Fourth stimulus check | News summary for Saturday 17 July

Latest news and information on related benefits from President Biden's coronavirus relief bill, and updates on a potential fourth payment.

Show key events only

US stimulus check and Child Tax Credit latest news | 17 July 2021

Headlines:

- Currency drive | Dollar higher after upbeat US retail sales data

-A giant step | President Biden sees the enhanced Child Tax Credit as a major act to counter poverty in the US

- Paying the price | Shoppers hit by Consumer Price Index increase, what is driving up prices? (Full story)

- CTC expansion | Families with 17-year-old children are now eligible for the Child Tax Credit. (Full story)

- Unemployment | States ending federal benefits see a slower decrease in unemployment and a look at what states will be ending benefits next. (Full story)

Useful information / links

Child Tax Credit | need to calculate your payments or opt-out? (Details)

-Mortgage rates fall: Is now the time to refinance? (Details)

- Everything you need to know about the Golden State Stimulus Check: How to apply and are undocumented residents eligible?

-Child Tax Credit is there a limit on the number of children? (Details)

- Still waiting for your tax refund? So are millions of other Americans. Should you update your tax return information? Find out when to contact the IRS.

Take a look at some of our related news articles:

$300 weekly unemployment payments resume in Indiana: When will I receive the check?

Indiana Governor Eric Holcomb in May ordered an end to federal pandemic unemployment benefits which took effect 19 June. Jobless workers in the state became the first in the nation to file a lawsuit to reverse the governor’s decision, arguing the governor’s actions were unlawful.

Governor Holcomb ended the federal programs providing financial aid to out of work Hoosiers claiming that the benefits were harming the state by causing a shortage of available workers to fill open positions. Marion Superior Court Judge John Hanley sided with the workers saying that the harm created by terminating the benefits far outweighed any risks to the state.

The Indiana Department of Workforce Development has begun sending out unemployment compensation to around 120,000 who had their benefits cut 19 June.

Do miserly unemployment benefits get people back to work?

All but two Republican governors, along with one Democrat governor, across the US announced they would end pandemic benefits early for those forced out of work by the fallout from covid-19. Two states have since restarted benefits after being ordered to do so by the courts. The idea was that it would get people back to work faster to fill a labor shortage being experienced across the US even as the nation added 850,000 new jobs in June. The Economist looks at whether stopping the financial aid is having the desired effect.

As per The Economist:

“It depends whom you ask. On June 27th the Wall Street Journal ran an article on Missouri, a state that abolished the supplement on June 12th, claiming that people were flying off the unemployment rolls. The very same day the New York Times ran an article also on Missouri, which drew almost exactly the opposite conclusion. The reality is somewhere in between these polarised extremes. Making benefits less generous may help America’s jobs market a little—but other factors do more to explain labour shortages.”

Cutting federal unemployment benefits forcing workers to accept less

Despite rising wages in the US as the economy gets back on its feet, not everyone reentering the job market is finding a good paying job after losing the security of federal pandemic unemployment benefits. NPR talks to some of those who were affected by their governor’s decision to end the benefits early with the claim that the federal assistance was harming their state’s employers looking for workers by keeping potential employees at home.

26 states announced that they would end pandemic unemployment benefits before the September expiration date. At the end of July, Louisiana will be the last to end benefits early but two states have had to reverse course, Indiana and Maryland, due to legal rulings.

Secretary Buttigieg on the road selling Dems other infrastructure bill

The Senate is working on a $1.2 trillion traditional bipartisan infrastructure bill, but behind the scenes Democrats are working on another $3.5 trillion bill that would cover much of what was left out of the former. Democrats plan to push the second bill through Congress without their Republican colleagues, none of whom has said that they will vote for it.

US Transportation Secretary Buttigieg went to Chicago to pitch what the bill could do for the city and Illinois. Garnering support from the countries mayors and governors will be key to helping get all 50 Senators that caucus with the onboard if the party plans to forgo any Republican votes and avoid a filibuster.

$2,500 fourth stimulus check isn't coming

A recent post on Facebook probably got a lot of people's expectations up about another round of stimulus checks. The FB post said that Congress had approved another round of stimulus checks, this time for $2,500, but it was just a hoax with PolitiFact giving it a "Pants on Fire" rating. The post has since been flagged by Facebook.

