Fourth stimulus check and child tax credit news summary: 14 July 2021

Latest news and information on the third stimulus check in President Biden's coronavirus relief bill, and updates on a potential fourth direct payment.

Show key events only

US stimulus checks live updates | Wednesday 14 July 2021

Headlines:

-Gov. Gavin Newsom signs a $100 billion dollar budget that includes a $600 Golden State stimulus check for two-thirds of California residents. (Full story)

- Around 4 million IRS tax refunds will be sent out this week (Full story)

-IRS will send first Child Tax Credit payment on 15 July, is it automatic? (Full story)

-An expansive reconciliation bill will be released today. Where does the debate over the fourth stimulus check stand? Will one be included? (full details)

-Child Tax Credit payments will begin tomorrow, do they affect the likelihood of a fourth stimulus check? (Full story)

Useful information / links

-Golden State Stimulus Check: How to apply and who is eligible?

- Child Tax Credit: We took a look at the question, is the web portal the best way to apply, what other options do I have? (Details)

- You have until Monday 2 August to opt out of the August round of Child Tax Credit monthly payments. (Find out more)

- How to use the IRS's two new online tools; the Child Tax Credit Update Portaland the Child Tax Credit Eligibility Assistant.

- Still waiting for your tax refund? So are millions of other Americans. Should you update your tax return information? Find out when to contact the IRS.

Take a look at some of our related news articles:

IRS promote CDC tool

The Internal Revenue Service have enabled an online Child Tax Credit too for families who did not file taxes for 2019 or 2020

Do you have to pay back the Child Tax Credit 2021?

Starting 15 July, millions of American families will receive federal financial support in the form of direct payments to help covering the costs of raising children. The payments are an advance on the 2021 Child Tax Credit greatly expanded in the American Rescue Plan passed in March by Democrats.

Unlike the stimulus checks paid out over the past year, the new advance payments on the Child Tax Credit will have to be repaid if you get more than you are eligible for.

Caregivers want to be included in infrastructure bill

The White House and Democrats have been pushing to include caregiving as part of their infrastructure bill. They argue that this “non-traditional” type of infrastructure helps those with family members that need taking care of get to work just as a highway or commuter system.

Caregivers would welcome more protections and better working conditions. According to ZipRecruiter over half the workers in the industry earn less than $26,000 annually, the average wage is $12 per hour.

When will the $3,000 to $3,600 Child Tax Credit money be sent?

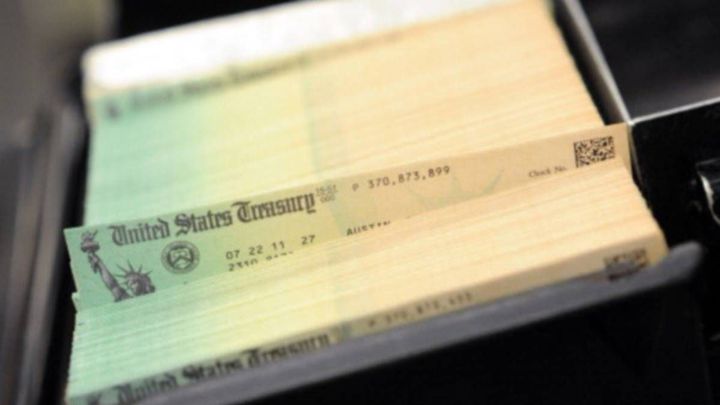

The Internal Revenue Service will begin sending monthly advance payments on the 2021 Child Tax Credit 15 July, either as a direct deposit or a paper check. Although the money is leaving the IRS, depending on how you will receive the money will determine how long you have to wait to actually be able to use it.

$3000/$3600 Child Tax Credit eligibility: Who is getting it? How to know if I qualify

The IRS is set to start sending millions of families a new series of direct payments. With just hours before the first batch of advance 2021 Child Tax Credit payments are made, families are still trying to find out if they are eligible.

$3000/$3600 Child Tax Credit 2021: How to calculate how much money will I receive

The first payment of the Child Tax Credit, worth $250 and $300 will hit bank accounts on 15 July, we took a look at how to calculate your payment.

Dems to extend expansion of Child Tax Credit

Although still a work in progress, details of the Democrat-only "soft" infrastructure bill are coming out. The $3.5 trillion spending proposal would include parts of President Biden's American Jobs Plan that left on the cutting room floor when a bipartisan group of 21 senators found a $1.2 Trillion compromise proposal for "traditional" infrastructure.

