Fourth stimulus check: COLA 2022 benefits, Medicare, Child Tax Credit… | Summary 27 December

Latest updates and information on President Joe Biden's Build Back Better bill, and news on a fourth stimulus check, Child Tax Credit, and Social Security.

Show key events only

Headlines

- Some parents will receive $8,000 stimulus checks this spring.

- Biden extends the student debt moratorium to May.

- As Omicron causes business closures, will a fourth stimulus check be passed to combat the economic losses?

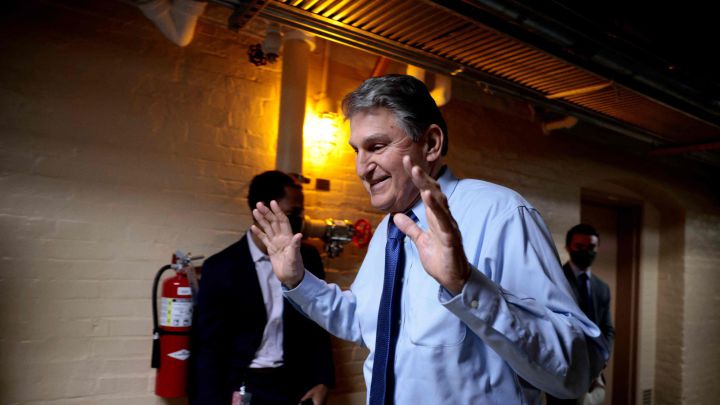

- West Virginia Senator Joe Manchin says he can't support Build Back Better bill

-"There will be more negotiations," says White House Press Secretary Psaki

Useful information & links

Child Tax Credit

- What next for the Child Tax Credit after Build Back Better bill talks stall?

-Why does Manchin oppose the Build Back Better bill?

- Final monthly CTC payment of 2021 sent out on Wednesday 15 December

Stimulus checks

-New parents could see another stimulus check reflected in their tax refund in 2022

-What's the deadline to get your stimulus check plus-up payment in 2021?

Social Security

- How many Social Security payments are there to go in 2021?

- When does COLA 2022 take effect for Social Security benefits?

-5.9% COLA increase - how much difference will it make to Social Security benefits?

Latest articles:

2022 stimulus checks: can Social Security recipients get paid $1,400?

Inflation is hurting some communities hard as the pandemic evolves and despite more than 169 million payments having been sent out in the third round of stimulus checks, there is a continued push for a targeted fourth one. The new covid-19 variant of Omicron had financial markets very worried at first, with a rapid transmission rate, but early studies have calmed them a little as illness, on the whole, appears to be less severe.

The Omicron variant is spreading fast around the US northeast with New York setting records for the most new cases reported in a single day since the pandemic started. This has given a boost to the prospect of further stimulus checks as the risk of great economic trouble lies ahead with some Social Security recipients hoping the new year brings new support.

Claiming the $1,400 stimulus check

Families that either had a newborn or adopted a child in 2021 will be able to claim the amount of the third Economic Impact Payment (EIP3) they are due through the 2021 Recovery Rebate Credit. This goes for all taxpayers who didn’t get the full amount due to them from the direct payment scheme.

You’ll want to check any documentation that the IRS sent regarding the EIP3 or “plus-up payments” received. If you lost the letter that the agency sent, through the IRS website you should be able to find the information in your federal tax account. If you try to claim more of the credit than you are due, it could delay processing of your tax return and thus your refund if you have one coming.

Taxpayers that are still missing the first two Economic Impact Payments (EIP1 and EIP2) will need to file a 2020 1040 to claim the 2020 Recovery Rebate Credit

World stock prices gain on strong US holiday sales

"Heading into 2022 we will still have covid uncertainties but the good news is that, according to the WHO, we may be see the end of the pandemic towards the end of year," said Jawaid Afsar, sales trader at Securequity.

He added that next year markets must also contend with other issues, ranging from inflationary pressures to policy tightening and geopolitical risks.

Looking ahead, thin trading volumes ahead of New Year could make markets volatile. Still, since 1945, the last five trading days of December and the first two days of January have boded well for U.S. stocks 75% of the time, according to CFRA Research data.

The pan-European STOXX 600 index rose 0.62%, nearing its highest level in over a month.

Biden says he and Manchin are 'going to get something done'

Joe Biden reaffirmed that he and conservative Democratic Senator Joe Manchin were "going to get something done" on the president's proposed social spending and climate legislation.

"Senator Manchin and I are going to get something done," Biden told reporters when asked about Manchin, who had publicly rejected the president's Build Back Better plan in a move that imperils the legislation.

"I want to get things done. I still think there’s a possibility of getting Build Back Better done," the president told reporters following his remarks on covid-19 at the White House.

'US consumer spending will likely remain strong'...

Despite the inevitability of some economic impact from Omicron, U.S. consumer spending will likely remain strong, said Cliff Hodge, chief investment officer for Cornerstone Wealth.

