Third stimulus check: news summary for 11 April

Latest updates on the third stimulus check included in President Biden's American Rescue Plan and news on a possible fourth direct payment.

Show key events only

US stimulus checks: latest news

Headlines:

- Over 156 million stimulus checks have now been distributed, worth over $372 billion

- Vast majority of stimulus checks (85%) were paid by direct deposit

- Social Security recipients have begun to receive their $1,400 direct payment (full details)

- Veterans Affairs (VA) and Compensation & Pension (C&P) beneficiaries to get their stimulus checks on 14 April

- Second batch of the 'plus-up' stimulus check payments were distributed on Wednesday (full details)

- G20 finance officials poised to back a $650 billion stimulus boost in the IMF's emergency reserves

- Key Democrats in Congress calling on President Biden to embrace recurring fourth stimulus check (full details)

- Track your stimulus check using the IRS' Get My Payment tool (more info)

- US covid-19 cases/deaths: 31.19 million/562,064 (live updates from JHU)

Scroll through our related articles:

When will IRS send Unemployment tax refunds in May?

The IRS plans to start sending automatic refunds to those who paid taxes on unemployment compensation in 2020 before Congress passed a $10,200 waiver.

The Internal Revenue Service has said that most taxpayers won’t have to do anything to get back money paid in taxes on unemployment compensation in 2020, they should receive and automatic refund starting in May.

Dems will push for permanent enhanced Child Tax Credit

This summer families could start to see another type of direct payment from the government through the expanded Child Tax Credit. Under the American Rescue Plan the expanded tax provision is only for the 2021 fiscal year. However, Speaker Nancy Pelosi hinted that when the House Democrats put forward the American Families Plan, the third part of President Biden’s Build Back Better plan, making the tax credit permanent will be part of the bill.

The current legislation envisions eligible families receiving $300 per child under 6 and $250 per child under 18 per month starting in July.

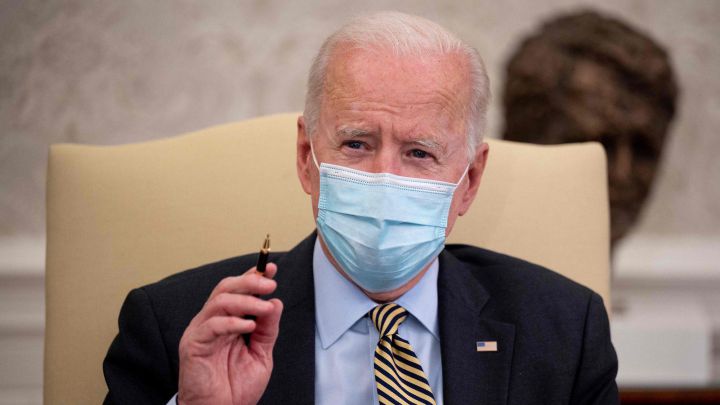

Where does Biden stand on a fourth stimulus check?

The effects of the $1,400 stimulus checks are beginning to be felt in the US economy as vaccination rates climb giving the American public more security to venture out of their homes. However, the road ahead for many struggling households is still long according to lawmakers urging the White House to continue direct stimulus payments until the pandemic emergency is over.

What does the White House have to say about recurring payments?Read her to find out.

Stimulus kept economic downturn from being “much worse”

Federal Reserve Chairman Jerome Powell sat down with Scott Pelley from 60 Minutes to give his thoughts on how the economy is rebounding from the covid-19 pandemic.

Powell thinks that the covid-19 pandemic worsened economic disparities in the United States and that this could take time to address during an uneven recovery. He also warns about reopening the economy too soon, that the pandemic still presents a threat to the US economic recovery.

Stimulus bill provides healthcare benefits as well as $1,400 checks

The most talked about feature of the $1.9 trillion covid-19 relief is the third round of stimulus payments that saw eligible households getting $1,400 per person. However, the American Rescue Plan Act also contains a whole slew of measures to help American families recover from the fallout of the coronavirus pandemic.

Included are important updates and tax breaks for medical care and health insurance that could benefit your family. Some of those benefits can be claimed on income tax filings this year. Check below to find out more.

