US stimulus checks: | news summary for 3 May 2021

Information on the third stimulus check in President Biden's coronavirus relief bill, plus news on a possible fourth check. Monday 3 May 2021.

Show key events only

US stimulus checks live updates, Monday 3 May 2021

Headlines:

- IRS has distributed around 163m third stimulus checks, worth a total of $384bn

-Two representatives introduce a bill to create a new tax credit for first-time homebuyers (read here)

- Weekly stimulus-check payment runs include so-called 'plus-up' payments (more info)

- President Biden supports extending expanded Child Tax Credit through 2025 (full details)

- No mention of fourth stimulus check in Biden's speech to Congress (full story)

- Golden State Stimulus payments being sent out to eligible Californians (find out more)

- Over 2m people have signed Change.org petition calling for recurring stimulus checks

- You can track your third stimulus check by using the IRS' Get My Payment tool

- Get all the latest US vaccine news by following our live blog

- US covid-19: 32.42 million cases / 577,172 deaths (live updates from Johns Hopkins University)

Check out some of our related articles:

Biden: Republican voters "overwhelmingly" support Families Plan

The president said that there is a groundswell of support for his American Families Plan among Republican voters, but admitted he needs to drum up bipartisan support in Congress with Republican lawmakers reticent over his big-spending legislation.

Stimulus checks boost US consumer spending in March

US consumer spending rebounded in March amid a surge in income as households received additional covid-19 pandemic relief money from the government, building a strong foundation for a further acceleration in consumption in the second quarter.

Other data on Friday showed labor costs jumped by the most in 14 years in the first quarter, driven by a pick-up in wage growth as companies competed for workers to boost production.

"While we aren't completely out of the woods yet, today's report shows the beginning of an economic rebound," said Brendan Coughlin, head of consumer banking at Citizens in Boston.

"Assuming no setback in the continued rollout of the vaccines, US consumers are well-positioned in the second half of the year to stimulate strong economic growth across the country."

Consumer spending, which accounts for more than two-thirds of US economic activity, increased 4.2% in March after falling 1.0% in February, the Commerce Department said.

Economists polled by Reuters had forecast consumer spending would increase 4.1%.

Photo: REUTERS/Shannon Stapleton

Supply constraints slow US factory activity in April

US manufacturing activity grew at a slower pace in April, restrained by shortages of inputs as rising vaccinations against covid-19 and massive fiscal stimulus unleashed pent-up demand.

The survey from the Institute for Supply Management (ISM) on Monday showed record-long lead times, wide-scale shortages of critical basic materials, rising commodities prices and difficulties in transporting products across industries.

The pandemic, now in its second year, has severely disrupted supply chains. The ISM noted that "companies and suppliers continue to struggle to meet increasing rates of demand due to coronavirus impacts limiting availability of parts and materials." It cautioned that worker absenteeism, short-term shutdowns due to part shortages and difficulties in filling open positions could limit manufacturing's growth potential.

The ISM's index of national factory activity fell to a reading of 60.7 last month after surging to 64.7 in March, which was the highest level since December 1983. A reading above 50 indicates expansion in manufacturing, which accounts for 11.9% of the US economy. Economists polled by Reuters had forecast the index edging up to 65 in April.

The White House's massive $1.9 trillion pandemic relief package and the expansion of the covid-19 vaccination program to all adult Americans have led to a boom in demand. But the pent-up demand is pushing against supply constraints.

Still, manufacturing remains supported by lean inventories both at factories and customers.

Unemployment benefits: how long will the $300 enhanced payment last?

Unemployment benefits: how long will the $300 enhanced payment last?

Those receiving unemployment benefits can breathe a little easier knowing that until 6 September, they will receive $300 on top of their weekly benefit. If a recipient claims all eligible weeks of the enhanced benefit, their total income will increase by around $7,500. This additional income has been described as critical to keeping US households afloat as millions scramble to find work.

Read more on the state of unemployment in the US here, including unemployment rate, states with the highest weekly benefits, and more.

