Can parents split the 2021 Child Tax Credit?

The Biden administration hopes that the reformed tax credit will provide vital support for American families but there is some confusion over who should receive it.

Last week the IRS started sending out the first batch of monthly payments as part of the new-look Child Tax Credit, with an estimated 35 million families having now received the support.

From 15 July until at least the end of 2021, eligible families will receive a monthly payment of up to $300 per child aged under six and $250 for each child aged between six and 17.

However this new system presents a problem for parents who are separated because the IRS does not allow them to split the tax credit. Guidance on the IRS website makes clear: “If two taxpayers have the same qualifying child, then only one taxpayer can claim all of the benefits for that particular qualifying child. They cannot agree to split these benefits.”

Read more

- Child Tax Credit: what is the income limit for joint filers, single filers and heads of household?

- Is there a limit of children a family can claim for the $3,000 to $3,600 Child Tax Credit?

- What happens if I don’t want to receive the $3,000 or $3,600 Child Tax Credit Monthly payments?

Which parent will receive the Child Tax Credit?

Although the decision is essentially down to the parents themselves to decide who claims the child as a tax dependent, it is typically whichever parent has custody of the child the most. Some parents choose to alternate the tax dependent status on an annual basis to ensure that they both receive the benefits equally.

If both parents claim the child as a tax dependent the IRS will “treat the child as the qualifying child of the parent with whom the child lived for the longer period of time during the tax year.” If the child lived with both parents equally, the child will be considered the tax dependent of whichever parent has the highest Adjusted Gross Income (AGI) for that tax year.

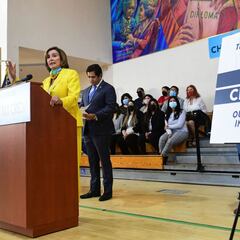

My mother and grandparents sacrificed to make sure that I was well-nourished and had the healthy start to life that every child needs. Proud that the expanded Child Tax Credit is helping families like mine and helping lift millions of America's kids out of poverty. pic.twitter.com/dqSxQPRcLs

— Jaime Harrison, DNC Chair (@harrisonjaime) July 22, 2021

If neither parent claims the child as a tax dependent then that status will automatically be allocated to whichever parent has the highest AGI. The IRS makes clear that these rules are designed to help taxpayers decide who should claim the child as a dependent, but will also be used as a tie-breaker by the IRS in the event that a child is claimed on more than one tax return.

Should separated parents opt out of the monthly Child Tax Credit payments?

In most cases the decision over who should claim the claim as a tax dependent is fairly straight-forward with one patent often providing the majority of the childcare. However even if this is the case there are still other things to consider.

Related stories

Janet Holtzblatt, senior fellow at the Urban-Brookings Tax Policy Center, warns that parents may want to opt out of the monthly payment structure because “there’s a risk that if you’ll have to repay it.” If the recipient of the Child Tax Credit monthly payments has a higher AGI than expected for 2021 they may become retrospectively ineligible for the support and be forced to pay the money back.

For more information on the reasons why people may opt out, and how to do so, check out Why should some families opt out of the advance 2021 Child Tax Credit payments?