Buttigieg not worried about semantics of infrastructure

As the Biden administration works with lawmakers to draw up the legislation that will become the American Jobs Plan, a $2-plus trillion infrastructure investment package, a lot of debate centers around what can be called infrastructure. Transportation Secretary Pete Buttigieg says “it’s the foundation that allows us to go about our lives.”

IRS intends to automatically refund taxed unemployment benefits

Last year, over 23 million workers nationwide in the US made unemployment claims, including self-employed workers who qualified for unemployed benefits for the first time. This income needs to be reported on tax returns.

Some taxpayers who claimed unemployment benefits in 2020 filed their return before the $10,200 waiver on jobless aid was passed.What you need to know here.

FEMA to open application process for reimbursement for covid-19 funerals

Families who lost loved ones to covid-19 can apply to receive retroactive reimbursement for funeral costs starting on Monday, 12 April. That relief maxes out at $9,000 per funeral and $35,500 per applicant if they were responsible for multiple funerals, but FEMA says not everyone will receive the maximum amount.

The federal agency is budgeting $2 billion for the program with money from the Coronavirus Response and Relief Supplemental Appropriations Act of 2021 and the American Rescue Plan Act of 2021. If you’re eligible, FEMA says the money will either get sent by a check in the mail or by direct deposit.

For more information you can check the dedicated FEMA website

Democrats are selling stimulus package to voters across the US

In their first recess from Washington since passing the American Rescue Plan last month, Democrats across the country, are crisscrossing their districts for a hybrid celebration-education tour. Their mission: Ensure constituents know how the package can help them, and make clear that Democrats were responsible for the legislation, which passed without any Republican support.

“Lots of people are aware in very broad strokes what’s in the plan, but they don’t necessarily know about some of the specifics,” said US Rep. Susan Wild. “A lot of people still don’t understand what a refundable tax credit is. We’re going to need to do a big educational push to make sure people who might not otherwise even file taxes do.”

They will have their work cut out for them. Despite the general popularity of the sweeping $1.9 trillion covid-19 relief bill a new POLITICO-Harvard pollshows that roughly only one in three think the stimulus bill will do much for them, including less than half of Democrats.

Are the third stimulus checks included in 2021 IRS tax filing?

The third round of EIP, the $1,400 direct stimulus payments, is an advanced credit for the 2021 fiscal year based on 2020 tax filings. However, the federal government isn’t waiting until those tax returns are processed to send out payments. In the four batches to date more than 156 million payments have been sent already.

You may get more money in 2022,find out more here.

Does Walmart cash stimulus check payments?

Does Walmart cash stimulus check payments?

For those who don’t have a current bank account, there are several places who will cash your $1,400 stimulus check, including Walmart.

Tax filing deadline moved to mid May

The Treasury Department and Internal Revenue Service announced that the due date for individuals filing federal income taxes for the 2020 tax year has been extended to May 17.

Veterans can expect payments next week

More than 25 million lower-income Americans whose stimulus payments were delayed finally received them on Wednesday. And one group still waiting — certain veterans and their beneficiaries — can expect their payments to arrive next week, the Internal Revenue Service said.

via NYT

Despite covid movie restrictions, 'Godzilla vs. Kong' Roars to $13.4 million in second weekend

"Godzilla vs. Kong" stormed to the top of the domestic box office, picking up $13.4 million in its second weekend of release. That brings the monster mashup's stateside haul to $69.5 million, an impressive gross considering it comes in the midst of a global pandemic.

The Legendary and Warner Bros. release's robust commercial performance has been all the more notable because it comes as covid restrictions are in place, limiting capacity in theaters, and also as the film is available on HBO Max. The film dropped 58 percent compared to its opening weekend gross of $32.2 million. Warner Bros. is releasing its entire 2021 slate on HBO Max at the same time they debut in theaters as a concession to coronavirus and a way to bolster the streaming service.

"Godzilla vs. Kong" is now the top-grossing film of the pandemic era, bypassing Christopher Nolan's "Tenet," which earned $58.4 million. The impenetrable "Tenet" still far outranks "Godzilla vs. Kong" when it comes to sheer narrative confusion.

Third stimulus check: who is getting extra money, why and how much?

Third stimulus check: who is getting extra money, why and how much?

The IRS is sending supplemental 'plus-up' payments to the stimulus checks already sent out for taxpayers that are newly eligible or that were due a larger stimulus check.

