US Financial News: news summary | 1 July 2023

Follow along with the financial news as the Fed continues to wrestle with inflation and millions of student loan borrowers prepare to restart payments.

Show key events only

US financial news live updates

Headlines | Saturday, 1 July 2023

- Supreme Court ruled 6-3 against Biden's Student Loan Forgiveness Program

- 16 million student loan borrowers had debt relief approved, what will happen now?

- When do student loan repayments restart?

- PCE data shows both headline and core inflation declined in May year-on-year to 3.8% and 4.6%, respectively

- The weekly average mortgage rate ticked up this week to 6.71% for 30-yr FRM

- Initial unemployment claims dropped last week to 239,000, a decrease of 26,000 from a week prior

- Fed Chair Powell doesn't discount two consecutive rate hikes in future

- US consumer confidence jumps to highest level since January 2022

- Dates for Social Security payments in July

The news has not been well received out west...

As one can see, many are already worried about the impact on their lives in the future. How this ends is anyone's guess.

It's a dark day...for some

In case you're just joining us, and you're not exactly sure of all the details, here's a refresher on the contentious topic that's now on everyone's mind. Rest assured, we're just getting started with this one...

It's about Correct vs Effective

Is the student loan forgiveness program too expensive? Quite possibly. Is it Socialist in it's nature? Not even close.

Though many detractors have pointed to the $430 billion cost of maintaining assistance for students - that's a lot of money - many of them are guilty of profiting off of other governmental structures. This of course begs the question as to whether their grievances are sincere or based in greed?

At any rate, what is clear is that students are in need of help, and with that it's quite plausible to argue that something must be done.

Median salary and average salary often get confused. However, the difference between the two can be quite substantial. Here’s a look at the each one.

The US has dozens of financial aid programs for low-income populations. Among them is the Supplemental Nutrition Assistance Program, or SNAP, formerly known as food stamps.

The distribution schedule of SNAP coupons depends on the administration of each state. These are the areas that start giving out payments on July 1.

We take a look at the 10 most affordable cities in the US in 2023 and what makes them more affordable than the rest.

White House strikes out at lawmakers who are cheering student loan forgiveness being struck down

One of the arguements against President Biden's student loan forgiveness program from its detractor was that it was too expensive, costing around $430 billion. The White House is is drawing a comparison with another goverment program, which some of those same detractors took advantage of.

During the pandemic the federal government handed out around $790 billion through the Paycheck Protection Program. This provided loans to help businesses keep there employees on the books. Of those funds handed out, the government has forgiven $757 billion, including a number of lawmakers in Congress.

California is still the home of the most expensive gas prices, but Washington State as a whole has overtaken the Golden State for pain at the pump.

Mortgage interest rates tick up

The weekly average mortgage rate in the US for the week ending 29 June ticked up this week to 6.71% for 30-yr FRM and 6.06% for the 15-yr FRM. The 30-year fixed mortgage average weekly rate has been hovering between 6% and 7% since peaking over seven percent late in 2022.

Gas prices are dramatically cheaper going into the Fourth of July weekend than they were a year ago as over 43 million Americans plan to hit the road.

Thanks to the distribution of SNAP coupons, these people could receive up to $4,223 in July 2023.

Initial unemployment claims drop by 26,000 to 239,000

The US Department of Labor released unemployment insurance data for the week ending 24 June. First-time out-of-work benefit claims dropped to 239,000 from the previous reports upwardly revised 264,000. The 4-week moving average was 257,500, an increase of 1,500.

Planning for retirement involves making important decisions about your financial future, and one crucial choice is selecting the right type of retirement account. Two popular options are the traditional 401(k) and the Roth 401(k). While they share similarities, understanding their differences is key to maximizing your retirement savings.

So what are the distinctions between these two pension programmes?

Plans underway for alternative student debt forgiveness

The Department of Education has initiated rulemaking aimed at opening an alternative path to debt relief for as many borrowers as possible, using the Secretary of Education’s authority under the Higher Education Act.

The Department issued a notice, which is the first step in the process of issuing new regulations under this so-called “negotiated rulemaking” process. The notice announces a virtual public hearing on 18 July and solicits written comments from stakeholders on topics to consider.

What the judges said about student debt cancellation

The Secretary’s comprehensive debt cancellation plan cannot fairly be called a waiver; it not only nullifies existing provisions, but augments and expands them dramatically. It cannot be mere modification, because it constitutes ‘effectively the introduction of a whole new regime.

The plaintiffs in this case are six States that have no personal stake in the Secretary’s loan forgiveness plan. They are classic ideological plaintiffs... In giving those States a forum, in adjudicating their complaint, the Court forgets its proper role. The Court acts as though it is an arbiter of political and policy disputes, rather than of cases and controversies.

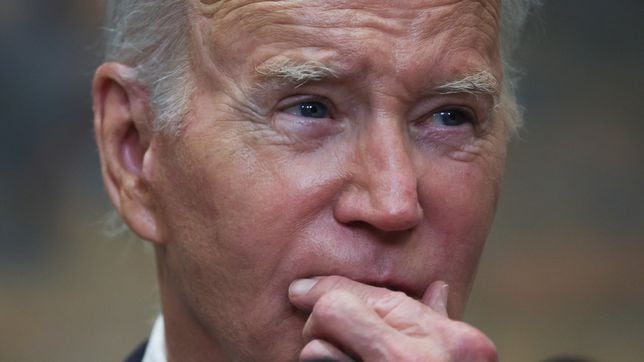

The Supreme Court has ruled against the legality of President Biden’s Student Loan Forgiveness plan, his flagship programme to eliminate hundreds of billions of dollars in student debt.

The Court currently holds a 6-3 conservative majority and voted along their party lines, despite being nominally unbiased.

Here is what the judges had to say.

The White House was not slow in publishing its updated plans on the announcement that the Supreme Court had struck down student debt forgiveness plans. Despite being a sensible contigency measure, the speed in which new plans were announced on Friday do belie the lack of belief in the administration that the Supreme Court was to vote in President Biden’s favour.

Here is what they have come up with.

Hello and welcome to AS USA's live blog covering financial news

The Supreme Court ruled 6-3 that President Biden didn’t have the authority to issue his broad student loan debt forgiveness executive order. Now millions of student loan borrowers who had hoped to benefit from the debt relief will need to reassess how to deal with what they owe.

The moratorium on student loan repayments and interest, in place for more than three years, cannot be extended under law. Experts worry that once repayments start in the fall it could take a toll on the economy, others are concerned that many borrowers could drown under debt.

But for now, American consumers feel the most confident about the economy since January 2022 as the US economy continues to chug along. The latest data showed initial unemployment claims dropping by the most in 20 months and the new PCE inflation report showed price increases slowing more than expected. Despite that good news, and because of it, the chances of the Federal Reserve resuming interest rate hikes in July jumped.

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/A3XOIXMNRBIWXCFR7ANPUMIWCI.jpg)

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/LQRR6HYHYBMYNFNOGJPCNPAOGA.jpg)

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/A3SUEOIBARBFBOHIFCVECXPU7A.png)

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/X5OVLK4K3BNPTJSXJW7STUTW7Q.jpg)