Why do I get $300/$250 from Child Tax Credit and not $3,600/$3,000?

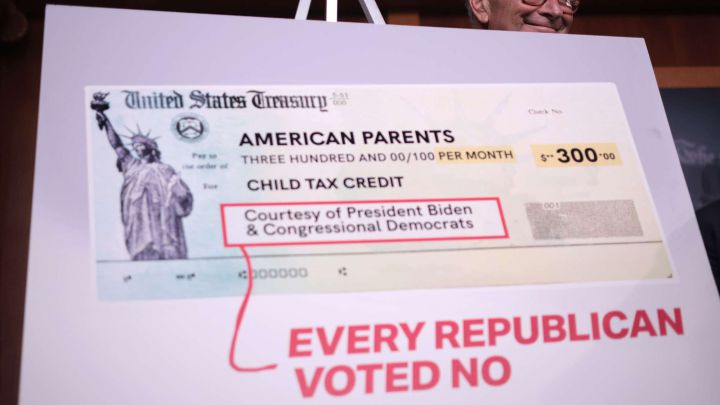

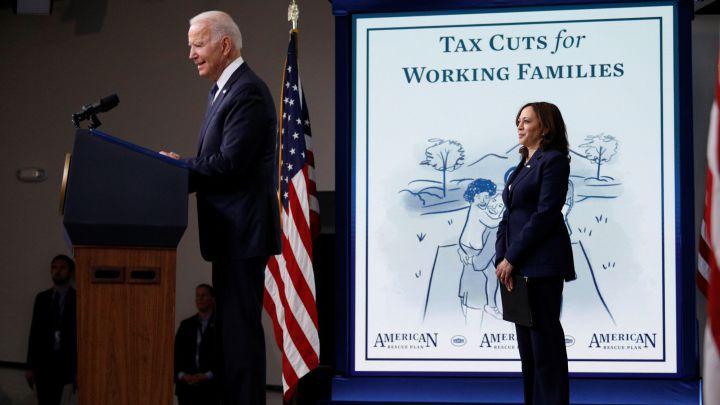

The IRS sent the first payments for the expanded 2021 Child Tax Credit this week. The changes to the tax credit were included in the Democrats’ American Rescue Plan enacted in March which gave the IRS four months to get the program up and running.

The changes are currently only for the 2021 fiscal year but the Democrats included the expansion with the expectation that the modifications would be extended. This means that families will receive only half the credit in advance payments this year instead of the whole credit being split into equal monthly installments in 2021. However, should the changes be extended families would receive the whole of the credit due to them in 12 monthly installments of up to $300, or they can choose to wait and receive the whole credit they are eligible for the following year.

Rosa DeLauro on 2021 Child Tax Credit "This is peace of mind"

Rosa DeLauro has been working to expand the Child Tax Credit since she introduced her first legislation on the program in 2003. That effort year after year has now resulted in eligible families receiving up to $300 per child each month until the end of the year.

Americans use Child Tax Credit payments for basics

The changes made to the Child Tax Credit for the 2021 fiscal year were included in the American Rescue Plan enacted in March. But the seeds for the changes were planted almost 20 years ago by US Representative Rosa DeLauro of Connecticut as a way to help struggling families make ends meet and help reduce childhood poverty.

The changes will expire at the end of 2021 unless Congress acts to extend the enhancements. Proposals are already afoot with congressional progressives drawing up legislation for the "soft" infrastructure bill. President Biden asking that the program be extended until at least 2025.

$1.2 trillion bipartisan infrastructure bill not enough

Infrastructure around the US has been lacking investment for decades and will need $4.5 trillion in investment by 2025 according to the 2021 Report Card from the American Society of Civil Engineers. This year’s report, which comes out every four years, gave the US its first grade outside the “D” range in 20 years but only just at a “C-”.

Overall, 11 of the 17 categories received D range grades, "a clear signal that our overdue bill on infrastructure is a long way from being paid off," the report concluded.

Currently the US Senate is preparing a bipartisan $1.2 trillion infrastructure bill which could be voted on as early as next week but there are still snags. Listen to US Representative Dan Kildee of Michigan explains what’s going on in Congress with the infrastructure talks, supply chain shortages and threats to voting rights.

