Fourth stimulus check news summary: 21 April 2021

Information on the third stimulus check included in US President Joe Biden's covid-19 relief bill, and updates on possible fourth direct payment, Wednesday 21 April 2021.

Show key events only

US stimulus check live updates, 21 April 2021

Headlines:

- Over $376bn in third stimulus checks have been sent to 159 million Americans, IRS said in most recent update

- New Child Tax Credit system expected to be in place by July, says IRS commissioner

- Over 2m 'plus-up' stimulus check payments have now been distributed

- President Joe Biden supports extending Child Tax Credit through 2025

- Golden State stimulus checks being sent out (who qualifies?)

- What has Biden said on fourth stimulus check? (Full story)

- Will a fourth stimulus check be sent out in May? (Full details)

- IRS distributing stimulus check 'plus-up' payments as tax returns processed (what is a 'plus-up' payment?)

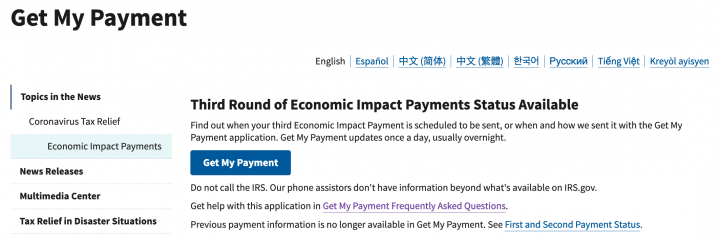

- You can track the status of your stimulus check using the IRS' Get My Payment tool

- US covid-19: 31.86 million cases / 569,402 deaths (live updates from Johns Hopkins University)

Have a read of some of our related articles:

Third stimulus check: how to check its status with the IRS Get My Payment tool

If your third stimulus check is still to arrive, you can track its status with the Get My Payment tool on the IRS website.

Stimulus checks harming staff rehire? Food industry may have to reassess

Following the Business Insider story, one of many similar such pieces, about some industries struggling to rehire and fingers being pointed at the stimulus checks and other benefits for making people less in a hurry to restart, food and comms advisor Bethany Khan has a different take.

Could the exit from the pandemic see a significant change in the employment and pay structure within bars and restuarants?

Stimulus check survival

Musical artist Annabel Ross explains how the stimulus checks have saved people like her, but how more support is required.

'Those funds have dried up and now, more than ever, I’m wondering how a freelance journalist is supposed to sustain this kind of work, especially in this industry. My first instinct is that I need to take on other work that pays to supplement the investigative work (duh).'

Read her thread...

Stimulus bill contradictions

LA based political scientist, Miranda Yaver, points to yet more hypocrisy from some of our politicians.

There's a feeling that many are taking credit for President Biden's stimulus relief package - and its offshoots - while having voted along party lines against it.

How stimulus funds can save schools

'With new leadership, it’s heartening to see the federal government finally stepping up to address the steep challenges students and families are facing by investing billions of dollars in K-12 schools.

'This funding can be used to provide young people with meaningful educational experiences, including work- and project-based learning, and college and career exploration opportunities that are proven to help more students stay in school, graduate on time, and develop the knowledge and skills employers seek for the future.'

Deborah S. Delisle and Anne Stanton share their thoughts on the education opportunity.

Bigger, retroactive PPP funds on the table

Self-employed businesses, as well as farm and ranch partnerships, would be eligible for larger pandemic relief loans under a bill introduced Tuesday by a bipartisan group of senators.

The bill would allow farm and ranch partnerships to apply for Paycheck Protection Program loans using “gross income” on their tax returns to get larger loans. The measure would also allow self-employed businesses to retroactively receive larger loans.

The bill comes after the Small Business Administration changed its rules to allowsole proprietors to use the gross income calculation. But the rules didn’t apply retroactively, meaning many businesses missed out.

Read more:

Fourth stimulus check: what entities are pressuring Biden to make a new payment?

Stimulus checks have been a key part of the economic relief offered by the federal government and three rounds of direct payments, worth up to $3,200 per person, have been offered so far. The IRS have confirmed that over 159 million stimulus check payments have been made, and they will continue to disperse money over the coming months.

However many have already turned their attention to the future with growing calls for a fourth stimulus check, both in Congress and across the country. Many lawmakers have signed a letter calling for recurring payments to be included in the new infrastructure package, but will President Biden listen?

