US financial news summary | 24 May 2023

Negotiations over the debt ceiling continue with eight days left before the country defaults. Follow along for the latest on the talks, Social Security, inflation, and other financial news.

Show key events only

US Finance: Latest Updates

Headlines | Wednesday, 24 May 2023

- The median selling price of homes sold in the US fell to $420,800 in April, the lowest level recorded in the last year.

- Experts remain divided over whether the Fed will announce another rate hike in June.

- The day the US could default on its debts, otherwise known as Day X, could come as soon as 1 June

- The impact of a default could present greater challenges for some states over others.

- Can President Bidenuse the Fourteenth Amendment to increase the debt limit?

Read more from AS USA:

Although the pandemic has reached manageable levels, inflation continues to be high and many families continue to have difficulties with putting food on the table. This has prompted some states to offer their own help in the absence of a fourth federal stimulus check.

This report tells about six states with aid projects for 2023.

Companies are talking less about a recession

Executives at S&P 500 companies are talking about recessions less after looking at earnings for the third straight quarter, per FactSet. S&P Global’s flash US composite PMI showed US economic output reached a 13-month high in May. Even the consumer slowdown teased by some companies doesn’t appear widespread quite yet.

“The economy is still on sound ground, with consumers willing to spend and businesses continuing to hire and invest despite fears that a recession is around the corner,” says Oxford Economics Lead US Economist Oren Klachkin.

"Consumers- the main engine of the US economy- will keep spending so long as incomes continue to rise."

Although there are still signs of a slowing economy, the larger numbers aren’t flashing warning signs. The economy grew 1.1 % in the first quarter, retail sales increased in April, the labor market is still robust, and even inflation, which remains historically high, grew at its slowest pace in two years in the most recent month.

Meta slashes more jobs in final round of layoffs

Meta, owner of Facebook, slashed jobs across its business and operations unit as it carried out its last batch of a three-part round of layoffs, part of a plan announced in March to eliminate 10,000 roles.

Dozens of employees working in teams such as marketing, site security, enterprise engineering, program management, content strategy and corporate communications took to LinkedIn to announce that they were laid off.

The social media giant also cut employees from its units focused on privacy and integrity, according to the LinkedIn posts.

Meta earlier this year became the first Big Tech company to announce a second round of mass layoffs, after showing more than 11,000 employees the door in the fall. The cuts brought the company's headcount down to where it stood as of about mid-2021, following a hiring spree that doubled its workforce since 2020.

(REUTERS)

Jason Reed / REUTERS

Federal Reserve Governor doesn’t see rate hiking finish just yet

The Federal Open Market Committee (FOMC) is set to meet again 13 and 14 June where the US central bank policymakers where decide on the future of interest rate hikes. The US economy while slowing continues to show resilience even after more than a year of rate hikes at the fastest rate in forty years.

On whether they will tighten the fiscal screws further or not Federal Reserve Governor Christopher Waller on Wednesday said that remains to be seen. But the rate hikes won’t likely be stopping in his view. “Prudent risk management would suggest skipping a hike at the June meeting but leaning toward hiking in July based on the incoming inflation data," he said.

He expressed concerns about the tight labor market that is still adding more jobs than expected and where there are roughly 1.6 jobs for every person unemployed. The jobs situation has in turn put upward pressure on wages that are rising too fast to be consistent with stable prices. Inflation is currrently more than double the Fed's 2% target.

“Whether we should hike or skip at the June meeting will depend on how the data come in over the next three weeks," said Waller.

Backlash against Bud Light and its parent company Anheuser-Busch continues after an attempt to widen its appeal put it at the center of the culture wars. The firestorm that erupted and boycott of the brand have left Anheuser-Busch sales in smoldering ashes. The company’s stock value has also taken a blow and two of the executives that were behind the attempt to widen Bud Light’s appeal have been put on leave.

Tax season in the United States came to an end in April, but many taxpayers are still waiting for their refund. What could be the cause of the delay?

Tens of thousands of clients of Maxim Healthcare Services are about to receive a payment of up to $5,000 in compensation for a data breach. The private medical personnel company based in Columbia, Maryland; agreed to pay 2020 data breach claims filed in a class action lawsuit by residents of the state of California.

