Fourth stimulus check live updates: Monday 27 April

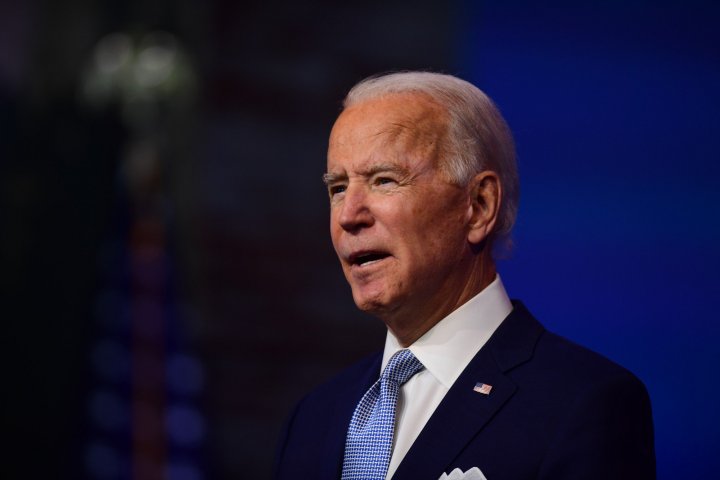

Latest news and information on the third stimulus check in President Joe Biden's coronavirus aid package, as well as updates on a potential fourth check. Tuesday 27 April 2021.

Show key events only

US stimulus checks: latest news

Headlines:

- Total cost of third stimulus check reaches $379bn after 161m direct payments are made

- IRS confirm that another 700,000 'plus-up' stimulus checks went out this week (full story)

- President Joe Biden urged to support more direct payments as part of 'Build Back Better' plan (who backs a fourth stimulus check?)

- How much could the fourth stimulus check be worth? (Full story)

- Biden's State of the Union address on Wednesday may reference future CTC and stimulus plans (Full story)

- Calls for temporarily expanded Child Tax Credit (CTC) to be made permanent (find out more about the CTC)

- Biden may include CTC extension in American Families Plan proposal

- $600 stimulus checks are going out in California as part of Golden State Stimulus (when can I expect my check?)

- You can track your third stimulus check by visiting the IRS' Get My Payment portal

- Stay across all the US vaccine news (live blog)

- US covid-19: 32.16 million cases / 573,316 deaths (live updates from Johns Hopkins University)

Scroll through some of our related articles:

Florida unemployment benefits work search requirement: how it works

Florida unemployment benefits work search requirement: how it works

New requirements may be implemented for those seeking unemployment benefits in Florida

US consumer confidence hits 14-month high

US consumer confidence jumped to a 14-month high in April as increased vaccination against covid-19 and additional fiscal stimulus allowed for more services businesses to reopen, boosting demand and hiring by companies.

The upbeat survey from the Conference Board on Tuesday, which also showed a strong increase in vacation plans, suggested the economy continued to power ahead early in the second quarter after what appears to have been robust growth in the first three months of the year, believed by many economists to have been the second strongest since 2003. Growth this year is expected to be the best in nearly four decades.

"Consumers are seeing the light at the end of the covid tunnel," said Ben Ayers, senior economist at Nationwide in Columbus, Ohio. "Led by strong spending as households return to eating out, travelling and visiting stores, the economy should surge ahead starting the second quarter and likely carrying into 2022."

Time running down to file tax returns

Despite the recent confirmation from the Internal Revenue Service announcing that the federal income tax filing due date for individuals for the 2020 tax year will be automatically extended from April 15, 2021, to May 17 (2021), less than three weeks remain to file.

"This continues to be a tough time for many people, and the IRS wants to continue to do everything possible to help taxpayers navigate the unusual circumstances related to the pandemic, while also working on important tax administration responsibilities," said IRS Commissioner Chuck Rettig.

What has the IRS said to do to claim a missing stimulus check and when it's coming?

The IRS has been sending out the third round of stimulus checks at a blinding pace. The agency has so far sent around 161 million payments for a total of $379 billion to eligible Americans.

However, if you never received the $1,200 or $600 stimulus checks and were eligible, the IRS urges you to file a 2020 tax return to claim the missing money. Likewise, if you think you didn’t get the right amount the only way the agency can correct it is to have the most current information on your economic and family situation, but time is running out.