White House appointment made stimulus spending possible

Since taking office, President Biden has pursued a more ambitious and progressive agenda than many were expecting him too, stirred on by a groundswell of public opinion. In February polling showed that 78% of Americans supported the proposed $1.9 trn stimulus bill, which included 64% of Republicans.

Larry Summers had played a key role in previous Democratic presidencies but Biden's decision not to base his economic policy on Summers' advice looks to have been crucial. Earlier today Summers warned against the risk of excessive stimulus spending but Biden looks set to push through a $2.25 trn infrastructure bill.

IRS: Child Tax Credit system will be in place for 1 July

The IRS have reaffirmed their commitment to hitting the 1 July target by which they hope to have introduced the new Child Tax Credit online system. The new-look programme will provide monthly payments, rather than an annual tax rebate, and will be administrated using a new online portal.

Initially it had been thought that the extension of the tax return deadline (to 17 May) and the ongoing effort to distribute the third stimulus check may delay the start of the CTC. However it appears that officials are now confident of getting the new system up and running soon.

Will the IRS send supplemental payments to 2020 tax filers?

The IRS has already began to distribute the first round of the ‘plus-up’ stimulus checks, the supplementary payments for those who received less than their full entitlement in the most recent round of stimulus checks.

In total around two million of these payments have been sent to individuals who had already received money from the third stimulus check. In most cases the payment was triggered by a recent income tax filing which altered their personal situation and, therefore, their eligibility for the $1,400 direct support.

The payments will continue to be sent on a regular basis until all those who are eligible have received their money, but when will that be and how can you claim yours?

E-file for quicker stimulus check payments

Many Americans have already filed their 2020 tax return, but for those of you who haven't it is worth getting yours in ASAP. Not only is it a legal obligation for many, but it could also trigger an additional stimulus check payment worth up to $1,400.

Some who were missed out of the third round of stimulus checks because their income exceeds the upper threshold may be entitled to the payment if they can show a loss of income in their recent tax filing. If you want to make sure you get the payments quickly you should file you tax returns electronically using the IRS' e-filing option.

Senator outlines the importance of Child Tax Credit expansion

The huge expansion of the Child Tax Credit system was one of the key inclusions in the recent $1.9 trillion stimulus bill, and Democrats are eager to talk about the benefits that it will bring. The White House has spoken about its potential to cut childhood poverty in half, a pretty staggering claim when you consider that it is only a 12-month programme as it stands.

Many have been calling for the new-look Child Tax Credit to be made permanent, but President Biden has warned that it may be too difficult to get something like that through the Senate.

Stimulus checks trigger consumer spending increase

The IRS is still attempting to distribute the third round of stimulus checks, but we are already starting to see the benefits of such large-scale federal spending. Scott Santens, a vocal advocate for Unconditional Basic Income (UBI), shares an article which notes that local stores have seen an upturn in business since the stimulus checks were sent out.

Santens has called for the direct payments to be made a regular thing, and many lawmakers have echoed calls for the stimulus checks to be made recurring for the duration of the pandemic. A letter signed by 21 senators in support of recurring stimulus checks was sent to the White House last month, but the President is yet to speak specifically on the prospect.

Restaurants searching for workers as economy rebounds on vaccinations and stimulus

CNN - Dining restrictions are lifting across the country, and people are getting vaccinated each day. That's good news for restaurants desperate for more business after getting hit hard last year. But some restaurant operators say they are facing a problem that could impair their road to normalcy: They can't find enough people to work for them.

Find out how restaurants are trying to get back up to full speed as stimulus money revs up the economy.

IRS $3,000 child tax credit: when will the monthly payments begin?

When the American Rescue Plan was passed in March, it included several measures to help struggling American families. One of the measures that households began seeing immediately were the $1,400 stimulus checks which around 159 million have been distributed. But this summer families will begin seeing another direct payment coming their way.

Fourth stimulus check: will it be approved and sent in May?

With the national unemployment rate still higher than pre-pandemic levels and some workers seeing hours cut to respond to decreased demand for certain goods and services, some lawmakers are pushing for a fourth stimulus check.

