Fourth stimulus check: COLA 2022 benefits, Medicare, Child Tax Credit… | Summary 24 december

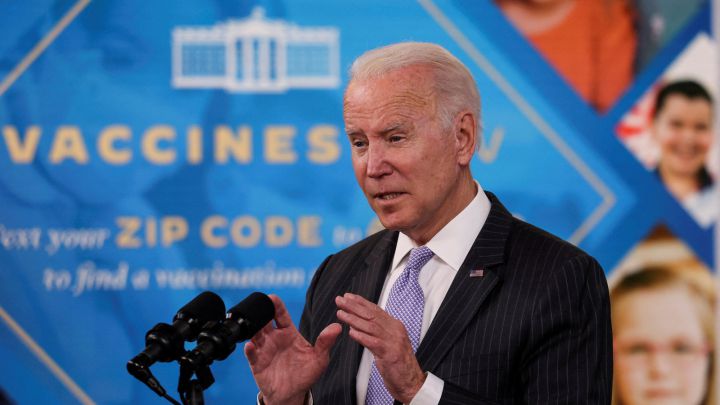

Latest updates and information on President Joe Biden's Build Back Better bill, and news on a fourth stimulus check, the Child Tax Credit, and Social Security payments.

Show key events only

Headlines

- Some parents will receive $8,000 stimulus checks this spring.

- Biden extends the student debt moratorium to May.

- As Omicron causes business closures, will a fourth stimulus check be passed to combat the economic losses?

- West Virginia Senator Joe Manchinsays he can't support Build Back Better bill

-"There will be more negotiations," says White House Press Secretary Psaki

Useful information & links

Child Tax Credit

- What next for the Child Tax Credit after Build Back Better bill talks stall?

-Why does Manchin oppose the Build Back Better bill?

- Final monthly CTC payment of 2021 sent out on Wednesday 15 December

Stimulus checks

-New parents could see another stimulus check reflected in their tax refund in 2022

-What's the deadline to get your stimulus check plus-up payment in 2021?

Social Security

- How many Social Security payments are there to go in 2021?

- When does COLA 2022take effect for Social Security benefits?

-5.9% COLA increase - how much difference will it make to Social Security benefits?

Latest articles:

Democrats face "worst case scenario" after Build Back Better collapse

Party infighting, rush votes, and failed negotiations have led Democrats to this point which Chris Cillizza says represents the worst-case scenario as the party enters an election year. Watch the video to see how Democrats got here and what they can do to increase their electoral chances this fall.

Will families receive a child tax credit payment in January?

No. Since Congress did not pass the Build Back Better bill families will not receive payment in January. However, they will be able to claim half of the value of the credit that was not distributed when they file their taxes this spring. Some may see payments as large as $8,000. Read more.

Rep. Barbara Lee tweets support for healthcare workers taking care of loved ones during the holidays. After nearly two years on the front lines of the pandemic, many medical professionals are burnt out and exhausted. They will get no break soon, as cases of the Omicron variant lead to an increase in hospitalizations around the country.

Are unemployment claims increasing?

While unemployment rates remained at their pre-pandemic level for the week ending on 18 December, the weekly average inched up a touch to "206,250, an increase of 2,750 from the previous week's revised average."

States that saw the largest increases in initial claims included Missouri (+7,344), Kentucky (+3,600), Illinois (+1,171), Nebraska (+1,032), and Tennessee (+705).

How have people spent their Child Tax Credit?

There has been opposition to the enhanced child tax credit amid claims that parents would blow their money on drugs instead of providing for their children's needs.

Studies however are showing that those who have received child tax credit payments have actuallly spent them on critical essentials such as food, rent, and utilities.

Low-income workers may receive up to $6,000 tax credit in 2022

A federal benefit for low-income workers known as the Earned Income Tax Credit (EITC) aims primarily to assist those with children and families.

The EITC functions as a tax credit with benefits. The credit can be refunded, so taxpayers may be able to receive their credit in cash.

Although principally targeted towards those with families, low-earning workers without children can also receive credits.

Unemployment claims unchanged staying historically low

Jobless claims remained at 205,000 for the week ending in 18 December. Unemployment is at historically low levels as the economy has recovered from the initial damage done by covid-19 pandemic.

The four-week average rose by 1,000 to just over 206,000. The data suggest that the spread of the omicron variant hasn't immediately triggered a wave of layoffs.

Build Back Better, final piece of the puzzle

President Joe Biden came to office with bold plans to rebuild the US pandemic-stricken economy. Although a president gets a four-year term, in modern history most lose their majority in the House in the mid-term elections.

Due to the election cycle then, a new president must get their entire agenda passed in the first year in office, minus a miracle that the remaining two years of their first term that they have a Majority in the House. Even then, they would potentially have to deal with an adverse Senate.

The Build Back Better Act, the final part of Biden's plan with the American Rescue Plan and Bipartisan Infrastructure bill already enacted, was given a potential death blow before Christmas. Inorder to pass it Democrats need all 50 vote that they can muster in the Senate, but one of those votes, Senator Joe Manchin, said he cannot.

Still there is optimism in the White House and among party members that they will salvage Biden's vision.

Higher wages starving public agencies and non-profits of employees

Besides the covid-19 pandemic, one of the defining features of 2021 as the US economy has pulled out of the economic crisis has been inflation. Due to many factors it has pushed up prices on just about everything, including wages for workers.