Third stimulus check: will there be a bonus payment?

As part of the third round of stimulus checks, the Internal Revenue Service is sending out supplementary cash injections known as ‘plus-up’ payments to qualifying Americans.

‘Plus-up’ payments are being distributed to taxpayers whose third stimulus check had already been automatically calculated and sent out using the income information in their 2019 federal tax return, but who are now entitled to a larger check based on the earnings detailed in their recently-processed 2020 return. These payments will continue throughout 2021 as the IRS works through a backlog of tax filings.

Dems pushing to make $3,600 Child Tax Credit permanent

Biden's $1.9 trillion stimulus package, signed into law in March, expanded 2021 child tax credits to $3,000 for each child aged between 6 and 17 and $3,600 for each child under the age of 6. But the change is only temporary for the 2021 fiscal year.

One of the three Democrats that introduced the measure Connecticut Rep. Rosa DeLauro said in a statement, "We must use this moment to pass the American Family Act and permanently expand and improve the child tax credit by increasing the benefit to families and providing payments monthly. Children and families must be able to count on this benefit long after the end of this pandemic."

Global economy surpassing pre-pandemic peak on back of stimulus

Jeffrey Kleintop at Charles Schwab told Yahoo Finance that he sees a global economy that has recovered from the downturn and is now pushing into positive territory. He thinks that the stimulus has done its job and that the markets are in generally good shape and that there are “still gains to tap.”

Biden is set to announce his next spending bill on Wednesday which will include tax hikes on the wealthy and investors, but he isn’t too concerned about tax hikes affecting earnings.

Fourth stimulus check: will the new relief bill have bigger payments if approved?

With mounting pressure on President Joe Biden to support further stimulus checks in his Build Back Better plan, how much more money could you be entitled to?

Fourth stimulus check: who is in favor of its approval?

The US has sent each eligible American adult up to $3,200 in three rounds of stimulus checks but some feel that even with the latest $1,400 checks more is needed. President Biden is facing mounting pressure from Democrats in Congress to include a fourth stimulus check in his Build Back Better plan.

In a letter signed by twenty-one Senators from fifteen states, Senate Democrats urged Biden to consider the inclusion of “recurring direct payments and automatic unemployment insurance extensions tied to economic conditions” in his new proposal.

But after an early burst of direct support, is Biden willing to sanction another wave of payments?

Will $3,600 Child Tax Credit arrive with third stimulus or fourth?

President Joe Biden will address a joint session of Congress 28 April where he is expected to announce the third part of his Build Back Better. Despite lawmakers urging to make the changes to the Child Tax Credit for 2021 permanent, they may have to settle for a temporary extension.

States need to prepare now for when stimulus dries up

For over a year, school leaders have faced steep challenges and, often, high costs in serving students at home and in the classroom during the pandemic. Congress stepped in to provide $67.5 billion in additional federal aid for education in 2020 and then, with the American Rescue Plan Act of March, provided another $129 billion to K-12 education. School districts have until 2024 to spend the latter, which should arrive in the next few weeks.

To avoid financial problems when the “funding cliff” occurs three years from now, Zahava Stadler of The Education Trust and Victoria Jackson Center on Budget and Policy Priorities say that school leaders must get their state financial houses in order now to prepare for the future.

Stimulus is slowing the recovery?

Many restaurants are struggling to find waiters, bartenders and kitchen staff. The disruption of the covid-19 pandemic sent millions of these workers to the streets with lockdown restrictions. Many sought new opportunities or were displaced by economic factors. However, some hold the view that the shortage has more to do with workers not needing to return to work because of stimulus money in their pockets and enhanced unemployment benefits.

Tilman Fertitta, Landry’s chairman and CEO and Houston Rockets owner, joins ‘Power Lunch’ to discuss the worker shortage and the economic recovery.

Could more stimulus create a new golden age for start-ups?