Washington Post reports on Republican response to President Biden's "American Families Plan"

Senate Minority Leader Mitch McConnell was quoted saying that the adminstration “wants to jack up taxes in order to nudge families toward the kinds of jobs Democrats want them to have, in the kinds of industries Democrats want to exist, with the kinds of cars Democrats want them to drive, using the kinds of child-care arrangements that Democrats want them to pursue.”

Read full coverage here.

IRS reminds those who received unemployment benefits this year that the American Rescue Plan "allows taxpayers who earned less than $150,000 in modified adjusted gross income to exclude unemployment compensation up to $20,400 if married filing jointly and $10,200 for all other eligible taxpayers. The legislation excludes only 2020 unemployment benefits from taxes."

After political back and forth between Texas Democrats and Republican governor Greg Abbott, $11 billion of $18 billion in federal stimulus money allocated to help public schools operate safely during the pandemic has been released.

President speaks to how he plans to pay for the American Families Plan

"I think it is about time we start giving tax breaks and tax credit to working-class families and middle-class families, not just the very wealthy. Here is what the American Families Plan doesn't do. It doesn't add a single penny to our deficit."

In an interview during Meet the Press with Chuck Todd, Senator Bernie Sanders of Vermont outlined his argument for a more progressive taxation system in the United States.

Will a tax credit for first-time homebuyers be available in 2021?

New tax credit for first-time homebuyers announced

On 26 April, two House representatives, Earl Blumenauer (D-OR) and Rep. Jimmy Panetta (D-CA), have followed the President’s lead and introduced a bill that would provide first-time homebuyers with a tax credit valued at 10% of the property’s purchase value, up to $15,000.

Rep. Blumenauer stated that the legislation would help those who have been historically shut out of the housing market as prices and demand continue to rise to unprecedented levels. The act would target low and middle-income families in the United States, particularly families of color, and would who have been subjected to decades of discriminatory and racist “housing policies that have left massive wealth, homeownership, and opportunity gaps between white communities and communities of color.”

Who would qualify?

The Act defines a “first type homebuyers” as a person who has not bought a home in the last three years. Additionally, to target the tax credit at families who need this type of assistance to make their home buying dreams a reality, the proposal outlines a few requirements:

• Income: The tax credit can only be given to recipients whose income is no more than 160% of the median income in the area.

• Property Value: The property can be worth no more than 110% of the median house price in the area.

• Residence Type: The credit can be claimed for houses used as primary residences but could not be used for a vacation home.

For more on the bill's future, read here.

Who is eligible for Earned Income Tax Credit for childless workers?

Much space has been given to the newly enhanced Child Tax credit, but what about the Earned Income Tax Credit for childless workers?

There are some income requirements as the credit is aimed at assisting low and middle-class families in the US.

The basic requirements to claim the Earned Income Tax Credit (EITC) on a 2020 tax return are that you, and your spouse if filing jointly, must have a valid Social Security number, be a US citizen or a resident alien all year, show proof of earned income and have investment income below $3,650 in the tax year you claim the credit. You must also claim a certain filing status, but those filing "married filing separately" cannot claim the EITC this year.

What changes did the American Rescue Plan make to the EITC for tax season next year?

Under the American Rescue Plan some of the rules were loosened for claiming the EITC. When filing in 2022 taxpayers will be able to once again choose to use 2019 earnings instead of 2021 to claim the credit. The maximum earnings rises to $21,430 for individuals or (HoH) and $27,830 for joint filers. Additionally, the limit of investment income increases to $10,000 from the current $3,650.

The law passed in March also reduces the age threshold for taxpayers with no qualifying dependents from 25 to 19 and eliminates the ceiling at age 64.

Texas education stimulus boost

A reminder of the news that North Texas schools are getting a huge boost to their budgets, thanks to $18 billion in federal stimulus money finally being released by the state - at least in part.

For Dallas ISD, that equates to roughly $362 million now.

Superintendent Dr. Michael Hinojosa detailed his spending plan at a news conference at a school in South Dallas.

