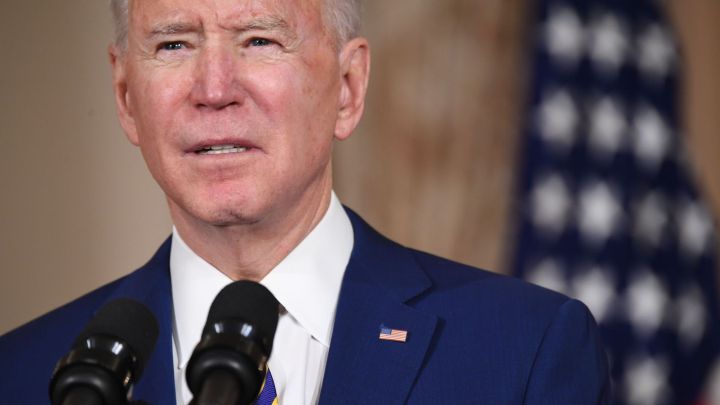

Third stimulus check updates: summary 14 February 2021

Daily information on the third stimulus check included in US President Joe Biden's Covid-19 relief plan, on Sunday 14 February 2021.

Show key events only

Stimulus check news: 14 February

Headlines

- Stimulus checks and child tax credits approved by House Ways and Means Committee (full story)

- Progressive lawmakers table new proposal for $2,000 stimulus checks

- Senate now clear to debate Biden's stimulus bill after impeachment trial concludes

- President Biden urges Congress to "pass the American Rescue Plan and deliver much-needed relief"

- IRS issues guidelines on stimulus checks rebates as we enter tax season (how to claim)

- Child tax credit and stimulus check boost could halve child poverty in the US

- Biden commits to $1,400 stimulus checks, but eligibility still being discussed (full story)

- Global spending on green economic stimulus slowly tracking upwards

- Senate adopts budget resolution that will allow the $1.9tn stimulus bill to be passed

- Over 50 House progressives sign letter calling for stimulus check thresholds to remain the same

- For the latest stimulus check news in Spanish (las noticias sobre los cheques de estímulo en español a través de este enlace)

- US covid-19 cases/deaths: 27.5 million / 484,535 (live updates)

Stimulus funds funeral expenses

Senate Majority Leader Chuck Schumer announced Monday that families of coronavirus victims can soon apply to have funeral expenses paid for through a fund through FEMA.

In the last stimulus bill signed into law in December, $2 billion were earmarked to pay for funeral expenses. The money was placed in the FEMA Disaster Relief Fund.

Read more on the statement released by FEMA.

Stimulus check for bill cover

With the report out that a $1,400 stimulus check will allow 22.6 million Americans to pay their bills in full through mid-July, some are pointing out on social media that this would not be the case for them.

There is clearly a difference between those that have financial means at the moment and those that are truly struggling.

Biden's stimulus package to provide huge boost for poorest Americans

New analysis shows that the $1.9 trillion stimulus package proposed by President Joe Biden would deliver significant financial assistance to the poorest US households.

The $1,400 stimulus check, added to the expansion of the Child Tax Credit and the Earned Income Tax Credit would provide a 33% boost to the pre-tax incomes of the poorest 20% of Americans - or a $3,590 hike per family - according to the Institute on Taxation and Economic Policy.

The lowest-earning households are more likely to spend that money quickly, providing a boost to the economy while stabilizing their own households, ITEP director of federal tax policy Steve Wamhoff told CBS MoneyWatch.

Read more:

$1,400 third stimulus check schedule: when will bill voted on, passed and checks sent?

When could a third $1,400 stimulus check arrive?

The Senate has just acquitted Trump for a second time, allowing the chamber to focus on other business, like passing a third round of stimulus checks.

Fauci: Stimulus bill needs to be passed for schools to reopen

Dr. Anthony Fauci, the nation’s leading infectious disease expert, said on Sunday that a stimulus bill needed to be passedin order for schools to safely reopen.

While appearing on ABC’s “This Week,” Fauci spoke with host George Stephanopoulos about how schools could safely reopen, expanding on new guidelines that were recently released by the Centers for Disease Control and Prevention (CDC).