Looking to use stimulus check to take a trip abroad, State Department says be careful

If you were thinking about getting away this summer using some of your $1,400 stimulus check the US State Department’s announcement won’t be good news. On Monday, the State Department said it would boost the number of countries receiving its highest advisory rating to about 80% of countries worldwide. The 116 countries added to its “Level Four: Do Not Travel” advisory list, putting the UK, Canada, France, Israel, Mexico, Germany and others on the list, citing a “very high level of COVID-19.”

The recommendations are not mandatory and do not bar Americans from travel.

How to claim your stimulus check on 2020 tax return

If you qualified for the first or second stimulus check but it did not reach you, do not worry: you can claim your cash when you file your 2020 tax return.

How many people have received their third stimulus checks?

The IRS has been working to distribute the $1,400 direct payments since the American Rescue Plan was signed last month, with close to $400 billion sent out so far. The agency will continue to send out payments weekly throughout the year.

Full details

Biden stimulus bill provides for paid leave to get vaccinated

The IRS wants businesses to know that they can get a tax credit for giving employees paid days off to get the covid-19 vaccine. The press release reads:

“Eligible employers, such as businesses and tax-exempt organizations with fewer than 500 employees and certain governmental employers, can receive a tax credit for providing paid time off for each employee receiving the vaccine and for any time needed to recover from the vaccine. For example, if an eligible employer offers employees a paid day off in order to get vaccinated, the employer can receive a tax credit equal to the wages paid to employees for that day (up to certain limits).”

"This new information is a shot in the arm for struggling small employers who are working hard to keep their businesses going while also watching out for the health of their employees," said IRS Commissioner Chuck Rettig. "Our work on this issue is part of a larger effort by the IRS to assist the nation recover from the pandemic."

Calculate how much you will get from the Child Tax Credit

There are several factors that go into figuring out how much you could expect from the enhanced Child Tax Credit for the 2021 fiscal year. Depending on the age of your children you could see $250 or $300 per month starting in July until the end of the year with the remainder going towards your tax refund.

Or, you could choose to collect the whole credit next year when you file your taxes. The full credit will be $500 for dependents 18 years old and 19 to 24 year-olds who attend college full-time. $3,000 for each child aged 6 to 17 and $3,600 for children under 6.

Bennet wants to make 2021 Child Tax Credit permanent

41 Democratic senators, led by Sherrod Brown of Ohio, Michael Bennet of Colorado, and Cory Booker of New Jersey, sent a letter to Biden last month urging him to make the Child Tax Credit (CTC) permanent. The CTC expansion is expected to cut child poverty nearly in half. Failing to make it permanent would result in a spike in child poverty after this significant advance, the senators wrote.

Biden has said that he won’t push to make the measure permanent right now, but that he would support extending it until 2025. The enhanced credit will provide families with $3,000 for each child aged 6 to 17 and $3,600 for children under 6.

Biden’s third stimulus package taking shape

WaPo - White House officials are closing in on a large spending plan centered on child care, paid family leave and other domestic priorities, according to two people aware of internal discussions. The package could amount to at least $1 trillion of new spending and tax credits, though details remain fluid.

The American Families Plan, the second part of the administration’s Build Back Better agenda, is expected to be unveiled ahead of President Biden’s address to a joint session of Congress on April 28, the people said.

Read the full story at The Washington Post.

A year of multiple stimulus checks and not just from the IRS

Eligible Americans have received as much as $3,200 in stimulus checks over the past year. But depending on where you live you may just have gotten more. Some states also sent out stimulus checks to their residents, California's Golden State Stimulus is the most recent to hit bank accounts around that state.

How the IRS can more effectively distribute the Child Tax Credit direct payments

By approving a third round of economic impact payments (EIPs) and expanding refundability of the Child Tax Credit, Congress has made refundable tax credits a more important pillar of income support than ever. But using tax credits as a way to provide income security to low-income households creates a significant challenge: How can the IRS more effectively deliver payments to those who are unbanked, or even homeless?

One possible solution: The IRS should consider expanding its use of prepaid low- or no-fee debit cards to deliver tax refunds and the CTC advance payments.

Help tracking your $600 Golden State stimulus check

As of 15 April, $600 payments have started to go out to Californians from The California Franchise Tax Board. Those eligible will receive theirs in the same way they received their tax return.

If eligible, the speed at which you will receive your payment depends on when you filed your taxes. The state must receive your 2020 taxes before the payment is sent and the deadline to send your taxes for the one-time payment is 15 October, 2021.

