What will the Biden administration’s new income-driven student debt repayment plan look like?

The Biden administration has launched a new income-driven student debt repayment plan. How can borrowers apply for the program and what does it look like?

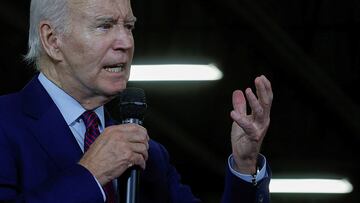

A month ago, the Supreme Court struck down the student loan forgiveness program proposed by President Joe Biden. It would have forgiven up to $20,000 in loans for low-income students.

Following the high court’s decision, the president announced a series of measures and new plans to help students and their families. Now, the government has launched a website for its new loan repayment scheme.

READ ALSO: What to do if you haven’t received a Social Security payment

What will the Biden administration’s new income-driven student debt repayment plan look like?

The government’s new plan for student loan repayment is income-driven, and the newly launched beta site will allow borrowers to start submitting applications for the program.

The Department of Education thought up what it calls the most affordable payment plan ever created- the Savings for Valuable Education or SAVE Plan. According to the White House, many borrowers will not have to make monthly payments under this plan, and those who do will save more than $1,000 a year.

The Biden administration says the SAVE Plan will reduce monthly payments to $0 for millions of borrowers who earn $32,800 or less individually per year. The limit will be $67,500 per year for a borrower in a family of four. All other borrowers will save at least $1,000 per year with this plan.

The SAVE Plan also aims to “stop runaway interest” that “leaves borrowers with more than their initial loan in debt,” Education Secretary Miguel Angel Cardona said in a statement. For example, under this plan, if you make your monthly payment, your loan balance will not increase due to unpaid interest.

The government says that by using the new website, borrowers will be able to see their exact payment amount, and then choose the most affordable repayment plan.

READ ALSO: What is public housing in the US and who can qualify?

How can I apply for the SAVE Plan?

Those with federal student loans can submit their Income-Driven Repayment (IDR) Plan Request at the beta website.

The application process only takes about 10 minutes, and many parts of the process can be auto-filled with information the government already has on hand.

Borrowers who are currently registered under the REPAYE program will be transitioned to the SAVE program automatically.

You can apply for an IDR if you are not on one currently and select REPAYE if you want to enroll in the SAVE plan.

The full website will be launched in August, and if you submit your application during the beta period, you will no longer need to submit it a second time.