Here's who will be eligible and how to make a claim.

Millions of student debt holders are awaiting the decision of the US Supreme Court to rule on the legitimacy of President Joe Biden’s debt cancellation. But not all student loans will be eligible if the Justices decide in favor of the White House.

There are two methods of applying for student loans; federal and private.There are a lot of differences that are important to consider when applying for either, as well as for those who have graduated and are claiming debt forgiveness.

Target voices concerns surrounding worker safety in LGBTQ+ store-fronts

Conservative lawmakers have launched a full-scale culture war against those who object to their understanding of the relationship between biological sex and gender expression. And now, companies that deviate from these interpretations are subject to vitriol and violence from their supporters.

For Target, the personal safety of their employees has been cited as the reason they “are making adjustments to our plans, including removing items that have been at the center of the most significant confrontational behavior.”

The safety of workers should be the priority of any company, not just Target. It is nevertheless an extremely stark warning that the physical safety of workers is being threatened because a private business is selling merchandise some customers see as inconsistent with their ideological perspective.

While debt ceiling negotiations continue between Democrats and Republicans, the consequences for a debt default are still serious. An immediate impact of the US government failing to increase the debt ceiling would be a recession, plunging household spending and rapidly increasing unemployment.

There would be another impact too, for Americans loaded with debt. People would be struck by increased interest rates as the cost of government borrowing increases as credit ratings fall. Investors would demand higher returns to compensate for the increased risk.

What does the 14th amendment of the constitution say about the debt ceiling?

A growing number of officials on Capitol Hill believe that the president has the power to use the Fourteenth Amendment of the US Constitution to avert a debt default. However, this move is not without its legal skeptics who point to the spending powers the legal document extends to Congress over the executive branch.

During a press conference hosted by Senator Bernie Sanders (VT-I) on the status of the negotiations, Senator John Fetterman (PA-D) described the ongoing talks as “a sad charade” and urged President Biden to consider using the Fourteenth Amendment to avert an economic crisis.

Millions of student debt holders are anxiously awaiting the decision of the US Supreme Court to uphold or declare unconstitutional President Biden’s executive order to cancel up to $20,000 in student loans.

All in all, the Department of Education estimates that there are 44 million people eligible for relief, with 26 million applying for loan cancelation before the courts began to hold up the implementation of the program. Together these borrowers owe around $1.78 trillion, up from around $400 billion in 2006, with the average balance growing $10,000 to $30,600 by 2021.

President Trump made it clear that the debt ceiling was not a bargaining chip

The current Speaker of the House, Kevin McCarthy is putting forward an argument over who would be to blame if the country defaults on its debts that does not hold up under scrutiny. In 2019, former President Donald Trump emphasized that increasing the debt ceiling was not up for negotiation, but a necessary action. This statement was made in front of numerous witnesses and the media, with Trump stating "I can't imagine anybody ever even thinking the debt ceiling as a negotiating wedge." However, now that the Republicans are no longer in control of the White House, they are using the debt ceiling as a tool to exert their power and demand concessions from the Democrats on social spending.

Speaker McCarthy asserted on Twitter that he tried to initiate negotiations in January, but the White House refused to participate. The response from President Bidne is similar to the response of the previous administration, but it seems that congressional leaders are not bothered by this hypocrisy. It's not just the Speaker who has changed his stance, as former President Trump recently expressed his support for Republicans using the situation to pressure Democrats, during a CNN Town Hall event.

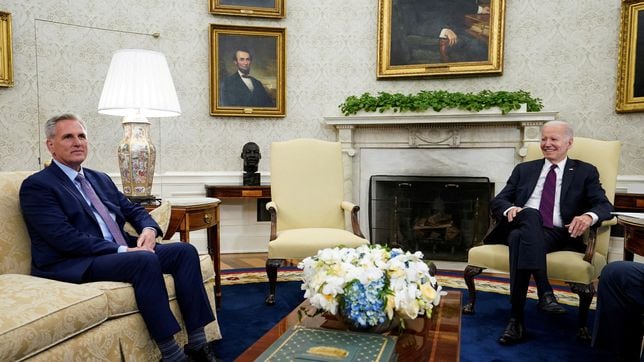

White House provides a status update on the debt ceiling negotiations

The President and Speaker McCarthy had a productive meeting yesterday about the need to prevent a default and avoid a catastrophi- — I’m sorry — catastrophe — pardon me — for our economy.