The sweeping bill would also include all the major proposals from the American Families Plan. One of which is the extension of the 2021 Child Tax Credit, but for how long is uncertain. The overall price tag of the bill will determine whether the changes will be until 2025 which Biden has asked for or beyond. Democrats would like to make the changes permanent but that doesn't look likely at this time.

2021 Child Tax Credit will provide financial stability

Some 36 million families will see payments begin to arrive in the coming days in their bank accounts or in the post. The IRS is set to disburse the first of the monthly payments tomorrow and depending on how you got your tax refund will determine how the agency will send those payments.

You can check the IRS 2021 Child Tax Credit website for the credit to see whether you were automatically registered. If you are scheduled to receive a paper check, which will take longer to receive, you can update the payment method to direct deposit for the August payment using the Manage Payments portal.

Parents will receive up to $300 per month per child under 6 and $250 for each child 6 to 17, to help with the day to day costs of raising their children.

Tomorrow, the expanded Child Tax Credit will begin providing monthly direct payments of up to $300 per child to working families in every state across this country. And with these direct payments, we will begin to cut childhood poverty by more than half. That is no small thing.

Why should some families opt out of the advance 2021 Child Tax Credit payments?

The deadline to opt-out of the Child Tax Credit payments is approaching.

Our team took a look at why some families are choosing to delay payment of the credit.

Where is my $600 second Golden State stimulus check? How can I track its status?

Where is my $600 second Golden State stimulus check? How can I track its status?

On 13 July, Gov. Gavin Newsom signed a law that will allow for the sending of the second round of direct payments. Those who received a check during the first round are not eligible for a second. However, taxpayers in the care of children are able to receive an additional $500 payment.

At the signing event, which focused on various pieces of legislation, in addition to the direct payments, Gov. Newsom said, “California is roaring back from this pandemic because we have your back.”

Payments are expected in September.Read our full coverage for the steps you need to take to receive yours.

What does an increase in the Consumer Price Index mean?

The Consumer Price Index is described by the US Bureau of Labor Statistics (BLS) as "measures the change in prices paid by consumers for goods and services."

In June, consumers saw the greatest increase in the price of some products since 2008. The CPI increased almost 1 percent in June driven by "used cars and trucks" which "continued to rise sharply, increasing 10.5 percent."

Food also saw an increase of .8, double what was seen in May.

Read the full report here.

Congressman Jammal Bowmen of New York tweets a video explaining the benefits of the Child Tax Credit. Payments will begin tomorrow.

What will the reconciliation bill proposed by the Democrats contain?

Today, leaders of the Democratic party unveiled the full $3.5 trillion dollar reconciliation package to the full caucus.

According to Senate Majority Leader Chuck Schumer, the package will include $600 billion in new infrastructure spending, which had been supported by around 11 Republican Senators. However, as the funding for roads and bridges will be tacked onto the larger spending bill, it is unlikely that Republicans will vote in favor.

In addition to infrastructure, the bill allocates funding to boost social programs related to health and child care, as well as more money to fight climate change.

Senator Mark Warner has yet to provide details after he stated that the package contained provisions for it to be paid for in full.

More details are expected later today.

What has the Biden administration said about extending the changes made to the Child Tax Credit?

In speaking to the media, Press Secretary Pskai reiterated the President's support for the extension and spoke to the wide support in Congress.

Republicans begin to withdraw support of the bipartisan infrastructure deal as Democrats move to introduce a reconciliation bill that includes many of the progressive pieces of the American Jobs Plan were left out.

How many tax refunds is the IRS sending on 14 July, and who are getting them?

The IRS have confirmed that tax refund payments are continuing throughout the summer as the tax authority looks to work through that huge backlog. The latest round is set to go out this week, with an average refund amount of $1,265 per filer.

In May the Treasury Department released a report stating that by early March the IRS had already found 7.3 million tax returns that were eligible for a refund, and that number is now thought to have doubled. Do not worry if you are not included in this round of payments, there are plenty more to come later this year. Here's everything you need to know about the payment schedule and how to track your tax refund...

More than 2.5 million signatures request a new stimulus payment

A Change.org petition created by Stephanie Bonin, a Colorado restaurant owner, has been gaining traction since its creation last year. The petition calls on Congress “to make recurring checks automatic if certain triggers are met,” so that people will not have to wait around for the government to act. Those recurring checks would be “$2,000 payments for adults and $1,000 payment for kids."