“It's the first time that it’s been put down in a document based on scientific observations and data over the last several months to a year, both in the United States and elsewhere. Part of that is to indicate and to suggest strongly that a preference be given to teachers to get vaccinated,” Fauci said, though he added it was possible to reopen schools without having all teachers vaccinated beforehand.

When asked by Stephanopoulos if schools had the resources available to abide by the new CDC guidelines, Fauci said he did not believe so.

“I think that the schools really do need more resources and that's the reason why the national relief act that we're talking about getting passed — we need that. The schools need more resources.”

House committees have begun marking up portions of President Biden's $1.9 trillion stimulus plan, and Democrats have vowed to pass a final bill into law by early next month.

Could your third stimulus payment possibly arrive faster than the last one?

There may be a few things you can do to help speed up receipt of a third payment, assuming it happens, according to Cnet.

Signing up for direct deposit in your 2020 tax return would put you in the priority category for a third stimulus payment.

And if you've moved recently, tell the IRS and USPS.

Note that there could be some changes to qualifications that may not apply to a possible third stimulus check.

How to make sure you don't miss out on stimulus check payments

As we enter tax season once again the stakes are a bit higher this year with another round of stimulus checks on the table. By law Americans can submit their tax returns anytime before Thursday April 15, but the exact date may have particular significance with the amount of financial relief you receive.

The stimulus check allowance is based on you most recent Adjusted Gross Income (AGI), which comes from whatest details the IRS has on file. If you earnt less than money in the 2020 tax year than in the previous one, then you should get you tax return completed as soon as possible to ensure you get the maximum amount possible in the upcoming stimulus check.

The new stimulus bill is expected to be passed in early March, meaning that you can effectively choose to have your stimulus check entitlement based off your AGI for either 2019 or 2020.

For full details on how AGI affects your stimulus check entitlement, read our handy guide.

RECAP: Who should get stimulus checks?

Eligibility requirements have been a key area of discussion as Congress looks to pass President Biden's $1.9 trillion covid-19 relief bill. The enormous cost of the bill has led some to question whether the federal support needs to be more targeted i.e should fewer people be given access to the financial support like stimulus checks.

So far it seems that the Democrats' bill will actually widen eligibility when compared to previous bills, with around 13.5 million adult dependents, such as students, in line to receive the direct payments for the first time. However billionaire investor Sam Zell has questioned whether this is neccessary, and calls for a more targeted approach.

Tax Filing 2021: what is the adjusted gross income and how do I check mine?

Tax returns will decide your stimulus check entitlement

As we enter tax season 2021 the stakes are little higher this year with the upcoming round of stimulus checks likely to be based on the latest tax return details on file. The tax authorities, the IRS, are in charge of administrating and distributing the $1,400 payments and will base it on the Adjusted Gross Income (AGI) of each individual filer.

But what is AGI? And how can you tell if you will be eligible for the full amount of the third round of stimulus checks included in the American Rescue Plan? We have all the information you need.

Read more:

$3000/$3600 child tax credit: who would qualify in the new stimulus bill proposal?

Stimulus bill and child tax credit: what will eligibility be?

President Biden's American Rescue Plan includes $1.9 trillion to provide economic support, but the federal funding will not be available to everyone and eligibility depends on a number of factors.

Third stimulus check wheels in motion as vaccination effort is rolling on

The United States has administered 52,884,356 doses of covid-19 vaccines as of Sunday morning and delivered 70,057,800 doses, the Centers for Disease Control and Prevention said.

The doses are for both Moderna and Pfizer/BioNTech vaccines as of 6 a.m. ET on Sunday, the agency said.

Joe Biden has several times altered the government's targets, following news that they kept being met. Right now it's at 1.5 million vaccinations per day.

Meanwhile, the President is urging that his American Rescue Plan including $1,400 stimulus checks be passed as soon as possible through Congress.

Federal tax filing 2021: IRS and Free File website link

Is your 2020 tax return the key to getting your stimulus check?

If you haven't yet received your second stimulus check, or haven't received the full amount, you may be able to claim it through your 2020 federal tax return and the Recovery Rebate Credit tool.

IRS' Free File tool allows you to prepare and file your federal income tax return for free.