"We’re grateful to the leadership of the state. They have now unclogged the drain. We get a portion. We get two-thirds of the dollars," he said. "First of all, we’re adopting a nontraditional calendar, but that’s only going to affect 30 of our schools."

Read more.

Stimulus checks work. Here's how...

The great news for the US economy continues, says Stephen Silver. After positive numbers first for retail sales in March and later on GDP in April, the government released a report at the end of April showing that personal incomes have risen as well.

Personal income increased $4.21 trillion (21.1%) in March, the Bureau of Economic Advisors (BEA) said in an April 30 report. In addition, the report said, “disposable personal income (DPI) increased $4.18 trillion (23.6%) and personal consumption expenditures (PCE) increased $616.0 billion (4.2%).”

The 21.1% increase was a record for that particular measure, even after personal income dropped in February.

“The 21.1% March surge in income was the largest monthly increase for government records tracing back to 1959, largely reflecting $1,400 stimulus checks included in President Biden’s fiscal relief package signed into law in March,” the Wall Street Journal said. “The stimulus payments accounted for $3.948 trillion of the overall seasonally adjusted $4.213 trillion rise in March personal income.”

The stimulus checks from the American Rescue Plan, the report said, had a lot to do with the big number.

Full article for The National Interest below

Stimulus checks: your questions answered

Whether it's doubts over your household's eligibility, working out what you are due, how to access EIP cards, use the non-filers tool or returning your stimulus check, the Inland Revenue Service has you covered.

Stimulus and strong earnings boost stocks

The markets continue their upward trend, supported by accommodative fiscal policy from the Federal Reserve, strong gross domestic product (GDP) numbers and solid earnings reports.

As President Biden celebrated his 100th day in office to close the month, the traditional favorable equity market performance during the so-called “honeymoon” phase continued, with the S&P 500 rallying about 10% over that time frame. The S&P 500 ended April up 5.24%, its third consecutive positive monthly gain. The Dow Jones and NASDAQ reached new highs as well.

Driving the equity market higher is the rapid distribution of over 235 million vaccines,the best economic growth (+6.4% annualized) since 2003, and a dramatic, better-than-expected surge in corporate earnings – the highest (+36%) since 2010, explains Raymond James Chief Investment Officer Larry Adam. As the presidential “honeymoon” period ends, debates over government spending, taxes, inflation and Fed tapering are likely to lead to increased volatility.

Read more:

Stimulus checks hit their mark increasing consumer spending

Ravi Saligram, CEO of Newell Brands which owns Rubbermaid and Mr. Coffee came on board just months before the pandemic hit to overhaul the company. He and his new management team are riding high and know it’s not just their work paying off telling Yahoo finance "The stimulus checks hit in March and no doubt we saw a bump [in sales]."

"Part of the reason in the improvement of course in our guidance was those checks. The savings rate has improved with consumers. And then of course the stimulus and the benefits all added to more discretionary spending. Having said that, we have been in a turnaround. We have been modernizing all of our brands and innovation is hitting the mark," Saligram said on Yahoo Finance Live.

If we want parents to be able to work—and if we don’t want women to get disproportionately pushed out of the workforce—it is time to invest in child care the same way we invest in roads and bridges. It’s all basic infrastructure.

Covid-19 vaccine in the US live updates: India variant, side effects, Pfizer, alcohol after doses...

President Biden's American Rescue Plan - along with the primary objectives he's been putting forward for several months - is two-fold: get the economy and US citizens back on their feet financially AND rid the country of the dangers posed by covid-19 through mass vaccincations.

Stay up to date with all the vaccine news you need with our daily live blog.

Some taxpayers can expect delays

CNBC - Receiving refunds and plus-up payments will take longer for some taxpayers than for others, as the IRS juggles processing returns, economic impact payments and other 2020 tax changes with a smaller staff due to covid-19. It also has a backlog of returns from 2019 it is still working through.

Taxpayers still have two weeks to file their returns before the May 17 deadline, though filing sooner may get them any stimulus payment they are owed more quickly. They can also claim the 2020 Recovery Rebate Credit on their returns if they are missing money from the first two rounds of stimulus payments.

