Fourth stimulus check news summary: 2 October 2021

Updates on the fourth stimulus check as the Democrats look to pass the $3.5 trillion reconciliation bill after narrowly avoiding a shutdown.

Show key events only

Stimulus checks and Child Tax Credit: live updates, Saturday 2 October 2021

Headlines

- Proposed $3.5 trillion reconciliation bill would lower the Medicare eligibility age to 60.

- Short-term spending package averts government shutdown until new 3 December deadline.

- Residents in some states will receive a fourth stimulus check in October.

- Speaker Pelosi says that this week House of Representatives could vote on the bipartisan infrastructure bill, which was passed by the Senate in August.

- Treasury Secretary Janet Yellen rings alarms bells over federal government running out money in October.

Useful information/Info

Medicare and Social Security

- When are the social security pay dates for 2021 and 2022?

- What is the maximum monthly Social Security paymentin 2021?

- What are the social security disability benefits by state?

- All you need to know about the 2022 Social Security "Cost-of-Living-Adjustment"

- Medicare deductible expected to increase to $7,050

- A Guide to Medicare Advantage Plans

Take a look at some of our related content:

How much were the first, second and third stimulus checks and when were they sent out?

So far, three stimulus checks have been distributed by the US federal government since the coronavirus pandemic began in early 2020.

How many unemployment claims have there been in September 2021?

September saw more than 1 million new applications for unemployment benefits, a large number but well below previous pandemic months. If all weekly applications are added together, the total is 1.36 million applications. Not all of these will be accepted however, due to the terms of benefit eligibility that many people who have been on the expanded pandemic benefits will be unable to claim.

The monthly average, to smooth out volatility in the figures, was 340,000, just above the lowest level since the covid-19 pandemic began. Despite the lows, they still remain far above the pre-pandemic average of 218,000.

Weekly jobless claims grew in the last week of September

The reading was above expectations of 330,000 following the prior week's 351,000.

The job market has been showing steady improvement this year, despite the Delta variant causing fluctuations in the data. Some businesses have forced to adopt new restrictions such as masking and vaccine mandates at the same time as states opening up. The past few weeks have seen jobless claims higher than expected.

Will the Social Security increase in 2022 be $200?

In October, the Social Security Administration (SSA) will announce the 2022 Cost-of-Living-Adjustment, or COLA as it is more commonly known. The COLA, which is tied to the Consumer Price Index, aims to ensure that the purchasing power of those on Social Security is not impacted by the year-to-year price increase caused by inflation.

This year the increase is expected to be historic, with prices trending upward across many goods. While rumors have circulated that the COLA could be $200, the increases are calculated as a percent, not a sum of money.

Where most children are at risk from missing out on the Child Tax Credit?

The Tax Policy Center has released a list of the places in America where it believes are most at risk of missing out on the checks.

This is because the CTC needs a filed tax return from 2019 and 2020 in order to be sent out. Cities with high levels of undocumented migrants are very unlikely to have parts with this information, meaning their families will miss out on the benefits.

Funding weapons or welfare

Head of the progressive caucus in the House Pramila Jayapal tweeted her disdain for how willing US politicians are to vote through massive weapons spending instead of bills that will actually help Americans.

Billions of taxpayer money is funded into private corporations weapons contracts, while millions of children in the country live below the poverty line. The Build Back Better act will hopefully arrest this, as evidenced by the research which showed child poverty would be cut by 40 percent if the Child Tax Credit was extended to 2025.

Child Tax Credit to have long-lasting effect on child welfare

Data shows that lifting children out of poverty helps to improve their health and school performance, and makes them more likely to be employed as adults, helping the economy in the long term. A Columbia study providing a cost-benefit analysis of the expanded Child Tax Credit found that increasing the credit and making it refundable would result in an increase in children’s future earnings in adulthood by $76 billion. It would also reduce the amount the government spends on health care for children, and could be seen in that aspect as a cost-saving measure.

More than 400 economists, including several Nobel Prize winners in economics sent a letter to Chuck Schumer and Nancy Pelosi earlier this month arguing that the expanded Child Tax Credit “can dramatically improve the lives of millions of children growing up in the United States and promote our country’s long-term economic prosperity.”