Democrats pushing for stimulus check resolution

Despite the hectic scenes in the Capitol in recent days as the former President stood trial for incitement of insurrection, President Biden's team have been working to pass the American Rescue Plan which he first proposed in early January. The $1.9 trillion package includes another round of stimulus checks, a boost for unemployment benefits and makes a sizeable increase in the child tax credit provision.

"There's more Democratic unity than ever on taking bold steps on an economic dignity compact," said Gene Sperling, author of a book on the Party after working for both previous Democratic presidents. "(It's) possible for 2021 to be one of the greatest years of progressive accomplishment in the past century."

2020 US tax return: what's the minimum income to file taxes?

Who needs to file a tax return?

It's that time of the year again, but tax season 2021 will be unlike any other with stimulus checks, additional unemployment benefits and all sorts of federal programmes to consider this time around. But not everyone is obliged to file with the IRS, with some low income earners not expected to pay tax on the previous year's earnings.

Although the new stimulus bill has not yet been agreed, your tax return could well be used to calculate the amount of stimulus check and child tax credits that you and your family are eligible for. To find out if you need to file a tax return this year, check out our guide:

Experts predict child tax credit distribution issues

One of the key components of Biden's American Rescue Plan is a significant expansion of the child tax credit provision which would see parents able to claim up to $3,600 a year. The support would be distributed as monthly payments similar, to the stimulus checks, worth up to $300 for children aged under six and $250 for those between six and 17.

However there are certain criteria based on income, household situation and custody status which can affect the entitlement, which may be out od date by the time the money is distributed. The Washington post expects some to miss out on the vital support because their situation has changed since they last filed their taxes. Those who have only suffered a loss of income recently may be unable to receive the money they need.

Check the status of your stimulus check payment with IRS online

The two previous round of stimulus checks have been a vital lifeline for millions all across the country but some have unfortunately fallen through the cracks as the IRS attempted to get over 160 million payments distributed. As we wait for confirmation that the American Rescue Plan has been passed and another round is on the way, it is not too late to check on previous payments.

Those who have wrongly missed out in the past can apply to receive the same amount as a tax credit on their upcoming tax returns, meaning they can receive up to $1,800 for missing payments. You can do this and check the status of previous stimulus checks, through the IRS' online portal.

Full details:

Stimulus check money will be vital for more than 20m Americans

A recent study conducted by research bosy Morning Consult found that a round of $1,400 stimulus checks, as proposed in the American Rescue Plan, would allow million of Americans to pay bills that they are otherwise unable to cover. They found that roughly 30.2 million Americans were unable to pay their bills at some point during January, but that three-quarters of that figure missed their bills by less than $300.

Many had hoped that BIden would include a stand-alone payment of $2,000 in his new stimulus bill, but this study suggests that even $1,400 stimulus checks would be enough to prevent millions from getting behind with bill payments.

The Morning Consult wrote of the proposal: "The cost of sending significantly larger stimulus checks to everyone far outweighs the benefits of helping relatively few additional Americans," but added that the package would be most effective if it can be successfully targeted.

"Here’s what I won’t do: I’m not cutting the size of the [stimulus] checks. They’re going to be $1,400. Period. That’s what the American people were promised."

How much will the new child tax credit be worth?

The American Rescue Plan proposes a ground-breaking increase on the amount offered to families in the form of child tax credits. It is just one of the measure that President Biden hopes will help cut childhood poverty in the US poverty in half, with stimulus checks and a boost to unemployment benefits also vital.

The new system would see the financial support issued in the form of monthly payments, rather than as an end-of-year rebate as was the case in the past. This breakdown on Biden's proposal shows how much more a family could stand to receive under the new plan.

Tax return information will decide how much you get in your stimulus check

As we enter tax season 2021 this year's returns will hold even greater significance than usual as they could be the difference between receiving or not receiving a stimulus check payment as part of Biden's American Rescue Plan. The thresholds for eligibility for the full $1,400 payments are based on the most recent set of tax returns that the IRS has for each filer.

This means that anyone who files before the new stimulus bill is officially signed into law (expected to be sometime in early March) will have their tax details for 2020 on the system. Anyone who has suffered loss of income due to the pandemic could therefore be entitled to a bigger stimulus check payment is they get their tax returns filed quickly.

For full details on how to maximise your stimulus check entitlement, check out this handy Wall Street Journal article...

