Which states have the highest debt burdens?

Household debt is a gnawing issue that continues to grow. Which states are dealing with it the best and which ones are struggling?

Since 2010, overall household debt in the United States has experienced significant fluctuations. According to recent survey data from Northwestern Mutual, the average household debt, excluding mortgages, has increased from $21,800 to $22,713 in 2024. This represents a modest increase of about 3.5% over the past 14 years. As a lump sum, total household debt rose by $184 billion to reach $17.69 trillion this year.

The debt-to-income ratio has also changed during this period. In 2010, the average debt-to-income ratio was around 1.45, indicating that households owed about 45% more than they earned. By 2024, this ratio had increased to around 1.84, indicating a significant increase in debt burdens.

What is the debt-to-income ratio?

This financial metric is used by creditors to assess an individual's ability to manage monthly debt payments and repay debts. It is calculated by comparing an individual's monthly debt payments to their monthly gross income.

How each state is dealing with household debt

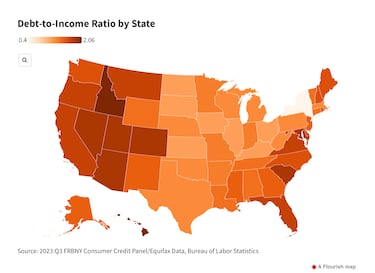

A recent study by Kaplan Collection Agency analysed debt-to-income in all US states using Federal Reserve data. A higher score means a higher amount of debt, with a score of 1 indicating no debt.

At the top of the list, Hawaii has the highest debt-to-income ratio at 2.06, indicating that households in the state owe significantly more than they earn. This is closely followed by Idaho, Arizona, Colorado, and Nevada, all of which have debt-to-income ratios above 1.84. These states are likely to face significant challenges in managing their debt.

Related stories

On the other end of the spectrum, Vermont has the lowest debt-to-income ratio at 0.4, indicating that households in the state have a relatively healthy financial situation.

The company also looked at search data using Google Trends in an attempt to see how pressing the debt issue is in individual states. New York leads in searches for “debt relief,” with 12 searches per month for every 100,000 residents. New York, Nevada, and California are among the top three states with the highest search volumes for debt relief, while Vermont, West Virginia, and Maine have the lowest search volumes.