Mila Kordestani thinks this is a good time to be an entrepreneur, with a little more help from Uncle Sam start-ups could flourish in a post-pandemic economy. Here’s an excerpt:

"While it may sound overly opportunistic, there has probably never been a better time to enter the world of entrepreneurship. As a result of the pandemic, a lot of entrepreneurs have a better chance of entering markets in which many competitors have had to close their doors for good. Thus, more hawkish entrepreneurs can swoop in to take advantage of market gaps that are quickly being filled by larger businesses."

Biden address Congress at State of the Union 2021: How to Watch

President Biden will make his first joint address to Congress Wednesday night.

The event is an opportunity for President Biden to outline his economic and legislative agenda for the coming year. Officials from Biden’s administration have stated that much of the speech will focus on his next signature piece of legislation, the American Families Plan.

What are Congress’ mortgage stimulus programmes?

Throughout the pandemic the federal government has introduced legislation aimed at easing the financial impact of the covid-19 pandemic. Homeowners who are dependent on a stable household income to cover mortgage payments are particularly vulnerable in a struggling jobs market.

Successive stimulus bills have offered relief to homeowners and the American Rescue Plan extends mortgage forbearance and the foreclosure moratorium until the end of June.

When will the IRS finish making stimulus payments?

The IRS has sent almost 380 billion dollars' worth of stimulus checks since mid-March across 161 million payments. The seventh batch is expected to land in bank accounts on Wednesday with additional checks going out the door.

At this point the vast majority of stimulus checks have been sent out the eligible Americans, but how many have been sent out in total?

Here's the latest update from the IRS, along with the state of play on the fourth stimulus check.

Ex-Trump aides challenge part of the stimulus bill on grounds of racism

Bloomberg - The Biden administration’s distribution of stimulus funds earmarked for “socially disadvantaged farmers and ranchers” illegally discriminates against White people, according to a lawsuit filed by a new legal group with ties to former President Donald Trump.

America First Legal, started in April by Trump’s ex-senior adviser Stephen Miller and former Chief of Staff Mark Meadows, among others, filed the suit Monday in federal court in Fort Worth, Texas, on behalf of the state’s agriculture commissioner, Sid Miller. The suit challenges the Biden administration’s definition of who qualifies as “socially disadvantaged.”

Democrats introduce bill to make enhanced Child Tax Credit permanent

House Democrats unveiled a bill on Monday to keep the one-year child tax credit expansion, an anti-poverty initiative which formed a major part of President Joe Biden's $1.9 trillion stimulus plan approved a month ago.

The plan was introduced by a trio of Democrats including Rep. Rosa DeLauro, chair of the House Appropriations Committee; Rep. Suzan DelBene, head of the centrist New Democrat coalition; and Rep. Ritchie Torres of New York.

It would maintain the strengthened child tax credit, increased to $3,600 per child under age 6 and $3,000 for kids between 6 and 17.

A tax credit even more valuable than the $1,400 stimulus check and the $3,600 Child Tax Credit

Having $1,400 show up in your bank account will make you take notice. The third round of stimulus checks that were included in the American Rescue Plan got plenty of media attention. Now parents can look forward to another direct payment through the Child Tax Credit, depending on the age of the child $250 to $300 per child could be coming each month.

But Andy Meek at BGR thinks people are overlooking a much bigger tax credit included in the bill.

“What we’re referring to is something that’s escaped much coverage in the media. It’s an expansion of the Child and Dependent Care Credit, and the fact that not enough people likely know about this benefit is a shame because it’s even more lucrative than the one-time stimulus checks, as well as the $3,600 stemming from the child tax credit expansion.”

Biden’s first address to Congress after 100 days in office

Typically presidents address Congress, cabinet officials, and the Justices of Supreme Court in January or February each year. However, being his first year in office, US President Joe Biden's first address has been postponed to give the administration time to prepare a legislative agenda, which will be announced in greater detail during the event.

More on what Biden is expected to talk about when he addresses Congress

Child Tax Credit a key part of new families bill

President Joe Biden is set to announce details of his American Families Plan on Wednesday when he makes the first Congressional address of his presidency. The next phases of Biden's Build Back Better plan will focus on families, after the intitial stimulus bill and more recent infrastructure proposal.

There have been growing calls for the new package to include an extension of the new Child Tax Credit system, which could see the 12-month programme last until 2025. Dem Rep. Richard Neal presents his own thoughts on the importance of the families package here.