Dem. lawmaker on stimulus checks: "We made a promise, we should keep it"

Rep. Rashida Tlaib has called for stimulus checks to be increased to help Americans deal with the economic consequences of the covid-19 pandemic. The progressive lawmaker is one of those who signed a letter to President Biden and Vice President Harris, asking them to consider replacing the one-off payments with a recurring stimulus check.

In this interview she explains her reasons for wanting more support, and questions why Americans are being so stringently means tested before they can get the vital payments. She cites a study that found that seven out of ten Americans would favour a more expansive stimulus bill. She goes on to describe the potential of a major stimulus bill as being "life-changing", saying "it's the people's money, give it to them".

What have the Democrats said about paying $ 3,600 per child?

How much child tax credits could I recieve under Biden's new plan?

The American Rescue Plan has been heralded by President Biden as a stimulus bill with the potential to halve the number of children living in poverty in the United States. As well as the stimulus checks, the $1.9 trillion package will also incude a hefty increase on the current child tax credit system.

The new payments will come in the form of monthly direct deposits, much like the stimulus checks, with parents entitled to up to $3,600 a year to help support their family. Representative Rosa DeLauro said of the proposal:

“The moment is here to make dramatic cuts in child poverty that could improve the lives and the future of millions of children."

Full details:

Stimulus check confusion could lead to tax season headaches

Personal finance experts are warning of potential chaos as the tax season begins with the prospect of stimulus checks still unsettled, and millions yet to receive previous payments. Those who have not yet received payment for either of the last two stimulus checks but are eligible are able to claim the money as a tax credit on their upcoming filing.

The uncertainty surrounding the next round of stimulus checks is also causing issues for some trying to do their returns at the moment. For more information on how to do so, check out our handy guide: How to claim your stimulus check on 2020 tax return

Christine Speidel, a law professor at Villanova University who directs the school’s Federal Tax Clinic, said recently: “It’s pretty common for lower income folks to count on their refunds. … The financial pressure to file early is augmented by the stimulus payments,” because many will be claiming after missing or not fully receiving a previous payment.

Calls for Congress to alter "unfair" child tax credits

One of the most talked about inclusions in Biden's American Rescue Plan is a marked increase in the current child tax credit allowance. In the past parents have been able to recieve up to $2,000 a year in the form of a tax rebate, but the new stimulus bill would see the top bracket upped to $3,600, in the form of monthly payments of $300 for parents of children under six.

The tax break is now designed to appear more like a stimulus check with monthly payments, something that has provided vital and immediate relief for millions. Rep. Katie Porter has called for another alteration to be made - removing the status distinction which leaves single parents losing out. Full details on her complaint, and what she proposes instead, can be seen in her statement here:

Stimulus bill needed to reopen schools

One of President Biden's key goals for his first 100 days in office was to see American school children back into classrooms. The pandemic has made it unsafe for people to gather in large areas but it is hoped that the roughly $400 billion of financial support for local authorities and vaccine distribution will get the virus under control.

Getting kids back to school would also ease the burden on families who, in many cases, have had to cut back on their work hours or pay for childcare. The economic pressures on low income families are particularly visible at the moment and Biden has proposed a significant increase on the child tax credit allowance which would see parents given up to $3,600 per child. The support, distributed in monthly payments like the stimulus checks, would be worth $300 a month for children under six and $250 a month for those aged between six and 17.

Reddit unemployment forum explodes during pandemic recession

A report by the New York Times shows a growing trend of jobless Americans taking to social networking platform reddit in search of employment, to recount their experiences and to vent. The posts first began to take off last April but the forum has just had one of its busiest weeks ever as millions worry about the fate of the new stimulus checks and other financial support.

Biden's American Rescue Plan includes another boost to the additional unemployment benefits which have been relied upon by millions during the pandemic. But with Congress unable to pass the stimulus bill in the four weeks since Biden took office, many have been forced to look online for support.

Third stimulus check: Biden asks for its rapid approval

Biden calls for stimulus checks to be passed

Much of President Biden's successful election campaign was ran on the promise of providing a more comprehensive covid-19 response than Trump and his American Rescue Plan was announced as a lifeline for millions of struggling Americans. The bill contains stimulus checks worth $1,400 and a boost to unemployment benefits but he faced stiff opposition from Republicans in the Senate.

