Fourth stimulus check live updates: on Tuesday 29 June

Latest updates and information on the third stimulus check in President Biden's coronavirus relief bill, and news on a possible fourth direct payment. Live blog is now closed.

Show key events only

US stimulus checks latest news - Tuesday 29 June 2021

Headlines:

- California lawmakers vote to approve another round of $600 stimulus checks. Who qualifies & When are payments expected?

-Will a fourth stimulus check be approved before the end of summer? (full details)

-IRS launches two new portals to help families manage the Child Tax Credit payments. (full details)

- New factors including the delta variant and states ending federal unemployment benefits may impact the possibility of a fourth stimulus check. (Full details)

-Everything you need to know about the possible "labor shortage. (Full details)

-Still waiting for your tax refund? Find out when it might be time to contact the IRS.

-Workers in Indiana, Maryland and Texas are suing to keep their federal pandemic-related unemployment benefits. Full details.

- US Dollar off to firm start as focus shifts to jobs data

- IRS prompts families to file taxes or, if eligible, use the Non-Filer tool ahead of Child Tax Payment date

- Biden walks back comments on infrastructure spending add-ons

- Ending Unemployment benefits is costly and not having desired effect (full story)

- Bipartisan infrastructure bill agreed and the inclusion of a fourth stimulus check (full details)

- Some non-profit organizations continue their push for an additional stimulus check (full details)

- Over half of states are ending federal unemployment benefits (full story)

- IRS has launched: Child Tax Credit Update Portal and Child Tax Credit Eligibility Assistant

- IRS has confirmed that the monthly Child Tax Credit payments will begin on 15 July (full story)

- Child Tax Credit monthly payments next "opt out" deadline: 2 August

- $10 billion fund for homeowner stimulus checks (how to apply)

- You can track your third stimulus check by using the IRS' online Get My Payment tool

Have a read of some of our related news articles:

Do business leaders support the infrastructure package circulating?

Axios reports that through their conversations with many top business leaders, many had stated that they supported the $1.2 trillion package.

A statement from UPS said, "A bipartisan deal can equitably and sustainably accelerate the country’s economic recovery from the COVID-19 pandemic while enhancing personal mobility, increasing safety, and facilitating goods movement."

Unemployment benefits: Have the additional $300 Covid-19 payments led to a labor shortage?

Unemployment benefits: Have the additional $300 Covid-19 payments led to a labor shortage?

Our team took a look at both sides of the argument and put together a brief explainer.

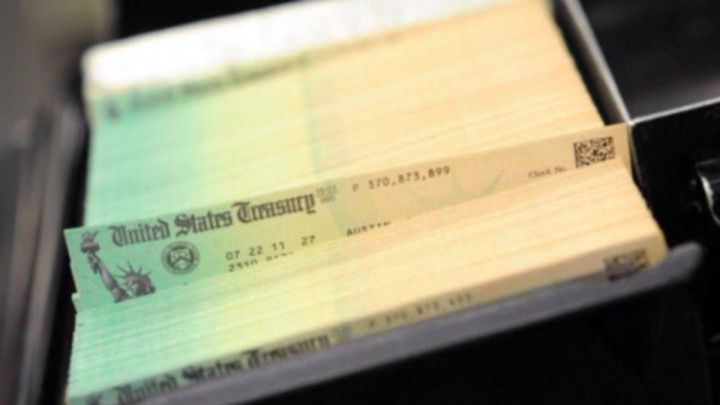

How many tax returns has the IRS processed?

The tax agency states on their website that they:

1. Collected close to $3.5 trillion through the tax returns submitted

2. Processed more than 240 million tax returns

3. Distributed more than $736 billion in tax refunds (including $268 billion in Economic Impact Payments).

Which states represented the greatest part of US GDP from January to March 2021?

A year ago, many economists worried about how long it would take the US economy to recover from the covid-19 pandemic. This month, the Department of Commerce released data on GDP that shows "Real gross domestic product (GDP) increased at an annual rate of 6.4 percent in the first quarter of 2021."