Those who have recently filed can use the IRS' Where's My Refund tool to check their refund status. E-filers can expect a status update within 24 hours, while those who file a paper return may have to wait up to four weeks.

Altogether, the IRS has sent out approximately 163 million of the third stimulus payments, valued at $384 billion.

The IRS has sent out 5 million ‘plus-up' stimulus payments so far

As the IRS wraps up sending out the third round of stimulus payments to eligible American households, it will continue to disburse the supplemental, "plus-up" payments, as the agency is calling them, in the weeks and months to come.

Plus-up payments are being sent to taxpayers who received their third stimulus check based on 2019 income but qualify for more money based on their recently processed 2020 returns.

Approximately 5 million plus-up payments have been sent since April 1, worth an estimated $11 billion, the IRS confirmed to CNBC Make It on Monday. The agency will continue to send out the payments in weekly batches as it receives and processes 2020 tax returns; it did not provide CNBC Make It with a more specific timeline.

Does the American Families Plan include new stimulus checks?

Last week, President Joe Biden gave his first address to a joint session of Congress, an occasion traditionally used to outline the priorities of an incoming administration. As has been the case for much of the first 100 days of Biden’s presidency he focused on bold spending proposals with an agenda to fundamentally change American society.

The key announcement from the evening’s speech was a first real look at the American Families Plan, the spending package that Biden hopes will provide a much-needed support network for working families. The $1.8 trillion package is the third part of Biden’s three-pronged Build Back Better plan, but there was one notable omission: stimulus checks.

Report says 56% of Americans stimulus money going toward student loans and credit-card debt

According to a LendingTree report, 56% of respondents who said they would use the stimulus check to pay down debt also said they'd put some of the money toward non-housing debt, like credit cards and student loans, and 47% said they'd use the money to pay utility bills, while 27% said it would go toward rent.

Here are other main findings of the report:

26% of respondents with incomes less than $25,000 saved the money, while 58% paid down debt;

52% of respondents with incomes of $200,000 or more saved the money, while 28% paid down debt;

61% of Black respondents said debt was the main focus of stimulus money, compared to 45% of white respondents;

And Louisiana saw the biggest change in spending, with a 49 percentage-point increase from last summer among respondents who used the money to pay off debt.

50% of Americans are using the the 3rd stimulus check to pay off debt, report finds

After the first $1,200 stimulus check arrived in Americans' pockets, the US Census Bureau found the majority of recipients were using the money on basic expenses, like food and households supplies.

But priorities have changed for the most recent $1,400 stimulus check to paying off debt.

LendingTree, an online lending marketplace, released a report last week, citing Census Bureau data. It found that in March, only 19% of Americans said they were using the latest stimulus check for basic expenses, and 50% were using the check to pay down debt. In June 2020, just 16% of Americans planned on using the first check to pay off debt, so that's a 34 percentage-point increase since last summer.

Americans say Biden has faced bigger challenges and performed better than Trump

The favorable comparison with Trump underscores a broader takeaway for Biden: At the historic 100-day mark, Americans largely approve of his presidency. In fact, Biden’s overall approval rating has now climbed to 54 percent, the highest it has ever been in a Yahoo News/YouGov poll. His disapproval rating stands at just 37 percent.

In contrast, Trump’s approval rating never averaged more than 48 percent, a peak he reached five days into his tenure; at 100 days, 53 percent of Americans disapproved of Trump’s performance, while just 42 percent approved. A majority of Americans continued to disapprove of Trump for the remainder of his presidency.

When Biden took office, he bet that voters would judge his presidency on one thing and one thing only: his approach to covid-19 and the economic damage it has inflicted. To date, their assessment has been overwhelmingly positive, and Biden’s emphasis on these issues appears to be driving his overall popularity.

