Will the Fed raise rates again in June? This is what the experts say

With the debt ceiling negotiations generating additional economic uncertainty, many wonder if the Fed will impose further rate hikes in June.

The Federal Funds Rate (FRR), the interest rate controlled by the US Federal Reserve, has hit its highest level in over a decade as the central bank attempts to cool down the economy and bring down inflation. Over the last year, the FRR rose from 0.77 percent to 4.83 percent. At the same time, inflation, as calculated by the Consumer Price Index (CPI), has fallen from a year-over-year rate of 8.3 percent in May 2022 to 4.9 percent in April 2023.

The decision of the Fed has led interest rates for 15-and-30 year mortgages to reach levels not seen since the 1990s but has had little impact on bringing down housing prices. In March, the Bureau of Labor Statistics reported that the housing sector had driven seventy percent of the 0.4 percent increase tracked in the CPI. Higher mortgage rates mean that some buyers are priced out of the market, but so far, housing prices have remained fairly even with where they were a year ago.

However, the price of other goods and services included in the CPI basket has fallen as supply chain issues have been resolved and as the price of oil stabilized at a lower level than that witnessed after the Russian invasion of Ukraine.

Will the Federal Reserve continue to increase interest rates?

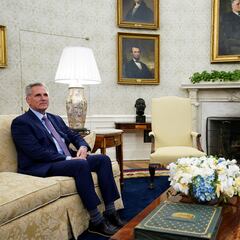

During Chair Jerome Powell’s semi-annual trip to Capitol Hill to answer the questions of lawmakers in the House and Senate in early March, he made clear that if the pace of rate hikes needed to be increased, the Fed was willing to do so.

A few days later, the country watched the collapse of Silicon Valley Bank and First Citizens Bank and, just a few weeks later, the failure of First Republic Bank. Rate hikes were having an impact on the balance sheets of major banks, and a few found themselves unable to maintain the confidence of investors. These failures come after Congress passed a series of laws under President Trump that allowed these smaller banks to be excluded from regulations that could have helped to avoid these outcomes.

Bank failures and the decision of the Federal Reserve to continue increasing interest rates

Some lawmakers, like Senator Bernie Sanders (VT-I), pushed back strongly against this deregulation. Citing a study from the Congressional Budget Office, the Senator from Vermont warned that the legal changes to the regulatory regime requested by the country’s largest financial institutions would “increase the likelihood that a large financial firm with assets of between $100 billion and $250 billion would fail.” For the record: Silicon Valley Bank held around $151 billion in assets; First Citizens Bank held around $109 billion; and First Republic Bank held around $212 billion.

It is not to say that the failures were entirely the result of deregulation, but coupled together with higher interest rates, these financial institutions were unable to stay afloat as credit markets tightened. In light of these bank failures, some financial experts argued that the Fed should slow the pace of rate increases.

In early May, Chair Powell announced that the FRR would rise by twenty-five basis points to between five and 5.25 percent. This increase did not reflect the Chair’s aggressive posture taken while speaking to Congress about a faster pace of rate hikes. Not only that, when the announcement was made in May that rates would rise once again, Chair Powell said that the Federal Open Market Committee (FOMC) was “assessing the appropriate stance of monetary policy” and that they would “continue to monitor the implications of incoming information for the economic outlook.” Should the data and information available to the FOMC change, the Chair said that the Fed stands “prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals.”

Do economists and financial experts foresee another rate increase in June?

Related stories

These bank failures and the slowdown in price growth, while unemployment has remained low, are forcing the Fed to reconsider its approach. The comments made by Chair Powell in May indicate that a slowdown in rate hikes may be coming as the Fed takes a moment to quell nerves over economic uncertainty, in part generated by the three major bank failures.

And as for how the Fed will approach the possibility of implementing another rate increase in June, experts are divided. The Wall Street Journal has said the decision is likely to come down to the wire, and the financial giant Goldman Sachs does not believe that another rate hike will come next month.