USA finance and payments news summary, Wednesday 23 March 2022

Latest news on inflation and rising gas prices, which have led US lawmakers to propose a gas stimulus check. We'll also have updates on tax season, Social Security payments and the Child Tax Credit.

Show key events only

US financial new: live updates

Headlines:

- LA becomes first US city where gas prices hit $6 per gallon

- Average gas price drops marginally to $4.237 per gallon

- Lawmakers propose 'gas stimulus checks'amid sky-high gas prices

- Tax season 2022 in full swing: deadline for most Americans is 18 April

- No tax-filing extension expected in 2022 (full story)

Useful information

- How long does the IRS take to process your federal tax return?

- Child Tax Credit could cause Americans to get lower tax refund

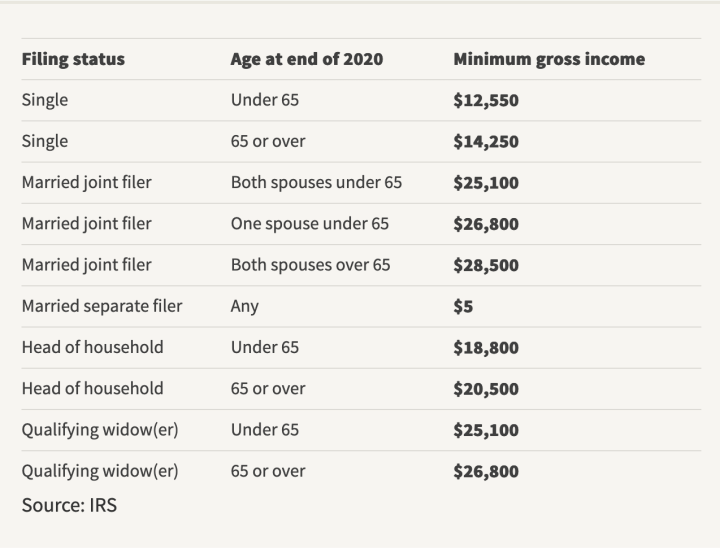

-What's the minimum income to file taxes in the US?

- Tax bracket calculator

- How much did Americans get as part of the first, second and third stimulus checks?

Related news articles:

Gas prices jump with Putin's declaration payments be made in rubles

In a surprise announcement on Wednesday, Russian President Vladimir Putin said that Moscow will seek payments for natural gas shipments to "unfriendly" countries in rubles. The announcement sent prices soaring across Europe which relies on Russia for 40 percent of its gas for heating and power generation.

The declaration helped the ruble regain some of the ground it has lost since the West imposed crippling sanctions on Russian. The currency is still down 22 percent since the start of Putin's war on Ukraine.

Despite millions of older Americans quitting their jobs Social Security claims haven't surged

More than 5 million Americans left the workforce during the covid-19 pandemic and according to research by Goldman Sachs nearly 70 percent were aged 55 or older. However, the number of people claiming Social Security benefits has not spiked in a similar fashion. Economists are wondering if this means that some of those older Americans might be coming back to the worforce sometime in the future.

Although Americans can begin collecting Social Security benefits at 62, it comes at a cost through lower payments. They don't reach full retirement age unitl 67 for people born in 1960 and later, but if Americans want to receive the maximum amount they are entitled to they'll need to keep going until 70.

New bitcoin ATMs have been popping up across the United States where people can buy and sell a range of cryptocurrencies. The number has grown more than sixfold in the past two years to over 32,000 nationwide according to Coin ATM Radar.

Currently, the machines are owned by private companies and mostly located in local convenience stores and gas stations. However, well-known companies like Circle K and Walmart have started installing them.

In recent weeks the price of gasoline has soared across the United States as the steep inflation rates combined with the fallout from the Russian invasion of Ukraine to put the squeeze on motorists.

On 14 March the average price of a gallon of gas in the US reached $4.32, breaking the previous record. By 23 March that figure had dropped slightly to $4.24 but that remains around $1.37 higher than the average price one year ago.

Estimates from Yardeni Research suggest that the increase could cost the typical household around $2,000 per year, a disaster for low-income individuals and families still reeling from the economic consequences of the pandemic.

Three restaurants and owners ordered to pay $1.45 million in back wages and damages

A federal court has ordered the owners of three Fusion Japanese Steakhouses, one in Pennsylvania and two in West Virginia, to pay back wages and damages to 116 back-of-the-house employees.

The ruling was the result of US Department of Labor litigantion that came after an investigation found that the workers had been paid off-the-books for hours worked while at the same time denied them overtime pay for hours worked in excess of 40 during a workweek.