Enhanced Child Tax Credit will make a difference

As Americans struggle to make end meet month to month, they can now count on a little extra help until the end of the year. Eligible parents, roughly 39 million households, will receive monthly up to $300 for each child under six and $250 for every child six to seventeen.

CNN shares stories of how it will make a difference for three families.

Child Tax Credit was "much needed relief"

Jimmy Panetta, the United States Representative for District 20, added his voice of praise to the newly implemented Child Tax Credit saying that it was "much needed relief for working families."

"I’m proud to have fought for this tax cut as a member of the House Ways and Means Committee," he added, "and I look forward to seeing its positive impact on our community."

$3000/$3600 Child Tax Credit: can I receive it if I am single or divorced?

Over recent months it has been a waiting game for millions as the 15 July date for the enhanced Child Tax Credit edged ever closer.

Now that we have past that milestone, parents and guardians across the United States have begun to receive their first payments of the fully-refundable credit worth $3,000 for children between the ages of six and seventeen, and $3,600 for those younger than six.

But questions have been raised amid concerns over how this is handled for divorced couples.

Read more in our latest advice piece.

It’s a good thing for Walmart and grocery stores.

The retail sectors where middle- and lower-income families spend money are likely to benefit some from this.

How much will Child Tax Credit cost anyway?

If that is a question that has been on your mind recently, then ponder no more. Some boffins have dusted off their modern abaci and worked out that Joe Biden's latest initiative will amount to an estimated $150 billion in stimulus over the next year.

The analysts add that while an estimated forty million families and 90 percent of all children will directly benefit from this newest government-issued cash windfall, retailers across the United States also stand to boost their bottom line in the coming months.

Win, win, win then...

50% child poverty...what happened to Republicans?

As you'll know from even giving our daily live blog a passing glance, the Child Tax Credit is now in effect.

Congresswoman Judy Chu of California joined Ali Velshi to talk about the impact it’s set to have - reducing child poverty in the US by half - and mythbusts some GOP claims about it being a disincentive to work.

“I’d like to know what happened to the Republicans,” says Chu. Back in 1997, “they were the ones who initiated the child tax credit.”

Citizen Care: from FDR to Joe Biden

This short video aligns this week's Child Tax Credit launch from the Biden administration with that of Franklin D. Roosevelt's social security measure back in the 1930s.

The aim for both, fight poverty.

Personal savings post stimulus

Dan Weiskopf has been keeping an eye on the personal savings rate across the United States, which shows another serious dip on the back of the latest stimulus package.

Still well above the situation we had before covid-19 decided to turn our world upside down.

Child care is as much about the GDP as it is about our families.

It’s really critical that we are making those investments both in human infrastructure and in physical infrastructure.

Did states ending federal unemployment benefits see decreases in June?

In May, as the national vaccination campaign picked up speed and more businesses started to reopen, many Republican governors began to announce that they would end the payments of federal unemployment benefits. As Montana and Carolina became the first states to make the change, over twenty others have followed, including Louisiana, led by the only Democrat.

These governors justified the ending of benefits by saying that they contributed to labor shortages. Many of these leaders take issue with the $300 federal topper sent in addition to state benefits. Some studies have shown that the additional federal payment bumps income above what many on unemployment were making when they had a job. For the GOP, this has led to people opting to stay home rather than find their next gig.

If you are looking for more information on this, look no further than this update from Maite Knorr-Evans.

Tax credits: could a long-term extension be coming

While the expanded Child Tax Credit is currently only on the books for this year, Democratic lawmakers are pushing to make it permanent.

House Ways and Means Committee member Suzan DelBene is among the lawmakers who have long championed an expanded tax credit as a way to help reduce child poverty. On this week’s episode of the Bloomberg podcast, Talking Tax, DelBene talks with reporter Kaustuv Basu about why Democrats pushed for the advanced payments and whether a permanent extension is possible.

Listen to the episode here.

We saw that many states are using better-than-expected revenue outlooks as an excuse to cut personal and corporate income taxes.

Unfortunately, the people that will be benefiting most from these cuts are not the people who were most heavily impacted by job losses or cuts to public services.

