cease to renew current ones. The decision was made as a necessity to manage risk exposure in a state with low elevation that is prone to hurricanes.

It is just the latest insurer to stop offering home insurance in the Sunshine State. Hurricane Ian, which struck the state in late September last year, was the most expensive in the state’s history and third most in US history. Covering the costs from that storm and Hurricane Nicole were cited in Farmers’ decision.

This year, thanks to the 8.7% increase in the cost-of-living adjustment, average retiree payments increased to $1,827, the SSA revealed in January.

The maximum benefit for those who retire at full retirement age (67) is $3,627. Those who early retire before full retirement age receive less money. Meanwhile, people who delay their retirement receive larger payments.

Those who retire at age 62 can expect a maximum benefit of $2,572 per month, while people who retire at age 70 or later may receive a maximum monthly payment of $4,555.

June US inflation report better than expected

The Consumer Price Index (CPI) released on Wednesday showed better-than-expected results with headline inflation rising 3% and core 4.8%. Economists had forecast that year-on-year price increases had been 3.1% and 5% respectively. That was down from 4% for headline inflation and 5.3% for core inflation in May.

The United States provides various financial aid payments for residents who could use the help. In many cases, these payments are aimed at those who present a tax return to the Internal Revenue Service.

But what about residents who can’t file taxes because they don’t have enough income to do so? Well, in New Mexico a new form of financial aid has been approved for low-income people who cannot file taxes for this reason.

Consumer prices rise at slowest pace since March 2021

The latest data from the Bureau of Labor Statistics released Wednesday morning show that consumer prices rose at the slowest pace since March 2021 as inflation showed further signs of cooling in June.

The Consumer Price Index rose 0.2% over last month and 3% over the prior year in June, a slight acceleration from May's 0.1% month-over-month increase but a slowdown compared to the month's 4% annual gain, per Yahoo Finance.

Both measures were slightly better than economist forecasts of a 0.3% month-over-month increase and a 3.1% annual increase, according to data from Bloomberg.

On a "core" basis, which strips out the more volatile costs of food and gas, prices in June climbed 0.2% over the prior month and 4.8% over last year. Both measures were also slightly better than economist expectations.

The monthly core increase was the smallest 1-month increase in that index since August 2021.

The IRS is reminding taxpayers not to leave money on the table, perhaps as much as $6,557.

Here’s who’s eligible, how to request payment, and the deadline.

Hello and welcome to AS USA's live blog

The US economy added 209,000 jobs in June, missing Wall Street estimates and reflecting a slowdown from the previous month, according to data from the Bureau of Labor Statistics.

Economists had expected that 225,000 non-farm payroll jobs were added in June. The report marks the first time in 15 months that non-farm payrolls have come in lower than Wall Street expected.

The June unemployment rate was 3.6%, down from 3.7% in May. Economists had expected 3.6%.

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/OL3CWCCD6VM3FJAAD5YXMA46VA.jpg)

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/5R4X3UYMRRKV3KUJD2VZFGJW3I.jpg)

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/QENICZ7TUGPKVQIPUIQBZD7AKA.jpg)

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/DXECHX4MWVGHNK427QRIUWW3VE.jpg)

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/LOT6BXPXQBBXRNDO753YL4VQ3Q.png)