Fourth stimulus check news summary: Wednesday 23 June 2021

Updates and information on the third stimulus check in President Biden's coronavirus relief bill, and news on a possible fourth direct payment.

Show key events only

US stimulus checks latest news - Wednesday 23 June 2021

Headlines:

- President Biden will meet with senators on Thursday to discuss "G21" bipartisan infrastructure plan

- Over half of states are ending federal unemployment benefits, but do those states have lower rates of unemployment? (Full details)

-White House responds to questions over labor shortages caused by generous federal unemployment benefits (Full details)

- VP Kamala Harris visits Pittsburgh to promote the Child Tax Credit

- Fourth stimulus check linked to decrease in retail spending (Find out more)

- Child Tax Credits: IRS launches new online portal to allow those who do not files taxes to claim the benefit

- IRS has also launched Child Tax Credit Update Portal and Child Tax Credit Eligibility Assistant

- May poll finds 53% of parents know "little to nothing" about Child Tax Credit, with Data for Progress estimating that 4m children were not registered as of the tax deadline

- Petition for recurring stimulus checks surpasses 2.38M signatures. Sign it here.

-Which organizations favor another round of stimulus checks? (Full details)

- Faster US wage rises will help entrench inflation

- IRS has confirmed that the monthly Child Tax Credit payments will begin on 15 July (Find out more)

- $10 billion fund for homeowner stimulus checks (How to apply)

- Many US taxpayers still waiting for tax refund (Find out more)

- Louisiana announces it will end $300 unemployment compensation booster at the end of July, becoming the first Democrat -led state

- Twenty-six US states, almost all GOP-led, are ending supplementary unemployment insurance early (Full story)

- You can track your third stimulus check by using the IRS' online Get My Payment tool

Have a read of some of our related news articles:

Biden gets to rewrite housing market rules

The Supreme Court in a unanimous decision ruled that the law that created the Federal Housing Finance Agency violated the Constitution. The housing agency has overseen mortgage giants Fannie Mae and Freddie Mac since 2008 at the start of the financial crisis.

The lawsuit came out of a dispute between shareholders of Fannie Mae and Freddie Mac and the Treasury Department over $124 billion in payments the two lenders were required to make to the government. The justices rejected the shareholders’ argument that the agency was overstepping its authority. While at the same time the court said that the law which created the housing agency violated the Constitution because the agency’s director was protected from presidential oversight.

President Biden moved quickly to replace the agency’s director so that the Administration’s housing policy could be implemented.

Fourth Stimulus Check: could the unemployment data from May affect a new payment?

The US Bureau of Labor Statistics released state employment numbers on Wednesday detailing how the recovery from the pandemic is proceeding across the nation. Although 21 states reported a decrease in unemployment, one state saw an increase while the remaining states held stable.

As Congress hammers out a new spending bill on infrastructure, how will these figures affect a possible fourth stimulus check?

Possible $1.2 trillion infrastructure proposal reached

A group of senators will meet with the President Biden on Thursday to go over the framework for a possible deal on infrastructure. The so-called "G-21," a bipartisan group of 21 senators, has been working on a $1.2 trillion infrastructure plan. Passing a bill to rebuild roads, bridges and other traditional infrastructure is a major priority for President Biden.

A major sticking point in the negotiations has been how to pay for the investments. That hurdle appears to have been cleared with Senators Mitt Romney and Joe Manchin saying it's fully paid for and new spending is offset.

New Jersey property owners could get new stimulus check

As soon as 1 July three quarters of million families in New Jersey could see a $500 property tax rebate under an agreement that state officials announced on Monday. “This is cash in the barrel, and the millionaires tax – the so-called millionaires tax - that's going to be directly into checks that families up and down this state in the middle class, and those aspiring to get into the middle class, are going to receive,” Governor Phil Murphy said.

Republican lawmakers however say that they have been left out of the process. They are calling for more property tax relief since the state has billions of extra funds this year.

California to use stimulus money to pay all back rent

As part of Governor Newsom’s $100 billion recovery bill for California, the state is set to pay the 100 percent of unpaid rent incurred during the pandemic by lower-income Californians. In order to qualify for the money, residents must earn no more than 80 percent of the median income in their area and show pandemic-related financial hardship.

