Fourth stimulus check news summary: 7 May 2021

Latest updates and info on the third stimulus check in President Biden's coronavirus relief bill, plus news on a possible fourth direct payment.

Show key events only

US stimulus checks: live updates

Headlines:

- White House reportedly considers introducing automatic stimulus checks

- California officals give an update on Golden State Stimulus check distribution process (read more)

- US jobs report set to be published on Friday

- Get your IRS tax returns in before the 17 May deadline, potentially qualifying you for a 'plus-up' stimulus check payment

- $1,000 stimulus check for Florida first responders(full story)

- President Joe Biden set to meet Republican & Democrat lawmakers on 12 May to discuss American Families Plan

- New batch of stimulus checks provides 585,000 additional plus-up payments, worth an estimated $1.2 billion

- Psaki suggests fourth round of stimulus checks will be a congressional matter: "They are not free."

- You can track your third stimulus check by using the IRS'Get My Payment tool

- US covid-19: 32.6 million cases / 580,102 deaths (live updates from JHU)

Check out some of our related articles:

Psaki to stand down

White House press secretary Jen Psaki has indicated she plans to step down next year. “I think it’s going to be time for somebody else to have this job, in a year from now or about a year from now,”

IRS reminds filers of May deadline

Despiite the deadline being extended by the IRS in March, time is running out for individuals to file their 2020 taxes with the new 17 May deadline looming.

Full extent of Child Tax Credit benefits not yet apparent

The IRS is still aiming to introduce the new Child Tax Credit system, which provides monthly direct payments for parents, in July. The White House claim that the programme could halve childhood poverty in the United States over the course of its initial 12-month duration, but studies suggest that the effects could be even more far-reaching.

Advocacy group The RAND Corporation have linked the potential rise in living standards for some of the country's poorest children to a vast range of later life benefits. Their report even suggests that the new Child Tax Credit could have an impact on life expectency with "decreasing mortality rates and increasing lifespan".

US releases April jobs report

The Biden adminstration has so far been characterised by a huge splurge of federal stimulus spending which the President hopes will kick start the American economy and remould society in a more egalitarian way. Biden has already announced details of the American Jobs Plan and the American Families Plan, both of which funnel trillion of dollar in federal money into stimulus programmes.

Here's what Yahoo Finance made of the jobs report when it came out, suggesting that Biden has some way to go if the US economy is to return to pre-pandemic levels.

Continued calls for recurring stimulus checks

The two-pronged campaign for a fourth stimulus check goes on, even as the IRS continue to distribute the third round of the direct payments. A group of 21 Democratic senators signed a letter asking Biden to consider recurring payments in future relief bill, and a petition calling for the same thing has already surpassed 2 million signatures in less than a week.

More lawmakers throw their support behind the Child Tax Credit

Rep. Sean Casten of Illinois is eager to talk up the potential benefits of the new Child Tax Credit provision, which is projected to make a significant impact on the lives of millions of Americans.

Casten said on Twitter recently: "At a moment when 1 in 8 children are going hungry and millions of families are struggling, it’s crucial that we all work together to ensure every parent has the resources to access the Child Tax Credit."

How will the Child Tax Credit help American families?

The new Child Tax Credit system has not even been introduced yet, and already there are debates in Congress about making the new process permanent. Biden's American Families Plan proposes extending the initial 12-month duration through 2025, but what does this mean for normal families?

Well, the new support will come in the form of monthly direct payments in the recipient's bank account. These payments will be worth up to $300 for children under six, and $250 for those aged between six and 17. In this freely-available podcast, Urban Institute discusses the new system.

White House reportedly considering automatic fourth stimulus check

So far President Biden has been unwilling to discuss the possibility of a fourth stimulus check but it appears that his view may be softening as the White House considers implementing a system that would automatically send payments when the economy dips.

The US' economic recovery from the pandemic is unlikely to be even and there may will be substantial bumps on the road back. With this measure in place low-income or struggling household could automatically receive a stimulus check whenever certain economic criteria are met. A number of lawmakers have called for a similar 'trigger-based' system but this is the first sign that Biden is considering it.