Biden has reaffirmed his commitment to the $1,400 stimulus checks but elements of the eligibility requirements may be altered. Here's everything you need to know about the fate of the President's covid-19 economic relief bill and what Biden himself has said about the proposal.

Read more:

Recovery Rebate Credit helps those still eligible for Economic Impact Payments

The Inland Revenue Service (IRS) say most people have received their stimulus checks that were issued last year, but those who didn't receive a payment, or only received a partial payment, may be eligible to claim the Recovery Rebate Credit when they file their 2020 tax return. The tax season opened on Friday (12 February) and runs until 15 April.

Hickenlooper admits vote against stimulus checks for undocumented immigrants was a mistake

Sen. John Hickenlooper (D-CO) voted for a Republican non-binding budget amendment aiming to prevent undocumented immigrants from receiving stimulus checks but was later forced to backtrack on his decision. Colorado immigration advocacy groups and community leaders were highly critical about Hickenlooper's vote - the The Colorado Immigrant Rights Coalition Action Fund calling it “a slap in the face”.

Hickenlooper’s office later issued a statement to Denver7 News to explain that the senator was still committed to comprehensive immigration reform, the Colorado Times Recorder reports.

Would the third stimulus check be based on 2020 or 2019 tax returns?

Delivering a third stimulus check of up to $1,400 per person (plus any dependents,) is not quite as simple as it seems. One area which could complicate the next round of payments is filing tax returns. The tax season for 2020 began on Friday 12 February and ends on 15 April. That means that the IRS could still be processing stimulus checks during the tax season. Would the IRS use your 2019 or 2020 tax return to determine your total payment?

Raising the minimum wage to $15 could save US billions of dollars per year

Ken Jacobs explains why Joe Biden’s plan to raise the minimum wage to $15 per hour by 2025 would benefit the US in the long-term. The Raise the Wage Act aims to give 32 million working people a much-needed pay rise.

Marcia Fudge to tackle crippling US housing crisis

Marcia Fudge is poised to be appointed secretary of the federal Department of Housing and Urban Development. If confirmed, the 68-year-old would become the second Black woman to serve in the post after Patricia Roberts Harris, to head an agency facing the worst housing crisis since the Great Depression

US consumer sentiment ebbs in February despite additional stimulus hopes

US consumer sentiment unexpectedly fell in early February amid growing pessimism about the economy among households with annual incomes below $75,000, even as the government is poised to deliver another round of covid-19 relief money.

The University of Michigan said on Friday its consumer sentiment index slipped to 76.2 in the first half of this month from a final reading of 79 in January. Economists polled by Reuters had forecast the index little changed at 80.8. "More surprising was the finding that consumers, despite the expected passage of a massive stimulus bill, viewed prospects for the national economy less favorably in early February than last month," the University of Michigan said in a statement.

President Joe Biden has proposed a $1.9 trillion recovery package, which is under consideration in the U.S. Congress. The government provided nearly $900 billion in additional pandemic relief in late December.

How many executive orders has Biden signed in his first few weeks?

How many executive orders has Biden signed in his first few weeks?

Since Joe Biden was sworn in as the 46th president of the United States on 20 January, he has been busy signing numerous executive orders, memorandum and actions covering a wide range of issues including Federal Covid-19 response, Civil Rights, workers’ protection, health care, immigration, racism, education, climate change and the economy.

According to the latest update issued by the US Federal Register, of the 45 Executive Orders signed since the start of the New Year, Biden signed 29 between 20 January and 9 February 2021 – the first, Revision of Civil Immigration Enforcement Policies and Priorities was one of several signed on his first day in office. The most recent, Rebuilding and Enhancing Programs To Resettle Refugees and Planning for the Impact of Climate Change on Migration was established just a couple of days ago.

Read the full story...

When was the second stimulus check sent out and how much was it?

When was the second stimulus check sent out and how much was it?

President Biden is still waiting for Congress to pass the American Rescue Plan, but how does the third round of stimulus checks compare to previous payments?

Full story...