The real GDP from January to March 2020, before the pandemic took hold in the US was $21.56 billion. For the same period in 2021, that number grew to $22.06 billion. After declining in Quarter 2 2020 (April to June), the GDP has increased each quarter.

Major increases in Q1 2021, are in part due to the increase in spending that took place after both the $600 and $1,400 stimulus checks were sent.

States that contributed most to GDP from January to March 2021 were,

1. California -- 14.7%

2. Texas -- 8.5%

3. New York -- 8%

4. Florida -- 5.2%

5. Illinois -- 4.1%

Who is pushing for paid family leave in the United States?

The Center for American Progress releases a short video outlining why Congress should take action to implement a federal paid leave program.

This measure is included in the American Families Plan, one of President Biden's proposals that seems to be losing attention as focus lasers in on the infrastructure proposal agreed to by Republican and Democratic Senators and the White House.

Second $600 golden state stimulus in California: eligibility and who would get it?

Second $600 Golden State stimulus in California: eligibility and who would get it?

California legislature has approved a bill that allows for the sending of $600 stimulus checks, this comes after the state saw a historic budget surplus

The bill approved on Monday 28 June, allows for the sending of a $600 check to all those in the state with an income of $75,000 a year or less. Those who received a check during the first round are ineligible to receive another. Additionally, two groups, adults with dependents and undocumented families, will be able to claim one additional $500 check.

Read our full coverage for more details on when the payments will be sent as well as information on other direct relief payments families may be eligible for.

Just after the world witnessed the horrific condo collapse outside Miami, the Economists report that much of the world's infrastructure is not prepared to handle the impacts of rising sea tides.

How has personal and disposable income changed throughout the pandemic?

With new data on personal income in May released by the Deparmtnet of Commerce on 25 June, a clearer picture of the economic recovery is beginning to show.

The Department of Commerce defines personal income as "the income received by, or on behalf of, all persons from all sources." This includes wages, social security, unemployment benefits, and more.

From January to March 2020, before the pandemic really took hold of the US, personal income in the US stood at 18.95 billion dollars. For the same time period in 2021, this figure stood at 22.1 billion dollars. The largest increase in recent history, much of this could be driven by the fact that 70% of those on unemployment were making more compared to when they were working.

In April and May, these numbers have begun to decrease, which many economists believe is driven by two factors.

The first being that in January and March 2021, incomes increased to record levels after the second and third stimulus checks were sent.

The second reason relates to the continued movement of people back into the workforce. If those on unemployment begin working jobs where they make less than they were when receiving benefits, this number will decrease.

The total income coming from unemployment benefits has fallen in recent months from a high of $556.4 billion, after the $300 a week federal topper was sent for the first time, to $458 billion in May as the unemployment rate dropped and benefit claims hit a record low since the pandemic began.

BREAKING: The California legislature has now approved the California Comeback Plan, Gov. Gavin Newsom's multi-billion dollar proposal to stimulate the economy and send money and aid directly to families across the state.

How would the American Families Plan impact rates of child poverty in the US?

The Center on Budget and Policy Priorities shares information on how the American Families Plan could cut child poverty compared to the current tax code.

Today happens to mark — coincidental — but today is the 60th [65th] anniversary of one of those significant investments to change the nation. Sixty-five years ago today, President Dwight Eisenhower signed the bill that created the Interstate Highway System. Sixty-five years ago today. That was the last infrastructure investment of the size and scope of what — the agreement I’m about to talk about today.

It’s time for us to write a new chapter in that story. After months of careful negotiation, of listening, of compromising together in a good faith, moving together, with ups and downs and some blips, a bipartisan group of senators got together and they forged an agreement to move forward on the key priorities of my American Jobs Plan — and one of them is sitting in front of me.