IRS plus-up payment: what is it, how much is it and who gets it?

Just before Easter, the Internal Revenue Service started sending out the third batch of stimulus checks, including "plus-up" supplement payments.

They will be going out to people who received a third stimulus check based on information taken from their 2019 income tax return, but who qualify for a larger payment based on their 2020 return.

The IRS will be sending them out weekly throughout 2021.

Third stimulus check: how to check its status with the IRS Get My Payment tool

The IRS is sending out stimulus checks weekly, last week saw another 2 million payment sent to total around 159 million so far.

You can track the status of your third stimulus check by using the IRS' Get My Payment portal.

Access the Get My Payment tool

More information about the Get My Payment tool

Should you be experiencing problems with the portal, you'll also find that the IRS website includes a useful Get My Payment FAQs page.

Enhanced Child Tax Credit overpayments may need to be paid back

One of the key features that will help families with children in the American Rescue Plan passed in March is the revamping of the Child Tax Credit. Starting in July Americans would get up to $300 a month per child if all goes according to plan.

However, the advanced payments will be based on an IRS estimate, from available data like income, marital status, and number and age of qualifying kids. Outdated data may trigger an overpayment of the tax credit — and the need to pay back any excess funds.

The agency has been tasked with creating an online portal where families can update their information and choose if they want the half the credit to come as monthly direct payments and the remainder in when they file in 2022. Or Families can choose to collect the credit as a lump sum tax refund, minus and taxes owed, in 2022.

Biden will seek to extend the enhanced 2021 Child Tax Credit

Speaking to lawmakers earlier this week, President Joe Biden expressed support for an extension of the 2021 Child Tax Credit. Democrats are seeking to make the changes for 2021 permanent but Biden thinks it will be too hard to get through the Senate right now. He would like to extend the changes through 2025 when the previous expansion will expire at the same time.

The enhanced child tax credit passed earlier this year temporarily increases the existing child tax credit from a maximum of $2,000 a year per child to $3,000 for each child aged 6 to 17 and $3,600 for children under 6.

More stimulus checks needed to stem the tide of poverty

As of last month, the US poverty rate has been on an upward trajectory. Between February and March, the rate of poverty in the US increased by 0.5 percentage points to 11.7%, resulting in the highest level since the onset of the coronavirus pandemic. The second-highest rate of 11.6% was recorded in November 2020. These estimates were taken before the rollout of the Biden administration’s American Rescue Plan.

Every time that there has been a stimulus payment to Americans the poverty rate dips, but it still has an upward trend, even as the US economy pulls out of the pandemic.

Humanity Forward pushing for recurring stimulus checks

Humanity Forward is a nonprofit organization whose singular focus is enacting direct cash relief to help families deal with the effects of the pandemic. They started a nationwide advocacy campaign that involves working with members of Congress, partner organizations, and grassroots leaders from all 50 states to build a bipartisan coalition in support of direct cash relief.

Close tax-gap to create $4,000 stimulus checks per year

According to the IRS commissioner Charles Rettig the US is losing approximately $1 trillion in unpaid taxes every year. Rettig told senators that the agency lacks the resources to catch tax cheats.

The so-called tax gap has surged in the last decade from an average of $441 billion unpaid per year from 2011 to 2013 by the last official estimate. Rettig said most of the unpaid taxes are the result of evasion by the wealthy and large corporations.

$1,400 third stimulus check: what is "IRS TREAS 310 - TAX EIP3"?

The reference "IRS TREAS 310 - TAX EIP3", or something similar, appears in your bank statement when the third stimulus check arrives by direct deposit.

Fourth stimulus check: will it be approved and sent in May?

As the IRS wraps up sending out the third batch of coronavirus stimulus checks, the question of a fourth direct payment remains.

Stimulus checks "a lifeline in a time when they were most needed"

Sue Schwartz, the owner of the Gypsy Soul clothes store in Springfield, Illinois, says the effect of the third stimulus check on business has been "fabulous".

"We actually had people who told us that they were spending their stimulus checks," Schwartz told WICS, the ABC affiliate in Springfield. “so we were pretty excited about that."

"It's fabulous because I'm still kinda shell-shocked from last year having to close down.

"The stimulus checks, I believe, did what they were supposed to do: stimulate the economy.”