Bonin, who fears for her financial future along with millions of Americans, wants the stimulus checks to be made monthly until the pandemic ends. The petition has now surpassed 2.5 million signatures with a stated goal of 3 million signatures which would make it one of the top petitions on Change.org.

IRS confirms that tax refunds are on their way

A recent post from the the Internal Revenue Service announced that the next wave of tax refunds will be sent out today as the agency continues to work through a backlog.

The statement reads: "today [we] will issue another round of refunds this week to nearly 4 million taxpayers who overpaid their taxes on unemployment compensation received last year."

"Refunds by direct deposit will begin July 14 and refunds by paper check will begin July 16. The IRS previously issued refunds related to unemployment compensation exclusion in May and June, and it will continue to issue refunds throughout the summer."

New Child Tax Credit payments will be sent out tomorrow

The IRS will start sending out direct monthly payments as part of the new Child Tax Credit from 15 July, meaning that American families will start seen hundreds of dollars landing in their accounts regularly. The programme will provide a monthly payment worth up to $300 for children younger than six, and up to $250 for those aged between six and 17. The lucrative new support programme is expected to cover around 88% of American children and will hopefully halve childhood poverty over the next 12 months.

What to expect from the Child Tax Credit overhaul

The American Rescue Plan stimulus bill included a variety of programmes aimed at providing support for working families, but the Child Tax Credit could be the most influential of all. From 15 July the IRS will be sending out monthly payments worth up to $300 per child, until at least the end of the year.

Biden is eager to see it extended beyond the initial 12-month duration and is in the process of garnering sunding for a massive $4.1 trillion legislative agenda that would see the programme extended through 2025.

Second $600 Golden State Stimulus in California: eligibility and who would get it?

After weeks of delays, Gov. Gavin Newsom has finally signed into law his $100 billion California Comeback Plan, which includes another round of Golden States Stimulus checks. The proposal put forward by Newsom aims to stimulate the economy and provide support for struggling residents.

In announcing the news, Newsom said: “Harnessing the largest surplus in state history, we’re making transformative investments across the board that will help bring all our communities roaring back from the pandemic – and pay dividends for generations to come."

Wondering whether you will be included in the latest round of payments? Here's everything you need to know..

Around 4 million IRS tax refunds to go out next week

Since March the IRS has been asked to oversee the distribution of the third round of stimulus checks and the introduction of the new Child Tax Credit, so it is no surprise that they are a bit behind on some of their other jobs.

This has left millions of people waiting months to receive their tax refund for 2020, far exceeding the normal wait. However a recent report from the Fast Company reads: "The new batch includes some 4 million payments, with the average refund size being $1,265," showing that the IRS is finally starting to get on top of the tax refund backlog.

Golden State Stimulus checks on their way to Californians

California Gov. Gavin Newsom has confirmed that he has signed the California Comeback Plan into law, the huge $100 billion relief bill aimed at restarting the state's economy and provide short-term support for residents. The $600 payments will be boosted with another $500 for those with tax dependents or who have missed out on federal support in the past.

After announcing the news, Newsom released a statement saying: “Harnessing the largest surplus in state history, we’re making transformative investments across the board that will help bring all our communities roaring back from the pandemic – and pay dividends for generations to come,”

$600 second Golden State Stimulus check in California: site and how to apply

After months of delays, Gov. Gavin Newsom finally signed the California Comeback Plan into law on 13 July, triggering another round of stimulus checks for millions of residents.The California Franchise Tax Board (CFTB) will use the information submitted in you most recent tax filing to judge eligibility for the direct payments.

The California Comeback Plan expands on the round of Golden State Stimulus checks that were distributed early this year, meaning that two-thirds of Californians are now eligible. How much could you be entitled to?

Dems push for Child Tax Credit extension in new reconciliation budget

It seems that President Biden is maintaining his support for an extension to the new Child Tax Credit programme. He administration have proposed a new reconciliation package, worth around $4.1 trillion in total, to cover both the massive infrastrucuture bill and a number of other legislative priorities. Biden had attempted to find common ground with GOP lawmakers in recent months but has faced enormous pushback from key moderates who argue that the levels of spending are too high.

Months wait expected for tax refunds

This report from 7News shows the scale of the problems facing the IRS as they look to work through a backlog of some 35 million unprocessed tax returns. The chaotic past 16 months have left the agency way behind on its normal target of sending out refund payments within 21 days, and some are now expecting it to take until October before the majority of refunds have been distributed.