Republicans still finding ways to help the richest

While some states, like Hawaii, Texas, and Nevada, that are reliant on tourism and the energy industries took blows to their revenue as a result of the pandemic, others have exceeded dire revenue projections from spring 2020 and now face budget surpluses in part thanks to the covid-19 relief legislation signed by Biden in March.

But rather than investing in underfunded schools and public services, some Republican-run states are instead funneling the cash to high-income households — and the Biden administration’s refusal to enforce the anti-tax-cut language in the federal legislation is providing a green light for Republicans to try to do even more.

Julia Rock looks at the 'clever' ways Republicans are using these excess funds.

Real moms on the Child Tax Credit

As senior advisor to the President and Director of the White House Office of Public Engagement, Cedric Richmond will have heard many an opinion - from both sides of the debate - on the new enhanced Child Tax Credit.

As he reminds us here, just a few days ago Julissa Reynoso spoke to Latina moms from Pittsburg, Durham, Alexandria, and San Antonio about the benefit and listened to their stories about its impact.

"The CTC will bring thousands of families critical relief," he says, and you can listen to the moms via the link below.

Scammers looking to benefit

The Inland Revenue Services continue to issue warnings for people to keep an eye open for any potential scam that could result in you losing your benefit to a criminal.

Stay aware, and remind your loved ones who may be less connected.

Each of the three checks arrived during a distinct moment of the crisis, each round provided unambiguous relief and helped boost overall spending

Stimulus checks: updated research

In the attached thread, Claudia Sahm analyses the impact and effects of the stimulus checks issued to the American people as part of the coronavirus relief efforts.

She headlines the research with a simple. 'they worked', but you'll be wanting a little more information than that so read on.

Child Tax Credit: what is the income limit for joint filers, single filers and heads of household?

Under the Child Tax Credit scheme, parents under the specified income threshold will receive $3,600 for each child under six years old and $3,000 for each child under 17 years of age.

$3000/$3600 Child Tax Credit 2021: How to calculate how much money will I receive

The first payment of the Child Tax Credit, worth $250 and $300 will hit bank accounts on 15 July, we took a look at how to calculate your payment.

Pelosi praises Senate budget plan as 'bold, essential investments'

U.S. House of Representatives Speaker Nancy Pelosi stated that the $3.5 trillion Senate budget plan 'will make bold, essential investments in our values as a nation.'

"The Senate budget will contain many of House Democrats’ top priorities, including transformative action on the investments needed to confront the climate crisis, to transform the care economy, and to expand access to health care with enhancements to ACA, Medicare and closing the Medicaid coverage gap," Pelosi said in a letter to colleagues.

What does an increase in the Consumer Price Index mean?

In June, the Consumer Price Index increased almost 1%, the largest in over a decade. But what does this really mean for the economic recovery and shoppers across the US?

What has Biden said about misinformation on social media regarding the covid vaccine?

Biden slams Facebook

Facebook has come under heavy criticism from Joe Biden for allowing misinformation about coronavirus vaccines to be posted on the popular social media platform

Which states have resumed unemployment payments as the lawsuits increase?

Across the country 26 states had opted to end the additional jobless benefits early but lawsuits in at least five states may help to reverse those decisions.

Why electric buses are key to Biden's green agenda

President Joe Biden has vowed to significantly reduce emissions by 2030, while at the same time creating new, well-paid green energy jobs. His administration has identified bus electrification as one of the main ways to achieve that goal.

While more than half of transport emissions are produced by conventional passenger cars, diesel-powered transit buses are considered among the worst polluters, particularly in America's cities.

Converting transit buses to battery or fuel-cell power is considered one of the fastest ways to reduce greenhouse gas emissions from the transportation sector, which at 29% accounts for the largest share of U.S. emissions.

Is there a limit of children a family can claim for the $3,000 to $3,600 Child Tax Credit?

Regardless the size of a family, every eligible child seventeen or younger at the end of 2021 in a family can receive the expanded Child Tax Credit.

Weekly jobless claims fall as expected

The number of Americans filing new claims for unemployment benefits fell last week as the labor market steadily gains traction, but worker shortages are frustrating efforts by businesses to ramp up hiring to meet strong demand for goods and services.