Speaking to WICS, economist Ken Kriz of the University of Illinois Springfield decribed the stimulus checks as "a lifeline in a time when they were most needed", explaining that the scheme has had a $300m to $400m impact on the economy in central Illinois.

Use Get My Payment tool to track stimulus check

If you're eligible for a third stimulus check but it hasn't yet arrived, you can use the IRS' Get My Payment tool to track the progress of your direct payment.

More info about Get My Payment

The IRS also has a helpful FAQs page for Americans with doubts about the Get My Payment tool

(Image: www.irs.gov)

#1400Challenge sees Americans use stimulus checks to benefit local communities

As part of the #1400Challenge, groups of people around the United States are pooling their $1,400 stimulus checks to fund projects that benefit their local communities, such as gyms, pallet homes and food-growing initiatives.

For example, Tampa, Florida resident Michael Chaney is leading a drive to use stimulus money to build fruit and vegetable gardens in his area.

“I want to have at least two community gardens on every block,” Chaney told Vice. “They each would have a multitude of fruits and vegetables for themselves, but they could each have a cash crop too.”

$600 Golden State stimulus check: who qualifies in California?

One of the provisions agreed to in state-wide stimulus bill provisions passed back in February 2021 was a $600 direct payment to residents who had been hit hard by the pandemic. At the time of the bill’s passing, California Gov. Gavin Newsom stated that 5.7 million payments would be made to low-income Californians.

Find out more about who qualifies for the Golden State stimulus check

IRS plus-up payment: what is it, how much is it and who gets it?

The IRS is now distributing so-called "plus-up" supplementary payments as part of the $1,400 stimulus-checks scheme included in President Biden's $1.9tn covid-19 relief package.

When is Tax Day 2021 and how can you avoid penalties?

The IRS have extended the tax return deadline for most taxpayers, but you could still face financial penalties if you don't get your filing in on time.

A customer enters a Macy's store in the Union Square shopping district in San Francisco, California, last week. According to a report by the US Commerce Department, retail sales rose 9.8% in March following the approval of a third stimulus check of up to $1,400.

(Photo: Justin Sullivan/Getty Images/AFP)

For most in the US, third stimulus check boost won't last more than three months

Bankrate’s recent survey (see also earlier post) has found that, for a majority of Americans, the financial boost provided by the third stimulus check will last for no more than about 90 days.

“More than 6 in 10 U.S. adults (or 61 percent) say the stimulus money won’t sustain their financial well-being for more than three months,” Bankrate’s report, which was released last week, says.

Just over a quarter of respondents to the organization’s survey said their check will last them “between one to less than three months”.

Full Bankrate report: More than 6 in 10 Americans say $1,400 stimulus checks won’t last three full months

“We need more checks” - Economic Security Project

Low-income Americans need more direct payments on top of the three stimulus checks sent out so far, says Adam Ruben of the Economic Security Project.

Citing figures that show “neary two-thirds” of families earning under $100,000 a year are still struggling to cover day-to-day living costs, Ruben said in a report posted on Medium this month: “The numbers show that stimulus checks have been the most powerful tool the government has to help Americans survive this economic crisis, and are still desperately needed by low-income families to cover basic needs like groceries, rent and gas.

“We see most families spending checks on daily expenses and paying down debt incurred during the eight months between stimulus checks - evidence that checks need to be sent regularly, not just when Congress gets around to it. For low-wage workers and Black and Latinx communities, the crisis isn’t over - we need more checks to make sure the recovery reaches everyone, and to put in place safeguards like automatic stabilizers that keep families from falling into poverty when the next crisis hits.”

Economic Security Project's full report: New Census Data Shows That Direct Cash Payments Are Still Needed

Unemployment benefits: What state has the best payments?

With unemployment benefit amounts ranging widely across states, many are left asking which states provide the “best” benefits for out-of-work Americans.

IRS tax refunds on $10,200 in unemployment benefits: when are they coming?

The IRS has sent out almost 68 million refunds already this year. However if you received unemployment compensation you may have to wait for your refund.

Americans without address and/or bank account can still get stimulus check

People without a permanent address or a bank account may still qualify for a stimulus check "and other tax benefits", the IRS says.

Stimulus checks: every AS English article

A reminder that you’ll find all our articles offering information on stimulus checks - not only the third round, but also a potential fourth one - in our dedicated section on direct payments.