Funds will come from a $5.2 billion program which is in the final phase of negotiations at the State Legislature. Another $2 billion package will go to pay for unpaid water and electricity bills.

Talking with Jake Tapper of CNN, Senator from New Mexico Bob Menendez says he hopes the infrastructure package "is a robust bill because we've been living off the investments of the greatest generation... It's time to make a major transformational investment."

Why is President Joe Biden's approval rating decreasing among Democrats?

After the passage of the American Rescue Plan which included a third round of stimulus payments, President Biden and Congress saw a jump in their approval rating. However, both rates have fallen in recent weeks as negotiations over packages that would inject trillions in the economy have stalled. The rate for Congress which has had dismal approval ratings in recent years, has been cut in half since its April high.

Read our full coverage for more details.

Unemployment benefits: Is the rate lower in states that are cutting benefits?

Is the unemployment rate lower in states that are cutting benefits?

The Bureau of Labor Statistics has released the May unemployment rates for each state and the District of Colombia. Compared to data from April, the average rate in unemployment fell .3%, from 6.1% to 5.8% with Delaware (-.5%), Rhode Island (-.5%), Connecticut (-.4%), Hawaii (-.4%), New York (-.4%), and South Carolina (-.4%) seeing the largest decreases.

But how does the data compare between states that are and are not ending federal pandemic-related unemployment benefits?Read our full coverage to find out.

David Rosenberg, Chief Economist & Strategist of Rosenberg Research says that the greatest threat to a strong economic recovery is the delta variant, "While everyone is partying, make no mistake; the delta variant is also spreading rapidly in the U.S. — this is now the greatest threat to the recovery, much more than the Fed."

In addition, the expert alerted the public that "for only the second time in history, the last in the 2005-06 housing bubble, the average price of an existing home now absorbs 8 years’ worth of wages and salaries"

How much have housing prices increased this year?

According to the Wall Street Journal, the median house price has increased almost 22.5% this year.

Criticism from Republicans continues to mount as House Minority Leader Kevin McCarthy attacks Democrats saying that the bipartisan infrastructure package may fail because "define what infrastructure is,” instead of “talking about how much money you would spend."

Politico reports that some Senate Republicans are questioning whether President Biden is willing to reach an agreement on an infrastructure package as some reporters see the discussions continuing into July.

Since talks began earlier this week, the President has rejected a GOP "proposals to raise user fees on drivers and resisting their push to raid coronavirus relief accounts for infrastructure."

Senator Kevin Cramer of North Dakota was quoted saying, "It makes me wonder how badly the White House even wants a bipartisan deal at all." Another Senator stated that he was disappointed to see the White House taking driver fees and increases on gasoline off the table, while also making it clear Republicans would notincrease the corporate tax rate to pay for the bill.

In a press conference Wednesday, Press Secretary Jen Psaki told reporters that the administration does is "not for a Ford-F150 tax," and was a bit confused why "others are."

Read the full story here.

Which states saw the largest decreases in unemployment from April 2021 to May 2021?

Data: Bureau of Labor Statistics

Is the unemployment rate lower in states that are cutting federal benefits?

The national unemployment rate in May stood at 5.8%. The rate for states who are cutting additional federal payments was 4.5% and the rate for those who are keeping them was 5.9%. While higher, the difference in the rates is not statistically significant.

Curious what the White House has said about the move to end the federal benefits? Read our full coverage.

May Unemployment Rates

Which states have the highest unemployment rates?

1. Hawaii -- 8.1%

2. New Mexico 8%

3. California -- 7.9%

4. Nevada -- 7.8%

5. New York -- 7.8%

Which states have the lowest unemployment rate?

1. New Hampshire -- 2.5%

2. Nebraska -- 2.6%

3. Vermont -- 2.6%

4. Utah -- 2.7%

5. South Dakota -- 2.8%

Senator Chirs Coons provides an update on the status of negotiations over the emerging infrastructure package

Prices in the housing market continue to rise

It is a seller's market for those who have placed their houses up for sale, with report after report showing that prices are up and to compete with other buyers as supply is short, many are bidding far above the asking price.