Widespread support for Child Tax Credit extension

A new study shows that there is strong support for extensing the new-look Child Tax Credit, one of the main features from the recent $1.9 trillion stimulus bill. The package included funding to make the new Child Tax Credit system, with monthly payments for recipients, last for 12 months.

But although the new provision has not even begun yet, there are growing calls for the move to be made permanent. In his American Families Plan announced last week, Biden told Congress that he would look to extend the Child Tax Credit through 2025.

When will SSI recipients receive the Golden State Stimulus?

Upon announcing the introduction of the Golden State Stimulus bill, Gov. Gavin Newsom said: “We passed the recovery package to get money into the pockets of Californians who were hit hardest by this pandemic, and that’s exactly what the Golden State Stimulus is doing."

That first announcement came back in February when the bill was signed into law, which included $600 to $1,200 in payments to eligible taxpayers in the state. Thursday was the first announcement of just how many stimulus check payments have gone out so far.

Stimulus check investors spur Bitcoin surge

Given the enormous scale of all three round of stimulus check payments, the influx of federal funding has created some perculiar consumer spending trends. Earlier this year home investors cause the price of unfancied stocks like GameStop and Blockbuster Videos to skyrocket.

A report from Forbes found that as much of $40 billion from the most recent round of stimulus checks may have gone on stocks and cryptocurrency investments. This represents close to 10% of the total amount distributed in the third round of stimulus checks to date and shows why the prices have enjoyed such a strong few months.

How will the Child Tax Credit affect families?

H. Luke Shaefer and Kathryn J. Edin, the co-authors of $2 a Day: Living on Almost Nothing in America, know what it's ike to scrape by with very little money in your pocket and they have turned their attention to the new-look Child Tax Credit for an article for the Atlantic.

The new programme will provide monthly payments to parents, marking a significant change to the federal government's role in American households' budget. The new Child Tax Credit will see monthly payments, essentially like a recurring stimulus check, to eligible households worth up to $300 per child.

Democratic Senator slates GOP stimulus check "hypocrisy"

The White House is in the process of sending out letters to every American to outline the positive impact that the recent American Rescue Plan is having on the country, with the third round of stimulus checks key amongst that.

President Biden's name was not on the $1,400 direct payments but the Democrats are clearly eager to take the credit for the stimulus checks and Senator Gary Peters takes a pop at the Republican Party here.

SSA and SSI recipients should have received stimulus check by now , if not action needs to be taken

The Social Security Administration says that beneficiaries of Social Security or Supplemental Security Income should file a tax return as soon as possible if they still haven’t received their stimulus check payments from the first two rounds approved last year.

Specifically, the first $1,200 and second $600 Economic Impact Payments. This is the case even if you have no income, you should file a return if you are missing those checks. It will also help the IRS process the third $1,400 stimulus checks currently being sent.

Stiglitz says tax system needs to change to finance 21st century economy

The US tax system currently taxes those who receive income through work at a higher rate than those who get income through investments. President Biden wants to reverse this to pay for his American Families Plan. Nobel Prize Winning Economist Joseph Stiglitz says that currently the tax system doesn’t collect enough in terms of GDP to finance all the needs to make a well-functioning 21st century economy.

Check out his interview below

Immortalizing and memorializing the pandemic with stimulus money

Tattoo artists are seeing a bigger than usual surge in people wanting to get body art this spring. Normally a busy time of year as people get their tax refunds, this year has seen a boom in people setting up appointments. The artists find themselves amazed that many clients want to get artwork based on the pandemic of the past year.

Silver lining in lackluster jobs report, new argument for more stimulus

With what looked like the economy revving up expectations for a million new jobs in April were dashed when the Labor Department released the April jobs report Friday. There was still job growth but only a quarter of what was expected, and the unemployment rate went up nought point one percent from March.

However for those pushing to invest more in the US economy they now have a new argument: that we're not out of the woods yet and there is still more to be done. President Biden is pushing to get his next two phases of his Build Back Better program through Congress which cost a combined $4 trillion.

When will SSI recipients receive the Golden State Stimulus?

In February Governor Gavin Newsom signed into law California’s own stimulus program, the Golden State Stimulus, which included $600 to $1,200 in payments to eligible taxpayers in the state.

