How is $600 Golden State Stimulus check paid? Direct deposit or paper check?

Eligible Californians are receiving a one-time stimulus check of $600 or $1,200 as part of a statewide relief package passed in February.

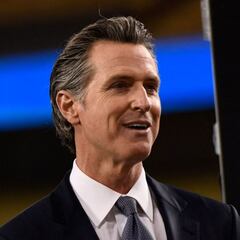

California’s Franchise Tax Board (FTB) is distributing Golden State Stimulus payments of $600 or $1,200 to eligible Californians, as part of a $9.6bn statewide coronavirus aid package signed into law by Governor Gavin Newsom in February.

How are the Golden State Stimulus checks being paid out?

Taxpayers need to have filed their 2020 state tax return to receive a Golden State Stimulus check - and the information you included in your return determines whether you’ll receive your payment via direct deposit or through the mail by paper check.

If you provided your bank details to set up a tax refund by direct deposit, your stimulus check will be sent straight to your account.

If not, the FTB will post your Golden State Stimulus payment in paper form to the address it has on file for you. If you have moved, get in touch with the FTB to let them know of the change of address.

The FTB notes that you’ll also be mailed a paper check "if you received an advanced refund through your tax service provider or paid your tax preparation fees using your refund".

Golden State Stimulus payment: who qualifies?

To qualify for a Golden State Stimulus payment, you must be:

- a recipient of the California Earned Income Tax Credit (CalEITC), or

- an Individual Taxpayer Identification Number (ITIN) tax filer who earned up to $75,000 in 2020

You must also:

- have lived in California for at least half of the 2020 tax year, and

- be a resident of the state on the date your Golden State Stimulus check is issued

And as mentioned above, you need to have filed your 2020 state tax return.

Golden State Stimulus payment: how much will you get?

According to the FTB, you will get a $600 one-time payment if:

- you receive the CalEITC

- you do not receive the CalEITC but are an ITIN filer who earned $75,000 or less in 2020

- you filed a joint tax return, you or your spouse is an ITIN filer and you earned $75,000 or less in 2020

According to the FTB, you will get a $1,200 one-time payment if:

- you receive the CalEITC, are an ITIN filer and earned $75,000 or less in 2020

- you filed a joint tax return, you receive the CalEITC, you or your spouse is an ITIN filer and you earned $75,000 or less in 2020

When will my Golden State Stimulus payment arrive?

This depends on when you filed your 2020 state taxes.

If you filed taxes between 1 January and 1 March…

Your stimulus check will arrive after 15 April: within two weeks of that date for direct-deposit recipients and within four to six weeks for paper check recipients.

If you filed taxes between 2 March and 23 April…

Your stimulus check will arrive after 1 May: within two weeks of that date for direct-deposit recipients and within four to six weeks for paper check recipients.

If you file taxes after 23 April…

Direct-deposit recipients will get their check within 45 days of their return being processed and paper-check recipients will be paid theirs within 60 days of their return being processed

Related stories

The FTB has a ‘wait time dashboard’ on its website, enabling Californians to check how long it will take for their tax return to be processed after filing.

US stimulus checks: live updates

For updates on the Golden State Stimulus payments, plus info on the third round of federal stimulus checks and news on a possible fourth round, check out our dedicated live blog.

- Coronavirus stimulus checks

- USA coronavirus stimulus checks

- Gavin Newsom

- Covid-19 economic crisis

- Science

- California

- Coronavirus Covid-19

- Economic crisis

- Poverty

- Pandemic

- Coronavirus

- Recession

- United States

- Economic climate

- Virology

- Outbreak

- Infectious diseases

- North America

- Microbiology

- Diseases

- Medicine

- America

- Economy

- Social problems

- Biology

- Life sciences

- Society