The Seatle Times reports on new data from the National Association of Realtors, which shows "sales are up nearly 45% from last May, when purchases fell to their lowest point of the COVID-19 outbreak."

Who is opposed to the new infrastructure package gaining steam in the Senate?

Senator Elizabeth Warren has said she is not sold on the package. In an interview with The Hill, Sen. Warren expressed concerns over the limited definition of infrastructure being used by supporters of the bill.

In her comments, she said, "that's not the whole infrastructure package, it is a subset." Warren continued arguing that negotiations are causing real delays in providing real solutions relating to infrastructure, which for her, includes human infrastructure.

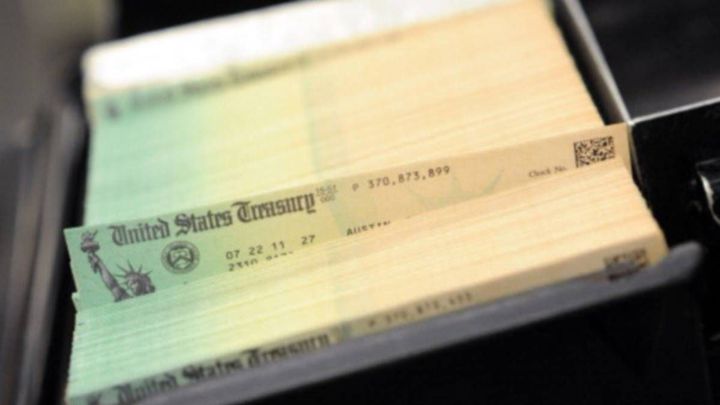

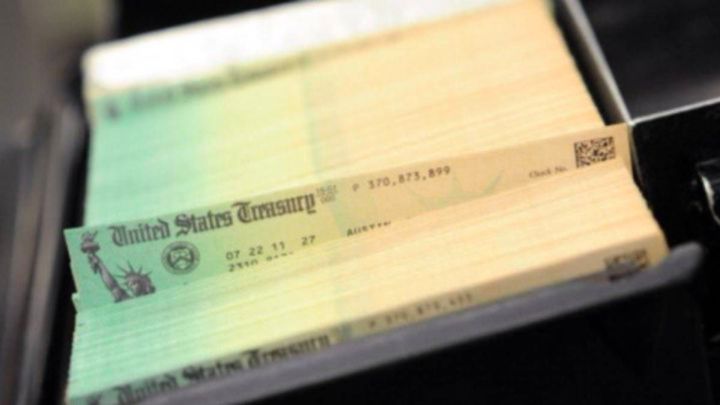

IRS checks: what does tax refund 30 mean?

FRAUD WATCH: If you receive a suspicious check claiming to be from the IRS, it is best to contact the IRS.

However, some people are curious about what "refund 30" on their refund check means? While in most cases this is probably nothing to worry about, a call to the IRS may be best to ensure that you are not a victim of fraud.

Read our full coverage for more details.

The US Department of Labor releases new tool showing state unemployment rates for may. Follow the link to interact with the map.

New research shows how the stimulus aid was spent and how it helped families

Using data collected by the US Census Bureau, researchers at the University of Michigan have examined the impact on American households of the three federal stimulus checks sent out so far during the coronavirus pandemic.

Who would be affected by Biden's ‘death tax’? Income threshold and limits

The President's Build Back Better plan includes some key changes to the estate tax which are designed to prevent rich Americans passing down their wealth tax-free.

Child Tax Credit FAQs

In addition to launching the Child Tax Credit Update Portal, Child Tax Credit Eligibility Assistant and Child Tax Credit Non-filer Sign Up Tool, the IRS has put together a useful FAQs page on the expanded CTC.

You'll find a host of questions and answers on topics such as eligibility, calculating your CTC and unenrolling from monthly payments.

Check out the IRS' Child Tax Credit FAQs page

(Image: www.irs.gov)

Fourth stimulus check: can the decrease in consumer spending impact its approval?

New data on consumer spending in the retail sector showed a dip in May, after figures had peaked in March following the approval of the third round of stimulus checks. Will another check be sent?