The expansion of the credit is tied up in the bills in Congress this month, but there is still no certainty that they will be both be signed by the president.

What is the maximum amount you can earn from Social Security in 2021?

Despite the turmoil of this week's debt limit being reached, and the potential impact it could have had on Social Security payments, the news of the short-term spending bill is only good news for recipients. Payments will continue as usual.

The terms of how much money payments will be for seniors depends mostly on the age of retirement. The most an individual who files a claim for Social Security retirement benefits in 2021 can receive per month is:

- $3,895 for someone who files at age 70,

- $3,148 for someone who files at full retirement age (currently 66 and 2 months),

- $2,324 for someone who files at 62.

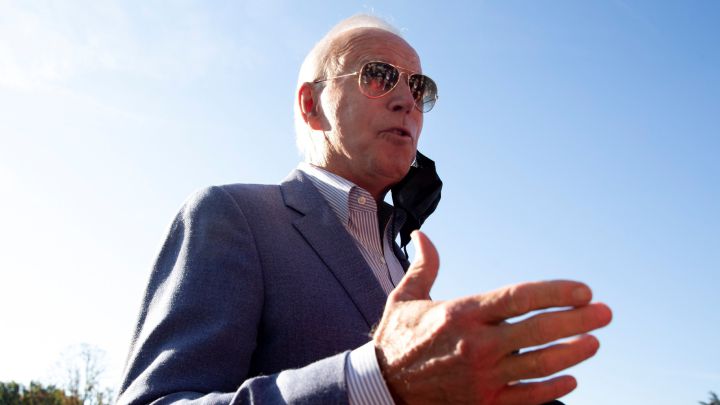

Biden to push more for bills

The president on Saturday acknowledged criticism that he had not done more to drum up support for the bills by traveling around the country. He said the bills were designed to make life easier for ordinary Americans by making child care affordable, for example.

"There's nothing in any of these pieces of legislation that's radical, that is unreasonable," Biden said. "I'm going to try to sell what I think the people, the American people, will buy."

Pressure growing to pass the bills

With the postponing of the passing of the infrastructure and reconciliation bills until the end of the month, pressure is growing to get the bills over the line. Moderates and progressives have been threatening to water down or outright stop the bills passing if their demands are not met. A careful balancing act is taking place.

If the bills were not to pass, it would almost certainly mean the Democrats would lose the midterm elections with no solid policy passed in the two years of the Biden presidency.

What's the difference between Social Security SSI and SSDI?

Social Security provides payments for over 63 million beneficiaries and currently around one in five Americans receive a Social Security benefit of some kind. The far-reaching programme has been hailed as the most successful anti-poverty implement in US history, but there is still some confusion about it is structured.

Two of the most common programmes from the Social Security Administration (SSA) are the Supplemental Security Income (SSI) and Social Security Disability Insurance (SSDI). These initiatives provide financial assistance for senior citizens and those living with disabilities.

Bills postponed

The House speaker, Nancy Pelosi, has set a new deadline for the House to pass a major infrastructure spending bill after a week of negotiations left Joe Biden’s social and environmental policy overhaul plan in a limbo. Child Tax Credits would be first on the chopping block if the bills don't get passed.

In a letter to House Democrats on Saturday, Pelosi said that the House will have until Sunday 31 October to pass the $1 trillion bipartisan infrastructure bill, which passed the Senate in August.

Child Tax Credit could slash childhood poverty

Earlier this week, Treasury Secretary Janet Yellen said that the first month of Child Tax Credit payments alone had cut food insecurity in the United States by a quarter. A new study by Gregory Acs, vice president for income and benefits policy at the Urban Institute, has suggested that passing an extension beyond 2021 would cut child poverty even further.

The report claims that an extension through 2025, as President Biden has propsed, could reduce it to about 8.4% from 14.2%, a fall of roughly 40%.

When are the Social Security pay dates for 2021 and 2022? Full schedule by month

Some last-minute negotiations allowed Congress to pass a stopgap funding bill on Thursday night, ensuring that there will be no delays in the distribution of federal payments. Some of the most important are Social Security, which tens of millions of Americans rely on every year.

