US financial news summary | 23 May 2023

Later today, the Census Bureau will release the April selling home price data. Follow along for updates on Social Security, the debt ceiling negoications, and Fed rate hikes.

Show key events only

US Finance: Latest Updates

Headlines | Tuesday, 23 May 2023

- The median selling price of homes sold in the US fell to $420,800 in April, the lowest level recorded in the last year.

- Experts remain divided over whether the Fed will announce another rate hike in June.

- The day the US could default on its debts, otherwise known as Day X, could come as soon as 1 June

- The impact of a default could present greater challenges for some states over others.

- Can President Bidenuse the Fourteenth Amendment to increase the debt limit?

Read more from AS USA:

Tax season in the United States came to an end more than a month ago. From Jan. 13 to April 18, the Internal Revenue Service received returns for tax year 2022 from millions of taxpayers nationwide.

Although the government agency has already issued around 130 million refunds, a certain number of taxpayers are still waiting for their payment. Our report tells you about some possible reasons why your money is taking so long to get to you.

One of the go-to places for people who wish to shop wholesale is Costco, which has 582 locations in 46 states. It’s only open to members.

After customers pay for and load their purchases onto shopping carts, ready to wheel them away to their cars, employees of the membership warehouse club meet them at the door to check their receipts as they exit. Members are used to this drill, which is also practiced in other warehouse clubs.

Our report explains why staff members do this, and what they look for in your receipt.

While states like Texas have gained 29 million residents in the last decade, there are some cities in the United States that are grappling with populating certain places due to their distance from urban centers.

In an effort to populate various areas of the United States, some cities are offering land and money to attract prospective residents to relocate there. Our coverage tells you where you can find the areas which are providing these incentives.

UBS in talks with Swiss authorities over Credit Suisse deal protections

UBS Group said it was in negotiations with Swiss authorities about loss protections related to its takeover of Credit Suisse Group and its regulatory capital requirements.

The disclosure underscores how some aspects of the tie-up between the two banks, arranged hastily over a weekend in mid-March by the Swiss government to avert a broader banking crisis, have yet to be ironed out.

The Swiss government agreed at the time to shoulder up to $10.12 billion in potential losses from the deal.

UBS said it expected the main terms of the loss protection agreement to be agreed prior to the acquisition of Credit Suisse being completed.

UBS added that it expects to complete the acquisition of Credit Suisse, which came to the brink of collapse in March following a string of financial scandals and mismanagement, by early June.

(REUTERS)

Lower tax refunds are affecting earnings results

Tax refunds were lower this spring than last year, and the impact is starting to show up in companies’ quarterly results, according to CNBC.

The average tax refund was $2,812 for the week ending May 12, down 7.3% from the same period a year ago, according to the Internal Revenue Service. That decline ties back to the elimination of certain tax credits after pandemic-era relief such as stimulus checks expired.

Intuit and H&R Block suggested that since there are no longer stimulus payments, fewer people are filing taxes – and that’s bad news for companies that provide tax prep software.

Total returns received by the IRS totaled about 142.6 million, down 1.2% from a year ago.

Debt ceiling priorities

According to the Treasury Department, the US “Congress has acted 78 separate times to permanently raise, temporarily extend, or revise the definition of the debt limit,” since 1960. The increases have been approved under both Democratic and Republican presidential administrations, 29 times and 49 times respectively, over that period.

The national debt ceiling was first introduced in 1917 when Congress passed the Second Liberty Bond Act, providing a formal limit on the amount of debt that the government could assume. Debt was issued in the form of government bonds which could be sold off to raise funds.

The level of public debt has fluctuated ever since but has always remained beneath the upper threshold, preventing a default on those debts. In the 20th century alone the debt ceiling was raised more than 90 times and has never been lowered.

However, despite the risks the US has never defaulted on its debt.

Housing prices begin to fall; demand remains strong

The US Census Bureau reported this morning that last month, the median price of homes sold in the country fell to $420,800 from $455,800 in March.

This is the lowest figure recorded over the last year and indicates that the housing market my finally begin to cool down as mortgage rates reach their highest level since the 1990s.

Interestingly, while the median and average prices both fell, more houses were sold in April than in March, and looking year-over-year, there was an eleven percent jump in the number of units sold. What this indicates is that there is still high demand in the housing market, and while higher rates may be pricing out some buyers, the market remains active.

The Federal Funds Rate (FRR), the interest rate controlled by the US Federal Reserve, has hit its highest level in over a decade as the central bank attempts to cool down the economy and bring down inflation. Over the last year, the FRR rose from 0.77 percent to 4.83 percent. At the same time, inflation, as calculated by the Consumer Price Index (CPI), has fallen from a year-over-year rate of 8.3 percent in May 2022 to 4.9 percent in April 2023.

Read more in our full coverage on what the Federal Reserve is monitoring as they make a decision as to whether or not continue to increase interest rates.

The Biden government and Congress continue to be at an impasse regarding lifting the debt ceiling, and unless the situation is resolved, the US could default on its debt as early as June 1, which would spell disaster for the economy.