When could there be a new stimulus payment according to the experts?

There are many voices calling for another round of direct payments for qualifying Americans, from the public to economists and Washington congressionals.

Who should opt out of advance payments on Child Tax Credit?

As part of the expanded Child Tax Credit scheme, monthly payments will begin showing up in the bank accounts of millions of American families on 15 July. However, some households may want to opt out of receiving the CTC in instalments and wait for the money as a lump sum next year.

(Photo: JIJI PRESS/EFE)

How much were the first, second and third stimulus checks and when were they sent out?

We take a look back over the federal stimulus checks sent out so far in the US since the beginning of the covid-19 pandemic.

Home prices rocket 24% in US

The housing market in the US continues to overheat, as house prices rose 24% year-on-year up to May, stoking fears of a housing market bubble. It is the biggest year-over-year rise since 1999. The median existing-home sales price in May topped $350,000 for the first time, the National Association of Realtors said on Tuesday.

Does the housing market currently benefit buyers or sellers?

The Bay Area which includes San Fransisco and the surrounding area is one of the most expensive housing markets in the country. As the housing market continues to pick up value, buyers are finding themselves paying well above the market value of houses.

San Fransisco Chronicle reports on this emerging phenomenon. Reporters looked at the data and on average this Spring, buyers paid 12% more for houses compared to their listing prices.

US House panel to take up Big Tech antitrust bills amid fierce criticism

The House Judiciary Committee will take up a package of six antitrust bills on Wednesday, many aimed at reining in Big Tech, with heated debate expected on both sides of the issue. There has been a flurry of opposition directed at the most sweeping reform bills, including from the powerful US Chamber of Commerce, Amazon.com Inc, Apple Inc, Facebook Inc and Alphabet Inc's Google. Facebook, for example, argued that the bills underestimate competition from overseas and 'are a poison pill for America’s tech industry at a time our economy can least afford it.'

Each of the bills has multiple Democratic and Republican co-sponsors, and each has sparked opposition, or at least concern, from members of both political parties. Eight US House of Representatives Democrats wrote to the House and Judiciary Committee leadership last week, urging them to delay the vote.

Republicans Jim Jordan and Mark Meadows said in an opinion piece that 'these bills would wreak bureaucratic havoc on conservative values, speech and free enterprise.' A White House official said US President Joe Biden believes steps are needed to protect privacy, generate more innovation and deal with other problems created by big technology platforms.

Two of the bills address the issue of giant companies, such as Amazon and Google, creating a platform for other businesses and then competing against those same businesses. One would require the competing business to be sold while the other would require platforms to refrain from favoring their own businesses.

A third bill would require a platform to refrain from any merger unless it could show the acquired company does not compete with it. A fourth would require platforms to allow users to transfer their data elsewhere. The last two would increase the budgets of antitrust enforcers and ensure that antitrust cases brought by state attorneys general remain in the court they select.

Unemployment Benefits: What has the White House said about the effects of ending payments early?

What has the White House said about states that have already ended or plan to end all federal pandemic unemployment benefits before the federal deadline in September?

More than half of all states, including Louisiana which is led by a Democrat have or plan to end federal pandemic-related unemployment benefits. This move includes the $300 sent in addition to state benefits.

Meanwhile, the Bureau of Labor Statistics has reported that unemployment benefit claims are decreases. For some, this means that the move by many GOP leaders is null, while others believe the decision to cut benefits is driving these decreases. On 17 June, the BLS reported that around 2.5% of the US labor force is claiming benefits, down significantly from a year ago when the number was recorded at over thirteen percent.

Read our full coverage to learn how the White House responded.

Another round of stimulus checks could harm US economy

Financial experts are warning that another round of stimulus payments could end up doing more harm than good on the US economy. The New York Times reports that we could see a subtraction in economic growth if the private sector cannot pick up the economic burden from the government.

Nancy Vanden Houten, senior economist at Oxford Economics, said, "We’re definitely going to see a huge drop-off in fiscal stimulus. The question is how well positioned is the economy to deal with that, and we don’t really know for sure, which applies to so much about this period we’re going through".

How have labor shortages impacted the hospitality and hotel sector?