Study: $1,400 stimulus checks would help 22.6 million pay bills through mid-July

President Biden's proposed $1,400 coronavirus relief checks would allow 22.6 million Americans to pay their bills for at least four and a half months, according to a study from data and research company Morning Consult.

The analysis comes as debates continue over the size and number of stimulus checks to be included in the next round of covid-19 aid.

To evaluate the stimulus's impact, Morning Consult analysed data on household finances, determining that a new stimulus targeted at low-income adults would help to prevent worsened financial hardship, more than just digging people out of trouble.

According to the study, roughly 30.2 million Americans were unable to pay their bills in January.

Out of those, 75 percent missed their bills by less than $300 — a 7 percent improvement from the month prior. Concerns may be raised that the study could be used as evidence against a fourth stimulus check.

How will the American Rescue Plan help small businesses?

The $1.9 trillion package proposed by Biden in early January provides much more than just stimulus checks and in an interview posted today by the White House Twitter account, the President talks with the owners of a restaurant from Atlanta, Georgia. The stimulus bill proposed includes funding for small businesses to keep them afloat but also to address the most pressing public health priorities.

The plan includes around $400 billion to help Americans return to workplaces, restaurants, bars and schools with a huge nationwide vaccination effort. As the restuarant owners point out, widespread vaccination is crucial to ensure the US economy prospers in the long-term.

Could the impeachment ruling complicate efforts on stimulus bill?

While many have pointed out that the end of Donald Trump's impeachment trial will allow lawmakers to focus their attention on passing President Joe Biden's American Rescue Plan and the much-needed $1,400 stimulus checks, USA Today editor Susan Page has argued that the result of the impeachment could complicate efforts.

"It is possible that the raw and deep feelings over impeachment are going to complicate efforts for bipartisanship on unrelated issues -- say, a $1.9 trillion stimulus bill," tweete Page, who heads up USA Today's Washington Bureau.

$1.9 trillion stimulus relief bill: What aids and payments have been passed in House committees?

$1.9 trillion stimulus relief bill: What aids and payments have been passed in House committees?

On Thursday another key part of President Joe Biden’s American Rescue Plan was passed as the Ways and Means Committee approved $940 billion of federal spending. The move comes despite strong opposition from Republican lawmakers but it is an expected step in the reconciliation process.

Read the full story...

Sign up to the Brookings Institute's webinar on stimulus checks

On Wednesday, February 17, The Brookings Institution will publish Financial Health Network’s Dan Murphy's new report, “Economic Impact Payments: Uses, Payment Methods, and Costs to Recipients”.

To coinicide with the release of the report, Murphy will hold a webinar to present the paper’s key findings and recommendations, providing recommendations for the new administration on how to improve any new rounds of direct payments.

Representative Jesús “Chuy” García will open the event with keynote remarks. Georgetown Professor Sonal Shah will respond to the paper, followed by a conversation with Murphy moderated by Aaron Klein.

You can sign up for the webinar here.

Economist says income limit for married couples should be cut to $100,000 for $1,400 stimulus checks

Economist John Leer has called on lawmakers to lower the top-income threshold for married couples to receive a joint $2,800 stimulus check to $100,000, down from the $150,000 limit of the previous stimulus payments.

“If we can find the smallest group of people to get the smallest amount that avoids the most harm, that’s a no-brainer,” said Leer.

Currently, President Biden’s proposed $1.9 trillion American Rescue Plan would send $1,400 checks to individuals earning up to $75,000 and $2,800 to married couples earning up to $150,000. People with higher incomes would receive smaller payments based on their earnings, until a phaseout for wealthier households.

Biden has previously said he is not against a more targeted stimulus checks and may be forced to limit income threshold if he wants to get a bi-partisan bill passed.

Many economists have echoed Leer’s idea, arguing that the income threshold for $1,400 stimulus checks should be cut to $50,000 for individuals and $100,000 for married couples. Republicans are in favor of this proposal, as too are some Democrats.

"Stop messing with the people's money ... We made a promise."

Michigan congresswoman Rashida Tlaib has called on her fellow lawmakers to "stop messing around with people's money" and approve the third round of stimulus checks.

Speaking about the importance of giving Americans $2,000 stimulus checks (and not a $1,400 payment), Tlaib said: "It's going to help our local economy. And it's gonna give people human dignity because they get to decide 'do I pay my water bill, my light bill?'