As a result, this is a generational investment — a generational investment to modernize our infrastructure, creating millions of good-paying jobs — and that’s not coming from me; that’s coming from Wall Street — millions of good-paying jobs that position America to compete with the rest of the world in the 21st century — because China is way out-working us, in terms of infrastructur

Where does the unemployment rate stand in each US state?

The Bureau of Labor Statistics, which forms part of the Department of Labor, released data last week detailing how the unemployment rate in each state compares to that of the rate recorded in April.

BLS reports that in May,the rate of those without work is lower than that national average in 27 states and higher in only 12.

Interested in reading more about unemployment?

-Have the additional $300 Covid-19 payments led to a labor shortage?

-Unemployment benefits: in which states have the courts ordered pandemic payments to be reinstated?

Fourth Stimulus Check: what are the reasons the new payment is at risk?

Fourth Stimulus Check: what are the reasons the new payment is at risk?

As the delta variant increasing its spread globally and in the US, public health experts at the CDC and the World Health Organization have stated that the variant poses a threat to those unvaccinated as well as those who have gotten their shots. The risk of death and suffering lasting effects of what is being called "long covid" is greater for those who have opted not to get poked.

President Biden was hoping to see at least seventy prevent of adults vaccinated by the Fourth of July and it is now looking like that benchmark will not be met. This in part is driven by states where vaccine hesitancy is high, including in Mississippi, Louisiana, Wyoming, and Alabama where more than half of adults have yet to receive even one dose.

As the delta variant overtakes alpha as the most prevalent strain infecting individuals in the US, hospitalizations, and spread could increase, forcing businesses to close shop again. However, in states like Vermont, Hawaii, Massachusetts, Connecticut, Maine, and ten others where the seventy percent goal was met, leaders are urging businesses to reopen, hire more staff, and removing regulations that limited capacity and that required mask-wearing and physical distancing in indoor spaces.

Read our full coverage for more on how the delta variant impacts the chance of a fourth stimulus check.

Still, waiting for your tax refund? The IRS-2-Go app can help your track the status of your payment.

This tax season has been very busy for the IRS and many taxpayers have experienced delays.

Unemployment benefits: Have the additional $300 Covid-19 payments led to a labor shortage?

Leaders, economists, and business leaders from across the country have begun an opposition campaign to federal pandemic unemployment benefits, including the $300 a week sent in addition to state payments. These policymakers believe that these benefits discourage those who lost their jobs from beginning their reentry into the workforce.

This theory has led over half of the states to end these additional payments, hoping that more people may begin to search for a new job.

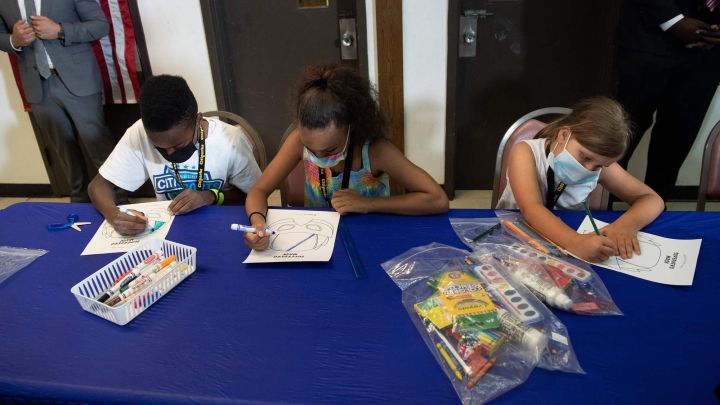

IRS will begin contacting parents eligible to receive 2021 Child Tax Credit

The IRS says over 36 million families should be expecting a letter in the mail to inform them about the new Child Tax Credit.

The letters will be going to families who, upon reviewing information from either their 2020 or 2019 tax return or who used the IRS Non-Filers tool last year to claim their $1,200 stimulus check, the agency deemed might be eligible for the enhanced credit.

