US financial news summary | 31 July 2023

Stay informed about the most recent developments following the Federal Reserve’s decision to raise interest rates to their highest level in 22 years.

Show key events only

Headlines: Monday 31 July 2023

- Federal Reserve has announced a 0.25% hike in interest rates

- Inflation in the US was at 3% in June, as Fed bids to cut rate to 2%

- Initial unemployment claims fell by 9,000 in week ending 15 July, to 228,000

- June jobs report showed that US added 209,000 jobs last month

Take a look at related AS USA news articles:

The White House has produced and published the SAVE plan. For all intents and purposes, this is the replacement for debt forgiveness amidst a hostile Congress and Supreme Court; is it any improvement?

Short answer; no.

Accessing the SAVE plan

Those with federal student loans can submit their Income-Driven Repayment (IDR) Plan Request at the beta website.

The application process only takes about 10 minutes. For those borrowers who are currently registered under the REPAYE program, the transition to the SAVE program will happen automatically.

The Save plan will go into effect on July 1, 2024

Since its establishment in 1997, Children’s Health Insurance Program (CHIP) has played a pivotal role in lowering the number of uninsured children in the United States. The program has successfully provided millions of children with access to affordable healthcare services, leading to notable enhancements in their overall well-being.

You can apply for CHIP through various methods that depend on your state. Commonly, you can apply online through your state’s Medicaid or CHIP website, or apply by phone through the state’s Medicaid/CHIP hotline on 1-800-318-2596.

The impact of the remote work on the economy and the weekend

Remote and hybrid work are boosting tourism and therefore have an impact on the economy because of more freedom to travel. The new work hours are affording more workers to have Fridays and Mondays free.

People who are working from home may be spending less on restaurants and other goods, but they are putting their money into flights, hotels, and experiences such as concerts.

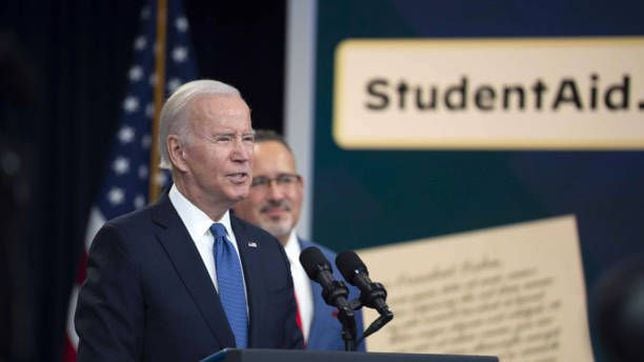

A month ago, the Supreme Court struck down the student loan forgiveness program proposed by President Joe Biden. It would have forgiven up to $20,000 in loans for low-income students.

Following the high court’s decision, the president announced a series of measures and new plans to help students and their families.

The Biden administration has now launched a new income-driven student debt repayment plan via a website.

How can borrowers apply for the program and what does it look like?

In June of last year, the price of gasoline in the United States reached a record after registering the highest price in history at $5.016 per gallon.

Subsequently, the price began to fall. However, last week, fuel prices reached their highest level in months, recording eight-month highs. On July 27, the average price of gas in the country was $3.714, the highest level since November of last year.

Why has the price of gas gone up so much? Will its price keep rising?

Millions of Americans, many of them retirees or people with a disability rely on Social Security checks to cope with day-to-day expenses.

The month is now ending and if you still haven't received your Social Security payment, it could throw off your budget.

Here are possible reasons for the delay, and how you can claim late checks.

San Francisco complains about Musk's glowing 'X' sign

A giant, glowing X marks the San Francisco spot where Elon Musk says he plans to keep his company, the messaging platform X, formerly known as Twitter. But city officials and some residents are unhappy with the display.

On Friday, the company erected an "X" logo on the roof of its Market Street headquarters, to the chagrin of neighbors who complained about intrusive lights, and San Francisco's Department of Building Inspection which said it is investigating the structure.

The move followed a post from Musk, the billionaire who acquired the company in October for $44 billion, announcing the newly named firm would remain in San Francisco despite what he termed the city's recent "doom spiral, with one company after another left or leaving."

Musk, who also is CEO of electric car maker Tesla, moved that company's headquarters from California to Texas in 2021.

(REUTERS)

A new month is coming up and that means one important thing to all SNAP recipients: the arrival of a new payment.

Although the SNAP program is a form of assistance offered by the federal government, payments are administered by the state governments. This means that each state is required to issue its own coupons, which is why in some places the requirements and payment dates vary.

These are the payment dates for the month of August in each state of the country.

A reverse mortgage allows homeowners aged 62 and older to access a portion of their home equity while continuing to live in their home. Unlike a traditional mortgage where the borrower makes monthly payments to the lender, a reverse mortgage works in the opposite way—the lender makes payments to the borrower.

These housing units are owned and operated by federal, state, or local housing authorities, and they aim to provide safe and affordable housing options for those who cannot afford market-rate housing.

Public housing units can be apartments, townhouses, or single-family homes located in specific housing developments or communities. As our coverage indicates, the rent for these units is typically set at a lower rate based on the tenant’s income, making them more affordable for low-income households.

Rent for public housing is determined by:

The formula used in determining the Total Tenant Payment is the highest of the following, rounded to the nearest dollar:

- 30% of the monthly adjusted income. (Monthly Adjusted Income is annual income less deductions allowed by the regulations);

- 10% of monthly income;

- welfare rent, if applicable; or

- a $25 minimum rent or higher amount (up to $50) set by an HA.

The Federal Reserve held interest rates steady at 5%-5.25% during their June meeting following an aggressive campaign of rate hikes intended to control rising inflation. However, they increased them again by 0.25% points last week, taking rates to their highest level this century.

They are aimed to suppress the spending power of people, thus tempering inflation. This only works if consumer spending is driving inflation, but is that really the case?

Good morning!

In the wake of the Federal Reserve's recent move to raise interest rates, our focus will be on examining its implications and how it is aimed at tackling inflation in the US.

We will also be providing real-time coverage of crucial topics like SNAP benefits, IRS refunds, and Social Security benefits.

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/DXECHX4MWVGHNK427QRIUWW3VE.jpg)

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/MFVPDIVCNCE5ARZ5ORA3MALAAY.jpg)

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/WQC65C2UZZPZJPHYARVB2U4REI.jpg)

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/BVTIVPRUONI4DAGGBCF6CNTSYQ.jpg)