What is the exchange rate between the US dollar and the British pound today, 28/09?

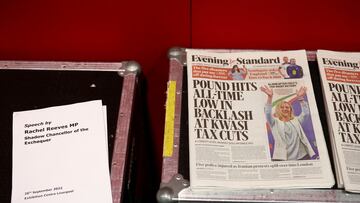

The British economy is taking a beating, leaving many residents worried about what winter will bring. How far could the value of the pound fall?

The exchange rate between the US dollar and the British pound has hit a thirty-year low, with $1 equalling £0.94. This latest wave of devaluation after Liz Truss’ new government announced its fresh approach to monetary policy. The financial troubles have also been spurred by Brexit, corporate greed, and the Russian invasion of Ukraine.

Since the beginning of this year, the pound has lost twenty percent of its value against the dollar, and as it continues in free fall, the situation could worsen.

The British economy could fall into a “death loop”

Most central banks, including the Bank of England, have increased interest rates dramatically over the last few weeks. However, in the British context, some economists, like, Julian Jessop, warn of a “death loop.” Jessop, a fellow at the Institute of Economic Affairs, a think tank that advocates free market strategies, believes that raising rates so quickly could be a mistake, given the current financial climate. The “death loop” is an economic phenomenon caused by increased interest rates that lead to slower growth throughout the economy.

However, Jessop does not think reversing the planned increases would restore the confidence of investors and the public. The economist does not put the majority of blame at the feet of the British government; instead, he pointed his finger at the US Federal Reserve.

In an interview with Radio 4, he said, “The fall in the pound is still primarily more of a dollar story… But the rise in long-term interest rates, if sustained, and I hope and expect it won’t be, that could be far more damaging for the economy because that’s not just the government’s cost of borrowing, it also affects mortgages and corporate debt and everything else as well.”

The Fed’s decision to increase rates is undoubtably having some impact on most currencies, but the background economic conditions of the United Kingdom have placed the country’s economy in a much more precarious situation.

IMF slams UK government for plans to proceed with tax cuts

The Truss government announced tax cuts on Friday that some economists believe could worsen the economic outlook over the coming months and years. The International Monetary Fund (IMF) has come out against this move, calling on leaders to reevaluate their decision.

“Given elevated inflation pressures in many countries, including the UK, we do not recommend large and untargeted fiscal packages at this juncture, as it is important that fiscal policy does not work at cross purposes to monetary policy.” Additionally, the IMF added that tax cuts would likely increase inequality, which given the high energy costs facing residents, could pour fuel on the fire.

The IMF has urged caution and sees the November budget as an opportunity to “provide support that is more targeted and reevaluate the tax measures, especially those that benefit high income earners.”

At this point, it does not seem that the Truss government is willing to budge, a decision that could cost her.

The future of Liz Truss as Prime Minister

An unnamed MP who served in the Johnson government told Sky News that the letters of no confidence are already flowing in, which could mean that Prime Minister Truss could be out of 10 Downing Street by the end o the year.

The justification for a vote of no confidence stems from how the government is fighting against the monetary policy of the Bank of England.

Related stories

The Chancellor of the howExchequer, Kwasi Kwarteng, has tried out a new financial policy that calls for high levels of spending coupled with tax cuts that critics argue will add to the national debt and further inflation. This has placed the treasury in direct opposition to the Bank of England.

“What Kwasi gives, the Bank takes away ... You cannot have monetary policy and fiscal policy at loggerheads,” said the anonymous MP.