US Financial News: news summary | 30 June 2023

Key inflation data to be released today, as well as the much-anticipated SCOTUS ruling on the legality of President Biden’s student loan forgiveness plan.

Show key events only

US Financial News: news summary | 30 June 2023

Headlines | Friday, 30 June 2023

- Supreme Court rules 6-3 against Biden's Student Loan Forgiveness Program

- 16 million student loan borrowers had debt relief approved, what will happen now?

- When do student loan repayments restart?

- PCE data shows both headline and core inflation declined in May year-on-year to 3.8% and 4.6%, respectively

- The weekly average mortgage rate ticked up this week to 6.71% for 30-yr FRM

- Initial unemployment claims dropped last week to 239,000, a decrease of 26,000 from a week prior

- Fed Chair Powell doesn't discount two consecutive rate hikes in future

- US consumer confidence jumps to highest level since January 2022

- Dates for Social Security payments in July

The White House was not slow in publishing its updated plans on the announcement that the Supreme Court had struck down student debt forgiveness plans. Despite being a sensible contigency measure, the speed in which new plans were announced on Friday do belie the lack of belief in the administration that the Supreme Court was to vote in President Biden’s favour.

Here is what they have come up with.

What the judges said about student debt cancellation

The Secretary’s comprehensive debt cancellation plan cannot fairly be called a waiver; it not only nullifies existing provisions, but augments and expands them dramatically. It cannot be mere modification, because it constitutes ‘effectively the introduction of a whole new regime.

The plaintiffs in this case are six States that have no personal stake in the Secretary’s loan forgiveness plan. They are classic ideological plaintiffs... In giving those States a forum, in adjudicating their complaint, the Court forgets its proper role. The Court acts as though it is an arbiter of political and policy disputes, rather than of cases and controversies.

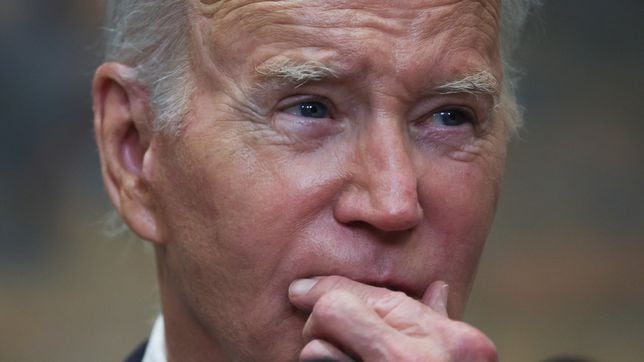

The Supreme Court has ruled against the legality of President Biden’s Student Loan Forgiveness plan, his flagship programme to eliminate hundreds of billions of dollars in student debt.

The Court currently holds a 6-3 conservative majority and voted along their party lines, despite being nominally unbiased.

Here is what the judges had to say.

Plans underway for alternative student debt forgiveness

The Department of Education has initiated rulemaking aimed at opening an alternative path to debt relief for as many borrowers as possible, using the Secretary of Education’s authority under the Higher Education Act.

The Department issued a notice, which is the first step in the process of issuing new regulations under this so-called “negotiated rulemaking” process. The notice announces a virtual public hearing on 18 July and solicits written comments from stakeholders on topics to consider.

Planning for retirement involves making important decisions about your financial future, and one crucial choice is selecting the right type of retirement account. Two popular options are the traditional 401(k) and the Roth 401(k). While they share similarities, understanding their differences is key to maximizing your retirement savings.

So what are the distinctions between these two pension programmes?

SCOTUS has struck down President Biden’s student loan forgiveness program to cancel up to $20,000 of debt. But what about the 16 million borrowers approved?

In an unsurprising 6-3 ruling, the Supreme Court ruled that President Biden did not have the authority to apply broad student loan debt forgiveness.

The Supreme Court has thrown out Biden’s student loan forgiveness plan. Borrowers will need to prepare as the moratorium on repayments will expire soon.

Expectations spike that Fed will raise interest rates in July after inflation data

Even though the PCE price index data for May came in lower than expected, investors are predicting that the Federal Reserve will raise rates once again when they meet in July. Expectations that policymakers would vote to hike interest rates by 25 basis points jumped by nearly 20 percent.

Investors now believe that there is almost an 87 percent chance that the FOMC will increase the federal fund rate next month.

PCE data shows inflation declined in May

Both headline and core inflation data declined in May according to Bureau of Economic Analysis. The Personal Consumption Expenditure (PCE) Price Index for May showed headline inflation running at 3.8% while once more volatile food and energy prices were removed, core inflation was 4.6%, lower than the 4.7% expected.

The Social Security Administration continues to mail payments for the month of June. Here are the beneficiaries who can expect to receive $914 on June 30.

The US has dozens of financial aid programs for low-income populations. Among them is the Supplemental Nutrition Assistance Program, or SNAP, formerly known as food stamps.

The distribution schedule of SNAP coupons depends on the administration of each state. These are the areas that start giving out payments on July 1.

Every month, the Social Security Administration (SSA) issues millions of payments to Social Security recipients, most of which are retired workers.