Biden's first budget fuels health, education spending in sharp change from Trump

U.S. President Joe Biden asked Congress to sharply increase spending to combat climate change and gun violence and to support education in a budget that marks a sharp departure from his predecessor, Donald Trump.

The $1.5 trillion budget, reflecting an 8% increase in base funding from the current year, would invest billions more in public transportation and environmental clean-ups, slash funding for a border wall, expand funding for background checks on gun sales, and direct a record amount to poor public schools, each goal clashing with the prior administration.

Nearly three months into a job consumed by the fight against the pandemic, the document offered a long-awaited glimpse into Biden's agenda and kick-starts a potentially grueling negotiation with Congress over what will ultimately be funded.

Europe needs a more ambitious covid stimulus plan, says France's Beaune

The European Union must shoot for a more ambitious COVID-19 recovery plan than the landmark 750 billion euro stimulus agreed last summer after the epidemic's first wave, French European Affairs Minister Clement Beaune said on Sunday.

Beaune said Europe must not repeat errors made after the global financial crisis a decade ago and this time should underpin the recovery with investment, in fifth-generation (5G) wireless networks, green and digital technologies, among others.

Asked in an interview on LCI television how much would be needed, Beaune said: "No doubt something like a doubling (of the existing fund).

"The economic response has to be more ambitious," he said. Beaune said he hoped the EU's 27 member states would ratify the recovery fund by May and that the 750 billion euros would be available from the summer. France is due to receive 40 billion euros under the scheme. EU governments are still submitting detailed spending plans for their share of the pot, and frustration is growing in Paris and some other capitals at the slow speed of disbursing the money.

In an interview published on Saturday, European Council President Charles Michel said he did not share the view held by some that the EU's recovery fund was insufficient when compared with the U.S. spending plan.

Biden budget would beef up IRS tax enforcement -Yellen

U.S. Treasury Secretary Janet Yellen stated that the Internal Revenue Service budget would increase by $1.2 billion or 10.4% under President Joe Biden's fiscal 2022 budget request.

Yellen, in a statement, said the $13.2 billion overall IRS budget would include an additional $900 million for tax enforcement in fiscal 2022. The Treasury is seeking to increase revenues by shrinking the "tax gap," the difference between taxes legally owed and those collected.

IRS officials have said that more than a decade of reduced or stagnant budgets have left the agency with 15,000 fewer revenue agents than it had in 2010, forcing it to reduce the number of audits it conducts and leaving significant tax fraud undetected.

Yellen said the budget request will increase fairness in the tax system. "It will make paying taxes a more seamless process for millions of Americans. And it makes sure that corporations actually pay what they owe," she said in a statement.

Wall St Week Ahead-With stocks at record highs, investors look to upcoming earnings

Wall Street is kicking off a crucial reporting season as U.S. companies provide quarterly results a year after the coronavirus pandemic crippled the economy and as investors look for reasons to support a stock market at record highs.

Results begin in earnest next week with major banks. Overall S&P 500 earnings are expected to have jumped 25% in the first quarter from a year ago, according to IBES data from Refinitiv.

That would be the biggest quarterly gain since 2018, when tax cuts under former President Donald Trump drove a surge in profit growth. With the S&P 500 index at record highs, valuations are stretched heading into the season, leaving some investors looking to earnings for further support.

"We've seen earnings estimates go up, but... when you look at the market price as a multiple of those forward earnings, it has stayed pretty steadily at around 22 times," said Brad McMillan, chief investment officer at Commonwealth Financial Network.

"If we're going to see significant moves going forward, it's going to come from earnings."

Third stimulus check: until when will the new "plus-up" payments be sent?

Third stimulus check: until when will the new "plus-up" payments be sent?

The IRS will send out stimulus checks on a weekly basis to eligible Americans, as the agency processes tax returns additional payments could be on the way.

World stocks hit record high, powered by Wall Street

Global stocks hit record highs, as tech shares on Wall Street cheered receding U.S. inflation fears, with the lack of inflation pressure keeping bond yields near two-week lows.