He is focused on any signs that Senator Joe Manchin could reach an agreement to support President Joe Biden's signature $1.75 trillion Build Back Better climate and social spending bill. Manchin, who would provide one of the key votes to pass the bill in a divided Senate, said on Sunday that he could not support the bill in its current form. Senate Majority Leader Chuck Schumer said that the Senate will vote on the bill in early January.

US jobless claims hold steady below pre-pandemic level

The number of Americans filing new claims for unemployment benefits held below pre-pandemic levels, while consumer spending increased solidly, putting the economy on track for a strong finish to 2021.

But price pressures continued to build up, with a measure of underlying inflation recording its largest annual increase since the 1980s in November. The report came as the nation was struggling with a resurgence in covid-19 infections, driven by the highly transmissible Omicron variant, which could crimp economic growth in the first quarter.

Initial claims for state unemployment benefits were unchanged at a seasonally adjusted 205,000, the Labor Department said. Early this month, claims dropped to a level last seen in 1969.

World stocks stall as virus concerns linger

World stocks steadied and oil prices eased in quiet trade on Monday as flight cancellations over Christmas revived concerns that the Omicron virus variant could slow down the economy heading into the new year.

US retail sales rose 8.5% during Christmas

Retail sales in the country rose 8.5% during this year's holiday shopping season from Nov. 1 to Dec. 24, powered by an e-commerce boom, a report by Mastercard Inc showed.

Rep. Jayapal asks Biden to continue focus on 'Build Back Better', urges executive action

U.S. Representative Pramila Jayapal, a leading liberal House Democrat, has asked President Joe Biden to continue focusing on his social spending legislation and urged him to use executive action despite Senator Joe Manchin's public rejection of the plan. In an opinion piece in the Washington Post, Jayapal, chair of the Congressional Progressive Caucus (CPC), wrote that the CPC will soon release a plan for some actions like lowering costs, protecting the health of families, and tackling climate action.

President Biden signs $770 billion defense bill

President Joe Biden signed into law the National Defense Authorization Act, or NDAA, for fiscal year 2022, which authorizes $770 billion in defense spending, the White House said on Monday.

Earlier this month, the Senate and the House of Representatives voted overwhelmingly for the defense bill with strong support from both Democrats and Republicans for the annual legislation setting policy for the Department of Defense.

The NDAA is closely watched by a broad swath of industry and other interests because it is one of the only major pieces of legislation that becomes law every year and because it addresses a wide range of issues. The NDAA has become law every year for six decades.

Dollar near one-week low as Omicron fears ease

The dollar index flatlined near a one-week low, as fears of fallout from the Omicron covid variant eased, boosting higher risk currencies such as the Australian dollar and British pound.

IRS alert children to risk of online scams

The IRS has joined with representatives of the software industry, tax preparation firms, payroll and tax financial product processors and state tax administrators to combat identity theft refund fraud to protect the nation's taxpayers.

Stimulus checks, benefits and other US economic stories in 2021

After experiencing an economic collapse not seen since the Great Depression, the US economy has been making record strides toward full recovery. At the end of 2020 that recovery seemed to be slowing down but two covid-relief packages supercharged the bounce back to health.

However, even though the economic recovery continues the virus remains with a new surge of infections as well as a new variant that is the most contagious yet. As the second year of the pandemic comes to a close, AS USA took a look back at the main news stories from 2021.

Taking executive action will also make clear to those who hinder Build Back Better that the White House and Democrats will deliver for Americans... This moment for the Biden administration and Congress can either lead to our greatest failure or our greatest success.

Could executive action break Senate deadlock?

Rep. Pramila Jayapal (D-Wash.) called on President Biden Sunday to "use executive action" to deliver his signature climate and social policy legislation that's stalling in the Senate, after Sen. Joe Manchin (D-W.Va.) rejected the plan.

Can a fourth stimulus check payment happen in January 2022?

The Omicron variant has led to a surge in cases all over the country, and many hospitals are feeling the strain. Additionally, as business slows over fears of infection, some economists worry that without additional stimulus aid the progress made in the economic recovery could be risked.

Holiday season leads to huge rebound in sales

Holiday sales rose by 10.7% compared to the pre-pandemic 2019 holiday period, the fastest increase in 17 years, according to the Associated Press.

Clothing and jewelry sales rose by more than 30%, according to AP. Online sales were also up 61% from 2019.

Republican pressed on Child Tax Credit

Mike Emanuel, guest-hosting Chris Wallace’s old show Fox News Sunday, challenged Senator Roy Blunt (R-MO) over the Republican’s opposition to extending the Child Tax Credit, a key provision of Biden’s Build Back Better agenda.

“Senator, one of the casualties of the collapse of that bill is the child tax credit that expires at the end of the year,” Emanuel noted.