The three restaurants and their owners will have to pay $725,000 in back wages and an equal amount in damages for a total of 1.45 million to the employees in addition to $76,724 in civil penalties for the willful nature of their violations.

"All of the above" approach to solving rising gas prices

I’m worried about how gas prices are affecting Virginians, so I’m advocating for an “all of the above” approach to solving this issue: supporting American energy independence, investigating price gouging, increasing drilling through unused leases, and investing in clean energy.

With sky-high energy prices, people in America are crying out for more support to help pay their bills. According to some estimates, gas prices may bump up the costs for a typical family by $2,000. Prices have fallen slightly in the last week, but remain more than $1.37 higher per gallon compared to a year ago, according to information from the US Energy Information Administration.

Plans have been mooted in Congress to try and alleviate these problems. They range from moves similar to the stimulus checks of the last two years to a tax on profits for big oil companies.

Californian proposals for dealing with gas prices

“We’re taking immediate action to get money directly into the pockets of Californians who are facing higher gas prices as a direct result of Putin’s invasion of Ukraine,” said Governor of California Gavin Newsom.

“But this package is also focused on protecting people from volatile gas prices, and advancing clean transportation – providing three months of free public transportation, fast-tracking electric vehicle incentives and charging stations, and new funding for local biking and walking projects.”

Proposals include:

- $400 per vehicle per person

- Free transit passes for three months

As consumers pay more at the pump, many voters are supportive of the government taking action to reduce costs. Over seventy percent of respondents to a poll conducted by Morning Consult said they would support tax holidays at the federal and state level. This would mean that the governments could reduce gasoline taxes over a period of time to cut costs for consumers.

Other popular measures included asking domestic producers to increase oil production and the release of barrels from strategic reserves. The White House has said that they are supportive of domestic producers increasing their production, but that at this time the federal government will not support them financially to do so.

Why is the price of gas so high?

The Russian invasion of Ukraine, combined with pre-existing inflationary pressures, has sent the average price of gasoline in the United States soaring to new highs in the last month.

The current high price of gas can be attributed to a combination of factors that have conspired to send fuel prices soaring. Firstly, as pandemic restrictions were removed in 2021 the American economy began to grow swiftly, bringing with it a spell of sustained high inflation.

But oil prices have slowed and have began to slip down again. However, gas prices remain high, leaving politicians to attack the companies which are keeping prices high.

The Federal Reserve's interest rate raise will increase the cost for those borrowing for vehicles or houses, though rates are far lower than they were 20 years ago.

Minimum income to file taxes in 2022

Depending on your earnings, as a US taxpayer you may not have to submit a tax return. However, it may be in your best interest to file even if you aren’t required to.

In March 2021, Democrats passed a sweeping covid-19 relief and stimulus bill, the American Rescue Plan, which enhanced several tax provisions. Those changes could benefit a large swath of the American public, especially those who struggle to make ends meet.

For most taxpayers, a tax return must be filed if your 2021 income exceeded the minimum income limits shown above.

Read more: AS USA's Greg Heilman offers the full lowdown on the income limit for filing taxes in the US

Video explainer: filing tax return electronically

The IRS has produced this short video explainer on the various benefits of filing your federal tax return electronically:

Late in 2021, the IRS announced new tax brackets for those filing their taxes in 2022. There is much change compared to last year. This is due to the high inflation in the US, meaning the Treasury needs to keep tax as fair as possible.

For example, if the tax bands didn't change then the wage increase, no matter how slow, would push those who, due to inflation, weren't actually earning any more in real terms, in to higher tax bands. Effectively, it would penalise Americans through no fault of their own.

IRS recommendations on how to avoid delays this tax season

To avoid delays in having your federal return processed this tax season, the IRS recommends filing electronically. This is because, unlike paper returns, electronic returns do not need to be dealt with by hand by an IRS official - a process that takes longer.

You can find out more about your options for filing electronicallyon this page on the IRS website.

The IRS is also urging Americans to seek their tax refund - if they are due one - by direct deposit.

See also:How long does it take the IRS to process your taxes?

The first Americans are receiving their tax refunds this year but unexpected problems could arise concerning the Child Tax Credit.

Stop Gas Price Gouging Tax and Rebate Act would "put people over profits"

Last week, another proposal for a ‘gas stimulus check’ was tabled, by Democratic congressman Peter DeFazio.

DeFazio’s Stop Gas Price Gouging Tax and Rebate Act would levy a 50% tax on any income accrued by major oil companies that exceeds 110% of their average annual earnings between 2015 and 2019.

The funds raised by the tax would then be distributed to Americans as part of a “monthly, advanced, and refundable tax credit that will be phased out by income”.