Fourth stimulus check: will it be approved and sent in May?

The number of unemployed workers in the US claiming benefits continued to decline in March, but the Department of Labor warned that the figures are still dangerously high. In total, 9.7 million unemployed workers claimed benefits last month, down from the 23.1 million peak in April 2020.

As the national unemployment rate is still higher than pre-pandemic levels and suffering a reduction in income, some lawmakers are pushing for a fourth stimulus check to be included in the next large-scale economic legislation introduced by the Biden administration. But with so many other important legislative goals, will Biden choose to use up vital political capital on pushing through a fourth direct payment?

Further details on Neal's Child Tax Credit proposal

Earlier today we reported that Rep. Richard Neal had spoken publically about a new piece of legislation that would make the new-look Child Tax Credit a permanent feature, and provide funding for other programmes. Neal, who serves as Chair of the House Ways & Means Committee believes that a regular monthly payment would provide much-needed peace of mind for families.

"We must finally acknowledge that workers have families, and caregiving responsibilities are real. Through sensible, but bold investments, we can put workers' minds at ease and ready our country to come roaring back," Neal said in a statement. "All while lifting millions out of poverty by permanently extending the hugely popular expansions the Ways and Means Committee made to key tax credits in the American Rescue Plan."

Authorities struggle to get stimulus checks to homeless Americans

All three rounds of stimulus checks have aimed at providing immediate financial relief for struggling Americans but it seems that one particularly vulnerable group is struggling to get the direct support. Homeless people are eligible to receive the payments but without an internet connection, telephone access or a fixed address it is proving difficult for them to apply for the cash.

For more information on how to help a homeless person, or anyone who has not yet received their full stimulus check entitlement, check out the IRS' help page.

Third stimulus check: will there be a bonus payment?

As part of the third round of stimulus checks, the Internal Revenue Service (IRS) is sending out supplementary cash injections known as ‘plus-up’ payments to qualifying Americans.

‘Plus-up’ payments are being distributed to taxpayers whose third stimulus check had already been automatically calculated and sent out using the income information in their 2019 federal tax return, but who are now entitled to a larger check based on the earnings detailed in their recently-processed 2020 return. These payments will continue throughout 2021 as the IRS works through a backlog of tax filings.

New programme would extend childcare support into the holidays

The Biden administration is set to expand a scheme that aims at providing financial support to schoolchidren during the summer holidays, with the funding coming from the recent stimulus bill. Agriculture Secretary Tom Vilsack called the summer benefits a “first-of-its-kind, game-changing intervention to reduce child hunger in the United States.”

Families are next on the agenda for Biden who is set to announce the American Families Plan at a speech in Congress on Wednesday evening. The proposal is likely to include an extension to the Child Tax Credit programme, which could take the provision up to 2025.

Will $3,600 Child Tax Credit arrive with third stimulus or fourth?

Tomorrow President Joe Biden is set to address a joint session of Congress where he is expected to announce the third part of his Build Back Better proposals, the American Families Plan. Despite lawmakers urging to make the changes to the Child Tax Credit for 2021 permanent, they may have to settle for a temporary extension.

Families are eagerly waiting for the monthly direct payments to begin that were included in the American Rescue Plan as part of the 2021 Child Tax Credit. The Internal Revenue Service chief says that the agency is on track to start those payments in July.

Stimulus checks initiate conversation on universal basic income

Throughout the pandemic the federal government has played an unusually large role in citizens' personal finance, providing financial support unparalleled in US history. The third round of stimulus checks alone has already seen over $380 billion in federal funds used to pay for the direct payments.

This has created a new conversation about the validity of a universal basic income in the US, which could see citizens granted monthly payments as standard. In some ways the new Child Tax Credit system would provide a version of this, albeit only for households with children.

How will President Biden pay for stimulus spending?

One of Biden's first priorities when entering office was to pass the $1.9 trillion American Rescue Plan, which provided the most generous round of stimulus checks to date. As well as the $1,400 direct payments, there was also a complete overhaul of the Child Tax Credit system, designed to help low-income families.

In order to pay for the trillions of stimulus spending, Biden will increase taxes for households with an annual income of more than $1 million. The White House estimate that just 0.3% of US households will be hit by the increase, which will also help fund the upcoming American Jobs Plan and the American Families Plan.