With the payments secured, for the next two months at least, we take a look at the payment dates for Social Security recipients across the country.

Fourth stimulus check would provide boost for low earners

After an underwhelming August jobs reports there were some suggestions that additional financial relief would be needed to provide support for low earning households. A study released recently in conjunction with the Capital One Marketplace Index found that 46% of lower earners would not have had enough money to cover their expenses last April without the third stimulus check from the federal government.

As the US braces for what could be a tough winter, a number of states and local authorities have opted to provide their own forms of direct support, with stimulus checks going out to residents.

“Thanks to the American Rescue Plan, families across the country will begin receiving monthly Child Tax Credit payments today. In our community, nearly 3 in 4 children will receive these payments, putting money in the pockets of parents to help pay for mortgages, child care, summer learning, and more, as we continue to recover economically from the pandemic."

“The Child Tax Credit will deliver critical resources to families when they need it most, but let’s be clear: families need support well beyond this pandemic. I’m fighting in Congress to permanently expand these Child Tax Credit payments, so our families have the resources needed to thrive this month and into the future.”

What does the stopgap spending bill signed by Biden include?

The federal government narrowly avoided disaster earlier this week, when Congress was finally able to pass a short-term funding package to ensure that the government was not forced into a shutdown on Friday.

This could have been catastrophic to the US' ecomonic recovery and the Democrats were forced to agree to a more limited package than they had initially hoped. But what, in total, was included in the new funding bills?

Yellen outlines benefits of the Child Tax Credit

Treasury Secretary Janet Yellen has been giving testimony in Congress, at a House Financial Services Committee hearing entitled: “Oversight of the Treasury Department’s and Federal Reserve’s Pandemic Response".

She used some of her time in front of lawmakers to highlight the benefits that the Child Tax Credit monthly payments have already had on American society. Yellen told lawmakers: "After first payments in July, food insecurity among families with children dropped 24%." The White House is hoping to secure an extension to the programme in the coming weeks.

Would Social Security be affected by a debt default?

Although Congress was able to pass a short-term funding bill in time to avert a government shutdown earlier this week, there is still the chance that the United States could default on its debts for the first time ever later this month. That would be ruinous for the US economy, particularly as it struggles to recovery from the consequences of covid-19.

However, some areas of federal spending are ring fenced and should not be affected by a default. Social Security is one of them, and recipients should continue to receive their payments even if the unthinkable happens.

Stimulus funds or Strike Fighter?

Shahid Buttar, a 2020 congresssional candidate for San Francisco, has drawn attention to the huge cost attached to the development of a proposed armed GJ-11 drone, at a time when Congress is wrangling over stimulus spending. There remains significant, and potentially insurmountable, opposition to the large-scale reconciliation package which would provide a four-year extension to the Child Tax Credit expansion which has already brought millions of children out of poverty in the United States.

What are the social security disability benefits by state?

Although all beneficiaries of Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) receive the same amount from the federal government regardless of where you live, you might or might not receive a top-up to your monthly SSI payments depending on where you live in the US.

Child Tax Credit could well be included in infrastructure bill

There is renewed hope that an extension to the Child Tax Credit programme can be included in the infrastructure package, despite disenting voices from some progressive Democrats. Sen. Joe Manchin, amongst others, has publically come out against the idea but could be persuaded by this new, smaller proposal.

How are Child Tax Credit monthly payments being spent?

The IRS has been sending out monthly payments as part of the advance Child Tax Credir since the middle of July, and studies are already starting to show how the money is being spent. THe most popular use of the funds is 'Emergency Savings', perhaps unsurprising given the turmoil and uncertainty of the last 18 months. In a close second is 'Housing, food, and utilities', which has been utilised by nearly two-thirds of all Child Tax Credit recipients, according to figures from Humanity Forward.

Progressive lawmaker calls for additional stimulus checks

The prospect of a fourth stimulus check has gone quiet in Congress in recent weeks but as covid-19 continues to claim thousands of lives everyday, there are renewed calls for additional direct payments. Progressive Rep. Cori Bush argues that more stimulus checks, and a return of the eviction moratorium, are needed to ensure that vulnerable Americans are protected during what could be another very tough winter.

