Will I have to repay my student loan of up to $20,000 according to the Supreme Court’s decision?

With the Supreme Court ruling President Joe Biden’s debt cancellation plan illegal students need to keep paying off their eye-watering debt.

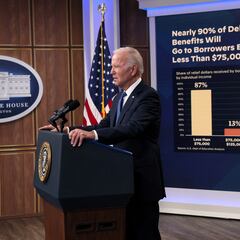

One of President Biden’s signature initiatives during the 2020 campaign was forgiving student loan debt. While it took nearly two years to announce, the Department of Education launched an online registration site in October for those with federal student loan debt to apply to have up to $20,000 of it forgiven.

However, the program was cancelled after the conservative majority on the court voted to deem it illegal. Coupled with this, the moratorium on repaying student loans and interest accruing on them is still in place, but only just about. The covid-era policy doesn’t expire until the end of August. After that interest will come back with a vengeance.

BREAKING: The Supreme Court has struck down the federal student debt forgiveness program.

— More Perfect Union (@MorePerfectUS) June 30, 2023

By a margin of 6-3 the Court has declared Biden's student's loan cancelation plan illegal.

But Biden can still cancel your debt, here's how: pic.twitter.com/ghY6gJDYV7

There will be no debt cancellation and you will need to repay all remaining debt after the end of August.

Options for Americans with student loan debt if forgiveness program is overturned

The Biden administration has been working to overhaul student loan forgiveness programs that are already in place. “Student loans were never meant to be a life sentence, but it’s certainly felt that way for borrowers locked out of debt relief they’re eligible for,” said US Secretary of Education Miguel Cardona last year announcing changes his department was working on to speed up debt cancellations under existing programs.

Student-loan borrowers can take advantage of Public Service Loan Forgiveness (PSLF) program and Income-Driven Repayment plans if they qualify. These plans provide the possibility for a borrower to have their debt cancelled in 10 to 20 years, respectively.

NYT’s useful life hack on how to escape student debt pic.twitter.com/eHlgsfPAOK

— Ken Klippenstein (@kenklippenstein) June 30, 2023

Related stories

The White House also announced proposed changes to shorten the time for debt to be forgiven under IDR plans to just 10 years of payments, even if those payments are for zero dollars per month, in some cases. The proposal could also cut payments in half by raising the threshold for income protected from repayment in addtion to stopping interest from accumulating if monthly payments are made.

One final option would be to declare bankruptcy, but this would come at the expense of a downgraded credit rating for 7 to 10 years. The Biden administration announced updated guidance on how the government treats federal student loan debt in bankruptcy proceedings. Previously, this avenue was near to impossible to use, but will only apply to those who are experiencing “undue-hardship” because of their outstanding student loan debt.