The IRS will send out a second letter specifically to families eligible for the advanced payments on the credit beginning 15 July.

(Image: BRENDAN SMIALOWSKI/AFP)

Stimulus checks: every AS English article

In our dedicated stimulus checks news section, you’ll find a host of articles on a possible fourth direct payment, as well as information on the third round of stimulus checks.

How much were the first, second and third stimulus checks and when were they sent out?

We take a look at the three stimulus checks approved so far by the US federal government since the coronavirus pandemic began in early 2020.

No guidance for divorced couples yet on 2021 Child Tax Credit payments

The revamped Child Tax Credit more than doubles the previous refundable amount families will be able to claim on a tax return. Another feature is that half the $3,600 credit per child under six and $3,000 per child 6 to 17 at the end of the year, will be paid in advance through monthly installments. The first payment will be 15 July and the last, if no action is taken by Congress, 15 December.

However, there are still many questions, like what if you are divorced, which spouse will get the payments. What if one spouse opts out of the advanced payments, will the other spouse still receive payments?

Signs of the economic recovery taking off

United Airlinees is making the largest purchase of aircraft in the company’s history, acquiring 270 new jets. The airline will add 200 Boeing 737 Max jets and 70 Airbus A321neo. The covid-19 pandemic dealt a severe blow to airlines with air travel dropping by 60 percent. Now with stimulus checks and savings built up during the lockdown Americans are looking to get out and travel.

A recent survey from MorningConsult found that 63 percent of US adults feel comfortable taking a vacation. 44 percent of Americans say they’re comfortable with domestic flights, but only 28 percent said the same about flying internationally.

Fattest stimulus checks sent to the Idaho and Utah

The American Rescue Plan sent every American up to $1,400 which meant that bigger families got more money, which is the case in Idaho and Utah that consistently have some of the highest number of children per family nationally. The average check according to Bloomberg from US Treasury Department data were $2,628 and $2,784, respectively.

The Eligibility requirements were based on income with the threshold for the maximum amount set at $75,000 for an individual taxpayer, but the phase out was much faster than previous stimulus payments. Those earning $80,000 or more saw no stimulus money. States in the Northeast with smaller families typically and larger incomes saw the smallest checks with DC residents getting the least on average at $1,965.

Could a fourth stimulus check happen before Congress' July recess?

After a little whiplash, the infrastructure deal drawn up by the bipartisan group of senators dubbed the “G21” and agreed to by President Biden is back on track. However, it still needs to be turned into actual legislation to be voted on by the Senate with more liberal members pushing to pass a reconciliation package in parallel with what the “G21” left out plus a number of proposals laid out in the American Families Plan. Neither of which look likely to get passed by Thursday.

Congress will have a tight schedule when lawmakers return 12 July. Democrats will be looking to use the three weeks left in July to pass both of the bills and more, or at least the $1.2 trillion infrastructure package, before Congress takes a month-long recess in August. There just might not be enough time, so some are pushing to drop all or at least some of the month-long recess.

Could Congress use that time to pass a fourth stimulus check?

Still waiting for a tax refund? Here’s why

The IRS normally takes about 21 days to process a tax return but this year has been extraordinary like last year. With a backlog from last year due to the covid-19 pandemic in addition to numerous tax code changes in March, in the middle of the tax filing season, and throw in getting out millions up on millions of stimulus checks the agency could be forgiven for the delay.

The IRS told the I-Team from 13 WGME that “We have processed all error free returns received prior to 2021 and continue to work the returns that need to be manually reviewed due to errors.”

The tax authority said that it is has over 17 million individual returns that need to be processed.

To find out what errors the IRS might have found click here

Investment needed to protect infrastructure from extreme events

This winter saw the power grid in Texas fail for a second time in a decade after the state was hit by severe cold and snow. Now Portland is experiencing the opposite, temperatures hit a record high three days straight, Saturday 108, Sunday 112 and Monday the city hit 116 degrees. Both the streetcar and light rail train are expected to be down until Tuesday night with the extreme heat melting power lines.