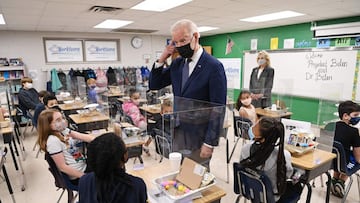

Biden to promote $4 trillion plans in visit to Virginia school

President Joe Biden travels to coastal Virginia on Monday to promote how his proposals to spend $4 trillion for infrastructure and families will help the US education system.

Biden, joined by his wife, Jill Biden, a teacher, will visit an elementary school in Yorktown and deliver remarks at Tidewater Community College in Norfolk, Virginia.

The travel is part of Biden's 'Getting America Back on Track' tour to promote his $2 trillion infrastructure plan and his $1.8 trillion America Families Plan.

Biden’s plan includes $1 trillion in spending on education and childcare over 10 years and $800 billion in tax credits aimed at middle- and low-income families.

It also includes $200 billion for free, universal preschool and $109 billion for free community college regardless of income for two years, the White House said.

(Reuters)

How many Golden State Stimulus payments have gone out?

Unlike the Internal Revenue Service, which is offering weekly updates on the number of $1,400 federal stimulus checks sent out as part of President Joe Biden’s American Rescue Plan, California’s Franchise Tax Board (FTB) has so far not released specific information on how many have Golden State Stimulus payments have been made.

However, although no precise figures have yet been announced, the Golden State Stimulus distribution timeline provided by the FTB offers some insight into which qualifying Californians are likely to have received their check.

(Photo: POOL/REUTERS)

Third stimulus check FAQs

If you have any queries about the third stimulus check, you may find your question is answered in the dedicated questions and answers section on the IRS website.

You’ll find several information topics, such as ‘Eligibility and Calculation of the Third Payment’, ‘Supplemental Economic Impact Payments’ and ‘Requesting My Payment’.

What ID can I use to cash stimulus checks?

If you want to cash your stimulus check you can do so at banks even where you are not an account holder or member, but you will need to bring ID.

What to do if the first/second stimulus check didn’t arrive

If you were eligible for the first or second stimulus check last year but didn’t get it, you can get your missing payment by claiming a Recovery Rebate Credit when you file your 2020 federal tax return.

If you received your first/second stimulus check, but didn't get the full amount you were entitled to, you can also seek a Recovery Rebate Credit for the amount you are owed.

On its website, the IRS has an in-depth info section on how you can claim your Recovery Rebate Credit.

The agency has also put together this useful video explainer:

$1,400 third stimulus check: what is "IRS TREAS 310 - TAX EIP3"?

When the third stimulus check arrives in the bank accounts of direct-deposit recipients, the payment appears with the identifying reference "IRS TREAS 310 - TAX EIP3", or something very similar to that.

$2,000 recurring stimulus checks petition among Change.org’s most influential

Colorado restaurant owner Stephanie Bonin’s Change.org call for recurring stimulus checks was named among the site’s most influential petitions in 2020.

The petition, which has now accrued over two million signatures, urges Congress to give Americans $2,000 monthly direct payments until the end of the coronavirus pandemic.

Such has been its popularity that it ranked seventh on Change.org's list of US “petitions that changed 2020”.

"Supplying Americans with monthly support until they can get back on their feet can save our communities from financial ruin," Bonin says.

See post below for more details on the petition.

(Image: www.change.org)

Child Tax Credit calculator

If you need help calculating how much you stand to get as part of the expanded Child Tax Credit, look no further than this useful CTC calculator created by personal-finance specialists Forbes Magazine:

Forbes Child Tax Credit calculator

Further reading: What to know about the expanded Child Tax credit: dates, eligibility, amount

(Photo: INA FASSBENDER/AFP)

$600 Golden State Stimulus in California: what's the deadline to file taxes and claim it?

To receive a $600/$1,200 Golden State Stimulus payment, which is part of a $9.6bn pandemic relief package signed into law by Governor Gavin Newsom in February, eligible Californians need to have filed their 2020 state tax return - and they have until 15 October 2021 to do so.

Who is eligible for Earned Income Tax Credit for childless workers?

The American Rescue Plan gave the Earned Income Tax Credit for childless workers a boost for 2021 tax filings in 2022, but they need to file to claim it.