Child Tax Credit monthly payments tackle food insecurity

In the months leading up to its introduction, the White House was effusive in its expectations of the Child Tax Credit expansion. In the early months there were some issues getting the money out to certain low-income families, who had to provide their details to the IRS before the payments would arrive.

However, despite this, the early signs suggest that the programme has had a considerable impact on the household economic for millions of struggling families. Treasury Secretary Janet Yellen has cited a 24% drop in food insecurity since the programme began.

Which states will pay additional stimulus money in October 2021?

For now, President Biden is focusing his efforts on ensuring that Congress passes a large-scale infrastructure plan as part of the huge $3.5 trillion reconciliation package. This appears to have taken precedence over hopes of a fourth stimulus check, but some states have taken matters into their own hands and are offering one-off direct payments for residents.

Will the Child Tax Credit be extended to 2025?

One of Biden's big hopes with the reconciliation bill is the extension of the CTC until 2025.This is doable if the bill stays at $3.5 trillion, but much lower and there will be a real squeeze on funding for the credit.

The CTC has already had myriad benefits, and any cut to them would have a huge impact on the millions of families already receiving them. More than 85% of US families are eligible for the payments.

When is the next Child Tax Credit payment?

The Child Tax Credit has been sent out since July and it has been very popular. Who wouldn't object to an extra $300 dollar in their bank account each month? Studies have proven its positive effects on recipients mental health, lifting millions out of poverty, and, surprising for some, an extra willingness to find work.

Three payments have been sent so far; July, August and September, with the next due in two weeks on October 15. The opt-out date is on October 4, so if you think it may be beneficial for you to opt out, then you must do so by this date. This can be done by using the IRS portal here.

Alabama GOP governor signs bills to use Covid-19 relief funds to build prisons into law

CNN - Alabama Gov. Kay Ivey signed into law Friday a number of prison infrastructure bills that will use coronavirus relief funds to build new prisons in the state, calling it a "pivotal moment for the trajectory of our state's criminal justice system."

Ivey, a Republican, had convened a special session of the Alabama Legislature to discuss how to fix what she has called a decades-long problem of prison infrastructure challenges. The governor said Friday's bill signing was the culmination of hard work and conversations between lawmakers on both sides of the aisle.

"I'd like to personally offer my thanks to the legislative leadership who are standing behind me right here, for a successful special session, and what we believe will yield untold benefits to all Alabamians in the days ahead," Ivey said.

Progressives exult in new-found power

The Hill - Progressive Democrats are celebrating a moral victory this weekend, even as the outcome of the broader battle to enact a huge social-spending bill remains in doubt.

Left-wingers say a dramatic week has shown they have far more muscle within the party than they have enjoyed in a generation — and that they’re willing to use it.

The decision by Speaker Nancy Pelosi (D-Calif.) late Thursday night to postpone a scheduled vote on a $1 trillion infrastructure package was seen by the left as a triumph over their most conservative party colleagues.

Will progressives lose the leverage on Biden's agenda spending bill?

House progressives say they will vote down the roads and bridges infrastructure bill if it is put to a vote in the lower chamber before the larger $3.5 trillion spending bill based on the Build Back Better plan the Biden Administration has laid out. They fear that if the smaller infrastructure bill becomes law momentum will wane to pass the more expansive parts of President Biden's agenda will go in the dust bin.

GOP lawmakers are universally opposed to the Democrats larger bill that would expand America's social safety net, providing child care, free college and expanding healthcare, along with measure to tackle climate change and the challenges it presents in the future.

The Republican party is also whipping votes in the House against the bipartisan deal, that if passed in the lower chamber would go to the President's desk to become law. Without that bill waiting for a vote in the House, the progressives wouldn't have the leverage they currently have.

Some GOP congressional members are trying to get their fellow Republicans on board to overcome the 50 or so "No" votes from Democrats to move the infrastructure bill forward. Which ones and which progressives have publicly stated they are a "No" until the larger bill passes?

This is a $0 spending bill

Senator Cory Booker wants his Democratic Senate colleague Kyrsten Sinema, who is resisting voting for the larger bill the House is working on, to say what she wants to include in the bill and not talk about the top line number.