CNN program, Quest Means Business covers the difficulty some hotel chains are having in finding workers. In some cases, bosses having their workers work twice as many shifts to cover the gaps, leaving some workers burned out and with the hope of greater pay.

The President of the American Hotel & Lodging Association, Chip Rogers, acknowledges that part of the hiring challenge stems from the fact that many workers in this sector had to find other work; they could "not wait 14 or 15 months."

Second, Rogers highlights what many business leaders have pointed to -- a "labor shortage" caused by generous federal unemployment benefits. Rogers said to combat this issue, wages have had to increase. This year the wage for housekeepers has gone by 25%.

Unemployment benefits: how many people will stop receiving the money this week?

When will some states be ending federal pandemic unemployment benefits?

To date eleven states including, Alaska, Iowa, Mississippi, and Missouri, Alabama, Idaho, Indiana, New Hampshire, North Dakota, West Virginia, and Wyoming have ended the additional benefits; this includes the $300 topper paid with state benefits.

26 June

-Arkansas, Georgia, Texas, Ohio, Oklahoma, South Dakota, and Utah

27 June

-Montana

30 June

-South Carolina

3 July

-Tennessee

10 July

-Arizona

Before August

-Louisiana

How has the pandemic impacted wages?

The US Department of Labor has released new data showing, the average cost employers pay to compensate their workers has increased.

March 2018 -- $36.32

March 2019 -- $36.77

March 2020 -- $37.73

March 2021 -- $39.01

This is one of the largest increases seen in the past decade. One of the key motivating factors behind the increase is the challenges many businesses are having in hiring workers. With enhanced unemployment benefits as a cushion, low-wage workers are in no rush to return to jobs with poor conditions and compensation.

Are businesses offering higher wages to attract workers?

The US Department of Labor finds that "Real average weekly earnings down 2.2 percent from May 2020 to May 2021."

This comes as business leaders create panic over labor shortages and make claims that they are offering higher wages to attract workers. However, the data shows that a year after the pandemic took hold of the US, actual weekly wages are down.

Will there be a second Golden State stimulus check in California?

Many residents of the Golden State are asking the same question: Will there be a second Golden State stimulus check in California?

In April California Governor Gavin Newsom announced a historic budget surplus. With these funds in hand, Newsom announced the California Comeback Plan which includes major investments in social programs throughout the state.

The package expanded eligibility to the $600 stimulus checks to two-thirds of all California residents, with billions of extra support for the pandemic-hit state.

Read our full coverage for details on who could receive a check.

How do child care responsibilities impact worker reentry into the labor market?

A recent study from the National Bureau of Economic Research found that "parents of young children did not leave the workforce substantially more than other comparable individuals."

According to their modeling, the research team believes that slow reentry could be due to "continued concern about the threat of getting COVID-19 at work or expanded unemployment insurance benefits and eligibility."

However, the experts stated that although they did not find that mothers with young children left the workplace at disproportionate rates, it does not mean that they were not "especially burdened over the past year." When breaking down child care responsibilities the data does not provide enough detail to know exactly how child care tasks were divided.

How has household income increased/decreased since January?

The US Department of Commerce will be releasing data on how household income changed compared to April levels on 25 June.

This year, incomes in the US have shifted up and down as the federal government has intervened and passed trillions of dollars in stimulus; a good portion of which ended up in the pockets of families and individuals.

After the American Rescue Plan was passed in March 2021, personal income increased almost 21% over February levels. But in April, that figure dropped to -13.1, showing that stimulus checks drove the increase in very significant ways. If this trend is any indication, May data will also continue the downward trend compared to the March numbers, however, the decrease may not be so severe.

Oregon lawmakers throw out essential workers stimulus bill

Oregon Democrats won’t fund an additional stimulus bill for the state’s essential workers this year. The bill has been deferred until 2022, but it’s not clear whether there will be sufficient funding in place to carry it through next year. Under House Bill 3409, frontline and essential workers could have received up to $2,000 in stimulus money if they worked through the pandemic, or $1,200 if they returned to work after collecting unemployment during the pandemic.