Biden may announce Child Tax Credit expansion in Wednesday speech

Speculation continues about the content of President Biden's State of the Union address on Wednesday evening, which is likely to relate to his next stimulus package, the American Families Plan. Despite hopes about a fourth stimulus check, it seems that Biden is more likely to concentrate on the Child Tax Credit extension and the introduction of universal paid leave.

Dem Rep. Richard Neal, member of the House Ways and Means Committee, said recently: “We wanted to develop a design and then we will address the issue of revenue. But treat this as an economic investment. This is about increasing productivity. This is about increasing stability in our homes.”

Fourth stimulus check: will the new relief bill have bigger payments if approved?

There is growing support both in Congress and across the country for another round of stimulus checks, with 60% of people polled by Bankrate saying that the recent $1,400 stimulus check would not last them three months.

Groups of lawmakers in both the Senate and the House have signed letters to President Biden asking him to include a proposal for recurring stimulus checks in the next part of his recovery plan. That said, as we have seen, there are other forms of stimulus, such as the incoming Child Tax Credit expansion, that struggling households will be able to take advantage of in the coming months.

Why are some people opting out of the Child Tax Credit system?

The expanded Child Tax Credit programme has been tipped to halve the number of children in poverty in the US over the next 12 months, offering a regular monthly payment to parents for the first time. But some may choose to opt out of these payments, for a few reasons.

Recipients may prefer to get the money in the form of lump sum at the end of the tax year, which could result in a payment of up to $3,600 per child after filing tax returns next year. Doing this eliminates the possibility of owing the IRS money if your household income increases over the course of 2021. A large increase could disqualify you from receiving the direct payments, meaning that you would need to pay it back come tax season 2022.

Stimulus checks spur consumer spending boost

The third round of stimulus checks provided payments worth up to $1,400 per person for eligible Americans, the largest amount offered in any round of stimulus support. The payments began to land in bank accounts in March, a year after the pandemic first took hold, and the impact of the most recent payments is clear to see.

The Wall St Journal reports that the stimulus checks had a positive effect of spending habits with consumer activity up 161% in comparison to the same month in 2020.

IRS stimulus checks and the Recovery Rebate Credit

The IRS has sent out over 161 million stimulus checks as part of the third round of payments, but they will continue to send out the 'plus-up' supplemental payments until the end of 2021. If you think you are due more of a stimulus check payment than you have received so far, you can claim the missing money in the form of a Recovery Rebate Credit.

For more details on the RRC and how it relates to the third stimulus check, check out this handy explainer from the IRS.

Fourth stimulus check: who is in favor of its approval?

President Biden is facing mounting pressure from Democrats in Congress to include a fourth stimulus check in his Build Back Better plan. In a letter signed by twenty-one Senators from fifteen states, Senate Democrats urged Biden to consider the inclusion of “recurring direct payments and automatic unemployment insurance extensions tied to economic conditions” in his new proposal.

The letter also spoke to the financial hardships many households in the US are facing stating, “almost six in ten people say the $1,400 payments set to be included in the rescue package will last them less than three months.” But after an early burst of direct support, is Biden willing to sanction another wave of payments?

Biden's stimulus bill brought huge tax cuts for low earners

The $1.9 trillion American Rescue Plan was designed to provide support for those most in need and federal funding for low- and middle-income households. In doing so President Biden's package actually brought tax cuts for millions of families, mainly in the form of stimulus checks (which were essentially an early tax rebate) and the new-look Child Tax Credit.

It is thought that the tax breaks included in the recent stimulus bill will prevent anyone earning less than $75,000 per year from paying any federal income tax.

White House officials discuss Child Tax Credit extension

Andy Duehren, the Wall St Journal's White House corresponent, has reported that the Biden administration have held meetings to discuss the possibility of extending the new Child Tax Credit (CTC) programme until 2025. The current provision is just for one year and is due to begin in July 2021.

President Biden has faced repeated calls to make the CTC a permanent programme to support low- and middle-income families. The White House' own analysis found that the measures could cut childhood poverty in the United States in half over the next year.