Stimulus checks used to cover rental and mortgage payments

A report published by Bankrate this month has found that most third stimulus check recipients are looking to spending across all income brackets is on monthly bills, with 45% of stimulus check recipients planning to spend the money on rent, mortgage, mobile phone or utilities payments.

Greg McBride, chief financial analyst at Bankrate, ascribed this caution to the precarious state of the US jobs market.

“More than half of the jobs lost last year have been recovered,” McBride said. “But there are still nearly 9 million jobs that disappeared that haven't yet come back. There are 18 million Americans still drawing some form of unemployment compensation.”

Overpayment of unemployment benefits: should I give it back?

There are a number of reasons you may receive more unemployment compensation than you were due. Depending on the circumstances you may need to pay it back.

“Unless you’re a seasoned investor, don’t risk your stimulus payment”

Forbes personal-finance expert Zack Friedman has some advice for third stimulus check recipients on how they should avoid spending their direct payment, telling Americans they should think twice before investing their money in the stock market.

“Unless you’re a seasoned investor, or you already paid essential bills, paid off debt and built an emergency fund, don’t risk your stimulus payment,” Friedman says.

“Why? If you need your stimulus check now or in the near future, there’s no guarantee that you will make money in the stock market - despite the success stories you’ve read or how your investment portfolio has performed.”

“If you simply must invest your stimulus check in the stock market, understand you could lose some or all of your stimulus check.”

$1,400 third stimulus check: what is "IRS TREAS 310 - TAX EIP3"?

Third stimulus checks are landing in the bank accounts of direct-deposit recipients labeled with the reference "IRS TREAS 310 - TAX EIP3", or something similar.

IRS plus-up payment: what is it, how much is it and who gets it?

As part of the third round of stimulus checks, the IRS is now sending out ongoing supplemental payments called "plus-up" payments. They will be going out to people who received a third stimulus check based on information taken from their 2019 income tax return, but who qualify for a larger payment based on their 2020 return.

What to know about $3,600 Child Tax credit: dates, eligibility, amount

The new, expanded Child Tax Credit will provide a 12-month payment of $3,000 for children aged from six to 17 and $3,600 for children who are under the age of six for the 2021 fiscal year.

Full details on how the expanded Child Tax Credit will work, and who is eligible

Dems out to extend Child Tax Credit beyond 2021

As part of the American Rescue Plan, the Child Tax Credit was enlarged and made available to millions more, but only for the 2021 fiscal year. Democrats want to make the provision permanent, but they may have to settle for a temporary extension.

$600 Golden State stimulus check: who qualifies in California?

California has started to distribute direct payments of to millions of its residents as part of a stimulus bill passed by the state legislature back in February.

Who qualifies, and how can those eligible claim the benefit?

How to claim your stimulus check on 2020 tax return

If you qualified for the first or second stimulus check but it did not reach you, do not worry: you can claim your cash when you file your 2020 tax return.

How many people have received their third stimulus checks?

The IRS has been working to distribute the $1,400 direct payments since the American Rescue Plan was signed last month, with close to $400 billion sent out.

Third stimulus check: how to check its status with the IRS Get My Payment tool

You can track the status of your third stimulus check by using the IRS' Get My Payment portal.

Access the Get My Payment tool

More information about the Get My Payment tool

Should you be experiencing problems with the portal, you'll also find that the IRS website includes a useful Get My Payment FAQs page.

Stimulus check live updates: welcome

Hello and welcome to our daily live blog bringing you the latest information on the third round of stimulus checks, which is being distributed as part of the $1.9tn coronavirus relief bill signed into law by President Biden last month. We'll also provide updates on other aid measures such as the expanded child tax credit, which sees eligible households with children receive up to $3,600 per child over a 12-month period.

- Joseph Biden

- Coronavirus stimulus checks

- Washington D.C.

- Nancy Pelosi

- Charles Schumer

- Kamala Harris

- Covid-19 economic crisis

- United States Senate

- Child poverty

- Science

- Coronavirus Covid-19

- Economic crisis

- United States Congress

- United States

- Pandemic

- Coronavirus

- Recession

- Poverty

- North America

- Economic climate

- Virology

- Outbreak

- Infectious diseases

- Parliament

- Microbiology

- Diseases

- America

- Medicine

- Economy

- Social problems

- Biology

- Health

- Politics

- Society

- Life sciences