He says that the Democrats' bill, if calculated on the measure that Republicans used to calculate the 2017 tax cuts, would be a zero cost bill. In order to pay for the $3.5 trillion in spending over the next ten years, along with raising taxes on the wealthy and corporations, tax loopholes would be closed so that the wealthy and corporations would pay the taxes they can currently avoid.

Time left for parents to update info or opt out of Child Tax Credit

Eligible parents looking to update banking or address information or to opt out of the Child Tax Credit have a couple days left to do it.

States ask for benefits back

States are asking some Americans that received unemployment assistance due to the Covid-19 pandemic to pay back benefits.

Virtue of the enhanced Child Tax Credit

The American Rescue Plan made major changes to the Child Tax Credit which has been around since the 1990s. The tax provision was made fully refundable so that even those who didn't pay as much in tax as the full amount of the credit still receive the entire amount. This allowed far more families to take advantage of this tax break, especially those with lower incomes.

Another major change was the advance payment scheme. In 2021 families will receive half the credit in 6 installments and the remainder in 2022 when they file their taxes. This financial stability on a monthly basis, besides helping families cover the basics, has given Americans trying to start a business more security or allowed parents to work more.

The revamp is only for the 2021 fiscal year, but an extension of the changes until 2025 has been included in the Build Back Better legislation. However, resistance from two moderate Democratic Senators is putting that extension in peril.

The claim: A federal infrastructure bill includes an 'animal agriculture tax' of $2,600 per head of cattle

As Congress deliberates trillions of dollars worth of spending on infrastructure and social welfare programs before a looming government shutdown, some online claim the legislation includes a new tax on farmers.

A September 27 Facebook post says the "$3.5 Trillion Infrastructure package includes an animal agriculture tax on dairy cows in the amount of $6,500.00 and $2,600.00 per head of other cattle."

"It also includes an agriculture tax in the amount of $500.00 on swine (pigs- hogs) raised in the United States," the post says. "AND that would be for each and every year."

Mitt Romney blasts House Democrats over infrastructure stalemate

Sen. Mitt Romney on Friday blasted House Democrats for blocking a bipartisan infrastructure bill due to disagreements within the party.

The Utah Republican tweeted Friday that House Democrats made a “purely political decision” to block the $1.2 trillion bill, which he said is “much-needed broadly supported legislation to fix America’s crumbling infrastructure.”

“It is unacceptable that a major piece of bipartisan legislation, which is vital to our economy and necessary to keep important transportation programs going, is being held hostage by the most extreme House Democrats for a completely unrelated and still unwritten piece of legislation,” Romney said.

Medicare vs Medicaid: what are the differences?

In the United States, there are two semi-public health insurance schemes: Medicare and Medicaid.

Together, Medicare and Medicaid provide health insurance to more than 143 million people in the United States. Each program serves a specific demographic group and is funded through different state and level budget mechanisms.

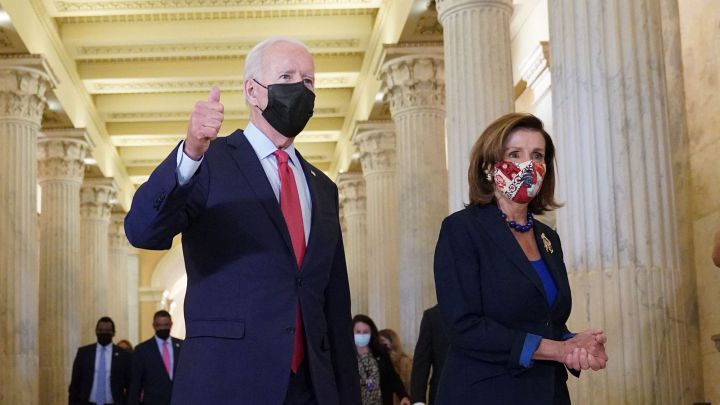

In Capitol visit, Biden tries to make peace with feuding Democrats

Reuters - In a rare visit to the U.S. Capitol, President Joe Biden tried on Friday to end a fight between the moderate and progressive wings of his Democratic Party that threatened to torpedo his domestic agenda.