On Thursday, California’s Franchise Tax Board announced it has sent out 2.5 million Golden State Stimulus payments. Payments are scheduled to go out twice a month.

Who is eligible for Earned Income Tax Credit for childless workers?

The Earned Income Tax Credit is a refundable tax credit that is targeted at low- and moderate-income workers. It reduces the amount of taxes filers owe and can even be collected as a refund. The American Rescue Plan gave the Earned Income Tax Credit for childless workers a boost for 2021 tax filings in 2022, but they need to file to claim it.

Will a tax credit for first-time homebuyers be available in 2021?

To keep a campaign promise, the President called on Congress to pass a tax credit for first-time homebuyers. Two House representatives, Earl Blumenauer (D-OR) and Rep. Jimmy Panetta (D-CA), have followed the President’s lead and introduced a bill that would provide first-time homebuyers with a tax credit valued at 10% of the property’s purchase value, up to $15,000.

Shouldn’t read too much into one #JobsReport. But there are still 8.2 million fewer jobs than pre-pandemic, 3.5 million people have permanently lost their jobs, 4.2 million have been out of work for more than 26 weeks A big #infrastructure bill can get Americans back to work

Jobs report misses expectations

The Labor Department released the April jobs report Friday morning and although the number of new jobs and payrolls increased in April, the numbers missed the mark that had been expected. Also the unemployment rate unexpectedly increased 0.1% from March, this can happen when people previously not looking for work begin to look for work.

Non-farm payrolls, April: +266,000 vs. +1 million expected

Unemployment rate, April: 6.1% vs. 5.8% expected and 6.0% in March

Average hourly earnings, m-o-m, April: 0.7% vs. 0.0% expected and -0.1% in March

Average hourly earnings, y-o-y, April: 0.3% vs. -0.4% expected and 4.2% in March

Stimulus checks help stave off hunger

MSN - The percentage of Americans struggling with hunger is now at its lowest level since the pandemic began, suggesting the recent flood in aid from Washington is making a significant difference to families struggling economically.

Data released by the US Census Bureau this week shows the percentage of adults living in households that sometimes or often did not have enough to eat dipped to just over 8 percent late last month, down from nearly 11 percent in March. That is a substantial drop, and it came after hundreds of billions in stimulus checks went out.

The rate of American adults in households struggling with food is now down more than 40 percent since its peak in December — a fact that Democrats are beginning to tout as proof that hundreds of billions of dollars in direct stimulus is working as intended as they push for another massive package despite growing GOP opposition to more spending.

Will the fourth stimulus check be approved? Can it still happen in May?

As President Joe Biden pushes on with his agenda he has announced trillions more in federal spending over the past few weeks, which will complete his three-pronged Build Back Better legislative plan.

Now the fate of the next round of direct payments is up in the air after public statements from President Joe Biden and White House press secretary Jen Psaki.

When to expect unemployment tax break refund: who will get it first?

As part of the American Rescue Plan those that claimed unemployment compensation in 2020 will receive a $10,200 tax waiver per individual. Unemployment benefits are taxed by the federal government, which came as a surprise to many of the 40 million who had never previously received jobless aid.

The IRS said it will begin to send tax refunds in two waves starting May to those who benefited from the $10,200 unemployment tax break for claims in 2020.

IMF prediction for US economic growth with stimulus

The IMF expects the US economy will grow 6.4% this year, its strongest growth in decades. That's faster than the 5.1% growth it was projecting just two months ago and nearly double the growth rate it predicted in October. The United States could become the engine of global economic growth this year.

Wonky look at whether stimulus will or won't affect inflation

How high might inflation rise in the US in the coming years? Blanchard (2021) and Summers (2021) caution that the recent $1.9 trillion American Rescue Plan Act (ARPA), together with the fiscal expansion passed in 2020, may push unemployment low enough to cause overheating and surging inflation. Others, such as Gopinath (2021), see a persistent surge in price pressures as unlikely, and Powell (2021) argues that the rise in inflation will be “neither particularly large nor persistent”.

Moms to benefit from stimulus checks this Mother’s Day

After a very long year of lockdown, pandemic, home schooling, juggling work and home, and more... Mothers can expect to be treated well this Mother’s Day as people can go out more with restrictions being relaxed and their admirers planning to spend a record amount on them this year to show their appreciation.