“I take the President at his word” Romney says of Biden walk-back

Senator Mitt Romney, one of the “G21” bipartisan group that negotiated the $1.2 trillion infrastructure deal told CNN's Jake Tapper on "State of the Union" that he is confident President Biden will sign the bill if it makes it through Congress. President Biden walked back comments he had made Thursday that he would only sign the bipartisan deal if a parallel bill with the parts of his agenda that were left out also made it to his desk.

"I certainly can understand why not only myself but a lot of my colleagues were very concerned about what the President was saying ... but I think the waters have been calmed by what he said on Saturday," Romney said.

Infrastructure bill on course for a game of chicken

President Biden and House Speaker Nancy Pelosi may be about to face off over the $1.2 trillion bipartisan infrastructure bill and the larger package of investments pushed by Progressives in the House. Although President Biden walked back his statements on passing both the bipartisan deal and the rest of his agenda in tandem, Speaker Pelosi intends to move forward. Part of the impetus for speaker Pelosi is the midterm elections in 2022 and the need of Democrats to deliver on promises made in 2020.

“Let me be really clear on this: We will not take up a bill in the House until the Senate passes the bipartisan bill and a reconciliation bill,” Pelosi said last week.

Facebook becomes fifth company to surpass $1 trillion market capitalization

Shares in Facebook rose over 4 percent on Monday after a federal court dismissed two antitrust cases against the social media company from the Federal Trade Commission and a group of 48 states. The two cases alleged that Facebook had engaged in a systematic strategy to eliminate competition through the acquisition upstart that could potentially become rivals to the social media giant.

Facebook like other tech companies has seen its value soar during the pandemic creating calls for higher taxes on tech companies and other corporations to help pay for post-pandemic rebuilding. President Biden’s American Family Plan includes raising taxes on the wealthiest by increasing capital gains taxes to match income tax rates.

Another round of Golden State Stimulus getting closer

The California assembly approved another round of Golden State Stimulus checks on Monday with a 59 to 6 vote. $8 billion will be used to provide tax rebates to residents with adjusted incomes of $75,000 or less. The tax rebate will take the form of a one-time payments of between $500 and $1,100 in a second round of “Golden State stimulus” checks. Governor Newsom and the Legislature still need to finesse some final details of the $262.6 billion spending bill before the 1 July new fiscal year begins.

What states have been sued after ending unemployment benefits?

Citing the need to get people back to work because of labor shortages, blaming overly generous federal unemployment benefits, 26 states have chosen to suspend federal pandemic unemployment compensation early. Workers in three states have not taken the decision lying down, filing lawsuits against their governors to continue payments.

Real wages in the US today are lower than they were 48 years ago, says Sanders

U.S. Senator for Vermont Bernie Sanders spoke to CNN about his concerns of wage deflation in the US. He told Chris Hayes, "One of the things that has bothered me in the last month or so, is that there is a lot of talk about numbers - $6 trillion, big number, a lot of talk about process... you know what there is not a lot of talk about? About the needs of working class Americans and what we have got to do. So the truth is that real wages in America today are lower than they were 48 years ago. The very, very rich are getting richer. And what some of us are saying, is that if we are going to retain the faith of the American people in their government, we are going to have to stand up for them and not just the big money interests".

Jobless in Maryland receive more aid from stimulus than from state unemployment insurance

Data issued by the Maryland Department of Labor on Monday shows that the number of people receiving regular unemployment insurance is almost three times lower than the number of people receiving unemployment aid through the federal pandemic programs. According to DLLR figures, 204,448 claimants received benefits across all unemployment programs in Maryland up to 12 June. That week, the DLLR notes that 44,020 people received regular unemployment insurance, 121,168 people received Pandemic Unemployment Assistance (PUA), and 39,364 people received Pandemic Emergency Unemployment Compensation (PEUC).