"They get to decide if it goes towards their rent and trust me, no one wants to be out on the streets. So when we provide this money, it is going to go towards people's quality of life."

Tlaib is one of a number of Democratic lawmakers, along with Ilhan Omar and Alexandria Ocasio Cortez, calling for recurring monthly stimulus checks worth $2,000.

Still haven't recieved your $600 stimulus check? Keep an eye on your mail

The IRS has advised those who have still not recieved their second $600 stimulus check to keep an eye on their mail, as around 8 million payments are being sent out as prepaid debit cards...

How can child support affect the size of your stimulus check?

While some details remained the same through previous rounds of direct payments, the relationship with child support payments has changed dramatically. During the first round of payments anyone who owed child support payments could have their stimulus check entitlement sent to a spouse who they owed child support to.

This was controversial at the time and even led to a series of administrative errors which gave the stimulus check money to the wrong person. Around 50,000 people had their money incorrectly sent to a third party, which the IRS was forced to hastily refund.

For the second round of payments the rules changed and the IRS were no longer able to withhold or redirect stimulus checks to pay child support debts. However this leaves people who are owed child support payments out of pocket, and comes at a time when around eight million children in the United States are living in food poverty.

Who will be prioritised for the third round of stimulus checks: the person in need of child support or the person who is unable to provide it? A decision is yet to be made but the outcome could have huge consequences for millions of families.

Will the $1,400 stimulus check be taxed?

If you're wondering if you will have to pay tax on your $1,400, then the answer gladly is "no".

"No, the payment is not income and taxpayers will not owe tax on it," the IRS has said.

One-third of Americans plan to save $1,400 stimulus check

According to a survey by Bloomberg, one third of Americans plan to save their $1,400 stimulus check when it comes through.

"The survey results are fodder for an intensifying debate about whether government money is going to people who don’t immediately need it. Some of Biden’s Democratic allies are making that case and calling for a more targeted approach as the administration steers its bill through Congress. They want to lower the income ceiling for people to qualify for the full $1,400, currently set at $75,000 for individuals and $150,000 for couples," reports Bloomberg.

"But there are potential advantages to a slow-burn stimulus. It could spread out government support over time and avoid the kind of consumer spending stampede that’s led some economists to warn of inflation risks. Federal Reserve Chair Jerome Powell said Wednesday that he doesn’t expect a sustained surge in prices when the economy reopens, even though Americans have built up some savings."

Some voters have not forgotten Biden's $2,000 stimulus check promise

Some voters are not forgeting Joe Biden's speech before the Georgian sentare run-off elections, when then-president-elect promised that $2,000 checks would "go out the door immediately".

His comments helped to secure election wins for both Democratic candidates, Jon Ossoff and Raphael Warnock, who were sworn in as senators in January. However some people are still asking what happened to the idea of the $2,000 stimulus checks...

ICYMI: Finance guru Dave Ramsey says: “I don’t believe in a stimulus check"

Personal finance guru Dave Ramsey has faced a serious backlash over his comments regarding the stimulus checks, saying that if a $600 or $1,400 stimulus payment would be a lifeline for you, then “you were pretty much screwed already.”

"If $600 or $1,400 changes your life, you were pretty much screwed already. You got other issues going on," Ramsaey told Fox News on Thursday.

“That’s not talking down to folks. I’ve been bankrupt. I’ve been broke. I work with people every day who are hurting. I love people. I want people to be lifted up, but this is, again, it is just political rhetoric,” Ramsey added.

Nasdaq outlines three top stocks to buy with stimulus check money

An article published on Nasdaq's website has identified three top stocks to buy for those who may be planning to invest their $1,4000 stimulus check once it comes through.

Not everyone will need to spend their $1,400 stimulus check on immediate expenses, with many planning to save the money, while others will no doubt invest in stocks.

And according to the three Motley Fool contributors to the article published on Nasdaq, the three top stock options right now for stimulus check investors are: Bumble (NASDAQ: BMBL), FuboTV (NYSE: FUBO), and Target (NYSE: TGT), which they say are "primed to be winners".

40 million people would be ruled out of more "targeted" stimulus checks

If the income threshold is lowered to $50,000 for the $1,400 stimulus check, it could mean 40 million Americans who got the previous two payments would not be entitled this time around.