Faced with a moderate faction that wanted an immediate vote on a $1 trillion infrastructure bill and a progressive arm that wanted to wait until there was agreement on a sweeping $3.5 trillion bill to bolster social spending and fight climate change, Biden sought to split the difference.

The former senator told his caucus during a 40-minute meeting that they could delay a vote on the smaller bill and sharply scale back the larger one to around $2 trillion. But his message that there was no rush belied the fact that Congress faces multiple approaching critical deadlines.

"It doesn't matter whether it's in six minutes, six days or in six weeks. We're going to get it done," Biden said.

A source familiar with Biden's remarks at the meeting said he told lawmakers, "Even a smaller bill can make historic investments."

Consequences of not passing the infrastructure bill

When the bipartisan infrastructure bill didn't come up for a vote on Thursday it had real-world consequences. Included in the roads and bridges bill was funding Highway Trust Fund that wasn't included in the stopgap bill passed hours before the government was set to shutdown.

The result was nearly 3,600 workers being furloughed Friday. Congress is voting on passing separate highway extension bill on Friday to keep the fund solvent for the time being.

Does Medicare cover covid-19 testing?

When the pandemic began many on Medicare were concerned that costs associated with the virus would not be covered by their plan. However, the federal government acted quickly to ensure that beneficiaries would be able to access care without paying any additional money out of pocket.

The Kaiser Family Foundation reported that still, even with vaccines, “people 65 and older have been at greatest risk of hospitalization and death due to COVID-19 compared to other age groups, and represent nearly 80% of all COVID-19 deaths as of September 29, 2021.”

Which states saw decreases in unemployment in August?

Check out the data tool launched by the Bureau of Labor Statistics to break down changes seen in the unemployment at the state level in August

Markets hold steady

Markets continue to hold steady as the debate over the debt ceiling makes no progress towards avoiding a default.

Would the $3.5 trillion reconciliation bill lower the Medicare eligibility age?

One of the most significant changes the reconciliation bill could make would be the lowering of the Medicare eligibility age from sixty-five to sixty.

President Biden made this a central part of his campaign, and the measure holds fairly widespread support from the public. A Data for Progress poll conducted in August 2021 found that around 60 percent of respondents said they were in support. Support is most substantial among Democrats (75%) and Independents (53) and lower for Republicans (48%).

On 3 September, 100 Democrats on Capitol Hill introduced a bill that lowered the eligibility age, with the hopes of having it included a reconciliation bill. In a press release put out by the co-sponsors, they noted that "Up to 25 percent of those ages 60 to 64 experience being uninsured before turning 65."

Do the majority of Americans support lowering the Medicare eligibility age?

Yes.

A Data for Progress poll conducted in August found that the measure was supported by around 60 percent of respondents.

President Biden visits lawmakers to smooth over differences

President Biden's agenda is under assault from both wings of his party even though the vast majority of Democratic lawmakers want to pass it according to members of the party. So what's the problem?

The two wings of the party made a deal, instead of passing the whole kit and caboodle in one go using reconciliation, whereby they could avoid a GOP filibuster, but they would have had to rely only on votes only from their party, just as they did for the American Rescue Plan. The Build Back Better plan was split into two parts.

Hoping to show that bipartisanship could still work in Washington, centrists Democrats stripped of the "hard" infrastructure of the bill to pass the "bipartisan infrastructure bill" on the guarantee that the rest of Biden's agenda would be passed in tandem using reconciliation.

Now the bipartisan bill is awaiting a vote in the House, but progressive won't let it move forward until moderates keep their word on the other part of the deal. President Biden paid lawmakers a visit on Friday to see if he couldn't bridge the divide in person.

Hello and welcome to the AS USA stimulus check live feed

We'll be bringing you all the latest news on the prospect of another round of direct payments, as well as negotiations in Congress for the Democrats' $3.5 trillion reconciliation bill after a government shutdown was narrowly avoided last night.

Some lawmakers are still pushing for a return to the additional pandemic unemployment benefits, while the long-awaited Child Tax Credit extension is still being negotiated in the Build Back Better plan.