US financial news summary | 6 July 2023

Headlines | Thursday, 6 July 2023

- Federal Reserve expected to raise interest rates later in July

- Layoffs fall to seven-month low in June

- FTC warns of scams following Supreme Court's 6-3 ruling against Biden's Student Loan Forgiveness Program

- 16 million student loan borrowers had debt relief approved, what will happen now?

- When do student loan repayments restart?

- PCE data shows both headline and core inflation declined in May year-on-year to 3.8% and 4.6%, respectively

- The weekly average mortgage rate ticked up to 6.71% for 30-yr FRM

- Initial unemployment claims dropped to 239,000, a decrease of 26,000 from a week prior

- Fed Chair Powell doesn't discount two consecutive rate hikes in future

- US consumer confidence jumps to highest level since January 2022

- Dates for Social Security payments in July

US labor market showing resilience

The US Bureau of Labor Statistics report that new claims for unemployment benefits increased last week, while private payrolls surged in June, suggesting that the labor market remained on solid ground. Over the month, the number of hires and total separations were little changed at 6.2 million and 5.9 million, respectively.

On the last business day of May, the number of job openings decreased to 9.8 million (-496,000), following an increase in April. Job openings increased in educational services (+45,000), state and local government education (+37,000), and federal government (+24,000).

Meta has launched a direct challenge to Twitter with the new app Threads, garnering millions of users in hours as it sought to take advantage of its rival's much-weakened state after a series of chaotic decisions made by owner Elon Musk exasperated the application's users.

Learn more about Mark Zuckerberg's latest social media platform.

The Federal Reserve held off on raising interest rates when they held their June meeting, but will they continue to do so this month?

Fed chief Jerome Powell, in testimony before Congress, said there is a long way to go in the battle against inflation, and that they expect to increase rates before the year is over.

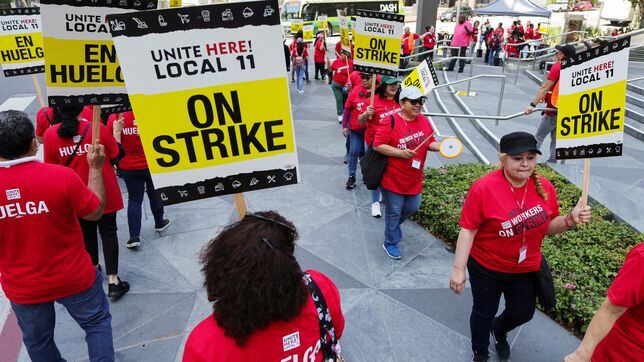

Layoffs fall to seven-month low in June

Employers slowed downsizing in June, marking the lowest number of layoffs since October 2022, per Reuters.

According to the latest job cuts report from employment firm Challenger, Gray & Christmas, employers said they were cutting 40,709 jobs in June, down 49% from the number of cuts announced in May.

The planned pace of layoffs in June was well above the 32,517 cuts announced in June 2022. There are 458,209 cuts so far this year, a 244% increase from the 133,211 layoffs announced through June 2022, as employers brace for the prospect of recession.

Bud Light is out with a new ad after sales plummeted, trying to win back its core consumers to show it’s about “good times, goodwill, and easy enjoyment.”

If you've been an avid Apple user for years, you may have an old iPhone tucked away in a drawer somewhere.

Check it out because some models could sell for up to $100,000. Find out if yours is a valuable cellphone.

Wall Street ends slightly lower as investors ponder Fed's latest meeting

Wall Street's main indexes ended with modest declines on Wednesday as investors digested minutes from the Federal Reserve's latest meeting and braced for significant economic data in the days to come.

Minutes showed a united Fed agreed to hold interest rates steady at the June meeting as a way to buy time and assess whether further rate hikes would be needed.

Following the release of the anticipated minutes, investors still largely expected the central bank to raise rates at its next meeting later this month. Key economic data is due before the meeting, including the monthly jobs report on Friday.

In April, the IRS announced that nearly 1.5 million people nationwide were still eligible to receive a tax refund worth up to $900.

The IRS will send these tax refunds when people file their 2019 returns who have not yet done so. However, there is a hard deadline before the money is lost forever.

This report has the details on how to get your refund.

It is important that workers, in addition to making it one of their financial priorities, are well informed about their retirement. That is why it is essential to consider several factors so that your money goes further so that you can enjoy your golden years. For example, finding out what the cost of living is where you live and if it is compatible with your budget.

In the country, there are some states that represent better options in terms of cost of living, as well as taxes for retirees, while others, in addition to high tax rates, have a high cost of living.

We’ll share with you the states that you should avoid in your retirement,especially if you’ll be living on a tight budget.

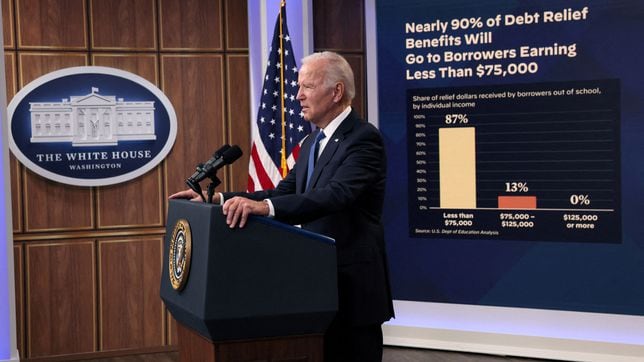

FTC warns of student loan scams following SCOTUS decision

Scammers are likely to target student loan borrowers after the Supreme Court struck down the Biden administration’s debt forgiveness plan in a 6-3 ruling, and as loan repayments are poised to restart in the fall, according to the Federal Trade Commission.

Scammers often “take advantage of confusion around big news like this,” the FTC said in a consumer alert. The commission warns that scammers would likely target borrowers by maybe posing as US Department of Education personnel and offering loan assistance.

“If you’re worried about repaying your loans, the offers to ‘help’ can be tempting,” the alert said. “Scammers are likely to start blasting out robocalls and texts about ‘helping’ you with your loan.

The White House moved fast after the Supreme Court struck down the student loan debt forgiveness program releasing the finalized structure of “the most affordable” payment plan ever.

Taxation varies state to state, from those with no income tax to those that take a hefty cut of your income.

Hello and welcome to AS USA's live blog covering financial news

The Supreme Court ruled 6-3 that President Biden didn’t have the authority to issue his broad student loan debt forgiveness executive order. Now millions of student loan borrowers who had hoped to benefit from the debt relief will need to reassess how to deal with what they owe.

Experts worry that once repayments start in the fall it could take a toll on the economy, others are concerned that many borrowers could drown under debt. The Federal Trade Commission is warning those who have loans to beware of scammers who may take advantage of the confusion following the SCOTUS decision.

For now, American consumers feel the most confident about the economy since January 2022 as the US economy continues to chug along. The latest data showed initial unemployment claims dropping by the most in 20 months and the new PCE inflation report showed price increases slowing more than expected. Despite that good news, and because of it, the chances of the Federal Reserve resuming interest rate hikes in July jumped.

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/665UV57YMZCRVEP4ZYX76N4OIU.jpg)

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/3G4ZQUJRTFI3LOQ5RDQCOSKBAA.jpg)