Tax Filing 2021: How to file an amended Tax Return

If you discover that some of the information on your tax return is inaccurate, you will have to file an amended form 1040-X – ideally, before the tax deadline date.

We all make mistakes, and filling in official forms, paperwork or documents can't be done in a hurry. In the United States, the tax season for filing returns for the past fiscal year (total earnings and deductions during 2020) began on Friday 12 February and will end on Thursday 15 April. During this period, anyone who has was employed and paying federal taxes during 2020 must file a tax return. This can be done free using the online IRS Free File Program or with IRS Free File software if your adjusted gross income is $72,000 or less.

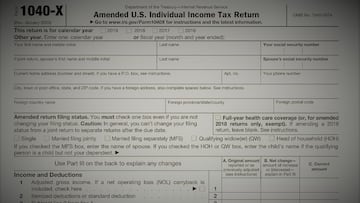

Tax returns are filed using Form 1040, however, if you have made a mistake filling in your tax return, or have changed address, you still have time to file an amended tax return – you will need to fill out another, two-page document: Form 1040-X, which is available here. Amended tax returns are accepted by the Inland Revenue Service (IRS) up to a maximum of three years after your original tax return was filed – that means that this year, the IRS will accept amended tax returns for the years 2018, 2019 and 2020.

There are no penalties or interest charged if you submit your amended tax return (Form 1040-X) before the deadline day, which this year is 15 April. If your return shows that you owe tax, any amended tax returns received after that date will be charged interest on a daily basis – until the balance is paid in full. You usually have 21 calendar days, from the day of notice to pay any additional tax.

Tax returns will decide your stimulus check entitlement

2020 US tax return: what's the minimum income to file taxes?

Form 1040-X used to file an amended tax return is very similar to Form 1040. You will need to tick the relevant box for the year of your declaration at the top of the form (2018, 2019 or 2020) and fill in all of the sections as you would for a normal tax return (marital status, adjusted gross income, deductions and taxable income, dependents and details of any other payments such as Earned Income Credit). The entries you make on Form 1040-X under the column headings Correct amount and Correct number or amount are the entries you would have made on your original return had it been done correctly. On Form 1040-X, you will also have to fill out Part III, giving an explanation of the changes you have made to your tax return, and why you are filing an amended tax return. All relevant supporting documents, new or changed forms must also be attached behind Form 1040-X. Don’t attach a copy of your original return, correspondence, or other items unless you are required to do so.

Amended tax returns cannot be filed online. Form 1040-X has to be printed off, filled in manually with black pen and mailed directly to the IRS. Depending on which state you live in, the addresses to which you must send Form 1040-X to can be found here:

A useful tip when preparing to fill in Form 1040-X is to first make the changes in the margin of the return which is being amended.

To complete Form 1040-X, you will need:

- Form 1040-X and these separate instructions;

- A copy of the return you are amending (for example, 2016 Form 1040), including supporting forms, schedules, and any worksheets you completed;

- Notices from the IRS on any adjustments to that return

- Instructions for the return you are amending. If you don't have the instructions, you can find them online at IRS.gov/Forms. If you are amending a prior year return, click on the link for prior year instructions under "Other Options." You can also order paper copies of the instructions for your return at IRS.gov/OrderForms or by calling 800-829-3676.

When you file taxes electronically, there is nothing to mail and the return is virtually mistake-free. This means the fastest way for you to get an #IRS refund in 2021 is to combine e-file with direct deposit. https://t.co/XUiXvm8pO6 pic.twitter.com/EnCeeJzqWD

— IRSnews (@IRSnews) February 15, 2021

Don’t file Form 1040-X if you are requesting a refund of penalties and interest or an addition to tax that you have already paid. Instead, file Form 843, Claim for Refund and Request for Abatement.

Related stories

Don’t file Form 1040-X to request a refund of your share of a joint overpayment that was offset against a past-due obligation of your spouse. Instead, file Form 8379, Injured Spouse Allocation. But if you are filing Form 1040-X to request an additional refund after filing Form 8379, see Injured spouse claim under Special Situations, later.

The penalty for failure to file a tax return within 60 days of the due date (with extensions) has increased to $435 or the amount of tax owed.