$3,600 Child Tax Credit: how will it be affected by Biden's American Families Plan?

The expanded Child Tax Credit will provide monthly payments for millions of families and its initial one-year duration looks likely to be extended as part of the new economic package.

Stimulus checks in the US: every AS English article

You'll find the latest information on the third round of stimulus checks in our dedicated section on direct payments, as well as updates on a potential fourth check. On top of that, you'll be able to get info on the Golden State Stimulus payments currently being sent out in California.

Biden Tax Plan VS Trump's: What new credits and breaks are being proposed?

To get the US economy back to pre-pandemic levels Biden plans to implement new tax credits and reverse some of the tax cuts passed under President Trump.

Track your third stimulus check with Get My Payment tool

If you're still waiting for your third stimulus check to come, you can follow its progress by accessing the IRS' online Get My Payment tool.

More information on Get My Payment

(Image: www.irs.gov)

How is $600 Golden State Stimulus check paid? Direct deposit or paper check?

Depending on the information you provide in your 2020 state tax return, you will either get your Golden State Stimulus payment by direct deposit or in the mail as a paper check.

Where is my Golden State Stimulus check? How to claim and track in California

When you get your Golden State Stimulus payment depends on when you file your 2020 state tax return.

Find out more about when you can expect your Golden State Stimulus check

Over 2m signatures for Change.org petition calling for recurring stimulus checks

A Change.org petition started last year urging Congress to approve recurring stimulus checks in the US amid the coronavirus pandemic has reached two million signatures.

Started by Stephanie Bonin, a Colorado restaurant owner, the petition calls for monthly payments of $2,000 for adults and $1,000 for children. At the time of writing, it had been signed 2,082,762 times

In an updated introduction to the petition, Bonin said Americans are “deeply struggling”, adding that another one-time stimulus check “won’t solve our problems”.

“As the Biden administration takes office, the country is deeply struggling,” she said. “We’re out of work and out of cash. It took nine months for Congress to send a second stimulus check, and just moments to spend it.

"Another single check won’t solve our problems - people are just too far behind. Like we’ve been saying from the beginning of this pandemic, people need to know when the next check is coming.

"And the best thing our government can do right now is send emergency money to the people on a monthly basis.”

What's the deadline to receive third stimulus check plus-up payments?

The IRS has now sent out around 163 million stimulus checks to eligible Americans. The seventh batch of direct stimulus payments, worth over $4.3 billion, featured an additional 2 million payments.

Included were 730,000 'plus-up' payments after the agency processed those taxpayers’ 2020 tax returns and saw that those individuals had more stimulus money coming their way.

Fourth stimulus check: does the American Rescue Plan budget for another direct payment?

The Biden administration released the framework for the American Families Plan prior to the president’s speech to Congress. It will invest in child care, early education, free community college, healthcare and provide paid family leave.

President Biden listed all these features of his plan when he addressed the joint session of Congress on Wednesday, as well as extending the Child Tax Credit expansion for another four years.

Although he didn’t mention additional stimulus checks, the Child Tax Credit will serve a similar purpose.

Stimulus checks live updates: welcome

Hello and welcome to our daily stimulus-checks live blog, which brings you the latest news on a possible fourth direct payment, in addition to updates and information on the third round of checks currently being sent out.

We'll also provide info on the Golden State Stimulus payments being distributed in California, as well as details on other economic-aid measures in the US, such as the expanded Child Tax Credit.

- USA coronavirus stimulus checks

- Coronavirus stimulus checks

- Joseph Biden

- Covid-19 economic crisis

- Child poverty

- Science

- United States Congress

- Unemployment

- Coronavirus Covid-19

- Economic crisis

- Pandemic

- Coronavirus

- Recession

- United States

- Poverty

- Economic climate

- Virology

- Outbreak

- Infectious diseases

- North America

- Parliament

- Employment

- Childhood

- Microbiology

- Diseases

- Medicine

- America

- Economy

- Work

- Social problems

- Biology

- Health

- Politics

- Society

- Life sciences