They both reiterated that default is off the table and only way forward is good faith — good faith — is in good faith and toward a bipartisan budget agreement.

While areas of disagreement remain, the President, the Speaker, and their teams will continue to discuss the path forward.

Over the past week, the President’s negotiating team has proposed options to reduce the deficit that both parties can support while also making clear that there are fundamental priorities that must be protected in this process.

The national debt ceiling was first introduced in 1917 when Congress passed the Second Liberty Bond Act, providing a formal limit on the amount of debt that the government could assume. Debt was issued in the form of government bonds which could be sold off to raise funds.

The level of public debt has fluctuated ever since but has always remained beneath the upper threshold, preventing a default on those debts. In the 20th century alone the debt ceiling was raised more than 90 times and has never been lowered.

However, despite the risks the US has never defaulted on its debt.

Read more on the history of the US debt and the instances where the country has come close to default.

Debt ceiling priorities

According to the Treasury Department, the US “Congress has acted 78 separate times to permanently raise, temporarily extend, or revise the definition of the debt limit,” since 1960. The increases have been approved under both Democratic and Republican presidential administrations, 29 times and 49 times respectively, over that period.

Lower tax refunds are affecting earnings results

Tax refunds were lower this spring than last year, and the impact is starting to show up in companies’ quarterly results, according to CNBC.

The average tax refund was $2,812 for the week ending May 12, down 7.3% from the same period a year ago, according to the Internal Revenue Service. That decline ties back to the elimination of certain tax credits after pandemic-era relief such as stimulus checks expired.

Intuit and H&R Block suggested that since there are no longer stimulus payments, fewer people are filing taxes – and that’s bad news for companies that provide tax prep software.

Total returns received by the IRS totaled about 142.6 million, down 1.2% from a year ago.

UBS in talks with Swiss authorities over Credit Suisse deal protections

UBS Group said it was in negotiations with Swiss authorities about loss protections related to its takeover of Credit Suisse Group and its regulatory capital requirements.

The disclosure underscores how some aspects of the tie-up between the two banks, arranged hastily over a weekend in mid-March by the Swiss government to avert a broader banking crisis, have yet to be ironed out.

The Swiss government agreed at the time to shoulder up to $10.12 billion in potential losses from the deal.

UBS said it expected the main terms of the loss protection agreement to be agreed prior to the acquisition of Credit Suisse being completed.

UBS added that it expects to complete the acquisition of Credit Suisse, which came to the brink of collapse in March following a string of financial scandals and mismanagement, by early June.

(REUTERS)

Hello and welcome to AS USA's live blog on finance and economic news.

To the dismay of many progressive Democrats, the White House seems to have placed itself in a situation where social spending cuts must be made to raise the debt ceiling. Some members of the caucus, particularly leaders in the Senate, have continued to call on President Biden to use the Fourteenth Amendment to override Republicans. As talks between Congressional Republicans and the White House continue, we will bring you the latest.

Yesterday, the US Census Bureau released the New Residential Sale report for April, which found that the median price for a home sold dropped to the lowest level in the last year. While prices have fallen, demand remains strong, with more houses being sold in April than any month in 2022.

The Federal Reserve continues to contemplate further rate increases, which in May said may be slowed as the financial and banking sector have been riddled with uncertainty after three major bank failures in March and April. Additionally, price growth has slowed since rate hikes began to be implemented, and unemployment has remained at a historic low.

Follow along for more on these topics and others.

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/YFPTAUBLHRJUBFL2N6DUCDKAXE.jpg)

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/3S4ABMDL5BKZPA43RFI5J6IO44.jpg)

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/4OXO53WA7RLKHIRFTW2KQ3IWGE.jpg)