“Big Oil is foaming at the mouth,” DeFazio said. “After price-gouging Americans in 2021 to make record profits, Big Oil is now reaping the benefits of Putin’s price hike. As we face COVID-related supply chain bottlenecks and uncertainty created by Vladimir Putin’s unprovoked invasion of Ukraine, I repeat to Big Oil what President Biden said just a week ago - it’s no time for profiteering or price-gouging.

“This is why I’ve introduced the Stop Gas Price Gouging Tax and Rebate Act. My legislation would tax Big Oil’s excess profits in 2022 and return the revenue back to Americans. It’s beyond time to put people over profits - period.”

Three federal stimulus checks have been sent out to qualifying Americans during the coronavirus pandemic. In all the direct payments were worth up to $3,200, plus extra credits for qualifying dependents.

Gas Rebate Act follows Big Oil Windfall Profits Tax

Earlier this month, a variant of the Gas Rebate Act (see post below) was proposed by Representative Ro Khanna (D-CA and Senator Sheldon Whitehouse (D-RI).

Under Khanna and Whitehouse’s Big Oil Windfall Profits Tax, large oil companies would be charged a 50% levy on the difference between the current and pre-pandemic price of a barrel of oil - a scheme they calculate could raise around $45bn a year.

This money would then be given to qualifying Americans as an annual payment estimated to be about $240 for single filers and $360 for joint filers.

To qualify for the full amount, single filers would have to earn no more than $75,000 a year, while joint filers’ combined income would need to be below $150,000.

“This is a bill to reduce gas prices and hold Big Oil accountable. As Russia’s invasion of Ukraine sends gas prices soaring, fossil fuel companies are raking in record profits,” Khanna said in a statement.

“These companies have made billions and used the profits to enrich their own shareholders while average Americans are hurting at the pump.”

The IRS is responsible for sorting your filings and will do so as efficiently as possible assuming all tax and appropriate details are in order.

AS USA's Calum Roche and Maite Knorr-Evans have all the details

The Supplemental Nutrition Assistance Program (SNAP) provides financial support for households struggling to pay for food and other nutritional essentials.

Could a 'gas stimulus check' be on the way in the US?

Three US lawmakers have introduced a bill that seeks to give Americans an ‘energy rebate’ of up to $100 a month amid high gas prices.

Representatives Mike Thompson, John Larson, and Lauren Underwood have tabled the Gas Rebate Act, which proposes giving single filers earning less than $75,000 a year a monthly payment of $100 until the end of 2022 “in any month where the national average gas prices exceed $4.00 per gallon”.

Joint filers with a combine income $150,000 would also get the full amount. Single filers earning up to $80,000 would get a gradually smaller amount, while the phase-out limit for joint filers would be $160,000.

Eligible Americans would also get a further $100 per dependent.

“Americans are feeling the impact at the pump of Vladimir Putin’s illegal invasion of Ukraine, and right now we must work together on commonsense policy solutions to ease the financial burden that my constituents are feeling,” Thompson said in a statement.

The legislation would “provide middle-class Americans with monthly payments to ease the financial burden of this global crises”, Thompson added.

Gas prices drop slightly, but hit $6 in LA

Average gas prices in the US remain sky high, albeit they have dropped very slightly in recent days. While regular gas cost an average of $4.305 a week ago, its price has now fallen to $4.237, according to AAA.

That said, the price-per-gallon reached $6 in Los Angeles County on Tuesday, and the national average remains well above the $2.877 of a year ago.

(Photo: REUTERS/Marton Monus)

US financial news, live updates: welcome

Good morning and welcome to AS USA's live blog for Wednesday 23 March 2022, bringing you the latest financial news in the United States.

Caused by rocketing inflation and the effects of the Ukraine war, rising gas prices have led US lawmakers to propose a 'gas stimulus check', to help American households deal with the growing cost-of-living crisis.

Among the range of other topics we'll be covering, we'll have information on tax season 2022, as the 18 April tax-filing deadline begins to home into view.

- Joseph Biden

- IRS

- Washington D.C.

- USA coronavirus stimulus checks

- Inflation

- Income tax return

- Covid-19 economic crisis

- Science

- Agencia Tributaria

- Income tax

- United States Congress

- Unemployment

- Coronavirus Covid-19

- Economic crisis

- United States

- Inland Revenue

- Taxes

- Government agencies

- North America

- Tributes

- Parliament

- Employment

- Money

- Economic climate

- Virology

- Infectious diseases

- Public finances

- Government

- Payment methods

- America

- State administration

- Work

- Finances

- Public administration

- Politics