Great news for workers to help keep up with rising prices on food, goods and gas. Not so good for employers who can't afford to raise their wages. This has especially be hard on childcare providers, non-profits and pubic employers who depend on the elected officials to approve wage hikes which in turn would mean raising taxes.

Transformative enhanced Child Tax Credit should be made permanent

Under the American Rescue Plan, Democrats made major changes to the Child Tax Credit which has been around since 1997. Over the years it has been improved but through the legislation enacted in March it had a outsized effect in reducing childhood poverty.

The advance payment scheme has sent six advance instalments on the credit for up to $300 per child each month since July. The first payment was found by experts to have kept 3 million children out of poverty and reduce the childhood poverty rate by 25 percent.

Rob Schofield from NC Policy Watch says "Congress should heed Biden's request to fine tune the credit and make it permanent right away."

$1,400 stimulus check in 2022: How do families that missed out in 2021 receive it?

The Internal Revenue Service began sending around 169 million Americans a third Economic Impact Payment, or stimulus check, after Democrats passed the American Rescue Plan in March 2021. That direct payment to taxpayers was for up to $1,400 for every eligible man, woman and child, to boost household finances in light of the continuing covid-19 pandemic, but not all of those who were eligible received a payment.

The IRS automatically sent out payments based on the information they received from taxpayers, either through an online portal for Non-Fliers or from 2019 or 2020 tax returns. Anyone who the tax agency was unaware of would not have received a payment, but when the 2022 tax season rolls around that oversight can be remedied.

Georgia work requirement for Medicaid yanked

In the final days of the previous administration permission was granted for Georgia to impose a work requirement, as well as charge premiums on coverage for low-income Medicaid beneficiaries. It was argued that the measure would improve people's lives through valuing work.

The Biden administration saw it differently, that it would create barriers to healthcare coverage, especially in the midst of the pandemic. On Thursday the Centers for Medicare and Medicaid Services (CMS) revoked approval for the policy which had yet to be implemented in Georgia.

We’ve added nearly 6 million jobs this year — the most of any first-year president in history. And the number of people receiving unemployment benefits has dropped from around 20 million to around 2 million since President Biden took office.

Child Tax Credit: letters in the post

The Internal Revenue Service said today that it’s starting to send out information letters to the 36 million families who got advance child tax credit payments this year. It’s important to hold onto the letter. If you got advanced child tax credit payments, you’ll need the letter when you file your taxes for tax year 2021 in 2022. Treat it like any important tax form like a W-2 or 1099.

It’s called Letter 6419: 2021 advance Child Tax Credit (CTC). The letter verifies how much you got in advance payments in 2021, and the number of qualifying children used to determine the payouts.

Ashlea Ebeling, Senior Contributor for Forbes, brings you more.

Joe Manchin has seen support for his super pac increase this fall

CNBC has reported that Senator Joe Manchin (D-WV) has seen contributions to his super pack increase substantially this year. Manchin came under fire from members of his own party this weekend he ended negotiations with President Biden over the Build Back Better bill. The donations began about the same time Manchin becomes a vocal critic of the trillion-dollar social spending bill.

Reports show that the 17 contributions came from corporations in October, and an additional 19 were given in November. Some of the companies include American Express, Goldenman Sachs, and Verizon.

How long has Biden extended the student loan moratorium? how to apply for the debt cancellation

President Biden sent a small gift to the millions of Americans who have student loan debt. The moratorium which allows borrowers to pause payments without accumulating interest was set to end in February and has now been extended a few more months.

Earlier this month prominent Democratic lawmakers had “strongly urged” Biden to extend the loan forbearance which started at the onset of the covid-19 pandemic. The news of the 90-day extension was greeted with enthusiasm as well as calls for debt forgiveness, something Biden had promised to do as a candidate.

Read our full coverage formore details on the extension and the renewed calls to cancel student loan debt.

$8,000 stimulus check: who gets it, how to apply and when will it be sent out?

Parents with children up to the age of 13 and who make less than an adjusted gross income of $125,000 could be entitled to a payment up to $8,000 in the new year.

The initiative is called the child and dependent care tax credit and it aims to help working families pay expenses that they would otherwise need to look after their loved ones.

“The credit is calculated based on your income and a percentage of expenses that you incur for the care of qualifying persons to enable you to go to work, look for work, or attend school,” said the IRS.

More on thepotential payments into 2022 and how your tax filing may be affected.

US stimulus checks live updates: welcome

Hello and welcome to AS USA’s daily live blog for Friday 24 December 2021. We’ll be bringing you the latest news on President Biden's Build Back Better bill, which has been dealt a major blow by Democratic Senator Joe Manchin’s announcement that he will not be voting for the legislation.

We’ll also provide information on the enhanced monthly Child Tax Credit, which is due to expire at the end of the month. A major goal of the Build Back Better bill is to extend the scheme, which has seen qualifying households receive up to $300 per month per child.

You’ll also find updates on a potential fourth federal stimulus check in the United States, in addition to information on unemployment and Social Security benefits.

- Joseph Biden

- Social Security contributions

- Nancy Pelosi

- Charles Schumer

- IRS

- Coronavirus stimulus checks

- Senate

- United States Senate

- Child benefits

- Retirement pension

- Unemployment compensation

- Covid-19 economic crisis

- United States Congress

- Social support

- Retirement

- Unemployment

- United States

- Pensions

- Inland Revenue

- Taxes

- North America

- Parliament

- Benefits

- Tributes

- Employment

- Working relations

- Public finances

- America

- Labour market policy

- Work

- Politics

- Society

- Finances

- Social security