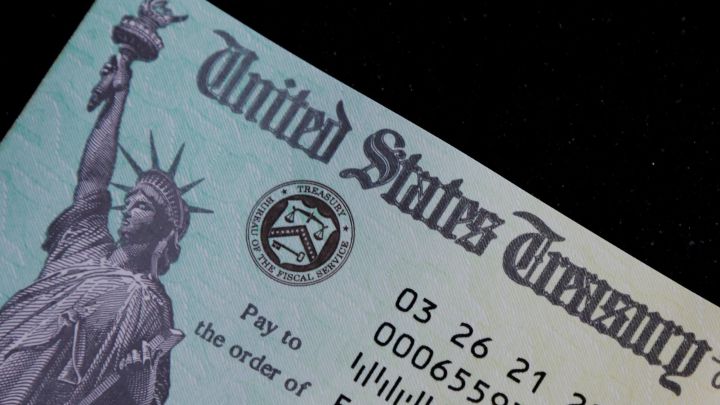

Kudos to the IRS for stimulus check delivery

According to a Newsweek analysis of data provided by the IRS in response to a Freedom of Information Act request, about 1.25 million stimulus checks from the first round have never been cashed or were returned or paid back to the US Treasury. That is out of 160 million stimulus payments sent.

The uncashed or returned first-round stimulus payments represent less than one percent—0.78 percent, to be precise—of the total $270 billion the IRS sent out. That small percentage has impressed observers tracking the economic impact of the effort, especially given the circumstances of the pandemic and staffing shortages at the agency.

The scramble to brand the $1,200 stimulus checks

ABC News has obtained internal emails on the discussions of how to included former President Trump’s name on the first round of stimulus check last spring. The documents provide a glimpse behind the scenes as the Trump administration sought to take credit for the payments. And for the first time, the government has released images showing versions of the checks that did not make the final cut.

Republicans thanked for talking up stimulus bill they opposed

Every Republican in Congress voted against the sweeping American Rescue Plan that President Joe Biden signed into law three months ago. But shortly after their “no” votes to the bill, Republicans from across the country have promoted elements of the legislation they fought to defeat.

With a little tongue in cheek White House spokesman Andrew Bates said "The American people — majorities of Democrats, independents, and Republicans — have long been firmly unified behind the American Rescue Plan. So it’s heartening to see Republicans in Congress reaching across the aisle to endorse it — even retroactively.”

How investing in the IRS can pay for itself

President Joe Biden is calling for $80 billion to help the IRS crack down on tax avoidance from wealthy Americans and big corporations.

The proposal would boost staffing to enforce tax law, technology and additional bank reporting. Together the measures could generate an estimated $700 billion in tax revenue over the next decade.

Biden’s proposal comes as the IRS struggles with increased volume and complexity of returns. The agency has lost over 30,000 employees over the last decade. These cuts have resulted in fewer audits for high-earning filers and lowered the agency’s able to man phone lines to aid taxpayers.

Alabama storm victims get tax extension until 2 August

IRS - Victims of severe storms, flooding, landslides and mudslides that began March 25, 2021 now have until August 2, 2021, to file various individual and business tax returns and make tax payments, the Internal Revenue Service announced today.

Following the recent disaster declaration issued by the Federal Emergency Management Agency, the IRS announced today that affected taxpayers in certain areas will receive tax relief.

The IRS automatically identifies taxpayers located in the covered disaster area and applies filing and payment relief. But affected taxpayers who reside or have a business located outside the covered disaster area should call the IRS disaster hotline at 866-562-5227 to request this tax relief.

Biden sets 12 May as American Families Plan discussion date

President Biden is to meet with top Democratic and Republican lawmakers at the White House on May 12 to try to find common ground.

Congress is polarized and Democrats hold only narrow majorities in the U.S. House of Representatives and the Senate. Biden had promised throughout the 2020 presidential campaign to work with Republicans, but his major legislative achievement, a $1.9 trillion pandemic relief plan, passed without a Republican vote.

Republicans in Congress already have their eyes on making gains in the midterm congressional elections in 2022, and are aligning a divided party around opposing Biden.

