Third stimulus check for veterans: how to track and claim a missing payment

The IRS have confirmed that Veterans Affairs stimulus payments have been processed but some eligible recipients are reporting that the money has not arrived.

The third round of stimulus checks featured slightly tougher eligibility requirements than previous rounds, but recipients of Veterans Affairs (VA) benefits are definitely in line for the direct payment.

The IRS has confirmed that no one who receives VA support will have to provide any additional details to trigger the payment, provided that they file income taxes with the tax authority. If not, they will need to file a tax return to ensure that the IRS has the relevant details to make the payment.

On 7 April, the IRS announced that they would “begin processing these VA payment files at the end of this week. Because the majority of these payments will be disbursed electronically, they would be received on the official payment date of April 14.”

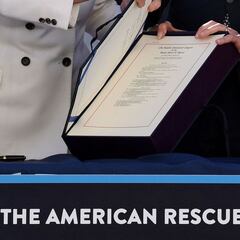

GREAT NEWS: Thanks to the American Rescue Plan, Mainers who receive Veterans’ benefits can expect stimulus checks of up to $1,400 to hit their bank accounts beginning this week.

— Congresswoman Chellie Pingree 🇺🇸 🇺🇦 (@chelliepingree) April 15, 2021

I am incredibly proud to have voted for this direct relief! #mepolitics

https://t.co/4PcyDz0sFm

However not all who are eligible have yet received their stimulus check; here’s how to check the status of your payment and report if it is missing.

How to check your Veterans Affairs stimulus check status

As with all stimulus checks, the IRS offers an online portal to check the status of your payment. Their Get My Payment tool is updated once a day, typically overnight, and will provide you with the status of the payment. VA recipients should have been able to view their stimulus check status in the portal since 10 April.

Once the IRS has made the payment, they will wait around 15 days and then send a physical letter (also known as a Notice 1444) to your home address, confirming that you received the payment. The letter will also provide details for how to get in touch if your stimulus check payment still has not arrived by then, suggesting that something has gone wrong with the distribution.

Beginning today, NEPA veterans who receive @DeptVetAffairs benefits and don't normally file taxes should start to see their #AmericanRescuePlan stimulus payments via direct deposit or your Direct Express card. More info at the IRS Get My Payment tool 🔽https://t.co/JiFlUxWSjI

— Matt Cartwright (@RepCartwright) April 14, 2021

If this is the case, then you will need to request a IRS payment trace and claim the missing stimulus check as a separate payment.

How to get claim a missing stimulus check

Unfortunately, there is no simple online portal to use when requesting a payment trace to claim a stimulus check. You can either call the IRS on 800-919-9835 (make sure you have the Notice 1444 to hand) or you can submit a completed Form 3911 (Taxpayer Statement Regarding Refund) by mail or fax.

- Veteran third stimulus check: how much and when?

- State of the fourth stimulus check negotiations

- IRS confirms tax return backlog from 2019

- Why you won’t be seeing a fourth stimulus check

If you choose to complete the form, the IRS has the following instructions:

1. Write "EIP3" on the top of the form, to make clear it relates to the third Economic Impact Payment

Related stories

2. Complete the form, including all refund questions as they relate to your payment.

3. When completing item 7 under Section 1:

- Select "Individual" as the Type of return.

- The Tax Period should be “2021”

- Leave the Date Filed section blank

- Then simply sign the form and submit by either mail or fax. Married couples who file jointly must both sign the form.