Oregon received $2.6 billion in state government funding from the $1.9 trillion federal stimulus bill Congress approved in March. House Speaker Tina Kotek didn’t say how much federal stimulus money lawmakers expect still will be available when they return next year.

In a statement, Kotek explained, "Essential workers have been risking their lives every day during the pandemic. We must continue to put working families first as we recover from this public health and economic crisis in the short term — and as we rebuild our economy in the long-term. That’s why my top priority for the remainder of Oregon’s share of federal American Rescue Plan dollars will be additional support for frontline workers in 2022".

Online tools to help families manage Child Tax Credit payments

On Tuesday, the Internal Revenue Service launched two new online tools designed to help families manage and monitor the advance monthly payments of Child Tax Credits. These two new tools are in addition to the Non-filer Sign-up Tool, announced last week, which helps families not normally required to file an income tax return to quickly register for the Child Tax Credit.

The new Child Tax Credit Eligibility Assistant allows families to answer a series of questions to quickly determine whether they qualify for the advance credit.

The Child Tax Credit Update Portal allows families to verify their eligibility for the payments and if they choose to, unenroll, or opt out from receiving the monthly payments so they can receive a lump sum when they file their tax return next year. This secure, password-protected tool is available to any eligible family with internet access and a smart phone or computer. Future versions of the tool planned for late summer will allow people to view their payment history, adjust bank account information or mailing addresses and other features. A Spanish version is also planned.

Powell says Fed won't raise rates for fear of inflation

The US dollar remained on the back foot against major peers on Wednesday after a two-day drop as Federal Reserve officials including Chair Jerome Powell reaffirmed that tighter monetary policy was still some way off. The dollar index, which measures the greenback versus six rivals, was at 91.775 in early Asian trading, off a two-month high of 92.408 reached at the end of last week. It has now given up about a third of its sharp gains posted since last Wednesday, when the Fed surprised markets by signalling much earlier rate hikes than investors previously expected.

Powell and New York Fed President John Williams warned that the economic recovery requires more time before a tapering of stimulus and higher borrowing costs are appropriate. "Latest smoke signals from the Fed ... all point to September as the meeting when the Fed is, on current trends, most likely to declare that substantial further progress towards their goals has been achieved, or is being achieved," Ray Attrill, head of foreign-exchange strategy at National Australia Bank in Sydney, wrote in a client note, forecasting tapering likely won't start until early next year.

"We will not raise interest rates pre-emptively because we fear the possible onset of inflation," Powell said on Tuesday in a hearing before a US House of Representatives panel. "We will wait for evidence of actual inflation or other imbalances."

Stimulus program is not driving up inflation - Cecilia Rouse

President Biden's economic adviser Cecilia Rouse discussed fears that the US stimulus program could spark a rise in inflation. Chatting to BBC Radio 4, she said, "We know that the US economy was in crisis. We had a pandemic which had brought our economy to its knees. There was hunger in the United States, children were out of school, we had a medical system in crisis. And people were behind on their mortgage payments, unable to pay their student debt, unable to pay their rent. This president believed that the way to get us through this crisis, as safely as possible, where people could continue to spend, feed their families and remain in their homes, was with aggressive pandemic relief. There is always a risk, but all of the signs suggest that this inflation is transitory. This is going to be a bumpy recovery".

Stimulus checks live updates: welcome

Hello and welcome to our live stimulus checks blog for today, Wednesday 23 June 2021. We'll be bringing you updates on a possible fourth direct payment, in addition to information on the third round of checks, which has seen around $395 billion go out to eligible people in the US.

We'll also be providing news on other economic-aid schemes such as the expanded Child Tax Credit, which will see monthly payments of up to $300 distributed to qualifying households.

- Coronavirus stimulus checks

- USA coronavirus stimulus checks

- Joseph Biden

- IRS

- Nancy Pelosi

- Bernie Sanders

- Unemployment compensation

- Science

- Coronavirus Covid-19

- Unemployment

- Pandemic

- Coronavirus

- Inland Revenue

- Money

- Virology

- Outbreak

- Infectious diseases

- Employment

- Microbiology

- Diseases

- Public finances

- Payment methods

- Medicine

- Work

- Biology

- Health

- Finances

- Life sciences