“According to the Urban Institute, continuing the benefit could have a significant impact on child poverty, reducing child poverty to about 8.4 percent from 14.2 percent, a fall of roughly 40 percent,” Emanuel explained, flashing a graphic on the screen.

“Is that a compelling argument to extend it?” Emanuel asked.

Blunt responded by saying the Republicans previously doubled the child tax credit and argued Democrats’ House bill “just simply doesn’t make sense.”

'A lot of us are gonna be disappointed'

Democratic Maryland Sen. Ben Cardin on Sunday said the Democrats are prepared to move forward on the Build Back Better bill, but conceded that "a lot of us are gonna be disappointed."

"We are prepared to move. We just need to make sure we have unanimity in our caucus. And that's what we're working on and we will start on that next week when we return," Cardin said on "Fox News Sunday."

"The stakes are too high for this to be, in any way, about any specific individual"

"I think the stakes are too high for this to be, in any way, about any specific individual", Vice President Kamala Harris said in a CBS News interview aired on Sunday, when asked about Manchin. Harris said the White House was not giving up on the legislation.

Manchin's support is crucial in the Senate chamber where the Democrats have the slimmest margin of control and Republicans are united in their opposition to the bill. Senate Majority Leader Chuck Schumer has said the chamber would vote on a package in early 2022.

The White House said on Wednesday that conversations with Manchin's office will continue. Biden said on Tuesday that he and Manchin were "going to get something done" on the legislation.

Manchin rejects Build Back Better: what does this mean for the Child Tax Credit?

Key moderate Democrat Sen. Joe Manchin has announced that he is not willing to support the Build Back Better bill, the $2 trillion package that is a key part of President Biden’s ambitious legislative agenda.

The bill would have expanded the social safety net and provided a raft of new incentives to promote green energy practices in the United States. It included extra funding for the Child Tax Credit which would have allowed the popular monthly payments to have continued for at least another year.

US Representative Pramila Jayapal, a leading liberal House Democrat, has asked President Joe Biden to continue focusing on his social spending legislation and urged him to use executive action despite Senator Joe Manchin's public rejection of the plan.

In an opinion piece in the Washington Post on Sunday, Jayapal, chair of the Congressional Progressive Caucus (CPC), wrote that the CPC will soon release a plan for some actions like lowering costs, protecting the health of families, and tackling climate action.

"The Progressive Caucus will continue to work toward legislation for Build Back Better, focused on keeping it as close to the agreed-upon framework as possible", she wrote in the newspaper Manchin, a conservative Democratic senator, rejected the president's "Build Back Better" plan last Sunday in a move that imperils the legislation.

Children will go hungry without expanded Child Tax Credit

Data released Wednesday by the US Census Bureau shows that more than 21 million people across the country live in households where there was "sometimes or often not enough to eat in the last seven days," a five-month high.

These are exactly the people who the expanded Child tax Credit is for. The fact this data is from the period of the expanded measures show just how critical it is it continues next year. However, there will be no vote on proposals until next year after Democrat Sen. Joe Manchin came out against voting, the only person in his party to do so.

Fourth stimulus check: Will Congress pass another payment as Omicron sparks an increase in cases?

During President Biden’s address to the nation on Tuesday, he warned that in the coming days and weeks the country could experience a surge in covid cases. This increase could result in the collapse of some hospital systems and a tragic number of deaths.

Additionally, many business owners worry that while lockdowns may not be imposed, customers may avoid dining out or shopping to lower the risk of contracting the virus.

In cities like Austin and Chicago businesses are already shutting their doors voluntarily as staff test positive and business hits a dead halt. Empty Bottles in Chicago will be closed until 30 December, with one of the owners, Bruce Finklestone saying: “Our first goal is to look out for the health and welfare not only of our staff but our friends and our customers, and it just seemed to make sense.”

Investors set to look to Omicron for direction

The Omicron variant is causing infections to double in 1.5 to 3 days, according to the World Health Organization. The variant now accounts for 73% of all new U.S. cases, up from less than 1% at the beginning of the month.

Still, questions about Omicron's virulence have made investors less pessimistic than the original reaction. The S&P 500 closed down 2.3% on Nov. 26 after the variant was discovered, on fears of fresh economic lockdowns.

A South African study offered hope about the severity of Omicron and the trend of covid-19 infections published earlier this week. Shares of vaccine makers slumped in December as investors expect the Omicron variant's impact to be limited based on recent data.

Welcome to AS USA’s daily live blog for Monday 27 December 2021. We’ll be bringing you the latest news on President Biden's Build Back Better bill, which has been dealt a major blow by Democratic Senator Joe Manchin’s announcement that he will not be voting for the legislation.

We’ll also provide information on the enhanced monthly Child Tax Credit, which is due to expire at the end of the month. A major goal of the Build Back Better bill is to extend the scheme, which has seen qualifying households receive up to $300 per month per child.

You’ll also find updates on a potential fourth federal stimulus check in the United States, in addition to information on unemployment and Social Security benefits.