Federal unemployment benefits and programs in Maryland will end on Saturday 3 July unless a class-action lawsuit to extend the additional $300 a week in unemployment aid until September is successful.

California lawmakers approve spending plan for $262.6 billion state budget

California Governor Gavin Newsom and Democratic leaders of the California Legislature have reached an agreement on how the $262.6 billion state budget will be divided - providing tax revenue for public schools, additional Covid-19 economic relief and aid for those on low incomes and the homelessness.

One major advance is an expansion of Medi-Cal, the state’s healthcare program for low-income residents and those over 50. The budget will also dedicate $12 billion of the state’s surplus cash from federal pandemic relief to addressing homelessness over the next two years; $5.2 billion will be set aside to cover unpaid rent and $2 billion to cover water and electricity bills owed by struggling residents.

A total of $8 billion will be used to provide tax rebates to residents with adjusted incomes of $75,000 or less — plus one-time payments of between $500 and $1,100 in a so-called second round of “Golden State stimulus” checks. It doesn’t however, include spending on the state’s propsed high-speed rail project that aims to connect San Francisco and Los Angeles. The final flecks of the budget must be ironed out before the new fiscal year begins on 1 July.

In which states has the court ordered pandemic payments to be reinstated?

So far workers in three states have challenged through the courts their governor’s decision to unilaterally end enhanced unemployment benefits early.

A judge in Indiana has placed an injunction on the state stopping the financial assistance ordering the reinstatement of payments. Last week workers in Maryland and Texas joined Indiana in taking their state's governor to court over the decision to end federal pandemic unemployment benefits.

Read our full coverage for more details on the cases and for how leaders have responded to the law suits.

"No reconciliation bill, no deal" says Bernie Sanders

Progressive Senator Bernie Sanders makes his position clear to his moderate colleague Joe Manchin, "no reconciliation, no deal." Sen. Manchin forms part of a group of Senators who negotiated a $579 billion infrastructure proposal with the White House, which stripped the President's American Jobs Plan (AJP) of social provisions supported by Sen. Sanders.

Many progressive members of the House and Senate have stated that unless a reconciliation package is passed that includes the measures left out of the AJP, they will not vote in favor of the infrastructure package. The Hill reports on a tweet released by Sen. Sanders on Sunday which read, "Let me be clear: There will not be a bipartisan infrastructure deal without a reconciliation bill that substantially improves the lives of working families and combats the existential threat of climate change." The Vermont Senator ended by saying "We need transformative change NOW."

This announcement came after "Biden walked back remarks on Thursday," that made the reconciliation package a requirement for getting the bipartisan infrastructure package to the floor of the Senate for a vote.

Will workers in other states sue to continue benefits?

The decision by an Indiana judge to reinstate payments could bode ill for states that have chosen to stop paying enhanced federal unemployment compensation. In his ruling Judge Hanley said that the harm to the jobless by ending the payments outweighed any harm to the state continuing to pay the benefits. Many states have provisions similar to Indiana’s that require the state to procure all federal benefits that are available.

Maryland workers sue to prevent state from ending federal unemployment benefits

Lawsuits have now been filed against three states for their governor’s decision to end pandemic unemployment compensation prior to the 6 September expiration date. 26 states have announced that they will stop paying enhanced jobless aid from one or all of the programs set up under the CARES Act and extended until September under the American Rescue Plan. Indiana is the only state where a judge has placed an injunction on the stoppage of payments ordering the state to continue payments until the case is decided.

$300 unemployment benefit: which states still keep payments?

Citing labor shortages due to overly generous unemployment compensation, the governors of more than two dozen states have ended or will end at least one or all of the federal unemployment insurance programs early, nearly all Republican led. In a handful of other states with Democrat governors but Republican-controlled legislatures, Republican lawmakers are pushing to end the $300 weekly unemployment booster.

