When is the next CPI report and what inflation rate is expected?

Inflation has been on people’s minds over the past year hitting a 40-year high in June. It’s been coming down and is expected to approach 4% in May.

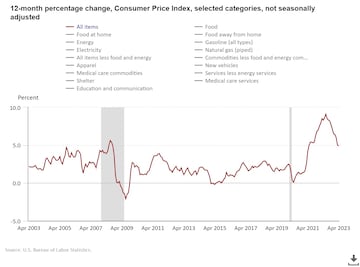

As the United States came out of the pandemic people went on a purchasing frenzy as they revenge shopped. However, all that pent-up demand collided with a lack of available goods due to supply chain disruptions caused by covid-19. That sent prices soaring last year with inflation peaking at 9.1%, a rate not seen since the early 1980s.

Fortunately, price increases have since receded but are still more than double the US central bank’s target of 2%. This is partly due to the unclogging of supply bottlenecks and also the Federal Reserves ratcheting up of interest rates. The overnight bank funding rate has gone from near zero to the range of 5.00% to 5.25% since March 2022 after ten consecutive increases.

The belief now is that policymakers will “skip” another hike when the Federal Open Market Committee (FMOC) meets 13-14 June. That is even after the Department of Labor released hiring data from May that showed the US economy added 339,000 jobs, well above the 190,000 that had been expected according to a Reuters survey. However, that is a 180 degree turn from just the week prior when Wall Street was betting on another 25 basis points rate hike.

When is the next CPI report?

The public won’t know what the central bankers are thinking until they exit from their June get-together as they are now in a blackout period that began Friday 2 June. However, between now and 14 June more economic data is due to come out that may sway their opinions one way or another.

While not their preferred inflation measure, which is the Personal Consumption Expenditures Price Index (PCE), the Consumer Price Index (CPI) numbers will be released 13 June, the first day of the two-day FMOC meeting. The Fed wants to see that inflation is consistently coming down before they let up on tightening monetary policy. The Fed shifted to a “meeting-by-meeting” approach, which in theory means that policymakers will let incoming data shape their choices on what to do with interest rates.

What inflation rate is expected for May?

The expectation at the moment is that the CPI will drop once again in May to 4.1% rise year-over-year and 0.2% increase over the prior month according to the Federal Reserve Bank of Cleveland’s “Nowcast”. Should that prediction be correct, it would be a significant decrease from the 4.9% and 0.4%, respectively, registered in April but still just over twice where the central bank aims to keep headline inflation over a 12-month period.

The prediction for CPI core inflation, once volatile food and energy prices are removed, in May is 5.3% higher compared to twelve months ago and up 0.5% from last month. The April CPI report showed core price increases at 5.5% year-over-year and 0.4% on a monthly basis.