Economists have been making predictions about how a default or even a breach of the ceiling could affect the country. If the US ends up with a full-fledged default, it will have an impact on people who receive government funding, including those who are sent food aid and Social Security payments.

Housing price report for April to be released later today

Later today, the US Census Bureau will release the data on the selling prices of homes in April. The report will be released at 10:30 am ET.

This information is critical as it helps explain how interest rate increases impact home prices. The Federal Reserve assumes that increasing interest rates will drive down prices to cool down the economy. In the housing sector, these decreases have not yet been seen and rental and housing markets have been identified as the driver of inflation in recent months.

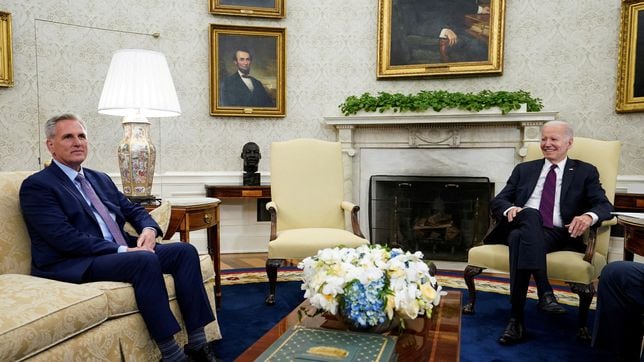

White House provides an update on negotiations with Speaker Kevin McCarthy

I just concluded a productive meeting with Speaker McCarthy about the need to prevent default and avoid a catastrophe for our economy.

We reiterated once again that default is off the table and the only way to move forward is in good faith toward a bipartisan agreement.

While there are areas of disagreement, the Speaker and I, and his lead negotiators Chairman McHenry and Congressman Graves, and our staffs will continue to discuss the path forward.

Last year, after inflation reached historical levels, several states across the US approved the sending of stimulus checks and tax refunds for their residents to provide economic relief in the face of high prices.

Little by little, the number of states sending money is decreasing. However, residents of some cities and counties in the United States may be eligible to participate in pilot guaranteed income programs that have been set up, which will issue payments of $500 or more each month.

Read more in the full coverage on when and where the payments will be sent.

Personal consumption helps prop up economic growth

Worries about recession risks linger, and the focus last week shifted to the consumer. Personal consumption accounts for about 71% of GDP, and there's good news on this front- according to Census Bureau data, retail sales in April climbed 0.4% to $686.1 billion.

While the pace of sales is off its record high, it continues to trend well above pre-pandemic levels.

"America runs on consumer spending,” JP Morgan economist Michael Feroli said. “And consumer spending continues to run in the right direction, as this week’s strong April retail sales report confirmed.”

Wall Street ends mixed as investors await debt ceiling talks

Wall Street finished mixed on Monday, with the Nasdaq helped by gains in Alphabet and Meta Platforms, while the S&P 500 ended near flat as investors refrained from big bets ahead of a fresh round of talks about raising the debt ceiling.

President Joe Biden and top congressional Republican Kevin McCarthy were set to meet to discuss raising the federal debt ceiling, just 10 days before the United States could face an unprecedented default.

"Investors are basically saying, 'We're giving at least a 60:40 likelihood that they will come to an agreement in time,'" said Sam Stovall, chief investment strategist at CFRA Research.

"An agreement could simply be the extension, kicking it down the road to decide on a debt ceiling when they also discuss the budgets in September."

(REUTERS)

Motorists keep their ride longer due to rise in car prices

Americans are keeping their cars longer than ever. The average age of a passenger vehicle on the road hit a record 12.5 years this year, according to data gathered by S&P Global Mobility.

Sedans are even older, on average- 13.6 years.

Since the pandemic struck three years ago, the average new vehicle has jumped 24% to nearly $48,000 as of April, according to Edmunds.com. Typical loan rates on new-car purchases have ballooned to 7%, a consequence of the Federal Reserve's aggressive run of interest rate hikes to fight inflation.

Hello and welcome to AS USA's live blog covering economic and financial news.

Negotiations between President Biden and congressional Republicans will continue at the White House early this week. Only eight days are left before the US Treasury could hit the debt limit and be left without enough money to pay its bills, so both parties are under pressure to reach an agreement. Both sides have confirmed that the proposal will need bipartisan support, which could pose a challenge for Speaker of the House Kevin McCarthy due to the slim majority he holds.

We will also bring you the latest on states that continue sending relief payments to residents.

As summer approaches, many are beginning to plan their vacations. Airfare prices have dropped, but as gas prices increased slightly, those planning to hit the road could encounter higher prices. However, these, like those for airfare, are likely to be lower than last year.

The Federal Reserve continues evaluating the prospect of another rate hike after saying they planned to pause additional increases for a period. However, with unemployment falling to 3.4 percent in April, the central bank may choose a more aggressive path. As we learn more, we will bring you the latest on that front as well.

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/3S4ABMDL5BKZPA43RFI5J6IO44.jpg)

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/OXYR5P7OWVMSPAZV27PN7XVKBM.jpg)