"American Families Plan" spending outline

Biden's $2 trillion infrastructure plan and his $1.8 trillion "American Families Plan" includes $1 trillion in spending on education and childcare over 10 years and $800 billion in tax credits aimed at middle- and low-income families.

It also includes $200 billion for free, universal preschool and $109 billion for free community college regardless of income for two years, the White House said.

Biden has vowed to work with both Democratic and Republican lawmakers in a search for a bipartisan agreement. However, whether he will be able to persuade the opposition party to join in a plan that will raise taxes on the wealthy is far from clear.

Solid gains also expected in manufacturing

Solid gains are also expected in manufacturing, despite a global semiconductor chip shortage, which has forced motor vehicle manufacturers to cut production. Strong housing demand likely boosted construction payrolls.

Government employment is also expected to have picked up as school districts hired more teachers following the resumption of in-person learning in many states.

Robust hiring is unlikely to have an impact on President Joe Biden's plan to spend another $4 trillion on education and childcare, middle- and low-income families, infrastructure and jobs. Neither was it expected to influence monetary policy, with the Federal Reserve having signaled it is prepared to let the economy run hotter than it did in previous cycles.

10 days remain to file taxes

Despite the IRS extension in March, filers have just 10 days remaining to file 2020 tax data. 17 May is the new deadline.

US economy likely created nearly a million jobs in April

U.S. employers likely hired nearly a million workers in April as they rushed to meet a surge in demand, unleashed by the reopening of the economy amid rapidly improving public health and massive financial help from the government.

The Labor Department's closely watched employment report on Friday will be the first to show the impact of the White House's $1.9 trillion covid-19 pandemic rescue package, which was approved in March. It is likely to show the economy entered the second quarter with even greater momentum, firmly putting it on track this year for its best performance in almost four decades.

"We are looking for a pretty good figure, reflecting the ongoing reopening we have seen," said James Knightley, chief international economist at ING in New York. "With cash in people's pockets, economic activity is looking good and that should lead to more and more hiring right across the economy."

According to a Reuters survey of economists, nonfarm payrolls likely increased by 978,000 jobs last month after rising by 916,000 in March. That would leave employment about 7.5 million jobs below its peak in February 2020.

Twelve months ago, the economy purged a record 20.679 million jobs as it reeled from mandatory closures of non essential businesses to slow the first wave of covid-19 infections.

Dollar near one-week low ahead of US jobs data

The dollar was stuck around a one-week low on Friday, under pressure ahead of U.S. jobs data that is expected to underpin hopes for a strong post-pandemic economic recovery and to increase investor risk appetite.

Against a basket of major currencies, the dollar index was at 90.841, down less than 0.1% on the day at 0728 GMT. It was on track for a loss of around 0.5% on the week overall, having seen its worst day in nearly two weeks on Thursday. U.S. payrolls data is due at 1230 GMT and is expected to show that employers hired nearly a million workers in April, as they rushed to meet a surge in demand unleashed by the reopening of the economy and massive financial help from the government.

In the previous session, a larger-than-expected fall in jobless claims saw stocks rise and the dollar fall, suggesting that the dollar is acting as a safe-haven currency, hurt by improving risk appetite.

How effective are stimulus checks according to Biden?

In his speech to Congress the President praised the impact that the direct payments have had, but appeared unlikely to push for a fourth stimulus check.

$1,000 stimulus check for Florida first responders: how many people will get it?

First responders in Florida are to receive a one-time bonus as a "small token of appreciation" for their efforts during the coronavirus pandemic, Governor Ron DeSantis has confirmed.

$3000/$3600 Child Tax Credit: when will the monthly payments begin?

The IRS has doubled down on their commitment to begin sending payments associated with the enhanced child tax credit this July. Families could begin seeing up to $300 per child in monthly payments from the enhanced child tax credit starting this summer.

Stimulus checks live updates: welcome

Hello and welcome to our daily stimulus-checks live blog, which brings you the latest news on a possible fourth direct payment, in addition to updates and information on the third round of checks currently being sent out.

We'll also provide info on the Golden State Stimulus payments being distributed in California, as well as details on other economic-aid measures in the US, such as the expanded Child Tax Credit.