The data provided by the SSA from May will give insights into how much beneficiaries can expect to receive next month. In May, the SSA sent Social Security checks to 66 million people, of which 74 percent were retired workers. The average check was worth 1,836.06, with the maximum benefit amount for this year being $4,555.

Read our full coverage for details on the July payment schedule.

Powell: process of getting inflation to 2% "has a long way to go"

The US Department of Commerce will publish new data Friday on where inflation is at in the US. The Bureau of Economic Analysis will release the Personal Consumption Expenditure (PCE) Price Index for May. This is the Federal Reserve’s preferred inflation measure, as it gives a clearer picture of how price rises are affecting households.

Speaking at the Bank of Spain on Thursday, Fed Chair Jerome Powell said that it’s estimated that the headline PCE dropped last month to 3.9%, while core inflation was unchanged year-over-year. The day before, Powell addressed an ECB Forum where he said that inflation isn’t expected to reach the Fed’s target of 2% until 2025.

One of the challenges for policymakers is the strong labor market which is “pulling the economy.” Last week saw initial unemployment claims drop by the most in 20 months, showing that despite some signs of softening the US labor market remains resilient.

Powell said on Wednesday that the majority of the FOMC sees at least two more rate hikes before the end of the year. And despite the pause in June, there is nothing stopping them from being consecutive.

Gas prices lower for 4th of July in 2023

Those planning to take a road trip for the 4th of July holiday this year can expect to pay less at the pump than last year. In 2022, gas prices peaked mid-June topping the $5 mark per gallon on average nationally.

Initial unemployment claims drop by 26,000 to 239,000

The US Department of Labor released unemployment insurance data for the week ending 24 June. First-time out-of-work benefit claims dropped to 239,000 from the previous reports upwardly revised 264,000. The 4-week moving average was 257,500, an increase of 1,500.

Thanks to the distribution of SNAP coupons, these people could receive up to $4,223 in July 2023.

Mortgage interest rates tick up

The weekly average mortgage rate in the US for the week ending 29 June ticked up this week to 6.71% for 30-yr FRM and 6.06% for the 15-yr FRM.

In recent months, mortgage rates have risen to their highest level in 20 years, causing a slowdown in buying activity. Where is the housing market headed in 2023? Bankrate questioned several real estate experts to come up with a five-year forecast for the real estate market.

According to Lawrence Yun, chief economist at the National Association of Realtors, mortgage interest rates could continue to rise. According to Yun’s forecasts, 7% could be the level of mortgage rates for the rest of this year and most of 2024. Within two years, he forecasts the rate should return to 5.5 or 6%.

When you apply for a mortgage loan, lenders use your credit score as one of the factors to assess your creditworthiness and determine the interest rate they will offer you.

A higher credit score indicates that you have a good credit history and are more likely to repay your debts on time. As a result, lenders view borrowers with higher credit scores as less risky, and they may offer them lower interest rates on their loans.

Clearly, if you have a lower credit score, lenders will consider you to be a higher risk borrower and will offer you a higher interest rate on your mortgage loan.

Student-loan borrowers can take advantage of Public Service Loan Forgiveness (PSLF) programme. This programme forgives the remaining balance on your federal Direct Loans after you have made 120 qualifying payments while working full-time for a qualifying employer in public service or non-profit organisations.

There is also the potential option of getting into an Income-Driven Repayment (IDR) plan. The Biden administration proposed new regulations to improve the terms of the Revised Pay As You Earn (REPAYE) to make it easier to qualify and keep up with payments, as well as speed up when a borrower would qualify to have the remainder forgiven.

There are other options available though none on the scale of debt cancellation.

President Joe Biden is still trying to get one of his flagship election policies put into law: student debt cancellation. Originally, student debt was to be cancelled, all $1.7 trillion of it. Then it was watered down to $20,000 per student, but now it could be reduced to nothing. The ruling from the Supreme Court will be released on Friday to determine its legality.

Something that will be intentionally ending around the same time is the student loan payment moratorium. Since the covid-19 pandemic students have not had interest accrue on their student debt but this is soon to change. It is due to end soon.

Hello and welcome to AS USA's live blog covering financial news

Today will be a busy day, not least because the Supreme Court is expected to hand down its decision on the legality of President Biden’s student loan debt forgiveness program. In August, Biden announced that his administration would cancel up to $20,000 in student loan debt.

However, not long after the Department of Education’s online portal went live, legal challenges paused the program. The Supreme Court heard arguments in February.

Also coming out today will be the Personal Consumption Expenditure (PCE) Price Index for May, the Federal Reserve’s preferred inflation measure. Policymakers and investors will be watching to see if and how fast price rises are slowing. The results will have a hand in what the Federal Open Market Committee decides to do with interest rates when it meets again in July.

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/SXMC6Q62MZLVZMDJ7IBN6JX2KQ.jpg)

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/A3SUEOIBARBFBOHIFCVECXPU7A.png)

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/2OSJ5AJOYJIS3BHS6XVLIUCEHY.jpg)

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/X5OVLK4K3BNPTJSXJW7STUTW7Q.jpg)

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/SV243KNPOBOOLGASVTR5I7EXYE.jpg)