How much will children receive from the Child Tax Credit this summer?

Payments for the enhanced Child Tax Credit are set to begin in July, but how much should families expect to receive in the coming months?

Eighty-eight percent of children in the US can expect to receive benefits from the enhancements made to the Child Tax Credit (CTC), passed through the American Rescue Act (ARA). The US first introduced the CTC in 1997 as a part of the Taxpayer Relief Act. In its original iteration, the credit was worth $400 a year per child under seventeen.

Over the years the value of the credit has increased, first in 1999 to $500, and by 2020, the amount received by families had quadrupled to $2,000 per child. The ARA increased the value of the credit to $3,000 for children between the ages of six and seventeen, and $3,600 for those younger than six. The stimulus package also altered the way the credit can be distributed. Rather than being given out as a bulk some with one’s tax return, now families will have the option to receive monthly payments.

Before the changes to the credit were made, individuals and families had to earn a certain amount of money to be able to receive the credit. According to the Center on Budget and Policy Priorities, “some 27 million children — including roughly half of all Black and Latino children and a similar share of rural children” did not receive the full credit amount because their families made too little. The income requirements were removed under the ARA, a change that experts believe could lift up to 4.1 million children out of poverty.

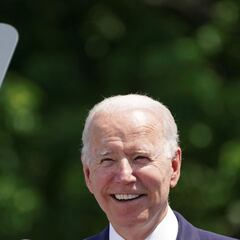

Help is here for America's families. Starting in July, nearly 90% of families with children will automatically receive a deposit each month under the expanded Child Tax Credit.

— Vice President Kamala Harris (@VP) May 17, 2021

Congress must pass the American Families Plan so working families can continue to rely on this relief.

How much will each child receive from the Child Tax Credit this summer?

Families with four children -- ages 3, 5, 7, and 9 -- will be able to receive payments worth $250 for the seven and nine-year-old, and $300 for the two younger children. This would be a monthly total of $1,100. The IRS has stated that the first payments will be made on July 15th and families can expect a payment around the middle of the month through December.

The remaining funds will be distributed after individuals and families file their income taxes in the Spring. Families can also opt out of monthly checks and defer the bulk payment for when they file their taxes.

Making the enhancements to the Child Tax Credit permanent

Related stories

NPR reported this week that Republicans are digging their heels in over protecting the tax cuts passed under President Trump. Biden has said that the American Families Plan, which includes a provision to extend the additional benefits of the CTC through 2025, will be paid for by increasing taxes on corporations and those making more than $400,000 a year. This proposed payment scheme is a non-starter for many Republicans making the prospect of garnering bipartisan support for the measure nearly impossible.

The expanded child tax credit is a major victory for American families.

— Data for Progress (@DataProgress) May 18, 2021

Now let's extend it through the American Families Plan — something that a majority of voters support. https://t.co/1k9DhobWyj https://t.co/bGuRYB1kkZ pic.twitter.com/9bY4j2AkYW

The Trump tax cuts were very favorable to corporations. Nearly fifty of the leading companies in the US paid zero dollars in federal taxes last year. Representative Carolyn Bourdeaux of Georgia argued that at a moment when the government is trying to make investments in infrastructure and the nation’s workforce, corporations, Republicans, and the wealthy are opposed; even though in the long run these investments could help them financially.

- Comisión Reconstrucción Covid-19 Madrid

- Asamblea Madrid

- Comisiones parlamentos autonómicos

- Science

- Coronavirus Covid-19

- Parlamentos autonómicos

- Taxes

- United States

- Pandemic

- Coronavirus

- Virology

- Outbreak

- Infectious diseases

- Parliament

- Tributes

- North America

- Microbiology

- Diseases

- Public finances

- Medicine

- Política autonómica

- Madrid Autonomous Community

- America

- Spain

- Biology

- Finances

- Life sciences

- Politics