Initial claims for state unemployment benefits fell 26,000 to a seasonally adjusted 360,000 for the week ended July 10, the Labor Department said this week. Economists polled by Reuters had forecast 360,000 applications for the latest week.

Claims have struggled to make further progress since dropping below 400,000 in late May, even as at least 20 states led by Republican governors have pulled out of federal government-funded unemployment programs.

The early termination of the federal programs followed complaints by businesses that the benefits, including a $300 weekly check, were encouraging unemployed Americans to stay at home. The economy is experiencing a shortage of workers, with a record 9.2 million job openings as of the end of May.

Queries re tax? consult IRS tax assistant

The Internal Revenue Service has set up a tax assistant portal for customers to use in resolving any queries and doubts.

Wall Street ends down as Delta variant drives fears

Wall Street ended lower on Friday, weighed down by declines in Amazon, Apple and other heavyweight technology stocks, while investors worried about a rise in coronavirus cases tied to the highly contagious Delta variant.

On Thursday, Los Angeles County said it would reimpose its mask mandate this weekend. On Friday, public health officials said U.S. coronavirus cases were up 70% over the previous week, with deaths up 26%.

"Covid is starting to affect the market, ironically, for the first time since last summer, when the reopening trade began,"said Jake Dollarhide, chief executive officer of Longbow Asset Management in Tulsa, Oklahoma.

IRS creates three online portals for the 2021 Child Tax Credit

Even though families are automatically signed up they may want to change the payment type or bank account for where the payments go. The IRS has created a Manage Payments online portal where recipients can update their information to redirect the payments to a different account or change from a physical check to direct deposit to receive the funds faster.

For more information about the advance Child Tax Credit in 2021 you can check out the IRS Frequently Asked Questions page.

IRS compliments CTC portal with Spanish version

The Internal Revenue Service has confirmed that it will augment it's Child Tax Credit portal with a version for Spanish speakers.

Top U.S. banks smash profit estimates on rebounding economy

The four largest U.S. consumer banks posted blockbuster second-quarter results this week, after pandemic loan losses failed to materialize and the U.S. economy began roaring back to life.

Wells Fargo & Co, Bank of America Corp, Citigroup Inc and JPMorgan Chase & Co posted a combined $33 billion in profits, buoyed by the release of reserves they had put aside last year to absorb feared pandemic losses.

That was beyond analyst estimates of about $24 billion combined, compared with $6 billion in the year-ago quarter.

Consumer spending has climbed, sometimes beyond pre-pandemic levels, while credit quality has improved and savings and investments have risen, the banks said.

Thanks to extraordinary government stimulus and loan repayment holidays, feared losses have not materialized. A national vaccination roll-out has allowed also Americans get back to work and to start spending again.

Sizzling capital markets activity has also helped the largest U.S. banks, with Goldman Sachs Group Inc reporting a $5.35 billion profit, more than double its adjusted earnings a year ago.

Faster U.S. inflation erases years of undershot targets: Kemp

Rapidly rising consumer prices as the U.S. economy re-opens after the pandemic have erased years of below-target inflation, intensifying questions about when the central bank will start reducing monetary stimulus.

U.S. consumer prices rose at a compound annual rate of 3.00% per year over the two years to June 2021, the fastest two-year increase since October 2008, according to data from the Bureau of Labor Statistics.

Core consumer prices excluding volatile food and energy items increased at a compound annual rate of 2.82% per year, the fastest increase for almost a quarter of a century.

Comparisons with 2019 help avoid distortions caused by the first wave of the epidemic and widespread business closures in 2020, and underscore that faster inflation is not just due to baseline effects.

In August 2020, the Federal Reserve committed itself to achieving an average inflation rate of 2% over time, as part of its review of longer-run goals and monetary strategy.

At the time, senior policymakers noted inflation had been below target “persistently” in recent years, so it should be allowed to run modestly above target for some time to return the average to 2%.

But they offered no guidance on when they believe the undershoot began, how big a price-level deficit they are seeking to correct, or how many years inflation will be averaged over in measuring compliance with the target.

The recent surge in core consumer prices following the re-opening of the economy has now erased all the undershooting in core consumer price inflation since April 2009.

