Ronaldo's expert witnesses consider he committed tax fraud

According to Spanish radio station Cadena Ser, the experts called on by Ronaldo's lawyers agreed with the tax authorities' arguments that the player defrauded €14.7M of tax.

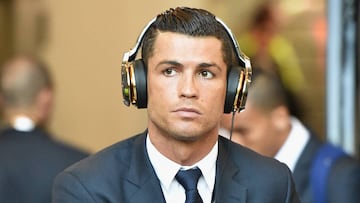

Cristiano Ronaldo's defence lawyers presented on Friday one of their final pieces of evidence in the tax fraud case against the Real Madrid star, according to Spanish radio station Cadena Ser. The case is being heard in a court in Pozuela de Alarcón, outside Madrid. Ronaldo's lawyers were hoping to take the tax authorities' case to pieces and avoid the trial going to the next stage of proceedings, however things didn't go to plan. The experts called in by Ronaldo's lawyers agreed entirely with the tax authorities' case that the striker defrauded 14.7 million euros of tax over four tax years.

The experts proposed by Ronaldo's lawyers were three professionals from the National Office of International Tax, a distinct body from Spain's tax authorities. They were questioned for four hours and far from arguing against the tax authorities case, they agreed with it on every point raised.

Experts reject Ronaldo's legal arguments

The experts even went so far as to say that one of the legal arguments used by the Ronaldo was "the most absurd" they had ever seen, in reference to the claim that his income from image rights was income from movable assets (which would be taxed at a lower rate) rather than work-related income, which is taxed at a higher rate.

Related stories

According to legal sources consulted by Cadena SER, after this evidence, Ronaldo will now be forced to negotiate a settlement with the tax authorities or risk going to an oral hearing, where he could face 10 years in jail for four tax fraud offences.

Ronaldo offered to settle tax case

Ronaldo's lawyers previously offered a settlement of €3.8M to the tax authorities, but this was rejected as insufficient. The tax authorities are seeking around €25M.