Federal Reserve Chair Jerome Powell reiterated that inflation was not a worry, following data showing an unexpected rise in the number of Americans filing new claims for unemployment benefits. "As long as monetary stimulus is easy, as long as fiscal policy is easy, any hiccups in stocks are probably only going to find buyers," said Giles Coghlan, chief currency analyst at HYCM.

Does Walmart cash stimulus check payments?

For those who don’t have a current bank account, there are several places who will cash your $1,400 stimulus check - Walmart offers a couple of solutions, either to cash the check or to load it onto a moneycard which you can then use.

Read more:

Stimulus checks more attractive than working?

WFTV reports that some business owners in Florida have been struggling to fill job vacancies and one of the reasons might be that unemployment compensation and stimulus checks allow people to make more from home.

You can’t keep a $1,400 stimulus check sent to you by mistake

The IRS is currently sending out “plus-up” payments to taxpayers who are newly eligible for a stimulus check or a larger amount for the third round of Economic Impact Payments as the agency processes 2020 tax returns. Although the IRS didn’t ask for people to return money that was overpaid in the earlier rounds of EIP due to a change in eligibility that isn’t the case when someone receives two $1,400 payments, you can only keep one.

To return a stimulus check you are not eligible for, write 'Void' in the endorsement section on the back of the check then mail the voided check to your local IRS office.

Democratic congressional lawmakers push for fourth stimulus check

The federal government has sent out over 156 million Economic Impact Payments over four weeks. Even as the $1,400 direct payments continue to go out there are calls for even more stimulus payments. So far, 74 congressional lawmakers have pushed for recurring checks until the end of the pandemic.

Broader definition of infrastructure needed

One of the main attacks by Republicans against President Joe Biden’s American Jobs Plan, his $2 trillion infrastructure bill is that it only includes a limited amount of money for roads, bridges and railroads. The White House is arguing that we need to rethink what we consider infrastructure, that it should include everything that helps workers do their jobs, including having child and elderly care.

Biden's housing plan hopes could hit a brick wall

President Joe Biden hopes to bring housing costs in line with people’s incomes with provisions included in his $2 trillion infrastructure package but its an issue which is riddled with difficulties. Some commentators have argued that financial incentives will not be enough to make housing more affordable to minority communities and for the creation of new housing, Politico reports.

Who qualifies for stimulus check ‘plus-up’ payments?

The IRS are still sending out the direct payments, but have announced that some could be eligible for more money after filing their 2020 tax returns.

Read more:

Analysts hoping stimulus aid will spark retail spending surge

Analysts are hopeful that the latest round of federal stimulus aid will lead to an increase in spending on the high street, the FT reports. Economists surveyed by Bloomberg expect month-on-month retail sales to rise from 3.5% to as much as 5.9%. Meanwhile the Bank of America expects there will be a massive 11.5% rise in retail spending.

Tax deadline moved for victims of Louisiana winter storms

Victims of Winter Storms that occurred on 11-19 February 2021 have until 15 June 2021 to file various individual and business tax returns and make tax payments. This includes 2020 business returns, normally due on 15 March and individual and business returns normally due on 15 April. It also includes the special 1 March filing and payment deadline for farmers and fishers who forgo making estimated tax payments. Taxpayers also have until 15 June to make 2020 IRA contributions.

Third stimulus check: until when will the new "plus-up" payments be sent?

The IRS will send out stimulus checks on a weekly basis to eligible Americans, as the agency processes tax returns, additional payments could be on the way.

Read more:

NYC breakdown of Paycheck Protection Program

The Paycheck Protection Program gives small businesses interest-free loans to keep their doors open and employees on the payroll. The amount of time that businesses have to access the funds was recently extended until 31 May, 2021.

Covid-19 stimulus packages included funeral costs reimbursements

On Monday families who lost loved ones to covid-19 can apply to receive $9,000 to retroactively reimburse them for funeral costs. The program is open to families regardless of their income, as long as they show documentation and have not already received similar benefits through another program. People do not need to be citizens to apply. There is no cut-off date as long as someone died of coronavirus after January 2020.

Stimulus check live updates: welcome

Hello and welcome to our daily live blog on Sunday 10 April.

We'll be with you throughout the day bringing you the latest information related to both the third stimulus check, which sees qualifying Americans get up to $1,400, and also on the possibility of a fourth, potentially recurring direct payment which is currently being debated.