Will there be problems receiving IRS Child Tax Credit payments?

For the past four months the IRS has been preparing to take on a new task; starting 15 July, the agency will begin sending advance monthly payments to parents for the 2021 Child Tax Credit. But there still may be some last-minute hurdles to overcome.

The American Rescue Plan made a series of changes to the Child Tax Credit which has existed since 1997. Itgreatly expanded the value of the credit and made it available to many low- and moderate-income families who previously either couldn’t take advantage of it or only in a limited fashion.

How should you get your Child Tax Credit?

The new Child Tax Credit payments structure is set to go live from 15 July with monthly payments going out to tens of millions of American families. However some have chosen to opt out of the the regular payments and to instead get the whole thing as a lump sum at the end of the year.

As was the case with tax credits in the past, they will receive a substantial amount that can be used to reduce the household's tax bill or to be claimed as a tax refund. For more information, check out Why should some families opt out the advance 2021 Child Tax Credit payments?

Child Tax Credit FAQs

The IRS has created a useful questions-and-answers page for those who have queries about the new, expanded Child Tax Credit.

You’ll find a host of topics covering issues such as eligibility, calculating your amount and unenrolling from monthly payments.

Visit the IRS’ Child Tax Credit FAQs page

See also: How is the new Child Tax Credit different to a stimulus check?

(Image: www.irs.gov)

Democrats are evaluating various proposals to cover the costs of the infrastructure and reconciliation packages floating around Capitol Hill.

Who do Americans give credit to for passing the three stimulus checks?

According to the Washington Monthly, it's not President Biden.

The outlet reports that Biden did use the sending of a third stimulus check to garner support for his administration's approach to the economic recovery.

Bill Scher reports that this publicity was not done during the Obama years. President Biden said that President Obama was "so modest, he didn’t want to take, as he said, a ‘victory lap.’ I kept saying, ‘Tell people what we did.’ He said, ‘We don’t have time. I’m not going to take a victory lap.’ And we paid a price for it, ironically, for that humility."

Political reporters like Ezra Klien argue that voters need to know what you have accomplished in order to reelect you.

Are you struggling to get in touch with the IRS?

Millions of Americans are still waiting for their tax returns. With long wait times when trying to contact the IRS, many have become desperate for answers as to when they can expect the payment.

Washington Post wants to hear from those that are experiencing these challenges.

Senate Majority Leader Chuck Schumer says "it's doable that they could "fully pay for" a reconciliation bill." The reconciliation bill is expected to include many of the progressive measures left out of the bipartisan infrastructure package.

Senators from all over the political spectrum will work together this week to finalize the bipartisan infrastructure package.

What have Democrats included in their proposed reconciliation bill?

In order to gain more votes on the bipartisan infrastructure bill, more progressive members of the caucus have worked with the White House on a reconciliation package.

The package was announced today 13 July, and the price tag stands at around $3.5 trillion. It has been referred to as "the most significant piece of legislation passed since the Great Depression," by Senator Bernie Sanders. More moderate members have told media outlets including CBS, that the package will be paid for and will not add to the deficit.

The package is expected to include the President's ""human" infrastructure priorities not covered by a bipartisan proposal, such as child care, health care, education and additional climate change-related provisions.

Moderate Democratic Senator Joe Manchin of West Virginia says that he will only vote for an infrastructure package that is "fully paid for."

Senator Mark Warner has told the press that the new $3.5 trillion reconciliation package that includes the elements agreed to by a bipartisan group of Senators, will be paid for in full.

Stimulus check live updates: welcome

Hello and welcome to our daily live blog for today, Wednesday 14 July 2021, bringing you updates on a possible fourth stimulus check in the US.

We'll also provide you with information on the third round of stimulus checks, which began going out in March as part of President Biden's American Rescue Plan, in addition to news and info on other economic-support programs such as the new, expanded Child Tax Credit.

- Joseph Biden

- Coronavirus stimulus checks

- USA coronavirus stimulus checks

- Covid-19 economic crisis

- Science

- Unemployment

- United States Congress

- Coronavirus Covid-19

- Economic crisis

- United States

- Pandemic

- Coronavirus

- Recession

- Benefits

- Economic climate

- Virology

- Outbreak

- Infectious diseases

- Employment

- North America

- Parliament

- Diseases

- Microbiology

- Social security

- Medicine

- Labour market policy

- America

- Economy

- Work

- Biology

- Health

- Politics

- Life sciences