Understanding CTC

The Child Tax Credit is being likened to a universal basic income for children, although it has income limits. It is expected to help people meet monthly expenses from rent to food and daycare.

The Center on Poverty and Social Policy at Columbia University estimates the expansion can reduce the U.S. child poverty rate by up to 45%.

Critics say the expanded credit is expensive and may discourage people from working. Some experts say it may not reach some of the poorest Americans who are not in the tax system.

The Democrat-backed $1.9 trillion covid-19 legislation known as the American Rescue Plan enacted in March increased how much is paid to families under the program.

The law made half of the tax credit for the 2021 tax year payable in advance by the Internal Revenue Service in monthly installments from July through December this year.

Biden proposed making the monthly advance payments permanent and maintaining expanded benefits through 2025 at least.

Biden sees U.S. child tax credit as 'giant step' to counter poverty

Some 35 million American families have started receiving their first monthly payout from the U.S. government in an expanded income-support program that President Joe Biden said could help end child poverty.

Under the Child Tax Credit program that was broadened under Biden's covid-19 stimulus, eligible families collect an initial monthly payment of up to $300 for each child under six years old and up to $250 for each older child.

Payouts made to families, covering nearly 60 million eligible children, totaled about $15 billion for July. The payments are automatic for many U.S. taxpayers, while others need to sign up.

Biden wants to extend expanded, monthly benefits for years to come as part of a $3.5 trillion spending plan being considered by Senate Democrats, who expect strong Republican opposition to the full bill.

"It's our effort to make another giant step toward ending child poverty in America," Biden said in a speech. "This can be life changing for so many families."

Dollar higher after upbeat U.S. retail sales data

The dollar edged higher on Friday, on track for a weekly gain and supported by upbeat retail sales data boosting expectations that economic growth accelerated in the second quarter.

The dollar index, which measures the greenback against a basket of six currencies, was 0.157% higher at 92.718.

The index is on pace to log a gain of 0.6% this week, its biggest weekly rise in about a month.

U.S. retail sales unexpectedly increased in June as demand for goods remained strong even as spending was shifting back to services.

Solid U.S. data and a shift in interest rate expectations after the Federal Reserve flagged in June sooner-than-expected hikes in 2023 have helped lift the dollar in recent weeks and made investors nervous about shorting it.

Friday's gains for the dollar came despite Fed Chair Jerome Powell reiterating on Thursday that rising inflation was likely to be transitory and that the U.S. central bank would continue to support the economy.

"The data was consistent with the economy making substantial strides and cements expectations of very robust second quarter growth of around 10%," said Joe Manimbo, senior market analyst at Western Union Business Solutions in Washington.

"A backdrop of rising inflation, falling unemployment and a resilient consumer makes a compelling case for the Fed to unwind stimulus," Manimbo said.

Mortgage rates fall: Is it a good time to refinance my mortgage?

The average interest rate for a traditional mortgage has fallen to the lowest level since February, but is now a good time to be buying a house?

What states have ended federal unemployment benefits and are more people working?

25 states have cut at least the federal $300 booster to unemployment benefit early, if not all pandemic benefits, only 15 saw significant job growth.

Which states have resumed unemployment payments as the lawsuits increase?

Across the country 26 states had opted to end the additional jobless benefits early but lawsuits in at least five states may help to reverse those decisions.

Stimulus check live updates: welcome

Hello and welcome to our daily live blog for today, Saturday 17 July 2021, bringing you updates on a possible fourth stimulus check in the US.

We'll also provide you with information on the third round of stimulus checks, which began going out in March as part of President Biden's American Rescue Plan, in addition to news and info on other economic-support programs such as the new, expanded Child Tax Credit.

- Joseph Biden

- Washington D.C.

- Coronavirus stimulus checks

- USA coronavirus stimulus checks

- Nancy Pelosi

- Detroit

- Chicago

- Michigan

- Seattle

- Illinois

- Science

- Coronavirus Covid-19

- United States

- Pandemic

- Coronavirus

- North America

- Virology

- Outbreak

- Infectious diseases

- Microbiology

- Diseases

- America

- Medicine

- Biology

- Health

- Life sciences