Advance Child Tax Credit payments won’t affect eligibility for other benefits

The 2021 Child Tax Credit monthly payments for up to $300 per child are an advance on a tax rebate and so they won’t count as income. The financial assistance is designed to provide stability by helping families cover monthly expenses. The payments cannot count as a resource for purposes of determining eligibility for benefits or assistance for at least 12 months after you receive it.

Fourth Stimulus Check: what are the reasons the new payment is at risk?

As the vaccination campaign has continued to slow, concerns over the Delta variant have some public health, and economic policy experts worried that it could slow the recovery and extend the length of the pandemic. With this new information in hand, some organizations and lawmakers have continued their ongoing push for a fourth stimulus check.

$50 monthly subsidy to help to pay for internet bill

During the covid-19 pandemic many Americans were confined to their homes relying on their internet connection to have access to the outside world for schooling, work and to have a chance to see the faces of friends and family. However, for many households paying for good or any internet connectivity could be a daunting task.

A new government program the Emergency Broadband Benefit that provides assistance to pay for internet access is now available to households.

Unemployment claims dropping, but are people returning to work?

Unemployment claims are falling in states that are ending federal benefits early than in states keeping the $300 weekly booster until 6 September. This is being touted as a success for those states that have chosen to cut the enhanced jobless aid. However, other data puts a different spin on that vindication that some have said is like "kicking people when they are down.” In those same states the number of people actually looking for work is lower than in states where the $300 top-up is still in place.

2021 Child Tax Credit “is a really, really big deal”

Advance payments for the 2021 Child Tax Credit will begin 15 July and, except in August, payment will be on the 13th, will drop the 15th of every month through December. Eligible families will receive up to $300 per child per month. But there is important information to know about the advance payments, especially if your income will be higher in 2021 than in 2020 or 2019, years which the IRS is using to determine eligibility. Unlike stimulus checks, any overpayment would need to be repaid or could be taken out of next year’s tax refund.

The payments should come as a boon though for low-income families that can struggle with fluctuating income from month to month. But some of those families aren’t required to file a tax return, and if they haven’t used the IRS Non-Filer online tool, they could be left out of the program.

Americans urged to watch out for 12 common tax scams

The Internal Revenue Service has started its "Dirty Dozen" list for 2021 with a warning for taxpayers, tax professionals and financial institutions to be on the lookout for these 12 common schemes and scams.

This year's "Dirty Dozen" is separated into four separate categories: pandemic-related scams like Economic Impact Payment theft; personal information cons including phishing, ransomware and phone "vishing"; ruses focusing on unsuspecting victims like fake charities and senior/immigrant fraud; and schemes that persuade taxpayers into unscrupulous actions such as Offer In Compromise mills and syndicated conservation easements.

A continuing threat to individuals is from identity thieves who try to steal Economic Impact Payments (EIPs or stimulus checks). Most eligible people will get their payments automatically from the IRS.

Taxpayers should watch out for these tell-tale signs of a scam:

Any text messages, random incoming phone calls or emails inquiring about bank account information or requesting recipients to click a link or verify data should be considered suspicious and deleted without opening.

Be alert to mailbox theft. Frequently check mail and report suspected mail losses to Postal Inspectors.

Don't fall for stimulus check scams. The IRS won't initiate contact by phone, email, text or social media asking for Social Security numbers or other personal or financial information related to Economic Impact Payments.

For more information on stimulus check scams, visit the IRS website

Stimulus checks live updates: welcome

Hello and welcome to our live stimulus checks blog for today, Tuesday 29 June 2021.

We'll be bringing you updates on a possible fourth direct payment, in addition to the latest information on the third round of checks, which has seen around $395 billion go out to eligible people in the US.

As well as this we'll be providing news on other economic-aid schemes such as the expanded Child Tax Credit, which will see monthly payments of up to $300 distributed to qualifying households and details of economic aid for Californians on low-to-middle incomes in the proposed new state budget. Basically, everything you need to know.