How will the student loan forgiveness plan affect your monthly payments?

The President has offered up to $20,000 in student loan relief for borrowers. Consider restructuring your monthly payments to save money in the long run.

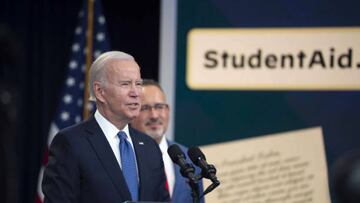

Last week the online portal allowing student loan borrowers to claim the federal debt relief promised by President Biden went live. The White House announced a forgiveness plan knocking up to $20,000 off the debt burden of those with a student loan debt.

That figure is comprised of a $10,000 reduction for borrowers who earn less than $125,000 per year, with an additional $10,000 for those who received a Pell Grant during their studies.

Biden’s announcement claimed that 95% of student debt borrowers would benefit from the forgiveness, while close to 45% of recipients would see their debt written off entirely. Here’s how to make the most of the support...

Make sure to choose the right repayment plan

There are a number of different types of repayment plans available to borrowers and you are able to switch between them and refinance your debt after graduating.

Some offer income-driven options which see you simply pay a proportion of your monthly income for as long as it takes to settle the debt, while others have a fixed monthly repayment. Once you have claimed the student loan forgiveness you should reassess your options to see what makes sense for you.

Folks, apply for student loan debt relief today.

— President Biden (@POTUS) October 17, 2022

No forms.

No special log-in.

It’s available in English and Spanish – and on desktop and mobile.

And it'll take you less than 5 minutes. https://t.co/WFCPfWoLhi

Writing in Business Insider, Leo Aquino explains how the student loan forgiveness plan allowed him to reduce his monthly payments from $370 to $150. After applying the $10,000 reduction to his outstanding balance, Aquino opted for the lowest monthly repayment plan to allow him to focus on boosting retirement contributions instead.

He began the process to contact his loan servicer to clarify what options he had and even enlisted the help of a financial planner to make the decision.

Claim forgiveness now to reduce interest on your loan

Alongside the student debt forgiveness program unveiled in August, Biden announced one final extension of the moratorium that has been in place since the start of the pandemic. The student loan moratorium has not only allowed borrowers to take a break from the payments, but has also stopped interest from accruing on the debt.

Related stories

Biden’s announcement confirmed that the moratorium has been extended to the end of 2022, but from 1 January onwards interest will once again be added to your balance. For this reason, it is important to ensure that your outstanding balance is as low as possible by the end of the year.

The White House has warned that it can take up to six weeks from submitting your forgiveness claim for it to be credited on your account. Try to get your claim submitted in the next couple of weeks to ensure that, when interest returns for student loan debt, your balance is as low as possible.