The income threshold for the $1,200 and $600 checks was set at $75,000 and most Democrats, including President Joe Biden, are eager to keep the cut-off point at the same level for the $1,400 checks.

However, Republicans have proposed a more “targeted” payment that would only be sent to those making $50,000 or less.

“More targeted checks, by my estimate, would mean that 40 million fewer people (12% of the population) who got a $600 check would not get a $1,400 check. That’s like Kyle Pomerleau’s estimate of 46 million (14% of the population),” economist Claudia Sahm has said.

Biden has previously said he is open to the idea of a more targeted payment. And considering the fact that the president is eager to pass a bi-partisan bill, he may be willing to waiver on the income limits in order to get Republicans to approve his $1,400 stimulus checks. All will hopefully become clearer in the coming weeks.

When will $1,400 stimulus checks arrive now that Trump's impeachment trial Is over?

With Donald Trump's impeachment trial out of the way, lawmakers can again turn their attention to approving Joe Biden's American Rescue Plan, which includes $1,400 stimulus checks.

On Thursday, the House Ways and Means Committee approved the $1,400 stimulus payments, with the legislation now moving to the House Budget Committee, where it will remain until the House reconvenes on February 22.

The proposal is then expected to be passed by the House by the end of the month. Lawmakers have earmarked 14 March as an unofficial deadline to approve the bill, as this is when federal unemployment benefits under Trump's $900 billion relief package expire.

Recently, House speaker Nancy Pelosi said: "We hope to have this all done by the end of February," adding that a bill could be on President Joe Biden's desk no later than the beginning of March.

How US stimulus checks compare to other countries?

See how US stimulus payments have compared to relief payouts in other countries such as Australia and the UK....

When will the new stimulus checks be passed?

The subject of stimulus checks has been pushed aside during the impeachment trial but now that it has been concluded there are hopes that progress can be made on Biden's American Rescue Plan. House leader Nancy Pelosi has confirmed that the Democrats hope to have the bill settled in the coming weeks:

"We hope to have this all done by the end of February," she said, and added that she expects the bill to be on President Biden's desk at the beginning of March at the latest.

This news comes after the House Ways and Means Committee approved $940 billion of federal funding to cover the $1,400 stimulus payments to millions of Americans.

Stimulus check: Who will receive $1,400 and who won't?

Last week, the House approved a budget that would allow President Joe Biden to move forward with a new covid-19 relief package. However, there's potential for things to be different this time around.

For starters, Congress is considering lowering the income eligibility threshold for a third stimulus check tremendously. Democrats are proposing lowing the threshold from $75,000 per individual to $50,000, and from $150,00 to $100,00 for married couples. Individuals earning $50,000 or less would receive the full $1,400 payment, and married couples earning up to $100,000 would receive the full $2,800 payment.

Parents with children would receive an additional $1,400 per child.

More than 50 House Dems tell Biden US needs recurring stimulus checks

“It is clear that in this unprecedented time in our nation’s history that we must take additional anticipated action,” a letter to the President reads.

“Recurring payments would provide a long-term lifeline to struggling Americans for the duration of this deadly pandemic.”

The letter doesn’t specify what amount the representatives would like the recurring payments to be, but as Politico points out, progressives in the House have previously pushed for $2000 monthly checks. Last year, when she was a senator, Vice President Kamala Harris herself introduced a bill to give Americans $2,000 each month in coronavirus relief due to the millions of jobs lost and the many businesses that have closed due to the pandemic.

US stimulus check: live updates

Welcome to our daily live blog bringing you updates on the progress being made in attempts to pass President Joe Biden's $1.9tn American Resuce Plan, which includes a measure for stimulus check of up to $1,400.

- USA coronavirus stimulus checks

- Washington D.C.

- Nancy Pelosi

- Joseph Biden

- Covid-19 economic crisis

- Science

- Coronavirus Covid-19

- Economic crisis

- Pandemic

- Coronavirus

- Recession

- United States

- Economic climate

- Virology

- Outbreak

- Infectious diseases

- North America

- Microbiology

- Diseases

- Medicine

- America

- Economy

- Biology

- Health

- Life sciences