Biden criticized for sending letter heralding stimulus checks

President Joe Biden has been criticized for "acting like Trump" after he signed a letter that will be sent out to millions of Americans to remind them who was responsible for their third stimulus check.

"A key part of the American Rescue Plan is direct payments of $1,400 per person for most American households," Biden wrote in the letter, which was obtained by Business Insider. "This fulfills a promise I made to you, and will help get Americans through the crisis."

The letter also details other parts of the $1.9 trillion stimulus measure passed by a party-line vote in March, some of which "will help you as well." It lists "aid for small businesses, an expanded child tax credit for families, and resources to reopen schools safely."

Unlike Trump, Biden did not put his name on the stimulus check, but critics say this letter is being used as a similar means of self-promotion, but this time at the expense of the taxpayer.

Will Biden discuss the possibility of a fourth stimulus check on Wednesday?

That is the big question this week. Tomorrow, the President is set to unveil his ambitious new plan to outline to rebuild crumbling infrastructure, boost the economy, and offer more significant financial support to American families.

No doubt millions of Americans will be tuning in to see if Biden will mention anything about fourth stimulus checks. At this point, it's unknown if he will do so.

Stimulus checks one of the highlight achievements of Biden's successful 100 days in office

Whether you're Republican or Democrat and whether you agree with his policies or not, one thing that can't be argued with is the fact that Joe Biden has got a lot done in his first 100 days in office. Chris D. Jackson points out the highlight achievements of Biden's first months in office:

- More jobs created than any admin. in history.

- Largest stock market growth of any president in at least 70 years.

- $1,400 stimulus checks

- New $3K child tax credit

- 200 mil. vaccinations

Republican counter proposals to 2021 Child Tax Credit

GOP policymakers now have three distinctive approaches to consider to expand the Child Tax Credit, with elements that might potentially be mixed and matched in various ways. Senator Josh Hawley has just presented his own plan to add to plans drawn up by Senators Marco Rubio and Mike Lee and Senator Mitt Romney as alternatives to the Child Tax Credit expansion passed by the Democrats.

House Democrats are seeking to make their expansion permanent but for now the White House has only expressed interest in extending the expansion until 2025. Under the changes passed with the American Rescue Plan families will receive a refundable tax credit of $3,000 for children aged from 6 to 17 and $3,600 for children who are under the age of six for the 2021 fiscal year.

Half of the credit will be paid in advance monthly starting in July through December.

Your $1,400 stimulus check could be in the mail

If you’re still waiting on your $1,400 Covid stimulus check, it could be in the mail. The government announced last week it had sent a sixth batch of stimulus checks. This time, that included more paper checks than direct deposits. Of the 2 million checks that were recently sent, almost 1.1 million were issued by paper check while 900,000 were sent by direct deposit.

Stimulus check recipients unlikely to pay income tax this year

President Biden's battle to ease the financial burden on low- and middle-income Americans will see most individuals earning less than $75,000 exempt from paying income tax in 2021. The effort to reduce the tax burden on Americans began with stimulus checks and enhanced Child Tax Credit programme, both of which are essentially as a tax reduction.

This report from CNN reads: "Instead, lower-income Americans can expect to receive hefty refunds - though, of course, that will vary depending on every individual's finances."

How many batches of stimulus checks have been sent?

The IRS continues to work on distributing the third round of stimulus checks and have now begun issuing additional stimulus payments known as 'plus-up' payments. These batches are sent out on a weekly basis to all those Americans whose total amount of the third stimulus check was based on their 2019 tax return, but who, thanks to the already processed 2020 return, are eligible for a larger payment.

At this point the vast majority of stimulus checks have been sent out the eligible Americans, but how many have been sent out in total? Here's the latest update from the IRS, along with the state of play on the fourth stimulus check.

US stimulus checks live updates: welcome

Welcome to our live stimulus-checks blog for Tuesday 27 April, bringing you the latest news on a possible fourth stimulus check, as well as up-to-date information on the third round of direct payments, which is a part of President Joe Biden's $1.9tn covid-19 relief bill.

We'll also provide info on other measures included in the aid package, such as enhanced unemployment benefits and the expanded Child Tax Credit, which gives households with children up to $3,600 per child dependent.