What is the average student loan debt for public and private US college graduates?

Despite the plan to waive $10,000 for most borrowers the amount of debt is still huge and a major burden for young people.

The amount of student debt in the US has been a problem for young Americans for years. Back in 2006 it was $461 billion, by no means small, but it was a trillion dollars lower than it is now. At the end of 2021 student debt was tallied to be worth over $1.75 trillion. This staggering number has prompted action from the federal government.

In terms of per capita number the debt makes for scary reading. In 2021 the mode average student loan debt per borrower was $39,351, which means an average monthly payment of $393, according to recent statistics from EducationData.org. The median debt is $17,000 and 56 percent of people owe less than $20,000.

In total 43.2 million people currently have a student loan and that number is only increasing each year. Worryingly, around 2.6 million graduates owe more than $100,000 in student loan debt alone.

The GOP says we “can’t afford” student debt relief.

— Robert Reich (@RBReich) October 19, 2022

Meanwhile, they're pushing 3 corporate tax breaks that would cost $600B.

That's far more than the cost of Biden’s student debt relief program.

If Republicans regain power, the tax cuts for the rich will only get more extreme.

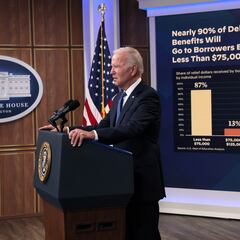

Back in August President Biden announced details of the long-awaited student loan forgiveness initiative that he had promised while campaigning for the 2020 election. While not going as far as many had expected, the program offers $10,000 in debt relief for borrowers with an individual income of no more than $125,000 per year, or $250,000 for couples who file jointly. Borrowers who received a Pell Grant while in university can receive an extra $10,000 in debt forgiveness.

What are the latest developments for debt cancellation?

Related stories

President Biden announced the official launch of his administration’s Student Loan Relief Forgiveness application on Monday. The Beta version of the online form went live on Friday and borrowers flocked to get their requests in. Over 8 million Americans have already signed up to get their federal student loan debt canceled during the short trial period for the online portal.

Just 3 steps and you can see student loan debt relief. pic.twitter.com/2Rw8m6qufp

— Secretary Miguel Cardona (@SecCardona) September 5, 2022

However, there is a looming Supreme Court battle over whether the support will go ahead. Brown County Taxpayers Association in Wisconsin has issued a challenge as well as a number of Republican states have tried to block the move.