Why do I get $300/$250 from Child Tax Credit and not $3,600/$3,000?

Families will receive half of the enhanced 2021 Child Tax Credit this year, the remainder will arrive in tax refunds in 2022, if extended that would change.

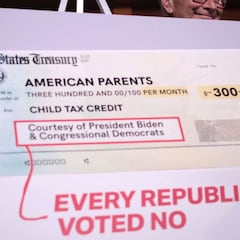

The IRS sent the first payments for the expanded 2021 Child Tax Credit this week. The changes to the tax credit were included in the Democrats’ American Rescue Plan enacted in March which gave the IRS four months to get the program up and running.

The changes are currently only for the 2021 fiscal year but the Democrats included the expansion with the expectation that the modifications would be extended. This means that families will receive only half the credit in advance payments this year instead of the whole credit being split into equal monthly installments in 2021. However, should the changes be extended families would receive the whole of the credit due to them in 12 monthly installments of up to $300, or they can choose to wait and receive the whole credit they are eligible for the following year.

Child Tax Credit: what is the income limit for joint filers, single filers and heads of household?

$3000/$3600 Child Tax Credit: what if I'm divorced?

Is there a limit of children a family can claim for the $3,000 to $3,600 Child Tax Credit?

What happens if I don’t want to receive the $3,000 or $3,600 Child Tax Credit Monthly payments?

American Families Plan would extend the changes to the Child Tax Credit

Proposals for extending the program are already being worked on in Congress which would be included in a Democrat-only “soft” infrastructure bill. This bill is expected to be passed in parallel to the $1.2 trillion bipartisan “traditional” infrastructure bill currently taking shape in the Senate.

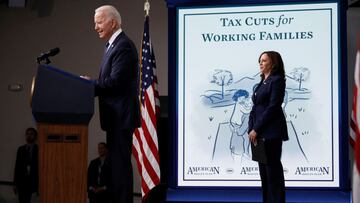

President Biden has asked for the program to be extended until 2025 when an earlier expansion of the tax credit will expire as well. Progressives in Congress want to make the changes permanent but that most likely won’t be possible at this juncture.

Starting today, American families will receive monthly payments up to $300 per child from the Child Tax Credit.

— Vice President Kamala Harris (@VP) July 15, 2021

This is a historic day in America. pic.twitter.com/rj4CUNGdZQ

At the moment there are no Republican votes for the Democrats family infrastructure bill which would include the extension. So, if as planned, Democrats use reconciliation, whereby they can pass the legislation with a simple majority in the Senate, all spending measures included will be time limited. Democrats have stated that the extension of the Child Tax Credit enhancements will be included but there are no details on how long.

2021 Child Tax Credit; half now, half later

The American Rescue Plan gave millions of parents a large tax cut for the 2021 fiscal year and not just with the enhanced Child Tax Credit. There were changes to the Earned Income Tax Credit and the Child Dependent Care Credit. In addition to the third Economic Impact Payment (EIP), or stimulus check. Like the EIPs, the 2021 Child Tax Credit will be paid out in advance, if parents don’t opt out of the monthly payments.

Have you received your first child tax credit payment?

— Rep. Josh Harder (@RepJoshHarder) July 17, 2021

Here's how it works: You’ll get roughly $3,000 per kid over the next year. Half of that will come in a monthly deposit just like your stimulus check and the other half will come when you file next year’s taxes.

The full credit is $3,600 for each child under six years of age and $3,000 for every child six to 17. If extended, the credit would be broken into 12 installments of up to $300 or $250 over the year depending on a child’s age. The age limits apply to the age of a child at the end of a fiscal year, so if a child turns 18 for example before 1 January of 2022, they will not qualify for the 2021 Child Tax Credit. Since payments began in July, parents will receive six installments this year and collect the remainder of the tax credit when they file taxes in 2022.

Why didn’t 2021 Child Tax Credit payments begin sooner?

The changes have been mooted for years by Representative Rosa DeLauro of Connecticut who first introduced a significant expansion of the Child Tax Credit in 2003, and every year since. Given that the Democrats want the program to be extended beyond the 2021 fiscal year, it was set up with the expectation that the changes would carry on beyond 2021.

I had the opportunity to talk with @Lawrence about this historic investment in our children and families.

— Rosa DeLauro (@rosadelauro) July 17, 2021

Vanessa Pierre told the story that so many American families face—a #ChildTaxCredit provides families with the opportunity to feel economically secure and seen. pic.twitter.com/FR9nfezbej

Related stories

Likely stars of Olympic football: Amad, Bryan, Claudinho...

The changes weren’t meant to be a one-year affair but currently are due to the limitations imposed on what could be spent in the American Rescue Plan. When the Democrats used reconciliation to get the sweeping bill through Congress, dodging a Republican filibuster, to keep the bill's total cost under $1.9 trillion, the Child Tax Credit could only be expanded for the 2021 fiscal year. The program will cost about $110 billion in 2021.

Since the American Rescue Plan was enacted in March, the IRS needed time to get such a complex program up and running. The agency was given four months so that payments would begin in July. There were initial worries that they IRS would not have enough time given the tremendous workload they’ve had to handle since the onset of the pandemic, operating with 20 percent less staff and budget than a decade ago. However, in spite of all the challenges the IRS managed to meet the deadline.

- IRS

- Coronavirus stimulus checks

- USA coronavirus stimulus checks

- Child benefits

- United States Senate

- Covid-19 economic crisis

- Science

- Social support

- United States Congress

- Coronavirus Covid-19

- Economic crisis

- Inland Revenue

- Taxes

- Partido Demócrata EE UU

- United States

- Pandemic

- Tributes

- North America

- Parliament

- Economic climate

- Virology

- Outbreak

- Infectious diseases

- Social policy

- Public finances

- America

- Medicine

- Economy

- Society

- Politics

- Finances

- Biology

- Life sciences

- Diseases